🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Ultra-Low Alpha Metals Market

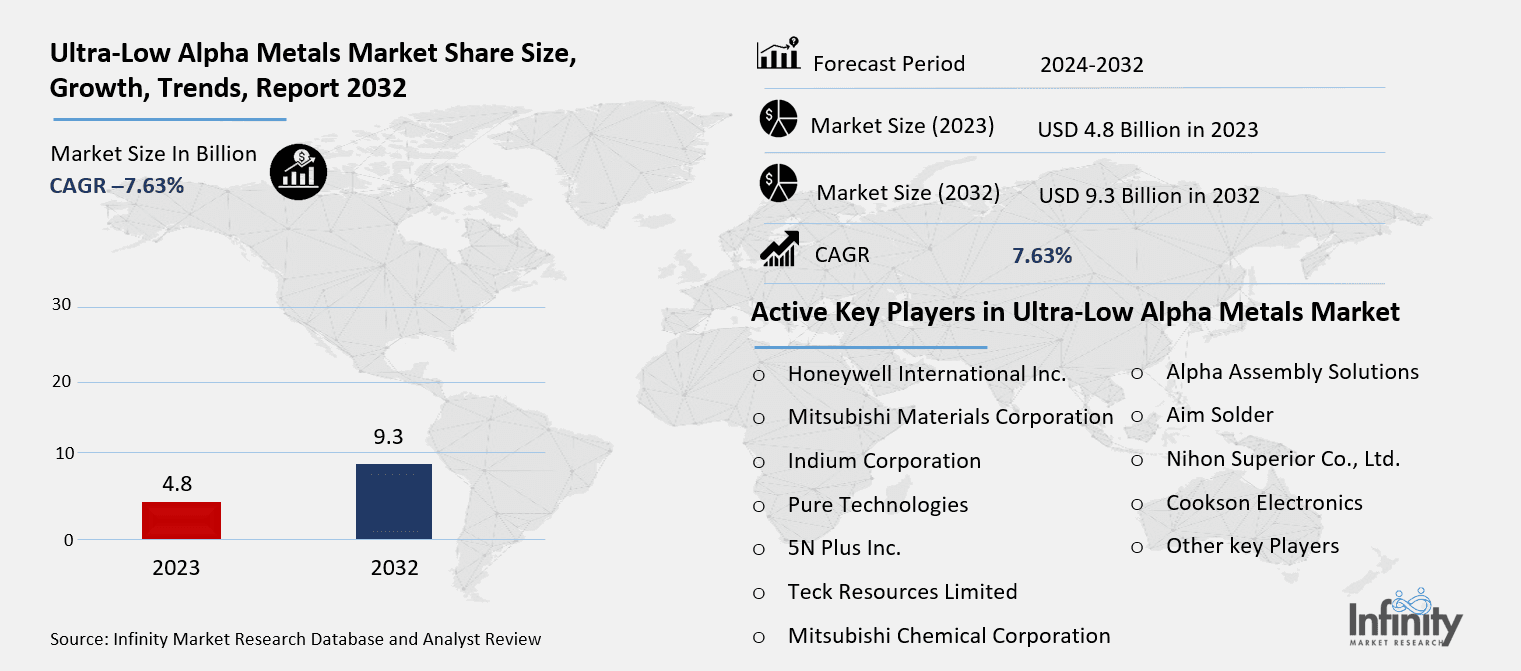

Ultra-Low Alpha Metals Market Global Industry Analysis and Forecast (2024-2032) By Product Type(ULA Tin, ULA Tin Alloys, ULA Lead Alloys, ULA Lead-Free Alloys), By Raw Materials(Tin, Silver, Copper, Lead), By End-User Industries(Electronics, Automotive & Transportation, Aviation, Medical, Telecommunication, Others) and Region

Feb 2025

Chemicals and Materials

Pages: 138

ID: IMR1667

Ultra-Low Alpha Metals Market Synopsis

Ultra-Low Alpha Metals Market Size Was Valued at USD 4.8 Billion in 2023, and is Projected to Reach USD 9.3 Billion by 2032, Growing at a CAGR of 7.63% From 2024-2032.

ULAs are defined to belong in the Ultra-Low Alpha Metals Market or industry segment that is focused on metals producing and distributing as well as applied on materials that emits alpha particles with value less than 0.002 cph cm². These metals include ULA tin, tin alloys, lead alloys, and lead-free solders and are used in high-reliability application such as electronics, automotive, medical, aerospace, and any other environment that requires minimum radiation-induced α-emission that will cause circuit malfunctions due to soft errors.

ULTRA-low alpha metals have become critical in most new technologies that require the highest reliability levels. These metals are purposely manufactured to prevent what are known as soft errors due to alpha particle exposure, which tends to upset electronic circuit and memory elements. There exist higher stakes in the automotive, telecommunications, aerospace, and MedTech industries where higher input of electronics has ignited elevated demand in ULA metals. With new miniaturization in electronic components and processed circuits, the vulnerability to radiations is also high and therefore, ultra low alpha metals are needed.

The market has experienced stellar growth as a result of innovation in the manufacture of semiconductors and the development of the 5G network. Due to changes in industrial trends towards sustainability, lead-free alloys have become more popular since they effectively provide a solution for applications that may have contained lead earlier but with comparable performance. Further, required highly reliable electronics for aviation and defense sector enhance the demand of these materials.

When it comes to geography, the market players that are based in the North America, Europe and Asia-Pacific area seem to have a competitive edge. Nonetheless, the Asia-Pacific region stands out in terms of manufactures and consumers due to the extensive semiconductor and electronics production. Local consumer incentives-policies to support local production and investment in technology all aid the market in this region. The market for metals within the ULA remit is likely to grow rapidly in the coming years as additional use cases are developed, most notably quantum computing and complex medical diagnostics, which require such low levels of radiation that they must be relegated to a separate continent.

Ultra-Low Alpha Metals Market Outlook, 2023 and 2032: Future Outlook

Ultra-Low Alpha Metals Market Trend Analysis

Trend: Growing Demand for Lead-Free Alloys

The global trend towards green and sustainable materials has placed lead-free alloys as an emerging force in the ultra-low alpha metals market. The ease of banning and regulating toxic elements like lead has made regulatory such as the European RoHS directive to push the manufacturer in the direction of lead bearing materials. These regulations seek to reduce the effect of hazardous substance on the environment and the health of users of electronics products.

Consumer electronics and automotive industries have embraced lead-free alloys to reflect the continuously improving sustainability agendas. Also, lead-free alloys provide improved performance characteristics including thermal and some mechanical properties for usage in higher performance applications. This trend is expected to rise progressively because worldwide governments and industries are following environmentally friendly campaigns for green activities, thus promoting ultra-low alpha lead-free products.

Opportunity: Expansion in 5G and IoT Applications

5G networks and IoT devices are set to create a considerable market for the ultra-low alpha metals market since 5G networks require highly dependable parts. Being immune to soft errors, ULA metals become indispensable for the stable operation of the elements that are involved in the provision of 5G communications, such as base stations and the user devices.

Likewise, increased interconnectedness of things such as smart homes, wearables, and industrial supply chain depend on small and sensitivity of electronic parts. After adopting the ULA metals IoT manufacturing is able to provide durability and resilience of the devices in practical environments. With the increasing uptake of IoT and 5G technology manufacturers of ULA metals are therefore presented with a huge business opportunity of expanding their markets to these regions.

Driver: Technological Advancements in Semiconductor Manufacturing

The ultra low alpha metals market is highly driven by the one service industry which relates to the pace of innovation in semiconductor manufacturing technologies. Since sizing of semiconductors continues to shrink to increase its efficiency it is more sensitive to radiation induced errors than before. The ULA metals help ensure the low-emission atmosphere needed to protect these components from degradation and to guarantee a fully effective operation and service.

In addition, the increasing use of additional and sophisticated packaging methods, like SoC and SiP, accelerated the requirement of ULA materials. These technologies means that several functions are on a single chip or package and thus can be affected by radiation which makes ultra-low alpha material critical. The constantly evolving processes with regard to semiconductors, including the EUV lithography, furtherincreases the requirement of using ULA metals in the manufacturing process.

Restraints: High Production Costs

Ultra-low alpha metals manufacturing requires immense purification of the metals and various special-purpose equipment thus incurring high costs of production. These costs can actually discourage manufacturers and at the same time prove inconvenient to end-users, especially those operating in the price conscious markets. The ever increasing demand for testing and certification to reduce the alpha level to ULPA standard increases manufacturing costs.

Further, the unavailability of large amounts of the low alpha emitting materials constitutes the problems that arise. The refining processes used by manufacturers become extremely complicated which affects operational costs. These cost factors may, however, put a damper on the increased uptake of the metals such as ULA in the emerging markets where capital constraints are a mater of concern.

Ultra-Low Alpha Metals Market Segment Analysis

Ultra-Low Alpha Metals Market Segmented on the basis of type, raw material and end user.

By Product Type

o ULA Tin

o ULA Tin Alloys

o ULA Lead Alloys

o ULA Lead-Free Alloys

By End User

o Electronics

o Automotive & Transportation

o Aviation

o Medical

o Telecommunication

o Others

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Product Type, ULA Tin segment is expected to dominate the market during the forecast period

UL-Alpha Metals include ULA Tin, Tin Alloys, Lead Alloys, & Lead-Free Alloys All of the ultra-low alpha metals are sub divided into ULA Tin, Tin Alloys, Lead Alloys and Lead-Free Alloys. ULA tin has widespread application in soldering applications of high reliability electronics. This gives it low alpha emission characteristics thereby making it desirable in controlling soft errors on semiconductor gadgets. ULA tin alloys are further replenished with other alloys, thus achieving improved mechanical and thermal properties to suit the different applications.

Conventional lead alloys and lead free alloys both satisfy unique market needs. While traditional applications incline to use lead alloys, low-lead alloys are now picking up the trend as more environments prohibit the use of lead. The transition to lead-free candidates has driven advances in alloy compositions related to performance and environmental concerns.

By End User, Electronics segment expected to held the largest share

The electronics industry is the largest consumer of ULA metals based on the reliability of the components utilized in semiconductors, printed circuit boards, and other inventive packaging solutions. Another important customer is automotive and transportation industry where ULA metals are used in different segments such as electronic control units, sensors and safety systems.

Due to the fact that failure can be slightly catastrophic in aviation and medical fields, electronic components require ULA metals for durability. There remain telecommunication applications such as the 5 ^{th} generation or 5G infrastructure that continue to fuel the market extensively. The “other” application segment includes military and industrial uses of ULA metals which demonstrates their ability to be used in a wide variety of high-reliability applications.

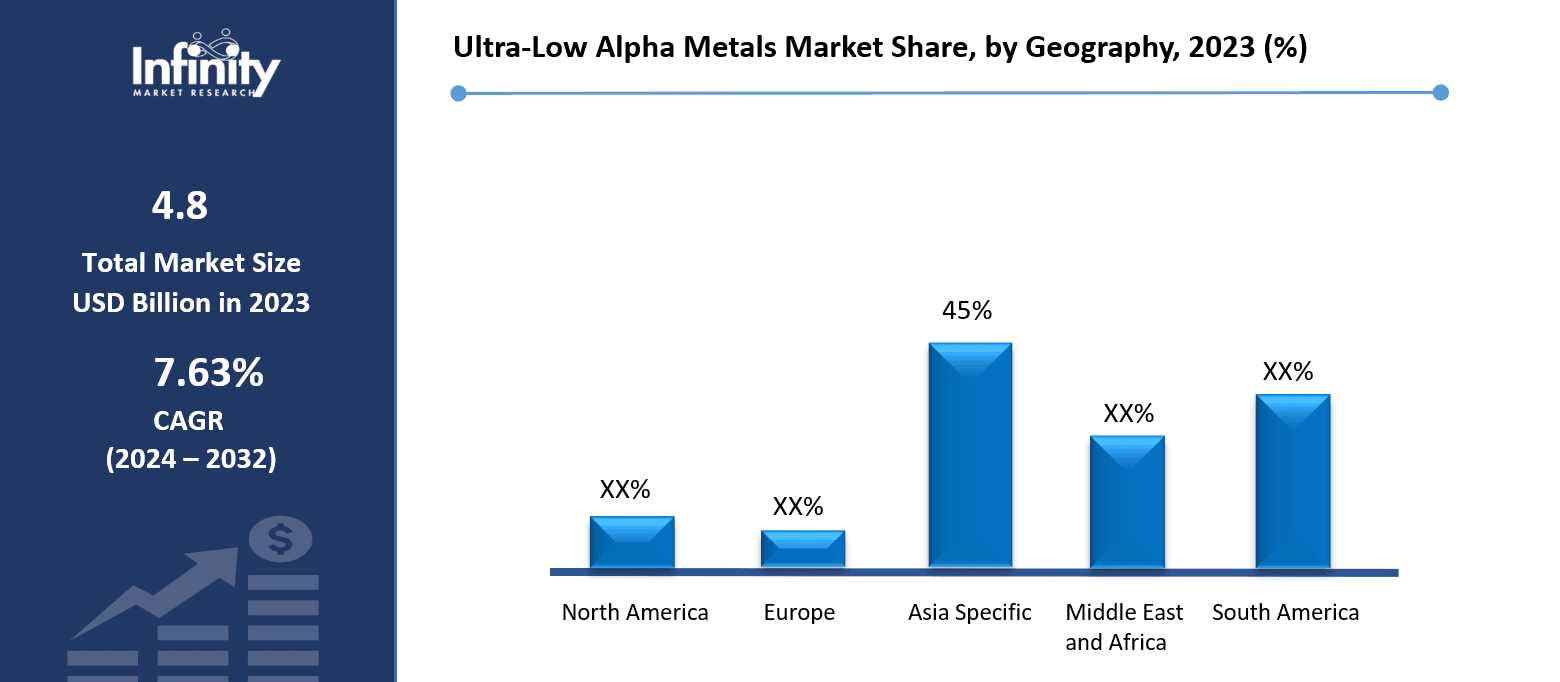

Ultra-Low Alpha Metals Market Regional Insights

Asia Pacific is Expected to Dominate the Market Over the Forecast period

Asia-Pacific is the largest consumer of the ultra-low alpha metals owing to the strong electronics and semiconductor industry in the region. As the leading producers of electronics such as China, Japan, South Korea, and Taiwan, ULA metals production is highly demanded. It is complemented by the focus on such developments as the advancement of technologies, and investments in new infrastructure, in the region.

Asia-Pacific’s leadership has also been played by government actions that result in advocating for the production of more domestic products as well as innovation. High availability of labor and quality manufacturing facilities along general supply chain infrastructure make region a favored of ULA metals buying an consumption. Representing 33% of this market, Asia-Pacific was identified as a market that will continue to hold the highest position as demand for high-reliability electronics increases in the global market.

Ultra-Low Alpha Metals Market Share, by Geography, 2023 (%)

Active Key Players in the Ultra-Low Alpha Metals Market

o Honeywell International Inc. (United States)

o Mitsubishi Materials Corporation (Japan)

o Indium Corporation (United States)

o Pure Technologies (Canada)

o 5N Plus Inc. (Canada)

o Teck Resources Limited (Canada)

o Mitsubishi Chemical Corporation (Japan)

o Duksan Hi-Metal Co., Ltd. (South Korea)

o Alpha Assembly Solutions (United States)

o Aim Solder (United States)

o Nihon Superior Co., Ltd. (Japan)

o Cookson Electronics (United States)

o Other key Players

Global Ultra-Low Alpha Metals Market Scope

|

Global Ultra-Low Alpha Metals Market | |||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.8 Billion |

|

Forecast Period 2024-32 CAGR: |

7.63% |

Market Size in 2032: |

USD 9.3 Billion |

|

Segments Covered: |

By Product Type |

· ULA Tin · ULA Tin Alloys · ULA Lead Alloys · ULA Lead-Free Alloys | |

|

By End User |

· Electronics · Automotive & Transportation · Aviation · Medical · Telecommunication · Others | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Technological Advancements in Semiconductor Manufacturing | ||

|

Key Market Restraints: |

· High Production Costs | ||

|

Key Opportunities: |

· Expansion in 5G and IoT Applications | ||

|

Companies Covered in the report: |

· Honeywell International Inc. (United States), Mitsubishi Materials Corporation (Japan), Indium Corporation (United States), Pure Technologies (Canada), 5N Plus Inc. (Canada), Teck Resources Limited (Canada),Mitsubishi Chemical Corporation (Japan), and Other Major Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Ultra-Low Alpha Metals Market research report?

Answer: The forecast period in the Ultra-Low Alpha Metals Market research report is 2024-2032.

2. Who are the key players in the Ultra-Low Alpha Metals Market?

Answer: Honeywell International Inc. (United States), Mitsubishi Materials Corporation (Japan), Indium Corporation (United States), Pure Technologies (Canada), 5N Plus Inc. (Canada), Teck Resources Limited (Canada),Mitsubishi Chemical Corporation (Japan), and Other Major Players.

3. What are the segments of the Ultra-Low Alpha Metals Market?

Answer: The Ultra-Low Alpha Metals Market is segmented into Product Type, Raw Material, End User and region. By Product Type, the market is categorized into ULA Tin, ULA Tin Alloys, ULA Lead Alloys, ULA Lead-Free Alloys. By Raw Materials, the market is categorized into Tin, Silver, Copper, Lead. By End-User Industries, the market is categorized into Electronics, Automotive & Transportation, Aviation, Medical, Telecommunication, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Ultra-Low Alpha Metals Market?

Answer: ULAs are defined to belong in the Ultra-Low Alpha Metals Market or industry segment that is focused on metals producing and distributing as well as applied on materials that emits alpha particles with value less than 0.002 cph cm². These metals include ULA tin, tin alloys, lead alloys, and lead-free solders and are used in high-reliability application such as electronics, automotive, medical, aerospace, and any other environment that requires minimum radiation-induced α-emission that will cause circuit malfunctions due to soft errors.

5. How big is the Ultra-Low Alpha Metals Market?

Answer: Ultra-Low Alpha Metals Market Size Was Valued at USD 4.8 Billion in 2023, and is Projected to Reach USD 9.3 Billion by 2032, Growing at a CAGR of 7.63% From 2024-2032.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.