🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Transformer Oil Market

Transformer Oil Market (By Product (Mineral-based Oils, Naphthenic Base Oils, Paraffinic Base Oils, Silicone-based Oils, Bio-based Oils, Others), By Rating ( <100 MVA, 100 MVA to 500 MVA, 501 MVA to 800 MVA, >800 MVA, Others), By End-use (Utilities, Industrial, Residential, Commercial, Others), By Region and Companies)

Jul 2024

Chemicals and Materials

Pages:

ID: IMR1136

Transformer Oil Market Overview

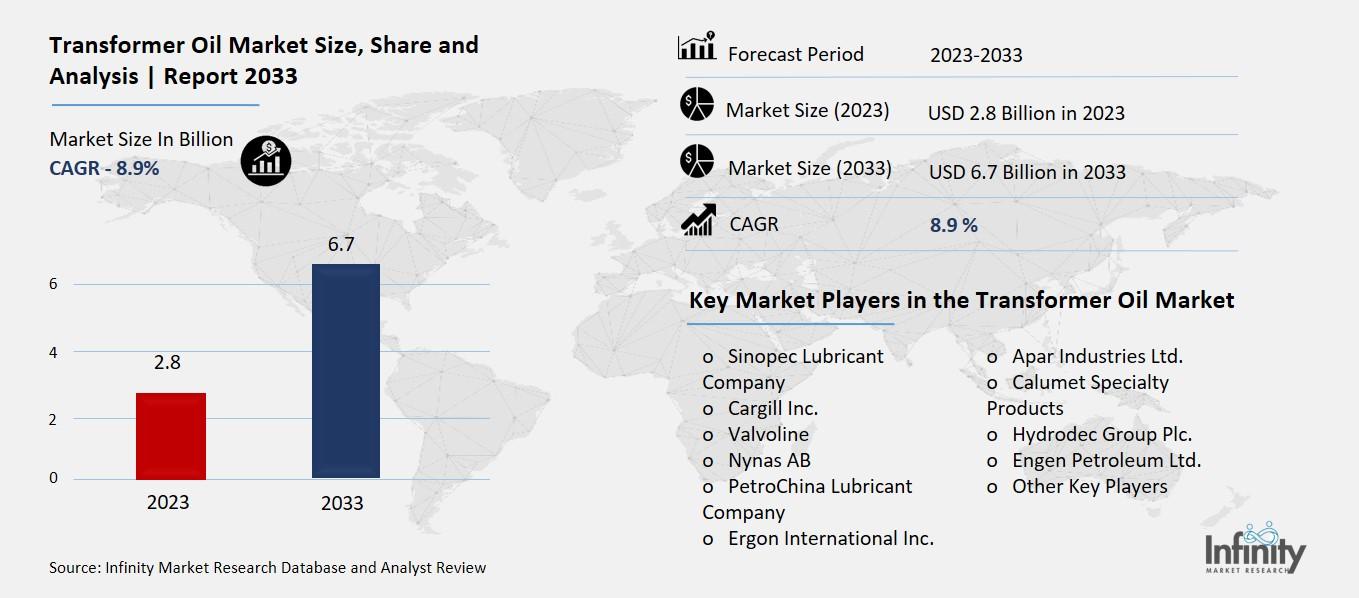

Global Transformer Oil Market size is expected to be worth around USD 6.7 Billion by 2033 from USD 2.8 Billion in 2023, growing at a CAGR of 8.9% during the forecast period from 2023 to 2033.

The Transformer Oil Market is all about the special oil used in transformers, which are devices that help control and distribute electricity. This oil is crucial because it keeps transformers cool and insulates them, ensuring they work well and last a long time. Without good quality transformer oil, transformers could overheat or fail, causing power outages and other issues.

This market covers everything from the production and sale of oil to its use in various types of transformers, whether for homes, businesses, or large power stations. As the electricity demand grows and more transformers are needed, the market for transformer oil also expands. Additionally, advancements in technology and the push for more efficient and eco-friendly oils drive further growth and development in this market.

Drivers for the Transformer Oil Market

Growing Demand for Electricity

As the world’s population increases and economies develop, the electricity demand continues to rise. More homes, businesses, and industries need a stable and reliable power supply, which puts pressure on the existing power grid. To manage this growing demand, new transformers are being installed, and old ones are being upgraded, driving the need for more transformer oil. This oil plays a vital role in ensuring transformers operate efficiently and safely, helping to meet the ever-increasing energy requirements.

Expansion of Power Infrastructure

Many countries are investing heavily in their power infrastructure to support urbanization and industrialization. This includes building new power plants, expanding transmission networks, and upgrading distribution systems. All these developments require a large number of transformers, and consequently, a significant amount of transformer oil. These infrastructure projects are crucial for improving electricity access in rural and remote areas, further boosting the market for transformer oil.

Modernization of Aging Transformers

A lot of the existing transformers in use today are quite old and need modernization or replacement. Over time, the efficiency and reliability of transformers can decline, necessitating maintenance and oil replacement. This modernization process involves the use of high-quality transformer oil to ensure the extended life and better performance of transformers. The ongoing need to maintain and upgrade aging transformers is a key driver for the transformer oil market.

Technological Advancements

Advancements in technology have led to the development of better and more efficient transformer oils. These new oils have improved thermal properties, longer life spans, and are more environmentally friendly. For example, bio-based transformer oils, which are derived from natural sources, are gaining popularity because they are biodegradable and have lower environmental impacts. These technological improvements make transformer oils more appealing and drive market growth.

Renewable Energy Projects

The shift towards renewable energy sources like wind, solar, and hydroelectric power is another significant driver for the transformer oil market. Renewable energy projects often require specialized transformers to connect to the grid and manage the variable power output. The increasing number of renewable energy installations means more transformers and, consequently, more transformer oil. This trend is particularly strong in regions investing heavily in clean energy to reduce their carbon footprint.

Government Regulations and Standards

Governments around the world are implementing stricter regulations and standards to ensure the safety and efficiency of electrical equipment, including transformers. Compliance with these regulations often requires the use of high-quality transformer oil that meets specific performance criteria. These regulations not only ensure the reliability of the power supply but also promote the use of better, more efficient oils, driving demand in the transformer oil market.

Restraints for the Transformer Oil Market

Environmental Concerns

One of the main restraints for the transformer oil market is the environmental impact of traditional mineral oils. These oils are often not biodegradable, leading to concerns about soil and water contamination in the event of leaks or spills. This non-biodegradability poses a significant environmental threat and necessitates stringent handling and disposal procedures, which can be costly and complicated for operators. Additionally, regulatory pressures are increasing globally, with many countries tightening environmental regulations related to the use and disposal of non-biodegradable transformer oils, further limiting their appeal.

Price Volatility of Raw Materials

The cost of raw materials used in the production of transformer oils, such as crude oil, is subject to significant fluctuations. This price volatility can affect the overall cost of transformer oils, making them less predictable and more challenging to budget for utilities and industrial users. When raw material prices rise, manufacturers may face squeezed profit margins or be forced to pass on these costs to consumers, leading to higher prices for transformer oils and potentially reducing demand.

Competition from Alternative Technologies

Advancements in alternative cooling and insulating technologies present a challenge to the transformer oil market. Technologies such as dry-type transformers, which do not require oil for cooling and insulation, are becoming more popular due to their lower environmental impact and reduced maintenance requirements. As these technologies improve and become more cost-competitive, they are likely to capture a larger share of the market, thereby restraining the growth of the traditional transformer oil sector.

Health and Safety Risks

Handling and using mineral-based transformer oils comes with health and safety risks. These oils can be flammable and pose a fire hazard, particularly if not stored and handled correctly. Moreover, exposure to certain chemicals in transformer oils can pose health risks to workers. These safety concerns necessitate strict handling protocols and safety measures, which can increase operational costs and complicate maintenance procedures, thereby limiting the attractiveness of transformer oils.

Market Competition and Price Wars

The transformer oil market is highly competitive, with numerous players vying for market share. This competition often leads to price wars, where companies may reduce prices to outbid each other. While this can benefit consumers in the short term, it can squeeze profit margins for manufacturers, limiting their ability to invest in research and development or expand their operations. This intense competition can also lead to market saturation, making it difficult for new entrants to establish themselves and grow in the market.

Opportunity in the Transformer Oil Market

Expansion of Electric Grids

One of the primary opportunities for the transformer oil market is the ongoing expansion and modernization of electric grids, especially in emerging economies. Countries like India and China are heavily investing in their power infrastructure to meet the rising electricity demand. This expansion includes installing new transformers and upgrading existing ones, which in turn increases the need for transformer oil. This demand is bolstered by initiatives aimed at ensuring reliable power supply, thus creating a significant market opportunity for transformer oil manufacturers.

Rise of Renewable Energy

The push towards renewable energy sources such as solar and wind power is another major opportunity for the transformer oil market. Renewable energy projects require a robust and efficient power transmission and distribution network. Transformer oils play a crucial role in maintaining the reliability and efficiency of transformers in these networks. As countries strive to reduce their carbon footprint and invest more in renewable energy, the demand for high-quality transformer oil will likely rise, providing a substantial growth avenue for the market.

Technological Advancements

Technological advancements in transformer oil production and application present further opportunities. Innovations aimed at improving the efficiency and lifespan of transformer oils can lead to increased adoption. For instance, the development of bio-based and environmentally friendly transformer oils is gaining traction. These oils not only meet stringent environmental regulations but also appeal to industries committed to sustainability. Such advancements open new markets and enhance the competitiveness of transformer oil products.

Infrastructure Development in Developing Countries

The rapid industrialization and urbanization in developing countries are driving the need for extensive power infrastructure. Governments are investing heavily in building and upgrading electric grids to support industrial activities and urban growth. This infrastructure development includes the installation of numerous transformers, thereby boosting the demand for transformer oil. The market can benefit significantly from these developments as the need for reliable and efficient power supply becomes paramount in these regions.

Aging Power Infrastructure

In many developed countries, the aging power infrastructure requires significant upgrades and maintenance. The replacement of old transformers and the modernization of electric grids are critical to ensure uninterrupted power supply and enhance efficiency. This scenario presents a lucrative opportunity for the transformer oil market as new and upgraded transformers will require high-quality oil to function optimally. The ongoing need for maintenance and upgrading of the existing power infrastructure in these regions will continue to drive demand for transformer oil.

Growing Data Center Industry

The surge in digitalization and the expansion of data centers also offer a promising opportunity for the transformer oil market. Data centers, which house numerous servers and electronic equipment, require efficient and reliable power distribution systems. Transformers are essential in managing the power supply within these facilities, and transformer oil is crucial for their operation. The growth of data centers, fueled by the increasing reliance on cloud computing and internet services, will significantly boost the demand for transformer oil.

Trends for the Transformer Oil Market

Growing Demand for Renewable Energy

A significant trend in the transformer oil market is the growing emphasis on renewable energy sources. Countries worldwide are investing heavily in renewable energy projects such as wind and solar farms. These projects require reliable and efficient transformers to convert and distribute electricity, driving the demand for high-quality transformer oils. For instance, China and India, two of the largest electricity producers, are expanding their grid networks and investing in green energy projects. This shift towards renewable energy is expected to boost the demand for transformer oils that can operate efficiently under the varying loads typical of renewable energy applications.

Technological Advancements

Technological advancements in transformer oils are another significant trend. Manufacturers are developing new oil formulations with enhanced electrical and thermal properties to improve transformer performance and reliability. These advancements include biodegradable and environmentally friendly oils that align with the industry's growing focus on sustainability. Companies are also investing in research and development to create oils that can better handle the demands of modern electrical grids and renewable energy installation.

Asia-Pacific Dominance

The Asia-Pacific region continues to dominate the transformer oil market. Rapid urbanization, industrialization, and a growing middle-class population in countries like China and India are driving the electricity demand, leading to the expansion and modernization of electrical grids. This regional growth is further supported by significant investments in infrastructure and renewable energy projects. The Asia-Pacific region's focus on increasing its power generation capacity and improving grid reliability is expected to sustain the demand for transformer oils in the coming years.

Increasing Focus on Grid Reliability

As electrical grids become more complex and interconnected, there is an increasing focus on grid reliability and efficiency. High-quality transformer oils play a crucial role in maintaining the performance of transformers, which are essential for stable and reliable power distribution. This trend is particularly evident in developed regions such as North America and Europe, where investments in grid modernization and smart grid technologies are ongoing. These regions are also witnessing a shift towards environmentally friendly transformer oils to meet stringent environmental regulations.

Environmental Regulations

Stringent environmental regulations are influencing the transformer oil market. Governments and regulatory bodies worldwide are implementing stricter guidelines to reduce the environmental impact of transformer oils. This has led to a growing preference for eco-friendly and biodegradable oils. Manufacturers are responding by developing products that comply with these regulations while maintaining high performance. The adoption of such oils is expected to increase as regulations become more rigorous and environmental awareness grows.

Market Consolidation

The transformer oil market is also experiencing consolidation, with key players focusing on mergers and acquisitions to enhance their market position and expand their product portfolios. This trend is driven by the need to achieve economies of scale, improve research and development capabilities, and gain access to new markets. Market consolidation is expected to lead to increased competition and innovation in the transformer oil industry, benefiting end-users through improved product offerings and better pricing.

Segments Covered in the Report

By Product

o Mineral-based Oils

o Naphthenic Base Oils

o Paraffinic Base Oils

o Silicone-based Oils

o Bio-based Oils

o Others

By Rating

o <100 MVA

o 100 MVA to 500 MVA

o 501 MVA to 800 MVA

o >800 MVA

o Others

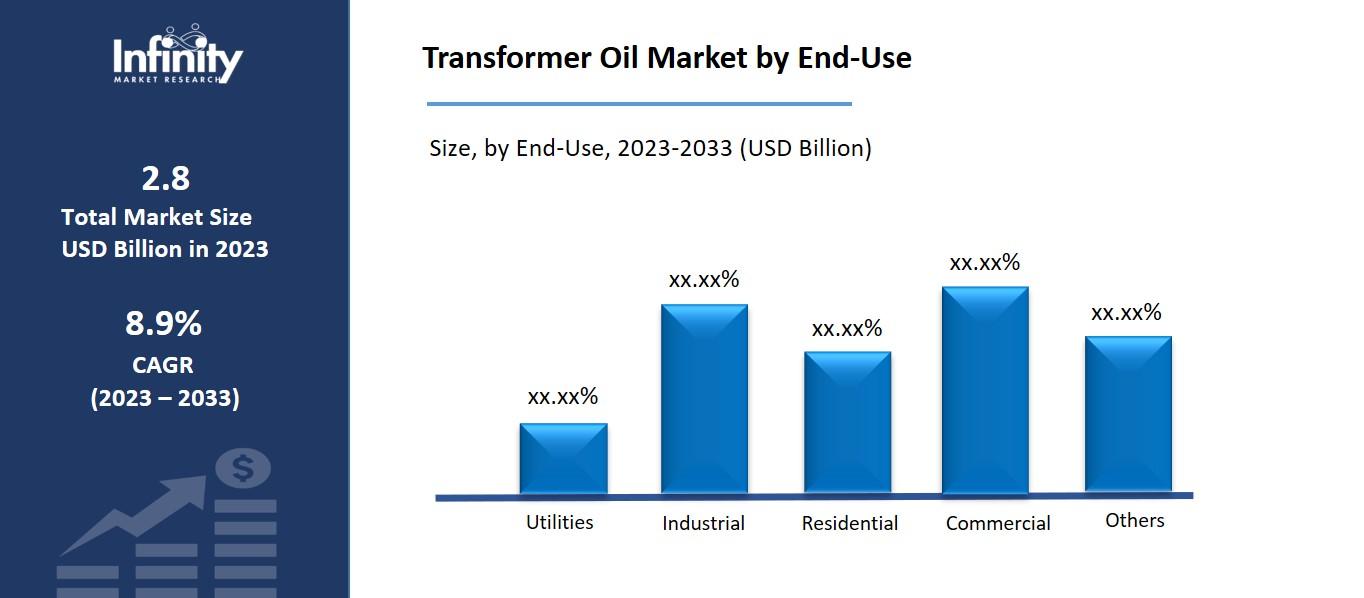

By End-Use

o Utilities

o Industrial

o Residential

o Commercial

o Others

Segment Analysis

By Product Analysis

In 2023, mineral-based oils held a dominant revenue share of over 76.1%. This is explained by the high compatibility and variety of uses of mineral-based oils in circuit breakers and capacitors. Products based on minerals are used to condition and shield boilers, switchgear, and transformers. It can also be utilized for transformer internal field winding protection and heat transfer. It is anticipated that the extensive use of mineral-based oils will propel growth between 2023 and 2033.

The demand for bio-based products has increased significantly recently. Because they're environmentally friendly, they work better than other items. Vegetable oil is used as a feedstock for biobased goods. Petroleum hydrocarbons, silicone, and halogens are not present in this type of oil. Because they are non-toxic and swiftly decompose in the event of a spill or leak, bio-based goods should see increasing potential.

Wax-free naphthenic mineral oil products have several benefits, including low cost, easy availability, high efficiency, and thermal cooling capability. However, from 2023 to 2033, it is anticipated that the market for mineral oil products based on naphthenic will be constrained due to non-biodegradability, which poses handling concerns and causes damage to the environment.

By Rating Analysis

In 2023, the 100 MVA to 500 MVA category held a dominant revenue share of over 54.2%. This expansion is anticipated to be driven by the use of these transformers in large-scale industrial settings, such as manufacturing facilities, power plants, and refineries. These transformers are now essential parts of the production, transmission, and distribution of electrical power because of their high capacity and design. They are also perfect for moving power from a source to a desired destination because of their ability to withstand high voltages, which allows them to distribute power effectively in densely populated places.

With a predicted CAGR of 13.1% from 2023 to 2033, the <100 MVA segment is expected to rise from its second-largest position in 2023. This is explained by the fact that it is used in numerous power distribution systems to adjust the voltage of electrical power so that it may be transferred over great distances.

By End-use Analysis

In 2023, the industrial segment held a dominant revenue share of over 49.3%. This is explained by the fact that more transformers are needed as a result of global industrialization. Transformers used in the steel, food processing, chemical, and automotive industries are examples of industrial end-use. Different kinds of electrical machinery with distinct voltage levels are needed for industrial processes. Power-producing facilities usually employ three-phase distribution transformers since they produce power at high voltages.

As a result, the need for transformers used in the global steel and chemical production industries has grown, which in turn has boosted demand for transformer oils needed to keep these transformers operating efficiently.

This is a result of expanding residential areas brought on by an expanding world population. Transformers used in homes, apartments, and villas are included in the residential section. Single-phase distribution transformers are usually used for individual residences in residential spaces and villas, whereas three-phase distribution transformers are used for larger residential areas.

Regional Analysis

In 2023, the transformer oil market was dominated by Asia Pacific, accounting for roughly 54.7% of total revenue. The increase in demand for electricity in Australia and developing nations like China, India, and Japan is the reason behind this. Furthermore, it is projected that as the commercial and industrial sectors expand, there will be a rise in substation construction, which will support the demand for transformers.

Growing power sector investments are facilitating Chinese businesses' entry into new markets. Furthermore, the sub-transmission segment's demand is being driven by the notable expansion of renewable capacity in nations like China and India. One of the biggest obstacles facing international markets entering the Asia Pacific region is the existence of powerful domestic manufacturers.

North America’s market is growing because of the expansion of the industrial and manufacturing sectors in the United States and Canada. It is projected that technological advancements, transformer modernization, and a contracting crude oil market will propel regional market expansion.

Competitive Analysis

To expand their product lines, major industry players are heavily investing in research and development, which will propel the growth of the transformer oils market. To expand their global presence, market players are also implementing a variety of strategic measures, including the introduction of new products, signing contracts, merging with other companies, investing more, and working together. For expansion and survival in a developing and more competitive market, rivals in the Transformer Oils sector must provide reasonably priced goods.

Recent Developments

June 2023: Nynas introduced the superior NYTRO RR 900X circular transformer fluid, which is built on the potent and successful re-refining technology. Using the fluid original production impact, the Nynas refining process recovers valuable molecules that are no longer fit for use in their current form.

February 2023: A new transformer insulating fluid called FR3r natural ester was introduced by Cargill. It is made up of more than 95% rapeseed oil.

Key Market Players in the Transformer Oil Market

o Sinopec Lubricant Company

o Cargill Inc.

o Valvoline

o Nynas AB

o PetroChina Lubricant Company

o Ergon International Inc.

o Apar Industries Ltd.

o Calumet Specialty Products

o Hydrodec Group Plc.

o Engen Petroleum Ltd.

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 2.8 Billion |

|

Market Size 2033 |

USD 6.8 Billion |

|

Compound Annual Growth Rate (CAGR) |

8.9% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

- |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Product, Rating, End-use, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Sinopec Lubricant Company, Cargill Inc., Valvoline, Nynas AB, PetroChina Lubricant Company, Ergon International Inc., Apar Industries Ltd., Calumet Specialty Products, Hydrodec Group Plc., Engen Petroleum Ltd., Other Key Players |

|

Key Market Opportunities |

Infrastructure Development in Developing Countries |

|

Key Market Dynamics |

Growing Demand for Electricity |

📘 Frequently Asked Questions

1. How much is the Transformer Oil Market in 2023?

Answer: The Transformer Oil Market size was valued at USD 2.8 Billion in 2023.

2. What would be the forecast period in the Transformer Oil Market report?

Answer: The forecast period in the Transformer Oil Market report is 2023-2033.

3. Who are the key players in the Transformer Oil Market?

Answer: Sinopec Lubricant Company, Cargill Inc., Valvoline, Nynas AB, PetroChina Lubricant Company, Ergon International Inc., Apar Industries Ltd., Calumet Specialty Products, Hydrodec Group Plc., Engen Petroleum Ltd., Other Key Players

4. What is the growth rate of the Transformer Oil Market?

Answer: Transformer Oil Market is growing at a CAGR of 8.9% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.