🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Vaccine Contract Manufacturing Market

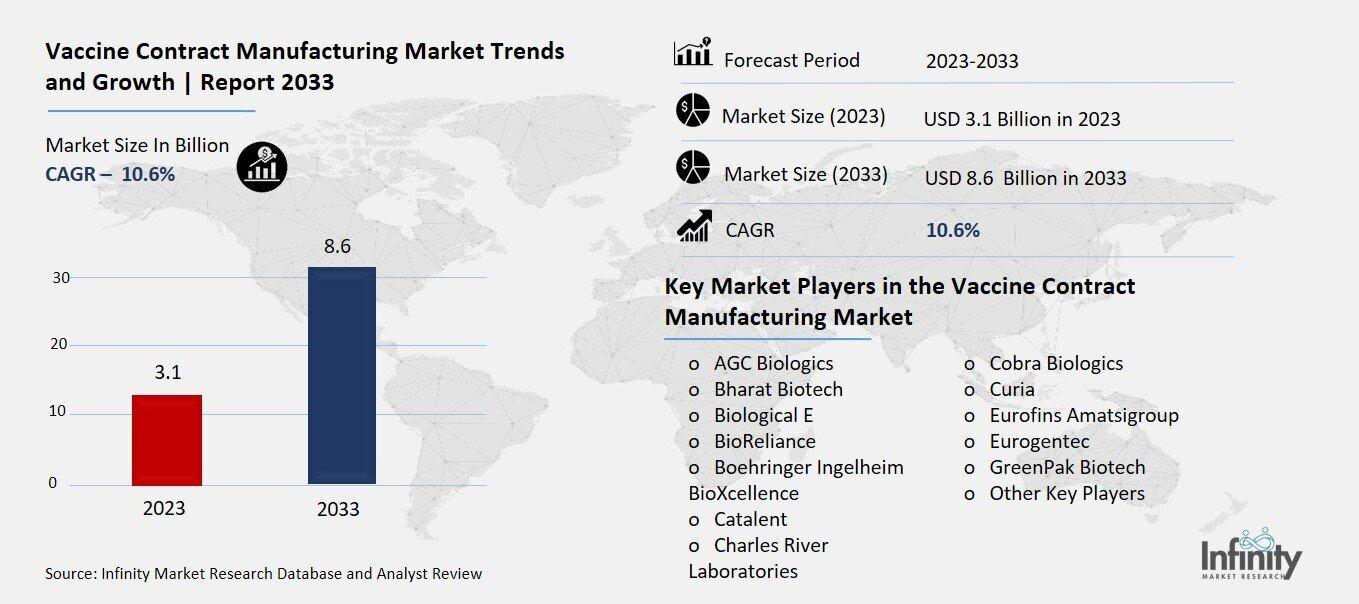

Global Vaccine Contract Manufacturing Market (By Vaccine Type (Attenuated, Inactivated, Subunit-based, Toxoid-based, DNA-based, Other Vaccine Type), By Workflow (Downstream, Upstream), By Product Type (Single Vaccines, Combination Vaccines, Other Product Type, By Application (Human Use, Veterinary, Other Applications), By Region and Companies)

Sep 2024

Healthcare

Pages: 138

ID: IMR1213

Vaccine Contract Manufacturing Market Overview

Global Vaccine Contract Manufacturing Market size is expected to be worth around USD 8.6 Billion by 2033 from USD 3.1 Billion in 2023, growing at a CAGR of 10.6% during the forecast period from 2023 to 2033

The Vaccine Contract Manufacturing Market refers to the industry where companies, often specialized manufacturers, are hired by other organizations (like pharmaceutical companies or governments) to produce vaccines. These companies don’t own the vaccine but have the facilities, technology, and expertise to make large quantities of it. Vaccine makers use contract manufacturing to meet high demands, especially during pandemics or when they don’t have enough production capacity themselves.

In simple terms, this market exists to help speed up vaccine production without needing every company to have its factories. The businesses involved in this market focus on producing vaccines safely, efficiently, and at scale for other organizations. This arrangement allows quicker delivery of vaccines to the market while reducing costs and risks for the companies that develop the vaccines.

Drivers for the Vaccine Contract Manufacturing Market

Growing Demand for Vaccine Outsourcing

The vaccine contract manufacturing market is driven by the growing need to outsource vaccine production due to the increasing complexity of manufacturing processes. Traditional vaccine manufacturers are finding it challenging to meet the high demand for vaccines, especially with more advanced technologies like mRNA and viral vector vaccines. Outsourcing to contract manufacturers enables faster production, especially during public health emergencies like the COVID-19 pandemic. Additionally, biopharmaceutical companies increasingly rely on these specialized contract manufacturers for their expertise, ensuring efficient production and regulatory compliance.

Rise in Global Disease Outbreaks

Frequent outbreaks of infectious diseases have made it essential to scale up vaccine production quickly. Contract manufacturers play a critical role in addressing urgent vaccine needs during pandemics or epidemics. The ongoing demand for vaccines against diseases like influenza, COVID-19, and others is pushing the industry towards more flexible and rapid production solutions. For example, during the COVID-19 crisis, contract manufacturing organizations (CMOs) helped significantly boost vaccine availability by partnering with pharmaceutical giants like Pfizer and BioNTech.

Increasing Government Support and Initiatives

Government initiatives and funding are also driving the vaccine contract manufacturing market. Public health programs and vaccination drives often rely on the robust manufacturing capacity provided by contract manufacturers. Recent initiatives, such as increased funding for COVID-19 vaccine distribution in underrepresented communities, highlight the growing reliance on outsourcing. These initiatives make contract manufacturers essential players in expanding vaccination programs, contributing to the market’s growth.

Technological Advancements in Manufacturing

The adoption of advanced technologies is enhancing the capabilities of vaccine contract manufacturers. The integration of single-use technologies, continuous manufacturing processes, and innovations in fill-finish services are helping streamline production while maintaining high quality. These technologies not only reduce costs but also improve scalability, making it easier for manufacturers to respond to sudden spikes in demand during global health emergencies.

Strategic Partnerships and Collaborations

Strategic collaborations between pharmaceutical companies and contract manufacturers are becoming increasingly common. These partnerships help both parties expand their market reach and improve vaccine accessibility. For instance, collaborations between companies like Vaxxas and the Coalition for Epidemic Preparedness Innovations (CEPI) are fostering the development of innovative vaccines and delivery systems, driving further growth in the contract manufacturing market.

Restraints for the Vaccine Contract Manufacturing Market

Complex Regulatory Landscape

The regulatory environment for vaccine contract manufacturing is highly stringent. Governments across different regions require detailed compliance with safety standards and rigorous testing protocols, which can delay product approvals. These delays can increase the time-to-market for vaccines and add substantial costs to the development process. Furthermore, maintaining compliance across different regulatory frameworks, especially in international markets, adds additional layers of complexity for contract manufacturers.

High Production Costs

Vaccine manufacturing is a capital-intensive process that requires significant investments in advanced biopharmaceutical technologies and specialized facilities. The cost of maintaining these high-tech production environments, combined with the need for consistent quality control and large-scale batch production, can be prohibitive. For smaller contract manufacturing organizations (CMOs), these costs can be a significant barrier to entry and sustainability in the market.

Dependence on a Few Key Players

The vaccine contract manufacturing industry is dominated by a few large companies, making it difficult for smaller players to compete. Established firms like Catalent, Fujifilm Diosynth Biotechnologies, and Lonza have well-developed infrastructures and established relationships with pharmaceutical companies. This imbalance in market power limits opportunities for new entrants and stifles innovation, as smaller companies struggle to secure contracts or maintain long-term business viability.

Supply Chain Vulnerabilities

The global vaccine manufacturing supply chain is complex and highly sensitive to disruptions. The market heavily relies on the timely availability of raw materials, reagents, and other critical inputs. Any disruptions, such as those caused by geopolitical issues, pandemics, or logistical challenges, can lead to production delays and affect the timely delivery of vaccines. Additionally, the scarcity of certain materials can drive up production costs and lead to inefficiencies in manufacturing.

Capacity Constraints

The demand for vaccine production can often exceed the manufacturing capacity available, especially during pandemics or health crises. Although many CMOs are expanding their facilities, sudden surges in demand, like those seen during the COVID-19 pandemic, expose gaps in the industry’s ability to scale up operations rapidly. This mismatch between demand and available capacity can limit the market's ability to meet global vaccine needs efficiently.

Intellectual Property and Contractual Challenges

Managing intellectual property (IP) rights in contract manufacturing agreements can be a challenge. Vaccine development often involves proprietary technologies, and ensuring that these technologies are protected while still allowing third-party manufacturers to use them is a delicate balancing act. Moreover, disagreements over contract terms, quality standards, and timelines can create friction between CMOs and their clients, leading to delays and potential legal disputes.

Opportunity in the Vaccine Contract Manufacturing Market

Rising Demand for Outsourced Manufacturing

A key opportunity lies in the growing trend of outsourcing vaccine production. Pharmaceutical and biotech companies are increasingly partnering with contract manufacturers to handle large-scale production and ensure compliance with stringent regulations. This outsourcing allows companies to focus on innovation while leveraging the manufacturing expertise of specialized firms, thus driving market expansion.

Surge in Vaccination Programs and Pipeline Development

Global vaccination programs have rapidly expanded in response to health crises like the COVID-19 pandemic. The development of new vaccines for both infectious diseases and other conditions has significantly increased. The need for large-scale manufacturing capacity has created opportunities for contract manufacturers to support these initiatives, especially with mRNA vaccines and other innovative platforms becoming more common.

Geographic Expansion and Emerging Markets

The growth potential is particularly high in emerging economies like China, India, and Brazil. These regions are expected to witness robust growth due to large populations, increased healthcare spending, and government initiatives promoting vaccination programs. Contract manufacturing organizations (CMOs) can capitalize on these opportunities by expanding their presence in these high-demand regions.

Technological Advancements and Innovation

Advances in biotechnology and manufacturing techniques are driving efficiency and scalability in vaccine production. The integration of automation, AI, and other novel technologies is opening new doors for contract manufacturers to enhance productivity while reducing costs. This technological evolution is expected to offer substantial competitive advantages and growth avenues.

Strategic Collaborations and Long-Term Partnerships

Strategic partnerships between CMOs and large pharmaceutical companies are becoming more common as companies seek to streamline production and expand their geographic footprint. Long-term agreements ensure stability and allow for shared investments in cutting-edge technologies. These collaborations are likely to be a key factor in capturing market share and driving sustained growth.

Trends for the Vaccine Contract Manufacturing Market

Growing Demand for Outsourced Manufacturing

The vaccine contract manufacturing market is seeing significant growth as pharmaceutical companies increasingly outsource their production needs. This is driven by the complex nature of vaccine production, requiring specialized facilities and expertise. Contract manufacturers offer end-to-end solutions from development to large-scale production, allowing companies to focus on research and marketing. The market is projected to grow steadily as more companies seek efficient ways to bring vaccines to market faster.

Technological Advancements

Technological innovations are transforming vaccine manufacturing, particularly through the adoption of mRNA technology. mRNA-based vaccines, like those for COVID-19, have shown that vaccines can be developed and scaled rapidly. This shift towards new technologies like genetic engineering and advanced delivery systems is expected to drive the market further. Manufacturers are investing in automation and digital technologies to enhance production efficiency and ensure high-quality output.

Partnerships and Strategic Collaborations

Collaborations between pharmaceutical companies and contract manufacturers are becoming increasingly common. Strategic partnerships allow for resource sharing, faster product development, and expanded global reach. For instance, key players like Lonza and Catalent have formed alliances to support the mass production of vaccines for global distribution. Such partnerships not only help in managing production surges but also enhance the overall capability and flexibility of contract manufacturers.

Rising Vaccine Initiatives and Government Support

Governments and international organizations are playing a crucial role in promoting vaccine production. Initiatives aimed at vaccinating large populations, especially in developing regions, have increased the demand for contract manufacturing. For example, efforts like the COVAX initiative, supported by WHO, have led to increased production volumes through outsourcing. This trend is expected to persist as governments continue to push for universal vaccination coverage against various diseases.

Cost Efficiency and Infrastructure Benefits

Contract manufacturers offer significant cost advantages due to their established infrastructure, which allows for economies of scale. Companies can avoid the high upfront investment required to set up production facilities and instead leverage the expertise of specialized manufacturers. This cost-effectiveness is especially attractive to small and mid-sized biotech firms that lack the resources for large-scale production. The demand for such efficient solutions is driving market growth globally.

Impact of COVID-19 and Future Outlook

The COVID-19 pandemic highlighted the importance of vaccine contract manufacturing, leading to rapid advancements and increased capacity. Although the pandemic created initial disruptions, it ultimately accelerated investments in manufacturing infrastructure. Moving forward, the market is poised for sustained growth as the focus shifts to producing vaccines for emerging infectious diseases and routine immunizations, ensuring long-term market expansion.

Segments Covered in the Report

By Vaccine Type

o Attenuated

o Inactivated

o Subunit-based

o Toxoid-based

o DNA-based

o Other Vaccine Type

By Workflow

o Downstream

o Fill & Finish Operations

o Analytical & QC studies

o Packaging

o Upstream

o Mammalian Expression Systems

o Bacterial Expression Systems

o Yeast Expression Systems

o Baculovirus/Insect Expression Systems

o Others

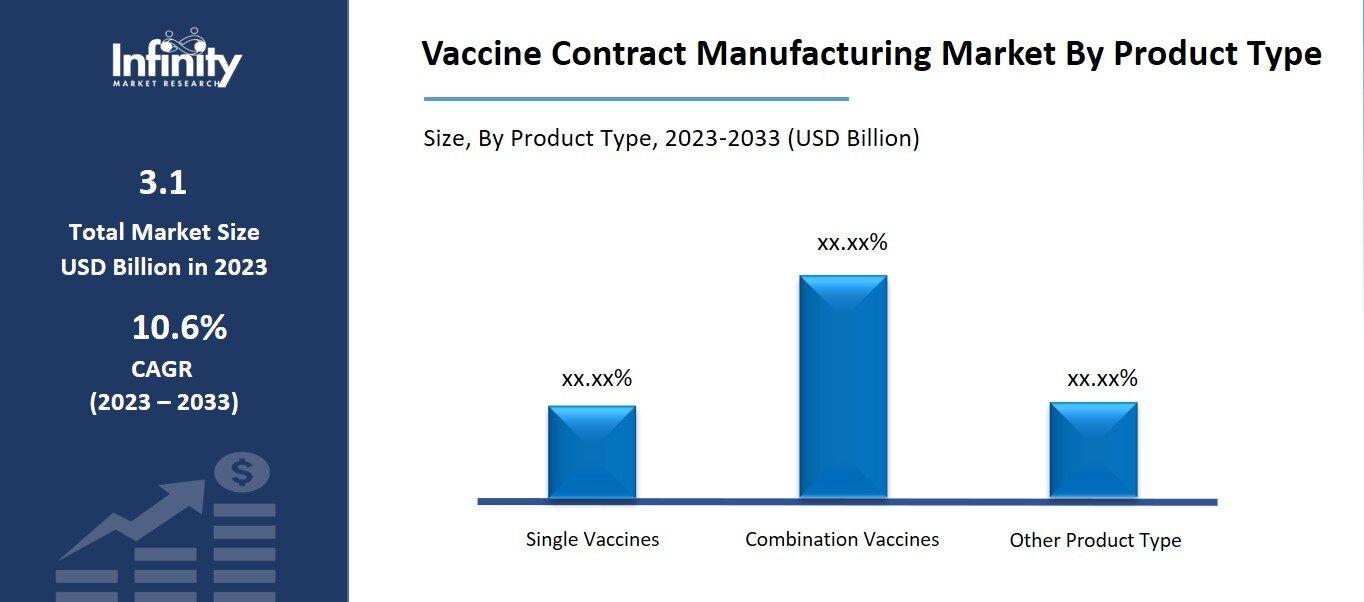

By Product Type

o Single Vaccines

o Combination Vaccines

o Other Product Type

By Application

o Human Use

o Veterinary

o Other Applications

Segment Analysis

By Vaccine Type Analysis

In terms of type, attenuated vaccines dominated the market in 2023, accounting for 30.2% of total revenue. These vaccines are generally simple to develop for specific viruses; thus, with rising incidences of viral infection, this market is likely to rise at a considerable CAGR throughout the forecast period. Furthermore, as manufacturing technology matures, the risk of attenuated vaccines reverting to a virulent, disease-producing condition is extremely low or nonexistent. This element contributes to the segment's substantial share.

However, the DNA vaccines segment is predicted to have the quickest CAGR of 9.5% during the projection period. DNA vaccines are projected to provide profitable growth prospects in the future. Several varieties are being tested on people. Continuous tests and investigations into the efficacy and safety of these vaccines are projected to fuel market growth. DNA vaccines are expected to transform immunization.

By Workflow Analysis

The downstream sector dominated the market in terms of workflow, accounting for 51.3% of total revenue in 2023. The segment is likely to maintain its current position over the projection period. Vaccine manufacturing necessitates trained workers for both upstream and downstream processing. Contract manufacturing organizations (CMOs) offer producers knowledge and cutting-edge technologies to help them accelerate the entire manufacturing process. Because downstream processing includes product recovery and purification stages, it necessitates a significant investment of time and money. As a result, the high demand for advanced biotechnological tools, money, and qualified staff for vaccine recovery as the final product has been a primary element driving the segment's expansion in recent years.

The upstream segment is predicted to have the quickest CAGR of 8.0% throughout the projection period. The upstream workflow encompasses the creation of scalable production and high-titer procedures for expressing various target compounds using cell culture systems, microbial fermentation, transgenic sources, and insect cells. Upstream workflows include process transfer-in and development, supply and toxicity study batches, soluble or solids material recovery, cell disruption, and process monitoring. The ongoing development of recombinant technologies and process control measures is projected to boost growth in this market.

By Product Type Analysis

The vaccine contract manufacturing market is divided into two product types: combination vaccines and single vaccines. The combination vaccination segment is expected to generate USD 3.9 billion by 2032. Efficiency, ease, cost savings, improved production processes, regulatory backing, and consumer preference contribute to this segment's rapid expansion.

Furthermore, these vaccinations protect a broader spectrum of infectious diseases, including those with similar target populations or epidemiological patterns. This full protection is especially beneficial for populations with limited access to healthcare facilities or in areas where many diseases coexist, which increases demand for combination vaccinations.

By Application Analysis

Based on application, the human-use segment dominated the market in 2023, accounting for 93.1% of total revenue. According to CDC research, vaccines administered to young children and newborns during the last two decades are anticipated to avert 322 million illnesses and save 732,000 lives in the United States this year. To address the need for vaccines, the government and other healthcare institutions have implemented a variety of programs. WHO works with countries throughout the world to promote the importance of vaccines and vaccination, and it ensures that governments have the necessary guidelines and technical assistance to build high-quality immunization programs.

However, immunization is effective in enhancing veterinarian health and reducing animal illnesses. This is expected to increase the usage of CMOs in animal inoculation manufacturing dramatically. Vaccination minimizes the demand for antibiotics when treating animals. Furthermore, the need for animal-based food is increasing as the human population grows. As a result, vaccination is projected to become increasingly important in the meat-production industry. These elements are likely to drive growth in the segment.

Regional Analysis

In 2023, Europe's vaccine contract manufacturing market had the second-largest revenue share, accounting for 32.8%. Furthermore, government entities and financial agencies have played critical roles in sponsoring vaccine development. Furthermore, the presence of European Investment Bank (EIB) financial facilities, which are involved in supporting vaccine R&D for combatting infectious diseases through various programs, is predicted to propel the country's market.

The Asia Pacific vaccine contract manufacturing market is predicted to grow at a lucrative CAGR during the forecast period. This can be due to positive legislative reforms, improved infrastructure, and a high number of possible study subjects. Rising R&D expenses have prompted several US biopharma businesses to consider outsourcing vaccine research to Asia Pacific countries, where a plethora of players provide low-cost production facilities and manpower.

Competitive Analysis

Leading competitors in the Vaccine Contract Manufacturing Market are focusing on increasing production capacity, improving technological capabilities, and developing strategic alliances. These companies want to address the growing need for vaccinations, particularly in the wake of public health events such as the COVID-19 epidemic. Furthermore, major businesses are investing in research and market development to create novel vaccine candidates and increase production efficiency. They are also using their knowledge of regulatory compliance to ensure the quality and safety of vaccine manufacturing procedures.

Recent Developments

April 2024: Bharat Biotech engaged in a relationship with Bilthoven Biologicals to manufacture and supply oral polio vaccines globally.

January 2024: The US Department of Defense awarded Emergent BioSolutions a five-year supply contract for the anthrax vaccine BioThrax.

Key Market Players in the Vaccine Contract Manufacturing Market

o AGC Biologics

o Bharat Biotech

o BioReliance

o Boehringer Ingelheim BioXcellence

o Catalent

o Cobra Biologics

o Curia

o Eurofins Amatsigroup

o Eurogentec

o GreenPak Biotech

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 3.1 Billion |

|

Market Size 2033 |

USD 8.6 Billion |

|

Compound Annual Growth Rate (CAGR) |

10.6% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Vaccine Type, Workflow, Product Type, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

AGC Biologics, Bharat Biotech, Biological E, BioReliance, Boehringer Ingelheim BioXcellence, Catalent, Charles River Laboratories, Cobra Biologics, Curia, Eurofins Amatsigroup, Eurogentec, GreenPak Biotech, Other Key Players |

|

Key Market Opportunities |

Geographic Expansion and Emerging Markets |

|

Key Market Dynamics |

Growing Demand for Vaccine Outsourcing |

📘 Frequently Asked Questions

1. Who are the key players in the Vaccine Contract Manufacturing Market?

Answer: AGC Biologics, Bharat Biotech, Biological E, BioReliance, Boehringer Ingelheim BioXcellence, Catalent, Charles River Laboratories, Cobra Biologics, Curia, Eurofins Amatsigroup, Eurogentec, GreenPak Biotech, Other Key Players

2. How much is the Vaccine Contract Manufacturing Market in 2023?

Answer: The Vaccine Contract Manufacturing Market size was valued at USD 3.1 Billion in 2023.

3. What would be the forecast period in the Vaccine Contract Manufacturing Market?

Answer: The forecast period in the Vaccine Contract Manufacturing Market report is 2023-2033.

4. What is the growth rate of the Vaccine Contract Manufacturing Market?

Answer: Vaccine Contract Manufacturing Market is growing at a CAGR of 10.6% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.