🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Ultra High Molecular Weight Polyethylene Market

Ultra High Molecular Weight Polyethylene Market (By Form (Sheets, Rods & Tubes, Films, Tapes, Others), By Application (Medical Grade & Prosthetics, Water Treatment, Food Processing Machinery Parts, Packaging Machinery Parts, High-Speed Conveyors, Wear Strips and Guide Rails, Bumpers, Pile Guards, and Dock Fenders, Chute, Hopper, and Truck Bed Liners, Star Wheels and Idler Sprockets, Batteries, Others), By End-Use (Healthcare & Medical, Oil & Gas, Aerospace & Defense, Electronics, Sports & Leisure, Automotive & Transportation, Industrial & Heavy Equipment, Textiles, Recreation & Consumer, Material Handling, Pipe & Mining, Food & Beverages, Chemical, Water Filtration, Others), By Region and Companies)

Jul 2024

Chemicals and Materials

Pages: 144

ID: IMR1181

Ultra High Molecular Weight Polyethylene Market Overview

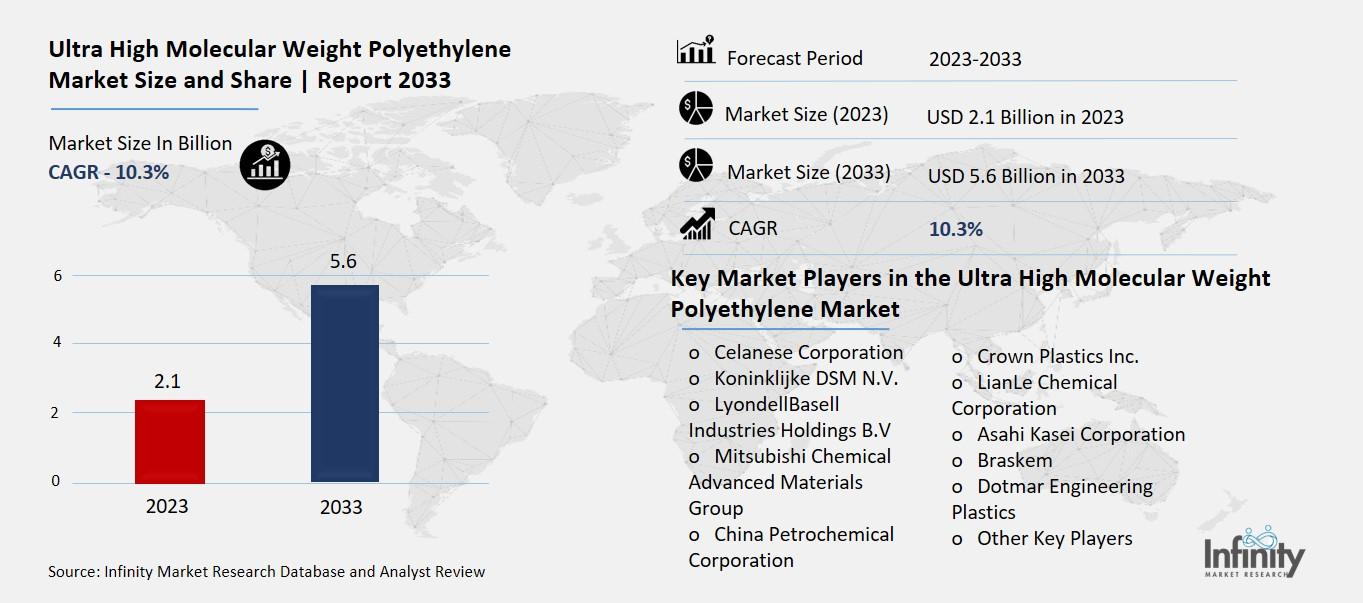

Global Ultra High Molecular Weight Polyethylene Market size is expected to be worth around USD 5.6 Billion by 2033 from USD 2.1 Billion in 2023, growing at a CAGR of 10.3% during the forecast period from 2023 to 2033.

The Ultra High Molecular Weight Polyethylene (UHMWPE) market revolves around the production and sale of a special type of plastic known for its exceptional strength, durability, and resistance to abrasion and chemicals. UHMWPE is used in a variety of industries, including medical, automotive, aerospace, and industrial manufacturing. In the medical field, it's commonly used for joint replacements and surgical implants due to its biocompatibility and wear resistance. In industrial applications, it's favored for its toughness and low friction properties, making it ideal for use in conveyor belts, liners, and other heavy-duty equipment.

This market is growing due to the increasing demand for high-performance materials that can withstand harsh conditions and have a long service life. As industries continue to advance, the need for materials like UHMWPE, which offers superior performance compared to traditional plastics, is rising. Additionally, technological innovations and improvements in production processes are making UHMWPE more accessible and cost-effective, further driving its adoption across various sectors.

Drivers for the Ultra High Molecular Weight Polyethylene Market

Growing Demand in Medical Applications

One of the main drivers for the Ultra High Molecular Weight Polyethylene (UHMWPE) market is its increasing use in the medical sector. UHMWPE is highly favored in medical applications, particularly for orthopedic implants like hip and knee replacements. This is due to its exceptional wear resistance and biocompatibility, which ensure longevity and safety in medical devices. The aging population and the rising number of joint replacement surgeries significantly contribute to this demand. Additionally, advancements in medical technology and materials science are enhancing the properties of UHMWPE, making it even more desirable for various medical applications.

Rising Adoption in the Automotive Industry

The automotive sector is another significant driver for the UHMWPE market. This material is increasingly used in the automotive industry for components that require high durability and low friction, such as gears, bearings, and bushings. The push towards electric vehicles (EVs) has further fueled the demand for UHMWPE due to its lightweight properties and high-performance characteristics, which are crucial for improving the efficiency and range of EVs. Moreover, the trend of miniaturization and the need for materials that can withstand high stress and wear in compact spaces are also boosting UHMWPE's adoption in the automotive sector.

Expanding Usage in Aerospace and Defense

UHMWPE is also gaining traction in the aerospace and defense industries. Its lightweight and high-strength properties make it ideal for use in various aerospace applications, including interior components and protective gear. In the defense sector, UHMWPE is used in body armor and ballistic protection due to its excellent impact resistance. The growing focus on enhancing the performance and safety of aerospace and defense equipment drives the demand for UHMWPE in these industries.

Growth in the Food and Beverage Industry

The food and beverage industry is another area where UHMWPE is seeing increased application. This material is used in food processing and packaging equipment because of its non-stick properties, high chemical resistance, and compliance with food safety standards. The ongoing expansion of the food and beverage industry, coupled with the need for efficient and safe processing materials, is driving the demand for UHMWPE. Its ability to maintain performance under various temperature conditions and resist contamination makes it a preferred choice in this sector.

Technological Advancements and Product Innovations

Technological advancements and continuous product innovations are also significant drivers of the UHMWPE market. Companies are investing in research and development to improve the material properties of UHMWPE, such as enhancing its strength, wear resistance, and processing capabilities. Innovations like the development of cross-linked UHMWPE and UHMWPE composites are expanding their applications across various industries. These advancements not only improve the performance of UHMWPE but also open up new opportunities for its use in emerging applications.

Increasing Demand in Emerging Economies

The rising demand for UHMWPE in emerging economies, particularly in Asia-Pacific, is another key driver of market growth. Rapid industrialization, growing healthcare infrastructure, and expanding automotive and aerospace sectors in countries like China and India are contributing to this increased demand. The focus on improving healthcare facilities and the automotive industry in these regions is expected to continue driving the market for UHMWPE. Furthermore, favorable government policies and investments in infrastructure development in these emerging markets are likely to boost the demand for UHMWPE in the coming years.

Restraints for the Ultra High Molecular Weight Polyethylene Market

Rising Costs of UHMWPE

One of the main restraints for the Ultra High Molecular Weight Polyethylene (UHMWPE) market is its high cost. UHMWPE is more expensive compared to traditional materials like steel, polypropylene, and regular polyethylene. This is due to its superior properties, such as high impact resistance, low friction, and excellent energy absorption. These characteristics, while beneficial, drive up the production costs, making UHMWPE less attractive for cost-sensitive applications. The higher price can limit its adoption, especially in industries where budget constraints are a significant concern.

Supply Chain Disruptions

The COVID-19 pandemic has significantly disrupted supply chains worldwide, affecting the availability and production of UHMWPE. Lockdowns, restrictions, and reduced industrial activities have led to delays in manufacturing and transportation. These disruptions have resulted in a shortage of raw materials and components necessary for producing UHMWPE, further constraining market growth. As industries recover from the pandemic, rebuilding and stabilizing supply chains remain a challenge that could continue to impact the market in the short to medium term.

Competition from Alternative Materials

UHMWPE faces stiff competition from other advanced materials that offer similar benefits at lower costs. Innovations in material science have led to the development of new polymers and composites that can compete with UHMWPE in terms of performance but at a reduced price point. For example, certain high-performance polymers and engineered composites provide comparable durability and resistance while being more economical. This competition can divert potential users away from UHMWPE, affecting its market penetration and growth.

Environmental Concerns

Environmental sustainability is becoming increasingly important in material selection across various industries. UHMWPE, being a type of plastic, raises concerns regarding its environmental impact, particularly its biodegradability and recycling challenges. As industries and governments push for greener alternatives, the preference might shift towards more sustainable materials. This environmental push can restrict the demand for UHMWPE, especially if regulations become stricter regarding plastic usage and waste management.

Limited Awareness and Technical Know-How

Another restraint is the limited awareness and technical knowledge about UHMWPE among potential users. Many industries are not fully aware of the benefits and applications of UHMWPE, which can hinder its adoption. Additionally, the specialized nature of UHMWPE requires specific technical expertise for effective application and integration into various products. The lack of skilled professionals and inadequate knowledge dissemination can slow down the growth of the UHMWPE market as potential users opt for more familiar materials.

Opportunity in the Ultra High Molecular Weight Polyethylene Market

Rising Demand in Medical and Healthcare Applications

The Ultra High Molecular Weight Polyethylene (UHMWPE) market is experiencing significant opportunities due to its increasing use in medical and healthcare applications. UHMWPE is renowned for its excellent biocompatibility, high wear resistance, and low friction properties, making it ideal for use in joint replacements, surgical implants, and prosthetics. With the growing aging population and advancements in medical technology, the demand for UHMWPE in the healthcare sector is rising. Medical professionals prefer UHMWPE for its durability and ability to improve patient outcomes, leading to increased production and innovation in this sector.

Growth in the Automotive and Aerospace Industries

Another key opportunity for the UHMWPE market lies in its applications within the automotive and aerospace industries. UHMWPE's lightweight and strong properties make it an attractive material for various components in these sectors. In automotive applications, UHMWPE is used in parts that require high-impact resistance and low friction, contributing to overall vehicle performance and safety. Similarly, in aerospace, UHMWPE is utilized for components that need to withstand extreme conditions while maintaining minimal weight. As these industries continue to innovate and seek materials that enhance efficiency and safety, UHMWPE's role is expected to grow.

Advancements in Industrial Applications

Industrial applications are also driving the demand for UHMWPE. The material's high abrasion resistance and chemical stability make it suitable for use in conveyor systems, wear pads, and liners in various industrial processes. The need for durable and cost-effective solutions in industries like mining, construction, and manufacturing is pushing the demand for UHMWPE. As industries look for materials that can withstand harsh conditions and reduce maintenance costs, UHMWPE stands out as a viable option, leading to increased market opportunities.

Technological Innovations and Product Development

Technological advancements and ongoing research are opening new avenues for UHMWPE. Innovations in polymer processing and modification techniques are enhancing UHMWPE’s properties, making it even more versatile. Researchers are developing new grades of UHMWPE with improved mechanical properties and processing capabilities, expanding its potential applications. This continuous development is creating opportunities for manufacturers to explore new markets and applications, further driving the growth of the UHMWPE market.

Growing Awareness and Adoption of Eco-friendly Materials

The growing emphasis on sustainability and the use of eco-friendly materials is another factor contributing to the UHMWPE market's expansion. UHMWPE is considered a more sustainable option due to its durability and long lifespan, which reduces the need for frequent replacements and associated waste. As industries and consumers become more environmentally conscious, the demand for eco-friendly materials like UHMWPE is increasing. This shift towards sustainable practices creates new opportunities for UHMWPE manufacturers and drives market growth.

Trends for the Ultra High Molecular Weight Polyethylene Market

Increased Use of Medical Implants and Devices

One of the major trends in the Ultra High Molecular Weight Polyethylene (UHMWPE) market is its expanding use in medical implants and devices. UHMWPE is favored in the healthcare sector for its exceptional wear resistance and biocompatibility. This makes it ideal for use in joint replacements, such as hip and knee implants, and other surgical devices. As the global population ages and the demand for advanced medical treatments grows, the need for UHMWPE in these applications is increasing. Continuous improvements in the material’s properties, such as enhanced strength and reduced wear rates, are driving its adoption in more sophisticated medical technologies.

Advancements in Manufacturing Techniques

Technological advancements in manufacturing techniques are significantly impacting the UHMWPE market. Innovations in polymer processing, such as advanced extrusion and molding methods, are improving the quality and performance of UHMWPE products. These advancements enable the production of UHMWPE with enhanced mechanical properties, such as greater impact resistance and improved dimensional stability. As manufacturers adopt these new techniques, they can produce UHMWPE components that meet the demanding specifications of various industries, leading to broader application areas and increased market growth.

Growth in the Automotive Sector

Due to its beneficial properties, the automotive industry is witnessing a trend toward greater use of UHMWPE. UHMWPE's low friction, high impact resistance, and lightweight nature make it suitable for various automotive applications, including fuel systems, bearings, and interior components. As automotive manufacturers seek to improve vehicle performance, safety, and fuel efficiency, UHMWPE is becoming a preferred material. The shift towards electric and hybrid vehicles is also driving the demand for UHMWPE, as these vehicles require lightweight and durable components to enhance efficiency and performance.

Rising Demand in Aerospace Applications

The aerospace industry is increasingly adopting UHMWPE due to its strength-to-weight ratio and resistance to extreme conditions. UHMWPE is used in components such as aircraft interiors, seals, and insulation materials, where durability and lightweight characteristics are crucial. The trend towards more fuel-efficient and longer-lasting aircraft is driving the demand for UHMWPE. Additionally, advancements in aerospace technology are creating new applications for UHMWPE, further expanding its role in this sector.

Sustainability and Recycling Initiatives

A growing trend in the UHMWPE market is the focus on sustainability and recycling. UHMWPE is known for its long lifespan and resistance to degradation, which contributes to its environmental benefits by reducing the need for frequent replacements. Companies are also exploring recycling methods for UHMWPE to minimize waste and improve sustainability. As industries and consumers become more environmentally conscious, the emphasis on sustainable practices is influencing the development and adoption of UHMWPE solutions.

Segments Covered in the Report

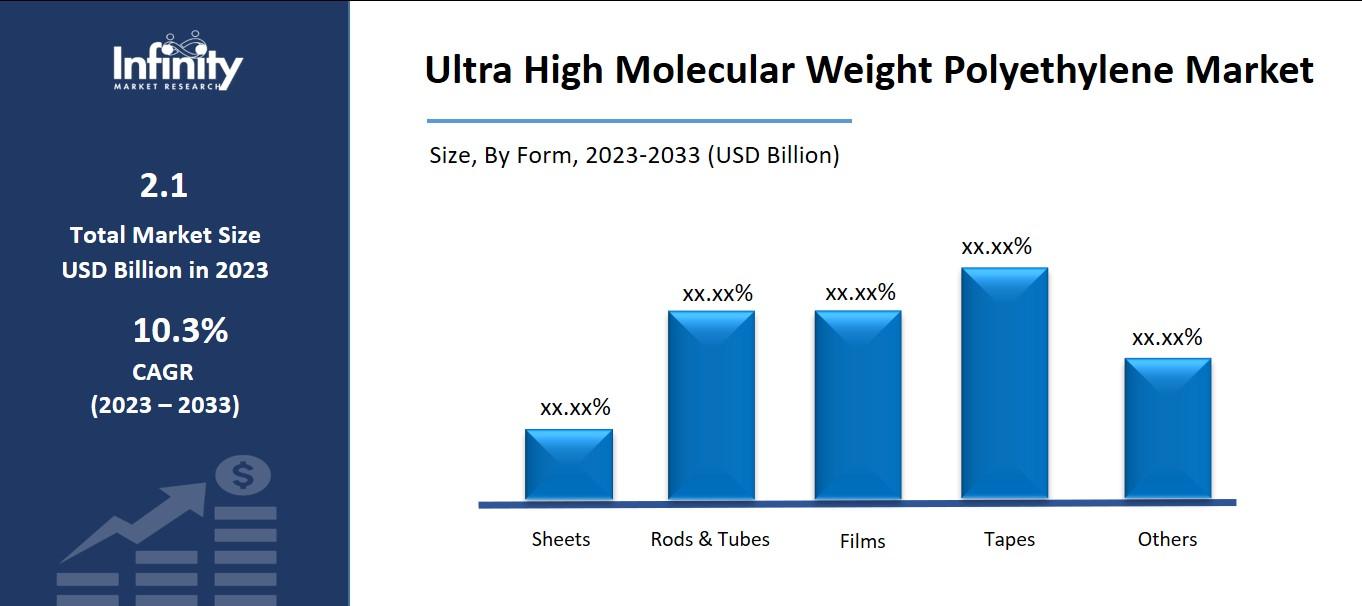

By Form

o Sheets

o Rods & Tubes

o Films

o Tapes

o Others

By Application

o Medical Grade & Prosthetics

o Water Treatment

o Food Processing Machinery Parts

o Packaging Machinery Parts

o High-Speed Conveyors

o Wear Strips and Guide Rails

o Bumpers, Pile Guards, and Dock Fenders

o Chute, Hopper, and Truck Bed Liners

o Star Wheels and Idler Sprockets

o Batteries

o Others

By End-Use

o Healthcare & Medical

o Oil & Gas

o Aerospace & Defense

o Electronics

o Sports & Leisure

o Automotive & Transportation

o Industrial & Heavy Equipment

o Textiles

o Recreation & Consumer

o Material Handling

o Pipe & Mining

o Food & Beverages

o Chemical

o Water Filtration

o Others

Segment Analysis

By Form Analysis

In 2023, the sheets section accounted for the greatest proportion, with 24.8%. UHMWPE sheets are widely employed in a variety of application industries to address wear, friction, and material flow issues. The exceptional sliding qualities, great impact strength, severe wear resistance, and strong chemical resistance of this material sheet set it apart. UHMWPE sheets are widely employed in many different industries, including chemicals, food and beverage, packaging, and general conveyor technology.

Regarding the ultra-high molecular weight polyethylene (UHMWPE) market value, it is projected to expand at a noteworthy compound annual growth rate (CAGR) between 2023 and 2033 for implants based on UHMWPE. One of the most popular materials to utilize in the creation of medical implant applications is UHMWPE. Because of its exceptional durability and strong resistance to wear and abrasion, it has been trusted. Long chains, great pliability, and good impact strength characterize UHMWPE. In addition, these materials weigh less than materials made of metal. In the last few years, these qualities have raised the demand for the product in medical applications. Throughout the forecast period, this tendency is expected to continue.

By Application Analysis

In terms of revenue, Medical Grade & Prosthetics held the greatest market share and was the most popular application category in the worldwide ultra-high molecular weight polyethylene market in 2023. Over the projection period, the expanding senior population—particularly in North America and Europe—is expected to have a significant impact on the development of medical grade and prosthetics, which will increase the use of ultra-high molecular weight polyethylene. Important elements that are anticipated to have a beneficial effect on the worldwide market include technological developments in the use of UHMWPE as prostheses.

For general and fluid-based situations, UHMWPE is a sturdy polymer that works well as a stable porous medium. It is more cheap in developed regions like North America and Europe, where product prices are higher. The market demand for UHMWPE in the water treatment sector is anticipated to be positively impacted by laws that are favorable and reliable.

In recent years, UHMWPE has become more and more common in lead-acid battery separators. Throughout the projection period, UHMWPE demand is anticipated to be driven globally by its higher molecular weight as compared to traditional HDPE, PVC, glass fiber, and cellulose separators. Rubber and engineering plastics industries employ UHMWPE as an additive. They are employed in some coatings and to improve lubricity. Furthermore, because of the high tensile strength, elongation, impact resistance, and other qualities of ultra-high molecular weight polyethylene, these fabrics are used in a variety of consumer goods applications, such as pantyhose, fencing apparel, and shoe liners.

By End-Use Analysis

In 2023, the healthcare and medical sectors held a dominant position in the market, contributing the highest revenue share of about 14.8%. The need for ultra-high molecular weight polyethylene products in the medical industry is being driven by factors such as an aging population, rising healthcare expenditures, and technological improvements. UHMWPE is frequently used in the production of several medical equipment, including prosthetic devices like limb components and orthopedic implants like hip and knee replacements.

Furthermore, one of the main end markets for ultra-high molecular weight polyethylene is the aerospace and defense sector. Because of its exceptional durability and resistance to abrasion, UHMWPE is a good choice for a variety of aerospace and defense applications, including vehicle armor panels, body armor plates, and helmets.

Regional Analysis

In 2023, North America accounted for over 39.7% of market revenue, dominating the industry. The United States is expected to continue to lead the North American UHMWPE market for the duration of the forecast period, having done so in 2023. The use of UHMWPE in protective armor is expanding significantly in the area. Ultra-high molecular Weight Polyethylene (UHMWPE) Market growth in the region is anticipated to be driven by rising military and defense spending in the United States and an increase in reported cases of joint procedures, including hip and knee replacements. The strong demand for ultra-high molecular weight polyethylene (UHMWPE) in aerospace and medical applications, such as body panels and cutting-edge medical devices, has historically propelled the U.S. market for this material.

Throughout the forecast period, Asia Pacific is anticipated to expand at the quickest CAGR rate in terms of revenue. Asia Pacific, being a small region, is important and has a lot of room to increase its market. It is anticipated that the major end-use sectors' existence and rapid expansion will positively affect regional growth. The region's automotive manufacturing sector is anticipated to be led by China, Japan, and South Korea. The industry is anticipated to gain from reports of rising healthcare spending as a result of rising disposable income in significant emerging nations.

Competitive Analysis

To preserve and increase their market share, major corporations are implementing a variety of inorganic and organic growth methods, including joint ventures, capacity expansion, and mergers and acquisitions.

Recent Developments

January 2024: The international sustainability accreditation ISCC PLUS was obtained by Asahi Kasei and a related business for a variety of products, including ultra-high molecular weight polyethylene. The company will be able to provide engineering plastics, other materials, and ISCC PLUS-approved grades of thermoplastic elastomers and rubbers after obtaining this certification.

February 2023: Ultra-fine fiber has been added to Honeywell International Inc.'s Spectra Medical Grade (MG) BIO fiber range. They lengthen the device's lifespan and are employed in the design of orthopedic and cardiovascular devices in a minimally unfriendly manner.

Key Market Players in the Ultra High Molecular Weight Polyethylene Market

o Koninklijke DSM N.V.

o LyondellBasell Industries Holdings B.V

o Mitsubishi Chemical Advanced Materials Group

o China Petrochemical Corporation

o Crown Plastics Inc.

o LianLe Chemical Corporation

o Braskem

o Dotmar Engineering Plastics

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 2.1 Billion |

|

Market Size 2033 |

USD 5.6 Billion |

|

Compound Annual Growth Rate (CAGR) |

10.3% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Form, Application, End-Use, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Celanese Corporation, Koninklijke DSM N.V., LyondellBasell Industries Holdings B.V, Mitsubishi Chemical Advanced Materials Group, China Petrochemical Corporation, Crown Plastics Inc., LianLe Chemical Corporation, Asahi Kasei Corporation, Braskem, Dotmar Engineering Plastics, Other Key Players |

|

Key Market Opportunities |

Rising Demand in Medical and Healthcare Applications |

|

Key Market Dynamics |

Rising Adoption in the Automotive Industry |

📘 Frequently Asked Questions

1. What would be the forecast period in the Ultra High Molecular Weight Polyethylene Market?

Answer: The forecast period in the Ultra High Molecular Weight Polyethylene Market report is 2024-2033.

2. How much is the Ultra High Molecular Weight Polyethylene Market in 2023?

Answer: The Ultra High Molecular Weight Polyethylene Market size was valued at USD 2.1 Billion in 2023.

3. Who are the key players in the Ultra High Molecular Weight Polyethylene Market?

Answer: Celanese Corporation, Koninklijke DSM N.V., LyondellBasell Industries Holdings B.V, Mitsubishi Chemical Advanced Materials Group, China Petrochemical Corporation, Crown Plastics Inc., LianLe Chemical Corporation, Asahi Kasei Corporation, Braskem, Dotmar Engineering Plastics, Other Key Players

4. What is the growth rate of the Ultra High Molecular Weight Polyethylene Market?

Answer: Ultra High Molecular Weight Polyethylene Market is growing at a CAGR of 10.3% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.