🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Vehicle Analytics Market

Global Vehicle Analytics Market (By Component, Software and Services; By Deployment Mode, On-Premises and On-Demand; By Application, Predictive Maintenance, Dealer Performance Analysis, Safety & Security Management, Usage-Based Insurance, Traffic Management, Driver & User Behavior Analysis, and Other Applications; By End-User, Automotive Dealers, Original Equipment Manufacturers (OEMs), Regulatory Bodies, Fleet Owners, and Other End-Users; By Region and Companies), 2024-2033

Oct 2024

Automobiles

Pages: 138

ID: IMR1263

Vehicle Analytics Market Overview

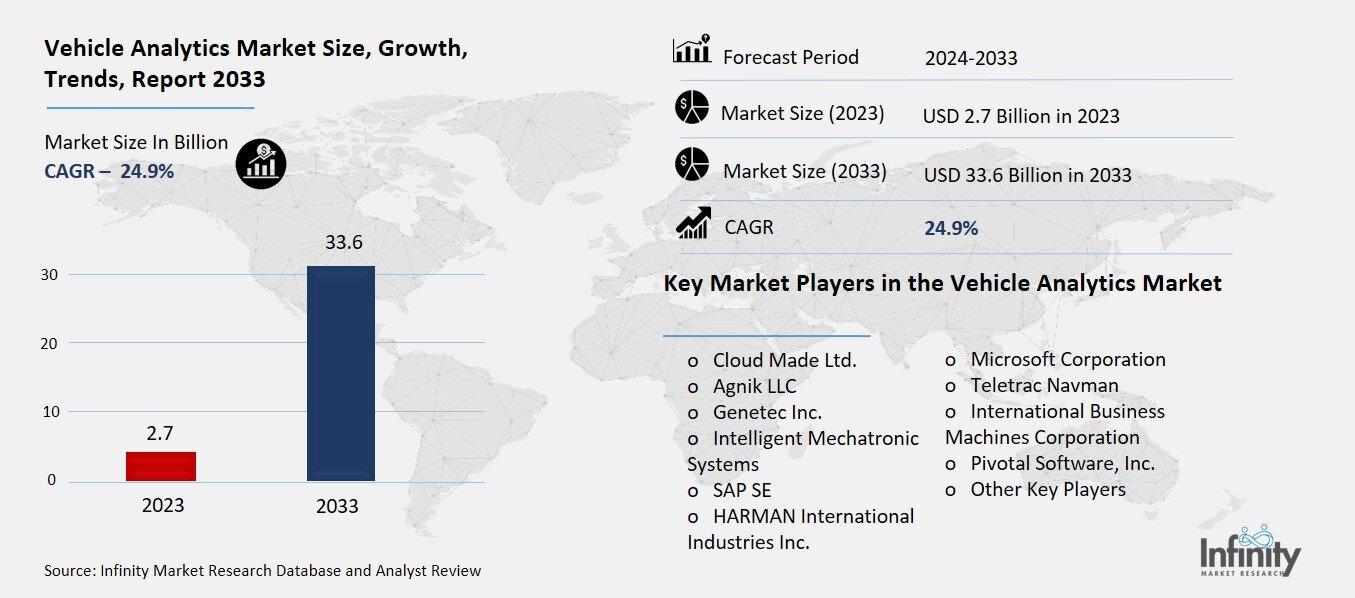

Global Vehicle Analytics Market acquired the significant revenue of 2.7 Billion in 2023 and expected to be worth around USD 33.6 Billion by 2033 with the CAGR of 24.9% during the forecast period of 2024 to 2033. The vehicle analytics market is more on the gathering and analysis of the data produced by vehicles including real-time data collected through sensors, cameras, and other connected systems. The information gathered could be about the driver and their operations, the car and its operation, usage of fuel, and traffic patterns, and among other things it is analyzed with the aim of enhancing vehicle safety, managing the fleet better, as well as to realize the potential in performing better.

It directly results in the expansion of the market due to the growing usage of connected cars, improving ARTS, IoT, and increasing concerns related to predictive maintenance. Some of the major players in this market are automobile makers, technology companies, as well as analytics solution firms, and can be applied across industries such as insurance, transportation, and logistics. In addition to this, growth is anticipated to stem from sourcing vehicle analytics with smart cities and the prospect for full-fledged self-driving automobiles in the future.

Drivers for the Vehicle Analytics Market

Increasing Adoption of Connected Cars Equipped with IoT Sensors

The integration of the automotive industry with IoT sensors that form and connect smart and innovative cars is rapidly changing the auto industry by allowing for the analysis of real-time data that is gathered by connected cars. Innovative cars today come equipped with Global positioning system, speedometer, cameras, sensors for monitoring the performance of the engine, and several other integrated systems, which systematically gather information within many areas such as; driving styles, fuel consumption rates and even the climate. This extensive data is then shared through the cloud or edge networks to analytics solutions that analyse it in real time. Consequently, analysis of the discussed data will pave way to efficiency in the determination of the best driving strategies, estimation of mechanical failures, safety features, and even the customized driving profiles.

Restraints for the Vehicle Analytics Market

Data Privacy and Security Concerns

The collection of vast amounts of data from connected vehicles raises significant concerns over privacy and cybersecurity, which in turn limit the broader adoption of vehicle analytics. As connected cars generate real-time data on location, driving habits, and even personal preferences, this sensitive information becomes a target for cyberattacks and unauthorized access. Without robust security measures, hackers could potentially exploit vulnerabilities in the vehicle’s software, gaining control over the car or accessing personal data stored in the system. This risk is particularly alarming as vehicles become more connected, making them an attractive target for cybercriminals.

Opportunity in the Vehicle Analytics Market

Growing Demand for Predictive Analytics Solution

The growing demand for predictive analytics solutions in the vehicle analytics market is transforming how companies manage vehicle maintenance and operations. Predictive analytics uses real-time data from IoT sensors embedded in vehicles to monitor various parameters such as engine performance, fuel consumption, tire pressure, and brake conditions. By continuously analyzing this data, predictive models can identify patterns and detect early signs of potential mechanical failures or inefficiencies before they lead to costly breakdowns or accidents. This allows companies to proactively schedule maintenance and address issues before they escalate, significantly reducing unexpected vehicle downtime.

For fleet operators, predictive maintenance is especially valuable as it minimizes disruptions to operations, enhances vehicle longevity, and reduces repair costs. By avoiding sudden breakdowns, companies can optimize fleet usage, improve driver safety, and enhance overall productivity.

Trends for the Vehicle Analytics Market

AI and Machine Learning Integration

Advanced analytics powered by AI and machine learning is becoming increasingly prevalent in the vehicle analytics market, driving innovation and enhancing capabilities in several key areas. AI and machine learning algorithms can process vast amounts of vehicle data collected from sensors, cameras, and connected systems, enabling the generation of predictive insights that help organizations make better, more informed decisions. These technologies are crucial for understanding complex patterns in the data, such as identifying potential mechanical failures, analyzing driver behavior, or predicting traffic conditions, allowing companies to take proactive measures to avoid issues before they arise.

Real-time decision-making is another major benefit, as AI-driven analytics can instantly analyze data as it is being collected, providing actionable insights in the moment. This capability is especially useful in safety-critical situations, such as autonomous driving or collision avoidance systems, where split-second decisions can prevent accidents or improve vehicle performance.

Segments Covered in the Report

By Component

o Software

o Services

By Deployment Mode

o On-Premises

o On-Demand

By Application

o Predictive Maintenance

o Dealer Performance Analysis

o Safety & Security Management

o Usage-Based Insurance

o Traffic Management

o Driver & User Behavior Analysis

o Other Applications

By End-User

o Automotive Dealers

o Original Equipment Manufacturers (OEMs)

o Regulatory Bodies

o Fleet Owners

o Other End-Users

Segment Analysis

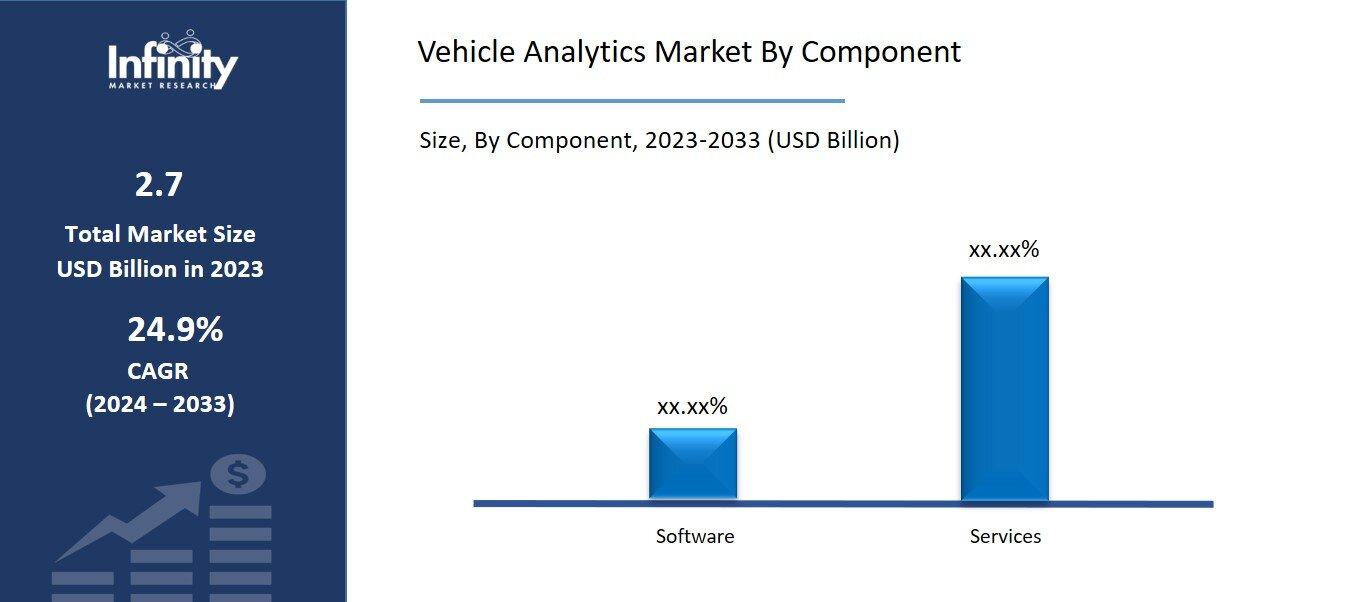

By Component Analysis

On the basis of component, the market is divided into software and services. Among these, software segment acquired the significant share around 52.1% in the market. The software solutions are essential for processing and analyzing the vast amounts of data generated by connected vehicles. These platforms use advanced algorithms, AI, and machine learning to provide real-time insights into vehicle performance, driver behavior, predictive maintenance, and fleet optimization, making them crucial for operational efficiency.

Additionally, software solutions offer scalability and flexibility, allowing businesses to customize and integrate analytics with existing vehicle management systems, making them highly adaptable across industries like logistics, automotive, and insurance. With the rise of autonomous vehicles and smart city initiatives, the demand for advanced software that can handle complex data analytics is growing rapidly.

By Deployment Mode Analysis

On the basis of deployment mode, the market is divided into on-premises and on-demand. Among these, on-demand segment held the prominent share of the market. Cloud-based solutions eliminate the need for companies to invest heavily in hardware, infrastructure, and maintenance, reducing upfront costs and allowing for a more scalable, pay-as-you-go model. This makes it particularly appealing to small and medium-sized businesses, as well as large enterprises that seek flexibility in managing vehicle analytics across distributed fleets.

By Application Analysis

On the basis of application, the market is divided into predictive maintenance, dealer performance analysis, safety & security management, usage-based insurance, traffic management, driver & user behavior analysis, and other applications. Among these, predictive maintenance segment held the significant share of the market due to its substantial benefits in operational efficiency and cost reduction.

Predictive maintenance relies on advanced analytics, AI, and machine learning to monitor vehicle conditions in real-time, predicting potential mechanical issues before they lead to failures. This proactive approach helps companies avoid unexpected breakdowns, reduce downtime, and extend the life of vehicle components. These factors are especially valuable for fleet operators, logistics companies, and businesses with large vehicle fleets, where maintenance costs can significantly impact overall profitability.

By End-User Analysis

On the basis of end-user, the market is divided into automotive dealers, original equipment manufacturers (OEMS), regulatory bodies, fleet owners, and other end-users. Among these, original equipment manufacturers (OEMS) held the most of the share of the market owing to their pivotal role in integrating advanced vehicle analytics solutions directly into the design and production of vehicles.

OEMs are at the forefront of adopting and developing cutting-edge analytics technologies as they strive to offer enhanced features such as predictive maintenance, vehicle performance optimization, and driver behavior analysis. By embedding IoT sensors, advanced software, and AI-driven analytics into vehicles during the manufacturing process, OEMs can offer more connected, intelligent vehicles to consumers, providing a competitive advantage in the market.

Regional Analysis

North America Dominated the Market with the Highest Revenue Share

North America held the most of the share of 34.1% of the market. The presence of major automotive manufacturers and technology companies in the region fosters a robust ecosystem for the development and deployment of advanced vehicle analytics solutions. Companies like Ford, General Motors, and Tesla are actively investing in connected vehicle technologies and data analytics, enhancing their offerings and leveraging real-time data to improve vehicle performance and customer experiences.

Additionally, North America has a high rate of adoption of connected vehicles, fueled by consumer demand for advanced features such as safety enhancements, infotainment systems, and efficient fleet management solutions. The region's strong infrastructure, including widespread internet connectivity and the proliferation of IoT devices, supports the seamless integration of vehicle analytics technologies.

Competitive Analysis

The competitive landscape of the vehicle analytics market is characterized by a diverse array of players, ranging from established automotive manufacturers and technology giants to specialized startups and analytics solution providers. Key players such as IBM, Cisco, Microsoft, and Oracle leverage their expertise in cloud computing, AI, and big data analytics to offer comprehensive solutions tailored to the needs of the automotive industry. These companies are focused on enhancing their product offerings through strategic partnerships, mergers, and acquisitions, allowing them to expand their capabilities and market reach.

Recent Developments

In March 2023, Latitude AI, a Ford subsidiary, has developed cutting-edge automated driving technology, focusing on a hands-free, eyes-off driver assistance system for upcoming Ford vehicles. With a team of 550 experts in machine learning, robotics, software development, sensors, systems engineering, and testing, Ford is expanding its portfolio of automated driving solutions to transform the driving experience for millions of customers.

In February 2023, Dassault Systèmes announced that Renault is utilizing its 3DEXPERIENCE platform’s data science capabilities to address rising raw material costs and optimize production expenses. Renault has expanded its use of the platform beyond design to include strategic functions such as costing and purchasing, supporting the company’s digital transformation efforts.

Key Market Players in the Vehicle Analytics Market

o Cloud Made Ltd.

o Agnik LLC

o Genetec Inc.

o Intelligent Mechatronic Systems

o SAP SE

o HARMAN International Industries Inc.

o Microsoft Corporation

o Teletrac Navman

o International Business Machines Corporation

o Pivotal Software, Inc.

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 2.7 Billion |

|

Market Size 2033 |

USD 33.6 Billion |

|

Compound Annual Growth Rate (CAGR) |

24.9% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Component, Deployment Mode, Application, End-User, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Cloud Made Ltd., Agnik LLC, Genetec Inc., Intelligent Mechatronic Systems, SAP SE, HARMAN International Industries Inc., Microsoft Corporation, Teletrac Navman, International Business Machines Corporation, Pivotal Software, Inc., and Other Key Players. |

|

Key Market Opportunities |

Growing Demand for Predictive Analytics Solution |

|

Key Market Dynamics |

Increasing Adoption of Connected Cars Equipped with IoT Sensors |

📘 Frequently Asked Questions

1. Who are the key players in the Vehicle Analytics Market?

Answer: Cloud Made Ltd., Agnik LLC, Genetec Inc., Intelligent Mechatronic Systems, SAP SE, HARMAN International Industries Inc., Microsoft Corporation, Teletrac Navman, International Business Machines Corporation, Pivotal Software, Inc., and Other Key Players.

2. How much is the Vehicle Analytics Market in 2023?

Answer: The Vehicle Analytics Market size was valued at USD 2.7 Billion in 2023.

3. What would be the forecast period in the Vehicle Analytics Market?

Answer: The forecast period in the Vehicle Analytics Market report is 2023-2033.

4. What is the growth rate of the Vehicle Analytics Market?

Answer: Vehicle Analytics Market is growing at a CAGR of 24.9% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.