🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Top Drive Systems Market

Global Top Drive Systems Market (By Product Type, Electric Top Drives and Hydraulic Top; By Vessel Type, Onshore and Offshore; By Application, Drillships, Semisubmersible Rigs, and Jackup Rigs, By Region and Companies), 2024-2033

Sep 2024

Automobiles

Pages: 138

ID: IMR1242

Top Drive Systems Market Overview

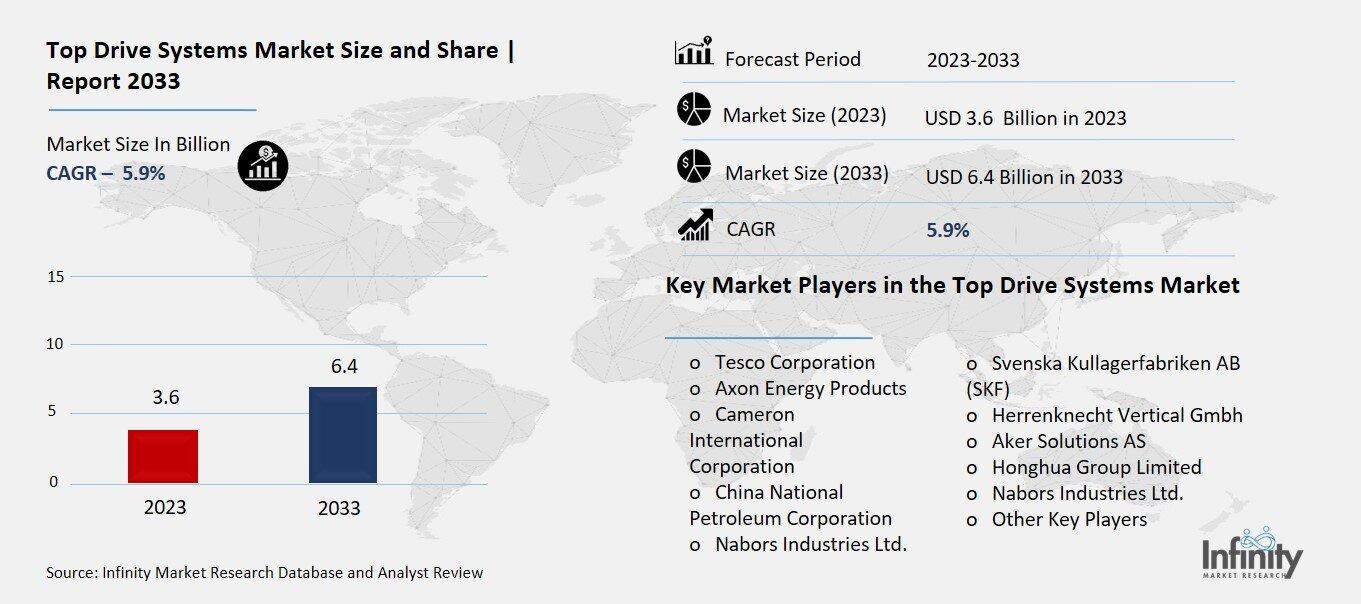

Global Top Drive Systems Market acquired the significant revenue of USD 3.6 Billion in 2023 and expected to be worth around USD 6.4 Billion by 2033 with the CAGR of 5.9% during the forecast period of 2024 to 2033. The market is an important segment within the broader oil and gas industry, chiefly focusing on the equipment used for drilling operations. Top drive systems are advanced drilling apparatus that provide rotational force to the drill string. This allows the system for greater control and efficiency compared to traditional rotary systems. This technology enhances the safety and productivity of drilling activities, making it increasingly popular among operators.

To Get An Overview , Request For Sample

The market is characterized by the growing demand for energy resources, technological advancements in drilling techniques, and the increasing need for efficient and automated drilling solutions. Moreover, key players in the market are continually innovating to improve performance, reduce costs, and enhance operational safety.

Drivers for the Top Drive Systems Market

Rising Global Demand for Energy

The rising global demand for energy is a major challenge due to the rapid population growth and increasing industrialization. As urban populations expand and living standards improve, the need for energy intensifies significantly. This demand surge compels exploration and production companies to seek more efficient and reliable methods of accessing energy resources. Advanced drilling technologies, such as top drive systems, play a crucial role in this context by offering enhanced operational capabilities. Top drive systems enable faster drilling rates and greater depth capabilities, which are essential for tapping into increasingly complex and remote energy reserves.

Restraints for the Top Drive Systems Market

Fluctuations in Oil Prices

Fluctuations in oil prices are a significant concern for exploration and production companies, as they directly influence operational budgets and investment strategies. When oil prices are high, companies typically experience increased revenues, allowing them to allocate substantial funds toward exploration and the adoption of advanced drilling technologies, such as top drive systems. However, in periods of low oil prices, the financial landscape changes dramatically. Companies often face tighter margins and reduced cash flow, which leads to a reevaluation of capital expenditures. Consequently, exploration budgets are often slashed, resulting in decreased investments in new technologies that could improve efficiency and reduce operational costs in the long run.

Opportunity in the Top Drive Systems Market

Increasing Focus on Sustainability Initiatives

As the oil and gas industry grapples with increasing pressure to enhance sustainability and reduce environmental impact, the demand for technologies that support these goals has intensified. Top drive systems, known for their advanced engineering and operational efficiency, have the potential to significantly lower emissions compared to traditional drilling methods. By optimizing the drilling process, these systems reduce fuel consumption and the associated greenhouse gas emissions, aligning with the industry's shift towards cleaner energy practices. Furthermore, their ability to integrate with digital technologies facilitates better monitoring and management of drilling operations, enabling companies to minimize waste and enhance resource utilization.

Trends for the Top Drive Systems Market

Increasing Emphasis on Workplace Safety

The increasing emphasis on workplace safety in the oil and gas industry is driving significant innovations in the design and functionality of top drive systems. As companies strive to reduce accidents and improve overall working conditions, they are prioritizing equipment that enhances operational safety. Top drive systems are evolving to incorporate advanced safety features, such as real-time monitoring systems, automated shutdown mechanisms, and enhanced ergonomics that minimize operator fatigue. These innovations not only help to prevent accidents but also streamline operations by allowing for more precise control during drilling activities.

Moreover, with safety regulations becoming more stringent, operators are compelled to adopt technologies that not only comply with legal standards but also exceed them to ensure the welfare of their workforce. The integration of smart technologies, such as predictive analytics and remote monitoring, allows for proactive identification of potential hazards, enabling operators to take preventative measures before incidents occur.

Segments Covered in the Report

By Product Type

o Electric Top Drives

o Hydraulic Top Drives

By Vessel Type

o Onshore

o Offshore

By Application

o Drillships

o Semisubmersible Rigs

o Jackup Rigs

Segment Analysis

By Product Type Analysis

On the basis of product type, the market is divided into electric top drives and hydraulic top. Among these, electric top drives segment acquired the significant share around 52.6% in the market. Electric top drives are known for their superior efficiency, as they require less maintenance and provide more consistent torque output. This efficiency translates into lower operational costs and improved drilling performance, which are critical factors for operators looking to maximize their return on investment.

Additionally, electric top drives have a smaller footprint and are generally lighter than hydraulic systems, allowing for easier installation and integration into existing drilling rigs. Their ability to provide precise control and enhanced automation capabilities further boosts their appeal, as they contribute to safer and more streamlined drilling operations.

By Vessel Type Analysis

On the basis of vessel type, the market is divided into onshore and offshore. Among these, onshore held the prominent share of the market. Onshore drilling typically involves lower operational costs compared to offshore drilling, making it a more accessible option for many exploration and production companies, particularly in regions with established infrastructure. The prevalence of onshore drilling rigs, especially in resource-rich areas, also contributes to the significant demand for top drive systems in this segment.

Additionally, the technological advancements in onshore drilling practices have led to increased efficiency and reduced environmental impact, further enhancing the appeal of onshore projects. As companies focus on optimizing their operations to meet rising energy demands, the use of advanced technologies, including top drive systems, becomes essential in improving drilling performance and safety.

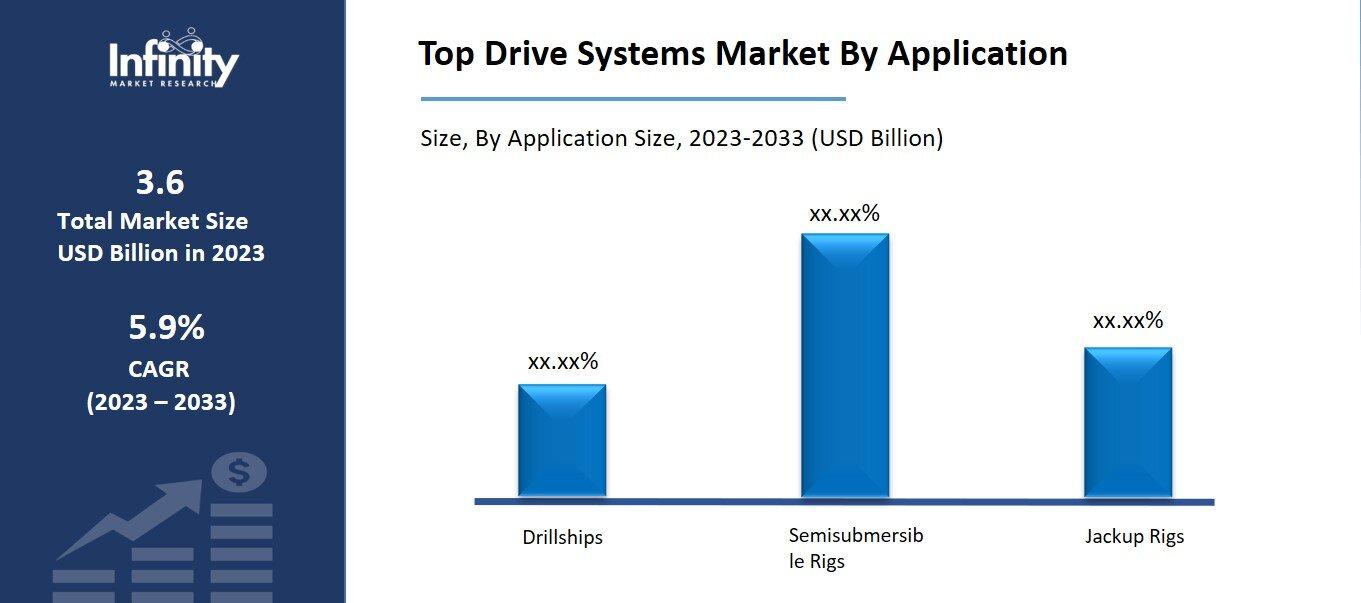

By Application Analysis

On the basis of application, the market is divided into drillships, semisubmersible rigs, and jackup rigs. Among these, jackup rigs held the prominent share of the market due to their versatility and efficiency in various drilling environments, particularly in shallow waters. Jackup rigs are designed to be towed to the drilling location, where they can be elevated above the water surface using legs that are anchored to the seabed, providing stability and safety during operations. This design makes them ideal for drilling in relatively calm and shallow water conditions, which are often more economically viable than deeper offshore environments.

To Learn More About This Report , Request For Sample

Regional Analysis

North America Dominated the Market with the Highest Revenue Share

North America held the most of the share of 36.4% the market. The region is home to some of the world’s most advanced oil and gas exploration and production activities, particularly in areas such as the Permian Basin, Bakken Formation, and Gulf of Mexico. The high level of activity in these regions has led to increased demand for efficient and innovative drilling technologies, including top drive systems, to enhance operational performance.

Moreover, North America has a well-established infrastructure for drilling operations, supported by a robust network of service providers and suppliers that facilitate the implementation of advanced technologies. The region also benefits from a favorable regulatory environment that encourages investment in energy exploration and production, further driving the adoption of advanced drilling solutions.

Competitive Analysis

The competitive landscape of the top drive systems market is characterized by a mix of established players and emerging companies, each vying for market share through innovation, strategic partnerships, and enhanced service offerings. Key competitors in this space include major manufacturers such as Schlumberger, Baker Hughes, National Oilwell Varco, and Halliburton, which dominate due to their extensive experience, technological expertise, and strong global presence. These companies offer a range of top drive systems tailored for various drilling applications, including both onshore and offshore environments.

Recent Developments

In January 2022, the Abu Dhabi National Oil Company (ADNOC) awarded framework agreements totaling USD 1.94 billion to four leading firms to enhance drilling operations. The contracts were granted to Adnoc Drilling (a subsidiary of ADNOC), Schlumberger, Halliburton, and Weatherford.

Key Market Players in the Top Drive Systems Market

o Tesco Corporation

o Axon Energy Products

o Cameron International Corporation

o China National Petroleum Corporation

o Nabors Industries Ltd.

o Svenska Kullagerfabriken AB (SKF)

o Herrenknecht Vertical Gmbh

o Aker Solutions AS

o Honghua Group Limited

o Nabors Industries Ltd.

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 3.6 Billion |

|

Market Size 2033 |

USD 6.4 Billion |

|

Compound Annual Growth Rate (CAGR) |

5.9% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Product Type, Vessel Type, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Tesco Corporation, Axon Energy Products, Cameron International Corporation, China National Petroleum Corporation, Nabors Industries Ltd., Svenska Kullagerfabriken AB (SKF), Herrenknecht Vertical Gmbh, Aker Solutions AS, Honghua Group Limited, Nabors Industries Ltd., and Other Key Players. |

|

Key Market Opportunities |

Increasing Focus on Sustainability Initiatives |

|

Key Market Dynamics |

Rising Global Demand for Energy |

📘 Frequently Asked Questions

1. Who are the key players in the Top Drive Systems Market?

Answer: Tesco Corporation, Axon Energy Products, Cameron International Corporation, China National Petroleum Corporation, Nabors Industries Ltd., Svenska Kullagerfabriken AB (SKF), Herrenknecht Vertical Gmbh, Aker Solutions AS, Honghua Group Limited, Nabors Industries Ltd., and Other Key Players.

2. How much is the Top Drive Systems Market in 2023?

Answer: The Top Drive Systems Market size was valued at USD 3.6 Billion in 2023.

3. What would be the forecast period in the Top Drive Systems Market?

Answer: The forecast period in the Top Drive Systems Market report is 2023-2033.

4. What is the growth rate of the Top Drive Systems Market?

Answer: Top Drive Systems Market is growing at a CAGR of 5.9% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.