🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Virtual Kitchen Market

Virtual Kitchen Market (By Component (Software, Services, Hardware, Others), By End-User (Commercial Space, Residential, Hospitality, Others), By Region and Companies)

Jun 2024

Information and Communication Technology

Pages: 105

ID: IMR1087

Virtual Kitchen Market Overview

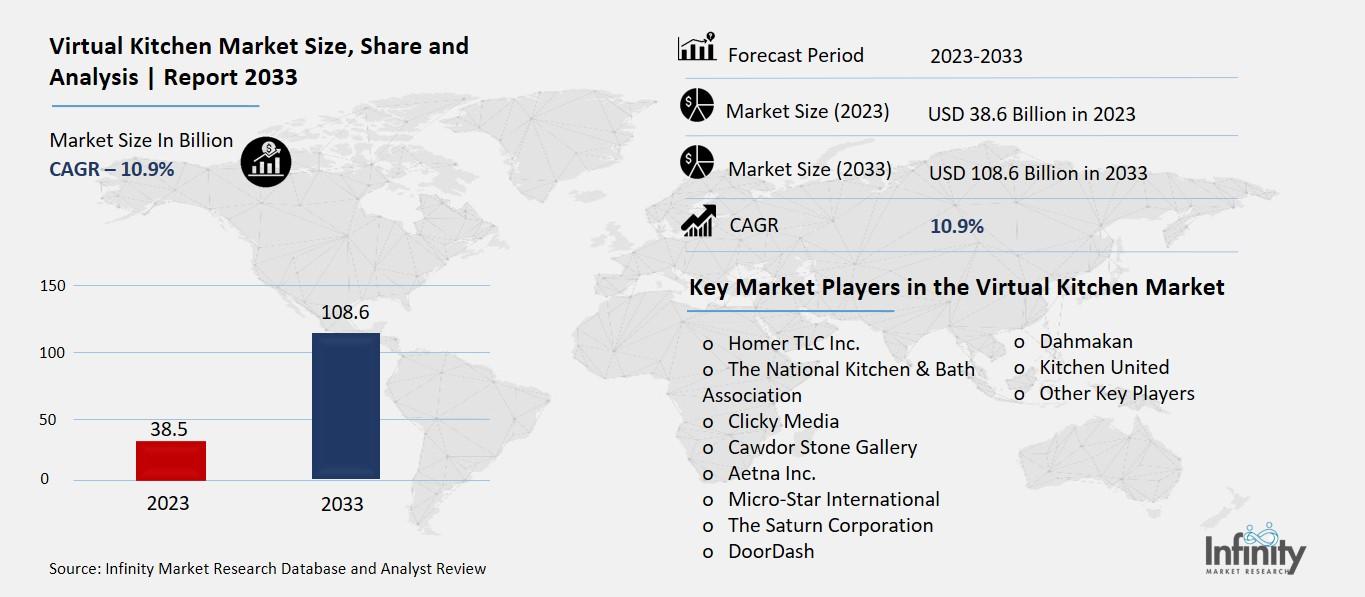

Global Virtual Kitchen Market size is expected to be worth around USD 108.6 Billion by 2033 from USD 38.5 Billion in 2023, growing at a CAGR of 10.9% during the forecast period from 2023 to 2033.

The Virtual Kitchen Market refers to a new trend in the food industry where meals are prepared in kitchens dedicated solely to online orders and delivery. These kitchens, also known as ghost kitchens or cloud kitchens, don't have a physical restaurant or dining area for customers. Instead, they focus entirely on cooking food that's ordered through apps or websites. This setup allows for more efficient food preparation and delivery, as well as lower costs compared to traditional restaurants.

Businesses that operate in the virtual kitchen market can serve a wide range of cuisines without the need for a storefront. They often partner with food delivery services to reach customers who prefer to order meals online rather than dine in. This model has become popular in urban areas where the demand for food delivery is high. By specializing in delivery-only meals, virtual kitchens can streamline operations and expand their reach beyond what traditional restaurants can achieve.

Drivers for the Virtual Kitchen Market

Changing Consumer Preferences

Consumer preferences are shifting towards convenience and speed. Many people prefer ordering food online rather than dining out or cooking at home. This shift has been accelerated by the increasing use of smartphones and food delivery apps, making it easier for consumers to order their favorite meals with a few taps on their phones.

Technological Advancements

Technological advancements play a crucial role in the virtual kitchen market. Innovations in kitchen equipment, order management systems, and food delivery logistics have enabled virtual kitchens to operate more efficiently. For example, AI and data analytics help optimize menu offerings based on consumer preferences and trends, while smart kitchen appliances ensure consistent food quality.

Cost Efficiencies

Virtual kitchens can operate at lower costs compared to traditional restaurants. By eliminating the need for a physical dining space and reducing staff overhead, virtual kitchens can allocate more resources to food quality and customer service. This cost efficiency is attractive to both startups and established food brands looking to expand their delivery capabilities without the high costs of opening new restaurants.

Urbanization

The trend toward urbanization has fueled the demand for virtual kitchens. In densely populated urban areas, space is limited and expensive, making it challenging for restaurants to open new locations. Virtual kitchens can operate in smaller, less expensive spaces and still reach a large customer base through delivery apps.

Rise of Food Delivery Services

The rise of food delivery services has created a strong demand for virtual kitchens. Platforms like Uber Eats, DoorDash, and Grubhub have made it easier for virtual kitchens to reach consumers who prefer to order food for delivery. These partnerships provide virtual kitchens with access to a large and growing customer base, further driving market growth.

Restraints for the Virtual Kitchen Market

Operational Challenges

Virtual kitchens face unique operational challenges compared to traditional restaurants. They rely heavily on technology for order management and food preparation, which can be prone to technical glitches and system failures. Maintaining consistent food quality and delivery times across multiple orders can also be challenging without the physical oversight of a traditional kitchen.

Food Safety Concerns

Food safety is a critical concern for virtual kitchens, especially those operating solely for delivery. Ensuring that food is prepared, stored, and delivered safely to consumers' homes requires stringent adherence to food safety standards. Failure to maintain these standards can lead to foodborne illnesses and damage to the brand's reputation.

Regulatory Issues

Virtual kitchens must navigate complex regulatory environments that vary by location. These regulations can include zoning laws, health and safety standards, and licensing requirements. Compliance with these regulations adds complexity and costs to operations, particularly when operating in multiple jurisdictions.

Competition

The virtual kitchen market is becoming increasingly competitive as more businesses enter the space. With low barriers to entry, new startups and established restaurant chains alike are launching virtual kitchen operations to capitalize on the growing demand for food delivery. This heightened competition can lead to price wars and pressure on profit margins.

Customer Loyalty

Maintaining customer loyalty in the virtual kitchen market can be challenging. Since virtual kitchens often operate solely through delivery apps, they may struggle to build a direct relationship with customers compared to traditional restaurants. Customers are more likely to switch between different virtual kitchen brands based on convenience, price, and promotional offers, making it difficult to establish long-term loyalty.

Opportunity in the Virtual Kitchen Market

Expanding Delivery Services

One of the primary opportunities for virtual kitchens is to expand their delivery services. With the increasing demand for food delivery, virtual kitchens can partner with multiple delivery platforms to reach a wider customer base. This allows them to tap into new geographic markets and increase their sales potential without the costs associated with opening new physical locations.

Catering to Niche Markets

Virtual kitchens can cater to niche markets and specific dietary preferences. They can offer specialized menus that cater to vegetarian, vegan, gluten-free, or other dietary requirements, which may be underserved by traditional restaurants. By targeting these niche markets, virtual kitchens can attract a loyal customer base that values personalized food options.

Leveraging Data Analytics

Data analytics plays a crucial role in the virtual kitchen market. By analyzing customer preferences, order patterns, and market trends, virtual kitchens can optimize their menu offerings, pricing strategies, and operational efficiency. This data-driven approach allows them to make informed decisions that enhance customer satisfaction and profitability.

Scalability

Virtual kitchens offer a scalable business model that can easily adapt to changes in demand. Unlike traditional restaurants that require significant investment in physical infrastructure, virtual kitchens can quickly scale operations up or down based on customer demand and market conditions. This flexibility enables them to seize growth opportunities and minimize operational costs.

Adapting to Changing Consumer Preferences

Virtual kitchens are well-positioned to adapt to changing consumer preferences for convenience and health-conscious options. They can innovate their menus to include trendy dishes, sustainable ingredients, and healthier alternatives, reflecting the evolving tastes of modern consumers. By staying agile and responsive to consumer trends, virtual kitchens can maintain relevance and attract a diverse customer base.

Trends for the Virtual Kitchen Market

Rise of Cloud Kitchens

Cloud kitchens, also known as ghost kitchens or dark kitchens, are central to the virtual kitchen market. These are kitchens that operate solely for fulfilling online food orders, without a physical dining space for customers. The rise of cloud kitchens is driven by the increasing demand for food delivery services and the need for cost-effective solutions for food preparation and delivery. They enable restaurants and food brands to expand their delivery capabilities without the high costs associated with opening new traditional restaurants.

Integration of Technology

Technology plays a crucial role in the virtual kitchen market. Virtual kitchens utilize advanced kitchen equipment, order management systems, and data analytics to streamline operations and enhance efficiency. For example, AI and machine learning algorithms are used to predict customer preferences and optimize menu offerings. Virtual kitchens also rely on food delivery apps and online platforms to reach consumers and facilitate orders, providing a seamless customer experience.

Focus on Sustainability

Sustainability is becoming increasingly important in the virtual kitchen market. Consumers are more conscious of the environmental impact of their food choices, and virtual kitchens are responding by offering sustainable food options. This includes sourcing local and organic ingredients, reducing food waste, and using eco-friendly packaging materials. Sustainable practices not only appeal to environmentally conscious consumers but also contribute to cost savings and brand reputation.

Rise of Virtual Restaurant Brands

Virtual restaurant brands are emerging as a trend in the virtual kitchen market. These are digital-only restaurant concepts that operate exclusively through food delivery apps and online platforms. Virtual restaurant brands can quickly launch and experiment with new menu concepts without the overhead costs of a physical location. They leverage data analytics to identify market gaps and consumer preferences, allowing for agile and innovative menu offerings.

Global Expansion

The virtual kitchen market is experiencing global expansion, driven by the increasing adoption of food delivery services worldwide. Virtual kitchens can easily enter new markets by partnering with local food delivery platforms and adapting their menus to local tastes and preferences. This global expansion allows virtual kitchens to capitalize on the growing demand for convenient and affordable food delivery options in urban areas around the world.

Segments Covered in the Report

By Component

o Software

o Services

o Hardware

o Others

By End-User

o Commercial Space

o Residential

o Hospitality

o Others

Segment Analysis

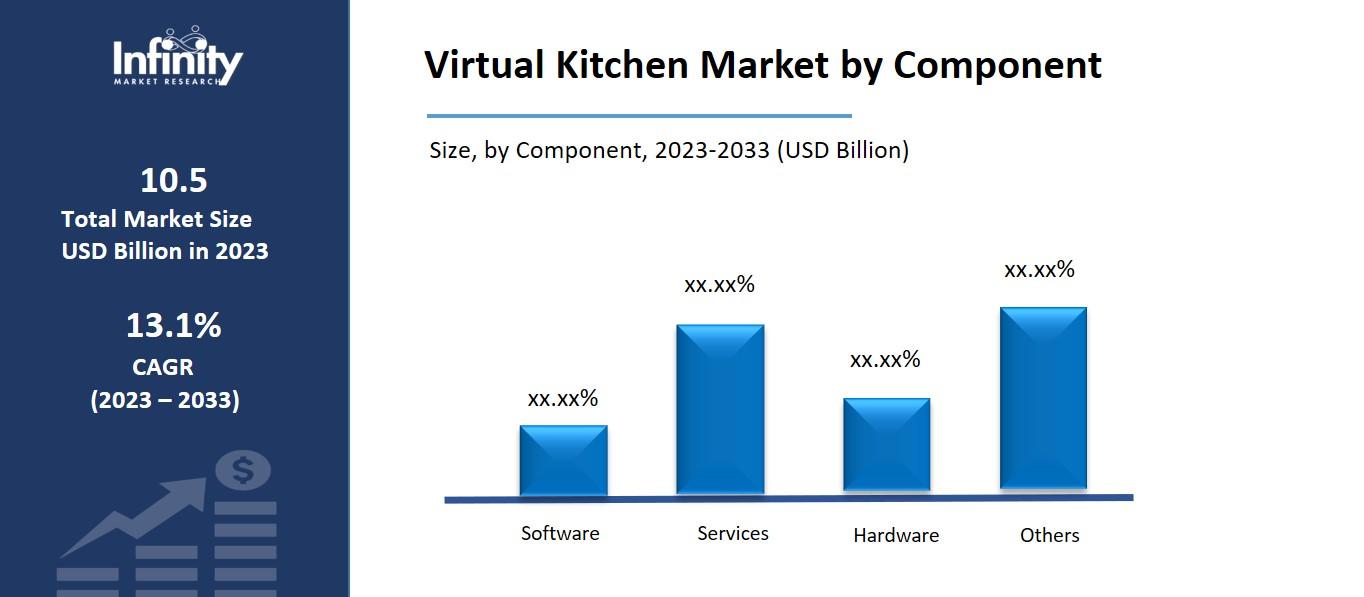

By Component Analysis

The software, services, hardware, and other segments make up the market. By 2033, the revenue share of the Service sector is anticipated to account for 34.8% of the total market share. Meals for a restaurant or virtual restaurant are prepared in a virtual kitchen and then delivered, taken out, or served at a drive-through. Not having enough space for dining areas and chairs for customers saves money on rent. Ghost kitchens can be set up in less expensive areas because the physical location is less relevant. Providing the greatest services to customers has led to significant growth in the virtual kitchen market, which is why this market sector is constantly expanding.

Nonetheless, throughout the forecast period, the Software category is anticipated to develop at a CAGR of 5.2%. When a novice customer wants to create their kitchen, Planner 5D is a great option. It works well and is accessible on Mac OS, Windows, iOS, and Android devices in addition to the web. The ability to create 2D renderings with the software's free edition is what mostly propels this market's expansion.

By End-User Analysis

The Virtual Kitchen Market is divided into Commercial Space, Residential, Hospitality, and Others segments based on End-User. By 2033, revenue from the Residential category is expected to account for 47.1% of the total market share. Even if the virtual kitchen is located far away, there is a high demand from clients for a particular kitchen. Cloud kitchen locations include vacant parking lots, residential neighborhoods, and market backsides. Alternatively, it might choose to use a communal kitchen, which would ultimately result in cost savings.

Nonetheless, the Commercial Space segment is anticipated to increase at a CAGR of 5.9% throughout the projection period. A fully furnished prep kitchen that is rented out for use by several individuals is known as a commercial kitchen. Other names for similar areas include food innovation centers, accelerators, hubs, shared kitchens, community kitchens, kitchen incubators, and culinary kitchens. The five most common styles of commercial kitchens are assembly line, island, zone-style, galley, and open kitchen. The key factor propelling this segment's growth is the variety of advantages available to customers who wish to open restaurants, including the type of food to be served, the amount of kitchen space provided by the building, and more.

Regional Analysis

In 2023, the region with the biggest market share North America was 51.9%. With a large number of well-established market players and a growing user base, North America is experiencing steady growth in this market. Accelerated technological progress, improved solutions, and related technologies also support the market's expansion. The increasing utilization of cloud-based technology in diverse applications has a positive effect on the growth of regional markets. Regional market expansion is also being aided by considerable R&D efforts in the creation of virtual kitchen solutions as well as a high need for dependable data backup and recovery systems. When it comes to expanding businesses in the region, the United States leads, followed by Canada.

Nonetheless, the Asia Pacific area is anticipated to expand at a CAGR of 4.5%. The APAC region represents a nascent virtual market. In terms of market expansion, India, China, and Japan are expected to be the most potent nations. Businesses operating in the region are using state-of-the-art technology to consider the tastes and preferences of consumers about virtual kitchens.

Competitive Analysis

The increasing use of cloud computing and Virtual Kitchen, as well as numerous strategic partnerships and investments among local companies, are expected to boost the market's growth. The US dominates the market in the region and contributes significantly to overall revenue, largely because numerous equipment providers are involved.

Recent Developments

March 2023: Kitchens@ Gets 'Swiggy Access' to Swiggy's Cloud Kitchen Arm. Swiggy executed an all-equity agreement and sold the company for an undisclosed sum.

February 2022: Accel-backed Maverix Platforms Pvt Ltd, the company behind the ready-to-cook food brand Fingerlix, was acquired by Curefoods Pvt Ltd, a cloud kitchen business launched by Cure.fit, which operates brands like EatFit, CakeZone, and Aligarh House, for an unknown sum.

Key Market Players in the Virtual Kitchen Market

o Homer TLC Inc.

o The National Kitchen & Bath Association

o Clicky Media

o Cawdor Stone Gallery

o Aetna Inc.

o Micro-Star International

o The Saturn Corporation

o DoorDash

o Dahmakan

o Kitchen United

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 38.5 Billion |

|

Market Size 2033 |

USD 108.6 Billion |

|

Compound Annual Growth Rate (CAGR) |

10.9% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

- |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

Component, End-User, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Homer TLC Inc., The National Kitchen & Bath Association, Clicky Media, Cawdor Stone Gallery, Aetna Inc., Micro-Star International, The Saturn Corporation, DoorDash, Dahmakan, Kitchen United, Other Key Players |

|

Key Market Opportunities |

Expanding Delivery Services |

|

Key Market Dynamics |

Changing Consumer Preferences |

📘 Frequently Asked Questions

1. How much is the Virtual Kitchen Market in 2023?

Answer: The Virtual Kitchen Market size was valued at USD 10.9% Billion in 2023.

2. What would be the forecast period in the Virtual Kitchen Market?

Answer: The forecast period in the Virtual Kitchen Market report is 2023-2033.

3. Who are the key players in the Virtual Kitchen Market?

Answer: Homer TLC Inc., The National Kitchen & Bath Association, Clicky Media, Cawdor Stone Gallery, Aetna Inc., Micro-Star International, The Saturn Corporation, DoorDash, Dahmakan, Kitchen United, Other Key Players

4. What is the growth rate of the Virtual Kitchen Market?

Answer: Virtual Kitchen Market is growing at a CAGR of 10.9% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.