🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Traction Battery Market

Traction Battery Market (By Type (Lead-acid based, Nickel-based, Lithium-ion based, Other Types), By Capacity (Less than 100 Ah, 100-200 Ah, 200 Ah-300 Ah, 300-400 Ah, 400 Ah & above), By Application (Electrical Vehicle (EV), Battery Electrical Vehicle (BEV), Plug-in Hybrid Electrical Vehicle (PHEV), Hybrid Electrical Vehicle (HEV), Industrial, Forklift, Mechanical Handling Equipment, Locomotives, Other Applications), By Region and Companies)

Jul 2024

Energy and Power

Pages: 138

ID: IMR1188

Traction Battery Market Overview

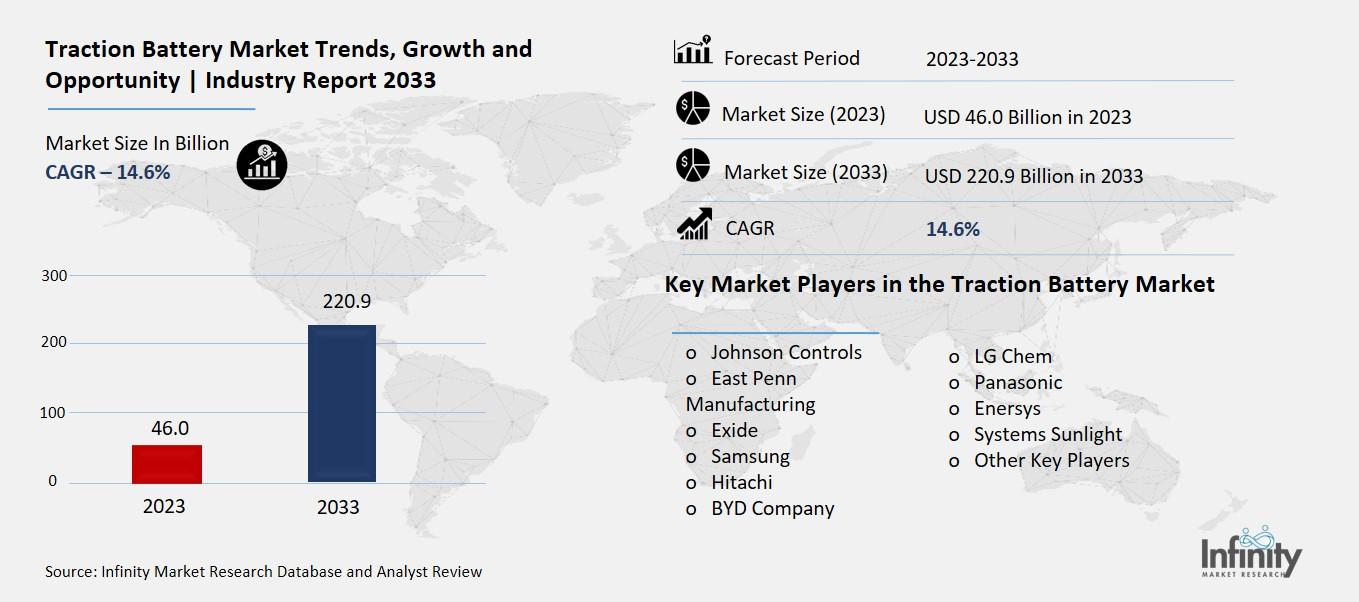

Global Traction Battery Market size is expected to be worth around USD 220.9 Billion by 2033 from USD 46.0 Billion in 2023, growing at a CAGR of 14.6% during the forecast period from 2023 to 2033.

The Traction Battery Market refers to the market for batteries that power electric vehicles (EVs). These batteries are specifically designed to provide the energy needed for the propulsion of EVs, such as electric cars, buses, and trucks. Traction batteries are crucial for the performance, range, and efficiency of electric vehicles. They are typically rechargeable and come in various types, including lithium-ion, nickel-metal hydride, and lead-acid batteries.

As the demand for electric vehicles continues to grow due to increasing environmental concerns and government regulations promoting cleaner energy, the Traction Battery Market is also expanding. Innovations in battery technology, such as improvements in energy density, charging speed, and lifespan, are driving this market forward. This market includes battery manufacturers, EV manufacturers, and companies involved in battery recycling and second-life applications. The overall goal is to develop more efficient and cost-effective batteries to support the widespread adoption of electric vehicles.

Drivers for the Traction Battery Market

Rising Demand for Electric Vehicles

One of the primary drivers of the traction battery market is the increasing demand for electric vehicles (EVs). Governments around the world are promoting the adoption of EVs through subsidies, tax incentives, and stringent emissions regulations. This shift towards greener transportation solutions is propelling the growth of the traction battery market. For instance, the International Energy Agency reported a 43% increase in the global electric car stock in 2020 compared to the previous year, reaching 10 million vehicles. By 2040, EVs are expected to constitute 58% of global passenger vehicle sales. This surge in EV adoption directly boosts the demand for traction batteries, essential components for powering these vehicles.

Technological Advancements

Advancements in battery technology are significantly driving the traction battery market. Innovations such as improved energy density, longer lifespan, and faster charging capabilities enhance the performance and reliability of traction batteries. Companies are heavily investing in research and development to create more efficient and cost-effective battery solutions. For example, Sunlight Group's launch of the ElectroLiFe semi-traction lithium-ion battery in 2022 showcases the ongoing technological progress in the industry. These advancements not only make traction batteries more appealing for EVs but also for industrial applications like forklifts and automated guided vehicles (AGVs).

Expansion of Charging Infrastructure

The expansion of charging infrastructure is another crucial factor driving the traction battery market. As more EVs hit the roads, the need for accessible and reliable charging stations grows. Governments and private companies are investing heavily in building extensive charging networks to support the increasing number of EVs. This development ensures that EV users have the necessary support for long-distance travel and daily commuting, further encouraging the adoption of EVs and, consequently, traction batteries.

Industrial Applications

Beyond transportation, traction batteries are seeing increased use in various industrial applications. Industries are adopting battery-powered equipment such as forklifts and other material-handling machinery to improve efficiency and reduce carbon footprints. The demand for reliable and powerful traction batteries is rising in sectors like warehousing, logistics, and manufacturing. The growing trend of automation and the need for uninterrupted power supply in industrial operations are fueling the demand for traction batteries.

Environmental Concerns and Regulations

Environmental concerns and stringent government regulations on emissions are pushing industries and consumers toward cleaner energy solutions. Traction batteries, especially lithium-ion variants, are favored for their lower environmental impact compared to traditional lead-acid batteries. Regulatory support for clean energy initiatives, including incentives for adopting EVs and battery-powered industrial equipment, is driving the market growth. Governments worldwide are implementing policies to reduce carbon emissions, further bolstering the traction battery market.

Strategic Partnerships and Collaborations

Strategic partnerships and collaborations among key players in the traction battery market are driving innovation and market expansion. Companies are forming alliances to leverage each other's strengths, share technology, and expand their market presence. For instance, the acquisition of Stangco Industrial Equipment by Concentric LLC in 2021 aimed to extend Concentric's footprint in the material handling industry. Such collaborations enhance the development and deployment of advanced traction batteries, driving market growth and providing a competitive edge to the involved companies.

Restraints for the Traction Battery Market

Limited Raw Material Supply

The availability of essential raw materials is another major restraint. The mining and extraction of lithium, cobalt, and nickel are not only costly but also subject to geopolitical and environmental concerns. Limited supply and the concentration of these resources in specific regions can lead to supply chain disruptions, impacting the production and availability of traction batteries. This scarcity can hinder the growth of the market by creating bottlenecks in production and driving up costs Supply Chain Vulnerabilities

High Production Costs

One of the main challenges for the traction battery market is the high cost of production. These batteries require expensive raw materials like lithium, cobalt, and nickel. The fluctuating prices of these materials further complicate the cost structure, making traction batteries significantly more expensive compared to conventional gasoline-powered vehicles. This high cost can deter consumers from adopting electric vehicles, which in turn affects the demand for traction batteries

Technological Barriers

Despite advancements, there are still significant technological barriers to overcome. Current battery technologies need improvements in terms of energy density, charging times, and overall efficiency. Innovations are required to make traction batteries more competitive with traditional fuel systems. Without significant breakthroughs, the adoption rate of electric vehicles, and consequently traction batteries, may remain limited.

Environmental and Recycling Challenges

While electric vehicles are touted as eco-friendly, the environmental impact of battery disposal and recycling remains a concern. The processes involved in recycling batteries are complex and costly. Additionally, improper disposal of traction batteries can lead to environmental hazards due to the toxic materials they contain. Developing efficient and cost-effective recycling methods is essential but remains a significant challenge.

Market Competition and Consumer Hesitancy

The market for traction batteries faces stiff competition from traditional fuel technologies. Many consumers are hesitant to switch to electric vehicles due to concerns about battery life, charging infrastructure, and the initial cost of purchase. Overcoming these consumer apprehensions is crucial for the traction battery market to expand. Manufacturers need to invest in educating consumers and improving the overall value proposition of electric vehicles.

Regulatory and Policy Barriers

While there are supportive policies promoting electric vehicles, inconsistent regulations across regions can create market uncertainties. Policies related to subsidies, tariffs, and environmental standards vary widely, impacting the global traction battery market. Consistent and supportive regulatory frameworks are necessary to provide a stable environment for market growth. However, navigating these regulatory landscapes remains a challenge for manufacturers and investors.

Opportunity in the Traction Battery Market

Growing Demand for Electric Vehicles

The traction battery market is experiencing significant growth opportunities driven by the increasing adoption of electric vehicles (EVs). Governments around the world are implementing policies and incentives to promote the use of EVs as part of their efforts to reduce carbon emissions and combat climate change. For example, the U.S. Inflation Reduction Act of 2022 provides substantial tax credits for the purchase of clean vehicles, which has boosted the demand for EVs and, consequently, traction batteries. As the global focus on reducing greenhouse gas emissions intensifies, the market for traction batteries is expected to expand rapidly.

Advancements in Battery Technology

Continuous advancements in battery technology present a significant opportunity for the traction battery market. Innovations in battery chemistry, such as lithium-ion and nickel-metal hydride, are enhancing the energy density, lifespan, and charging efficiency of traction batteries. These improvements not only make EVs more reliable and convenient but also reduce the overall cost of ownership. Companies are investing heavily in research and development to create batteries that offer longer ranges and faster charging times, which are crucial factors for the widespread adoption of EVs.

Expansion of Charging Infrastructure

The expansion of EV charging infrastructure is another major opportunity for the traction battery market. Many countries are investing in building a robust network of charging stations to support the growing number of EVs on the road. This infrastructure development is essential to alleviate range anxiety among potential EV buyers and to support long-distance travel. As the availability of charging stations increases, the adoption of EVs is likely to rise, further driving the demand for traction batteries.

Emerging Markets and Urbanization

Emerging markets, particularly in Asia-Pacific, are poised to become significant growth areas for the traction battery market. Rapid urbanization and the increasing focus on sustainable transportation solutions in countries like China and India are driving the demand for EVs. These regions are not only adopting electric passenger vehicles but also electric public transport options such as buses and two-wheelers. This shift towards electric mobility is expected to create substantial opportunities for traction battery manufacturers.

E-Commerce and Industrial Applications

The rise in e-commerce activities is fueling the demand for electric vehicles in logistics and warehousing. Electric forklifts, delivery vans, and other industrial vehicles are increasingly being adopted to meet environmental and efficiency standards. Traction batteries that power these industrial applications are becoming more popular due to their ability to provide consistent performance and reduce operational costs. The growth in e-commerce and the push for sustainable logistics solutions are expected to significantly contribute to the traction battery market's expansion.

Government and Private Sector Investments

Significant investments from both governments and private companies are providing a substantial boost to the traction battery market. Governments are not only offering subsidies and tax incentives but also directly investing in the development of EV infrastructure and technology. Meanwhile, private sector companies are expanding their manufacturing capacities and forming strategic partnerships to enhance their market presence. These combined efforts are accelerating the growth of the traction battery market and paving the way for future advancements and adoption

Trends for the Traction Battery Market

Rising Adoption of Electric Vehicles (EVs)

The traction battery market is seeing a surge in demand primarily due to the growing adoption of electric vehicles (EVs). Governments across the globe are encouraging the use of EVs through incentives and regulations aimed at reducing carbon emissions. This has led to an increase in production and sales of EVs, driving the demand for high-capacity and efficient traction batteries.

Advancements in Battery Technology

Continuous advancements in battery technology are significantly influencing the traction battery market. Innovations such as solid-state batteries, which offer higher energy densities and faster charging times, are being developed. These advancements are making batteries more efficient, reliable, and cost-effective, which in turn is boosting their adoption in various applications, especially in EVs and renewable energy storage systems.

Expansion of Renewable Energy Storage

The integration of traction batteries in renewable energy storage systems is another key trend. As the world shifts towards cleaner energy sources like solar and wind power, the need for efficient energy storage solutions is increasing. Traction batteries are being used to store excess energy generated from renewable sources, ensuring a stable and reliable energy supply even when the sun isn't shining or the wind isn't blowing.

Increasing Investments in Battery Manufacturing

There is a significant increase in investments in battery manufacturing infrastructure. Major companies and new entrants are investing heavily in setting up gigafactories to scale up the production of traction batteries. This not only helps in meeting the growing demand but also in reducing the cost per unit through economies of scale, making EVs and other battery-dependent applications more affordable for consumers.

Focus on Sustainability and Recycling

Sustainability is becoming a critical focus in the traction battery market. Companies are working on developing more eco-friendly batteries and improving recycling processes to reduce environmental impact. The push towards creating a circular economy for batteries, where old batteries are recycled to extract valuable materials for new batteries, is gaining momentum. This not only addresses environmental concerns but also helps in managing the supply chain for critical raw materials.

Regional Growth and Market Expansion

The traction battery market is expanding globally, with significant growth observed in regions like Asia-Pacific, North America, and Europe. Asia-Pacific, led by countries like China and India, is seeing rapid industrialization and urbanization, driving the demand for electric vehicles and industrial applications. North America and Europe are also witnessing strong growth due to stringent environmental regulations and increasing consumer preference for sustainable products. This regional expansion is opening new avenues for market players and fostering competitive growth.

Segments Covered in the Report

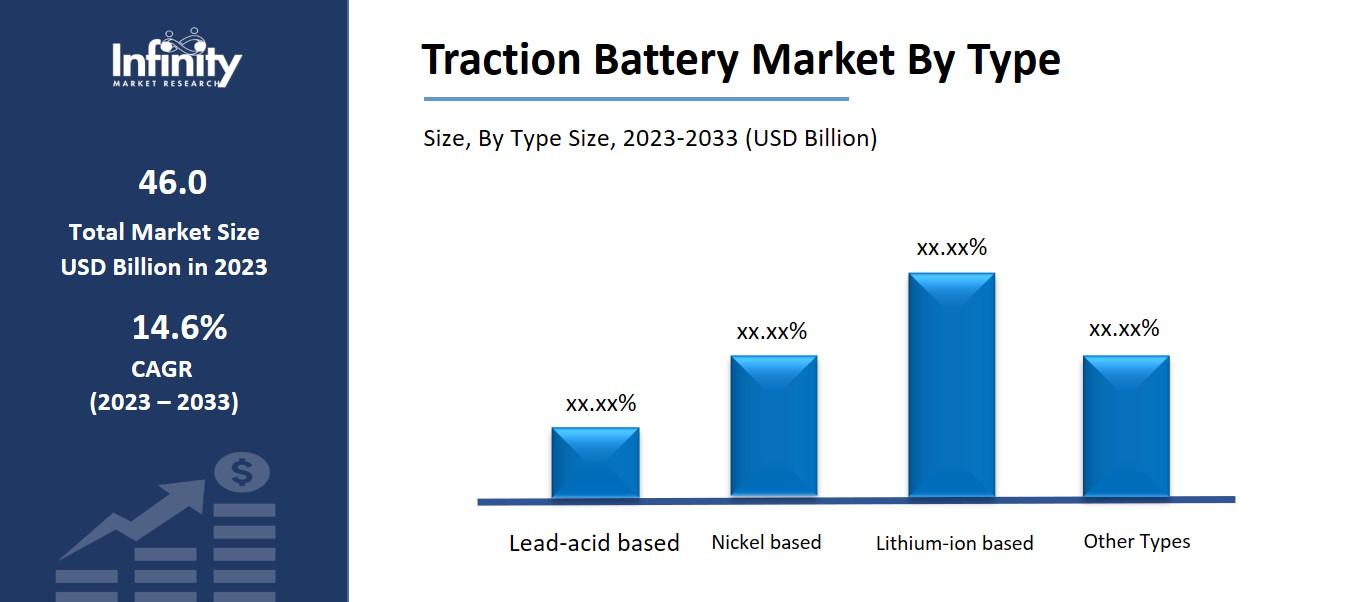

By Type

o Lead-acid based

o Nickel based

o Lithium-ion based

o Other Types

By Capacity

o Less than 100 Ah

o 100-200 Ah

o 200 Ah-300 Ah

o 300-400 Ah

o 400 Ah & above

By Application

o Electrical vehicle (EV)

o Battery Electrical Vehicle (BEV)

o Plug-In Hybrid Electrical Vehicle (PHEV)

o Hybrid Electrical Vehicle (HEV)

o Industrial

o Forklift

o Mechanical Handling Equipment

o Others

o Locomotives

o Other Applications

Segment Analysis

By Type Analysis

In this category, lead-acid batteries accounted for 44.7% of the market in 2023. The market is divided into lead acid-based, nickel-based, lithium-ion-based, and other segments based on the kind of product. The sector that generates the most revenue, lead-acid batteries, is predicted to expand at a compound annual growth rate (CAGR) of 7.2% throughout the projection period. Better vibration resistance, a longer life cycle, and a lower cost are some crucial characteristics that could help these batteries become more popular worldwide.

Due to the industry's outstanding charging efficiency and quick cost savings, growth is predicted. The automotive and transportation industries are expanding faster than ever thanks to the world's population increase. Lead-acid traction batteries are extensively utilized in industrial forklifts, locomotives, road vehicles, scrubber dryers, and other applications.

In electric car applications, its high energy density and better design quality outperform lithium-ion batteries. NiMh is more appropriate for HEVs than existing alternatives since it has a greater weight analysis and volumetric energy density. NiMh batteries are found in almost 70% of hybrid electric cars worldwide, which bodes well for the traction battery industry going forward.

For instance, research issued by the Indian Ministry of Trade and Industry predicts that one of the fastest-growing sectors in the country will be transportation, which is expected to develop at a CAGR of 5.9%. This has the potential to significantly propel the lead-acid battery traction battery market forward.

By Capacity Analysis

Due to the rising demand for HEVs, the category with a battery life of less than 100 Ah held the biggest market 29.7% share in 2023. Less than 100 Ah traction batteries are normally recommended for these cars as their main source of power is still a traditional internal combustion engine.

The submarkets for less than 100Ah, 100-200Ah, 200-300Ah, 300-400Ah, and 400Ah & above comprise the global traction market. The category with less than 100 Ah generates the most revenue and is predicted to expand at a CAGR of 8.5% during the forecast period. The market is expected to develop due to the growing demand for hybrid-electric propulsion devices in small industries. These sectors mostly rely on traction batteries with capacities of less than 100Ah to operate tiny industrial mechanical systems.

Furthermore, it is ideally suited for usage as a backup rechargeable battery in non-plug-in hybrid cars like the Honda Civic Hybrid due to features like its extended lifespan and maximum charge cycle. This could propel the demand for traction batteries with capacities lower than 100Ah.

By Application Analysis

In 2023, the BEVs category held the greatest share of 39.8% in the applications section of the traction battery market. Traction batteries are in greater demand as a result of growing worries about pollution and the growing need for electrification of vehicles, which powers the electric motors of EVs, PHEVs, and battery locomotives.

The Traction Battery Market is segmented into four segments based on application: electrical vehicles, industrial, locomotives, and others. Throughout the projection period, the electric vehicle market is expected to increase at a CAGR of 8.5%. Traction batteries are frequently used to power the electric motors of battery-powered and hybrid electric vehicles, which is in line with growing concerns about pollution and the rapid expansion of electric vehicles. Government programs to lower greenhouse gas emissions are at the forefront of it. Government tax breaks and the aggressive desire of electric vehicle manufacturers to promote EVs in developed countries have aided in the company's expansion.

Rapid industrialization and the movement in customer preferences toward electric forklifts are predicted to help the market's industrial sector. The sector is expanding quickly due in part to the rise in e-commerce activities as well as the unavoidable usage of electric forklifts to promote the sustainability and efficiency of business operations.

Regional Analysis

For the forecast period, the Asia-Pacific traction battery market is expected to increase at a compound annual growth rate (CAGR) of 8.9%, holding a 55.1% market share for traction batteries in 2023. In nations like China and India, where traction batteries are utilized to power industrial equipment systems, the growing demand for consumer goods is fueling the expansion of the industrial manufacturing sectors. This could accelerate the expansion of the traction battery market in Asia Pacific. Furthermore, the popularity of electric vehicles is being fueled by expanding environmental measures, and traction batteries are a common component of electric power motors.

For industry participants, the government's attempts to support e-mobility and appropriate charging infrastructure in India present new prospects. With growing sales of electric vehicles and stringent regulations aimed at reducing carbon emissions in the automotive industry, the European traction battery market was estimated to be worth more than USD 6 billion in 2022 and is expected to continue growing.

Competitive Analysis

To keep a competitive edge, major competitors in the traction battery market are concentrating on several tactics. These include making investments in market research and development to lower costs and improve battery performance, forming strategic alliances and collaborations to broaden product offerings and increase market reach, and launching expansion projects to meet the rising demand for traction batteries in electric cars and other applications. In addition, businesses are experimenting with novel battery chemistries and technologies in response to changing consumer demands and industry developments.

Recent Developments

In June 2021: To supply one of the biggest battery energy storage systems in Europe to the Olkiluoto nuclear power station in Finland, Hitachi ABB Power Grids received a contract with Teolisuden Voima Oyj (TVO). The 90MW system will support the whole power grid at Unit 3 of the Olkiluoto NPP Impact and Mitigation. With a quick startup time, the turnkey system serves as a backup power supply.

In October 2021: A joint venture was agreed upon by Samsung SDI Co Ltd and South Korea's Stelantis (STLA.MI) to produce battery cells and modules for electric vehicles (EVs).

Key Market Players in the Traction Battery Market

o Johnson Controls

o Exide

o Samsung

o Hitachi

o BYD Company

o LG Chem

o Enersys

o Systems Sunlight

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 46.0 Billion |

|

Market Size 2033 |

USD 220.9 Billion |

|

Compound Annual Growth Rate (CAGR) |

14.6% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Type, Capacity, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Johnson Controls, East Penn Manufacturing, Exide, Samsung, Hitachi, BYD Company, LG Chem, Panasonic, Enersys, Systems Sunlight, Other Key Players |

|

Key Market Opportunities |

Advancements in Battery Technology |

|

Key Market Dynamics |

Rising Demand for Electric Vehicles |

📘 Frequently Asked Questions

1. What would be the forecast period in the Automatic Transfer Switch Market?

Answer: The forecast period in the Traction Battery Market report is 2024-2033.

2. How much is the Traction Battery Market in 2023?

Answer: The Traction Battery Market size was valued at USD 46.0 Billion in 2023.

3. Who are the key players in the Traction Battery Market?

Answer: Johnson Controls, East Penn Manufacturing, Exide, Samsung, Hitachi, BYD Company, LG Chem, Panasonic, Enersys, Systems Sunlight, Other Key Players

4. What is the growth rate of the Traction Battery Market?

Answer: Traction Battery Market is growing at a CAGR of 14.6% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.