🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Viscosity Index Improvers (VII) Market

Viscosity Index Improvers (VII) Market Global Industry Analysis and Forecast (2024-2032) By Product Type (Olefins Copolymers (OCP), Polymethacrylates (PMA), Hydrogenated Styrene-Diene Copolymers (HSD), Others) By Application (Engine Oils, Hydraulic Fluids, Gear Oils, Transmission Fluids, Others. By End-Use Industry (Automotive, Industrial, Marine, Aerospace, Others) and Region

Feb 2025

Chemicals and Materials

Pages: 138

ID: IMR1747

Viscosity Index Improvers (VII) Market Synopsis

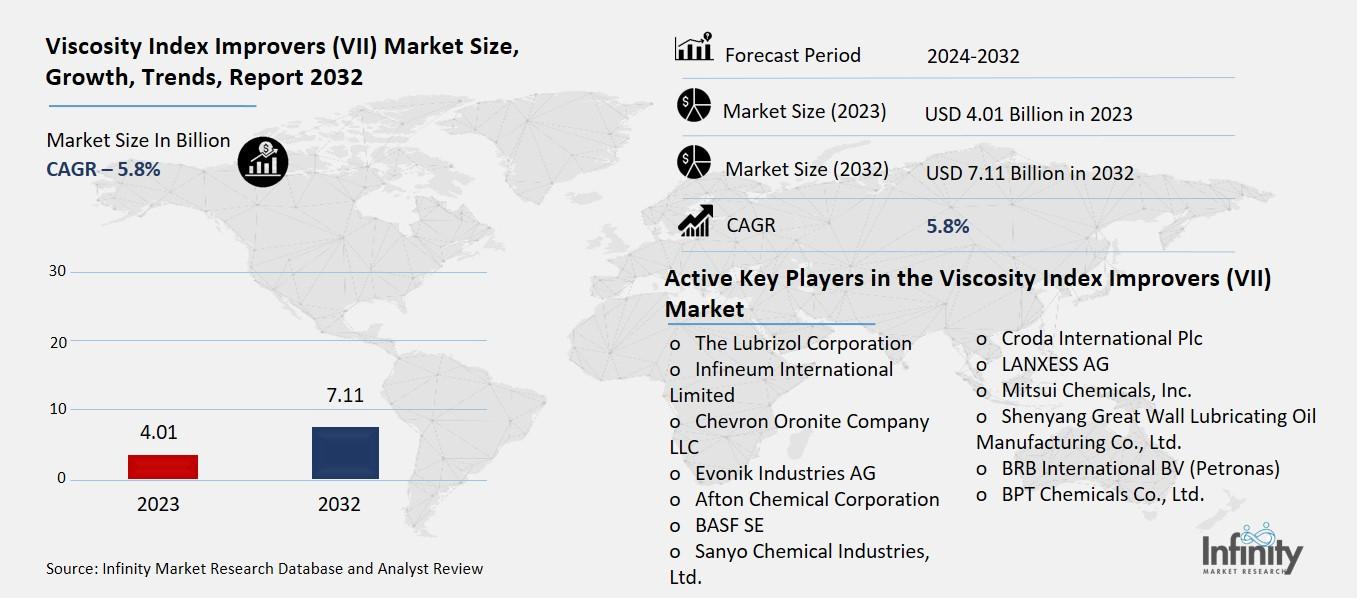

Viscosity Index Improvers (VII) Market acquired the significant revenue of 4.01 Billion in 2023 and expected to be worth around USD 7.11 Billion by 2032 with the CAGR of 5.8% during the forecast period of 2024 to 2032.

The Viscosity Index Improvers (VII) market concentrates on chemical products known as VII that can improve on the viscosity-temperature characteristics of lubricants and oils. VIIs allow these fluids to have high and low temperature viscosity to perform its function in high temperature and low temperatures. A VII is used in automotive, industrial machinery, hydraulic systems and many other applications where the durability and stability of the lubricant results in less wear and tear in mechanical applications. The market includes, but is not limited to polymers like polyalkylmethacrylates, olefin copolymers, and styrene based copolymers for high performance lubricants to fulfill the requirement of efficient industries focusing on sustainability.

About the VII Market The market for Viscosity Index Improvers (VII) is set to experience growth momentum on an international level as the need for high-performance lubrication grows amongst automotive, industrial, and energy industries. These additives improve the ability of lubricant to increase its viscosity when the temperature of the system is low, and vice versa. The focus on energy recovery and enhancement of engine performance has been a key driver to the use of high-quality multi-functional VII additives. Also, there are increasing legislations in environmental consciousness relating to low-emission vehicles and cleaner industrial processes are putting pressure on the market to produce more complex and sustainable viscosity modifiers to support this trend.

Regionally, Asia-Pacific leads in the VII market due to the rapidly growing automobile and industrial units especially in countries such as China, India as well as Japan. The population of the South East Asia region is growing at a relatively fast pace along with industrialization and urbanization thus there is massive use of vehicles and thus the demand for finished lubricants with better qualities is on the rise. North America and Europe also dominate this market with automotive technology improvements and concerns from strict environmental legislations driving this market. On the other hand, the potential growth prospects, being demonstrated by the developing markets in the LATAM and M & A regions, are the effect of the growing industrial processes and infrastructure advancement.

The major market players especially the end-product manufacturers are intensively investing in research activities to enhance their VIDI production for enhanced quality, environmentally sustainable processed end-products. There is increasing partnership between the manufacturers and the producers of lubricants in order to enhance product differentiation to fit certain market needs. Resultantly, they have seen a continuous steady growth due to advancements such as electric vehicles require thermal management fluids. However, variable raw material costs, and increasing interest towards other forms of energy, are the parts that remain complex and which industry participants have to manage tactfully.

Viscosity Index Improvers (VII) Market Trend Analysis

Trend: High-Performance Lubricants for Modern Internal Combustion Engines

The automotive segment is proving to be a key influencer for VII, as a result of the increasing necessity for effective lubricants to improve engine performance under different temperature conditions. Many contemporary internal combustion engines, utilizing lightweight metals and compact formats, produce greater heat and abrasion than older models so that conventional lubricants work less efficiently. These pathologies are resolved by the use of high-viscosity index lubricants that contain increases levels of VIIs to provide consistent performance at high or low temperatures that can help guarantee more permanent functionality and durability in vehicles. Further, the demands for fuel economy and bearing emissions have fortusrd the usage of advanced lubricant technologies in standard vehicles.

EV technology has been the principal genre in introducing totally new performance demands for lubricants thus opening the possibility for bespoke VII. Contrary to conventional cars, EVs require oils in order to focus on maximum heat control while simultaneously maintaining energy efficiency in batteries and minimizing powertrain loss. VIIs enhanced lubricants are required with low viscosity during high speed working conditions in addition to withstanding climate changes. In the coming years, the automotive industry is expected to play a critical role determining growth trends in the VII market, given that more and more OEs are launching new EV models, thus resulting in high demand for lubricants specifically tailored to meet these unique demands.

Drivers: Increasing Demand for High-Performance Lubricants Across Industries

The viscosity index improvers (VII) market is growing at a vibrant rate powered by the need to manufacture and use high-quality oils and greases that offer better performance levels in auto-engineering and a host of other sectors such as industrial machinery and marine applications. Contemporary motors and equipment work with extreme and fluctuating temperature procedures, obliging the appropriate lubricant which will maintain viscosity and is thus able to provide long service. VII additives are necessary in modern high-performance lubricant formulations to correctly tune the viscosity-temperature relationship. As industries globally advance their use of better and improved production machinery and High Performance Engines the demand for High Performing Lubricant with VII integration is on the rise especially in automotive manufacturing industries, oil and machinery manufacturing companies plus marine industries.

Further, the increase in the size of the automobile industry is also responsible for the increase in the demand of VII. Today, vehicle manufacturers are in search of efficient lubricants especially for car production especially in new markets such as India, China and Brazil. Due to the significant need to reduce wear and improve the functionality of industrial machinery, it operates at high performance, which encourages the application of viscosity index improvers. This strategic direction of manufacturers to improve the performance of their brands and the reduction of operational downtimes necessitates the use of these VII, which is a force pushing the market higher.

Restraints: High Raw Material Costs and Its Impact on VII Additives Pricing

The key challenge exhibited in the VII market is the elevated cost of raw material that is utilized in the production processes of the product. Many of these raw materials are obtained from synthetic and specialty items, and so greatly tend to boost the total cost of manufacturing VII additives. In this respect, Petroleum and advanced chemical products used in the formulation of VII additives have increased costs of production, thereby reducing the economic viability of such products in markets which are sensitive to costs. Consequently, manufacturers are under the pressure on one hand to provide high-quality additives while on the other to constraint prices, particularly where price is sensitive as in automobile and industrial oils.

In addition, the operations of synthesizing Viscosity Index Improvers as a key ingredient need complex chemical procedures, hence attract heavy capital investments on modern technology, research and development. This is in addition to high technological requirements and expertise that are needed to produce these additives hence increasing the operations costs. Manufacturers are also charged with the responsibility of operating under strict environmental and safety policies thus incurring a cost. All these aspects determine the total pricing mechanism of VII additives that may prove to be a challenge in areas of market entry where economic threats or pricing pressures are decisive.

Opportunities: Growing Demand for High-Performance Lubricants in Automotive Engines

So as the automotive engines move forward to become more efficient with improved fuel economy, the requirements for high output lubricants that can function properly at both high and low temperatures are rising. Viscosity Index Improvers (VII) are particularly valuable in these respects since they help lubricate retain as much viscosity and performance under both high and low temperatures as needed. During the recent development of engines that offer improved fuel consumption, and environmentally friendly emissions VII provides the lubrication stability to avoid the deterioration of lubricant at high temperatures or low temperatures. The requirement of high quality as well as improved thermal stability in lubricants offers ample growth opportunities in VII market to the leading companies to address changing demands of constructors of automobiles, engines and industrial application segments utilizing exclusive lubricating materials.

Furthermore, with EV technology taking shape, there is a focus on creating lubricants for new systems in the automotive industry as its moves to a more sophisticated and environmentally friendly technology. Normal drive-trains used in ICEs need lubricants for combustion operations, but the emergent EVs need efficiency fluids for electric motors and other components, giving rise to new VII prospects. These product offerings expand in response to technological changes in the automotive sector because they enable companies to maintain their portfolio’s product differentiation. The increase in demand for better, high-performance lubricants in cars and other automobiles in conventional and electric vehicles makes VIIs crucial in future automotive and industrial application.

Viscosity Index Improvers (VII) Market Segment Analysis

Viscosity Index Improvers (VII) Market Segmented on the basis of

By Product Type

o Olefins Copolymers (OCP)

o Polymethacrylates (PMA)

o Hydrogenated Styrene-Diene Copolymers (HSD)

o Other

By Applications

o Engine Oils

o Hydraulic Fluids

o Gear Oils

o Transmission Fluids

o Others

By End-User Industry

o Automotive

o Industrial

o Marine

o Aerospace

o Others

By Product Type, Olefins Copolymers (OCP) segment is expected to dominate the market during the forecast period

Olefins Copolymers (OCP) are synthetic polymers known for their exceptional low-temperature flow properties and resistance to oxidation, making them ideal for use in a wide range of lubricants. These polymers are often employed to improve the viscosity index of oils, allowing them to perform consistently across a broad temperature range. In applications such as engine oils, transmission fluids, and hydraulic oils, OCP enhances the lubricants' stability, preventing thickening in cold temperatures and breakdown in high temperatures. This ability to maintain performance under varying environmental conditions is a key driver of OCP's demand, particularly in industries requiring high-performance lubricants.

The demand for OCP is particularly strong in the automotive and industrial sectors, where the need for reliable, high-performance lubricants is growing. As vehicles become more sophisticated and industrial machinery continues to evolve, OCP-based lubricants are crucial for ensuring smooth operations and prolonging the lifespan of engines and equipment. Furthermore, the increasing emphasis on fuel efficiency and reduced emissions in the automotive industry is driving innovation in lubricant formulations, with OCP playing a central role in meeting these demands. As a result, the market for OCP continues to expand, particularly for advanced lubricants used in high-performance applications.

By End-Use Industry, Automotive segment expected to held the largest share

The automotive industry is one of the largest consumers of lubricants, using a variety of products to ensure the smooth operation of vehicles. These products include engine oils, transmission fluids, hydraulic oils, and gear oils, all of which are essential for reducing friction, preventing wear, and enhancing the performance of vehicle components. As the automotive sector shifts toward fuel efficiency and high-performance vehicles, there is a growing demand for advanced lubricants that not only optimize engine and transmission performance but also contribute to reducing overall vehicle emissions. Innovations in lubricant formulations, such as those based on advanced polymers, are helping automakers meet regulatory requirements and performance expectations, particularly in light of increasing fuel economy standards and environmental concerns.

In addition to traditional vehicle lubricants, the rise of electric vehicles (EVs) is introducing new challenges and opportunities in the lubricant market. Unlike conventional internal combustion engine (ICE) vehicles, EVs require specialized lubricants for their electric motors, batteries, and cooling systems. These lubricants must meet specific requirements for thermal management, reduce friction in electric motor systems, and ensure efficient battery performance. As the EV market continues to expand, the demand for these tailored lubricants is growing, leading to further innovation in the lubricant sector. This shift toward EVs is contributing to the diversification of the automotive lubricant market, highlighting the need for more specialized products that address the unique needs of electric propulsion systems.

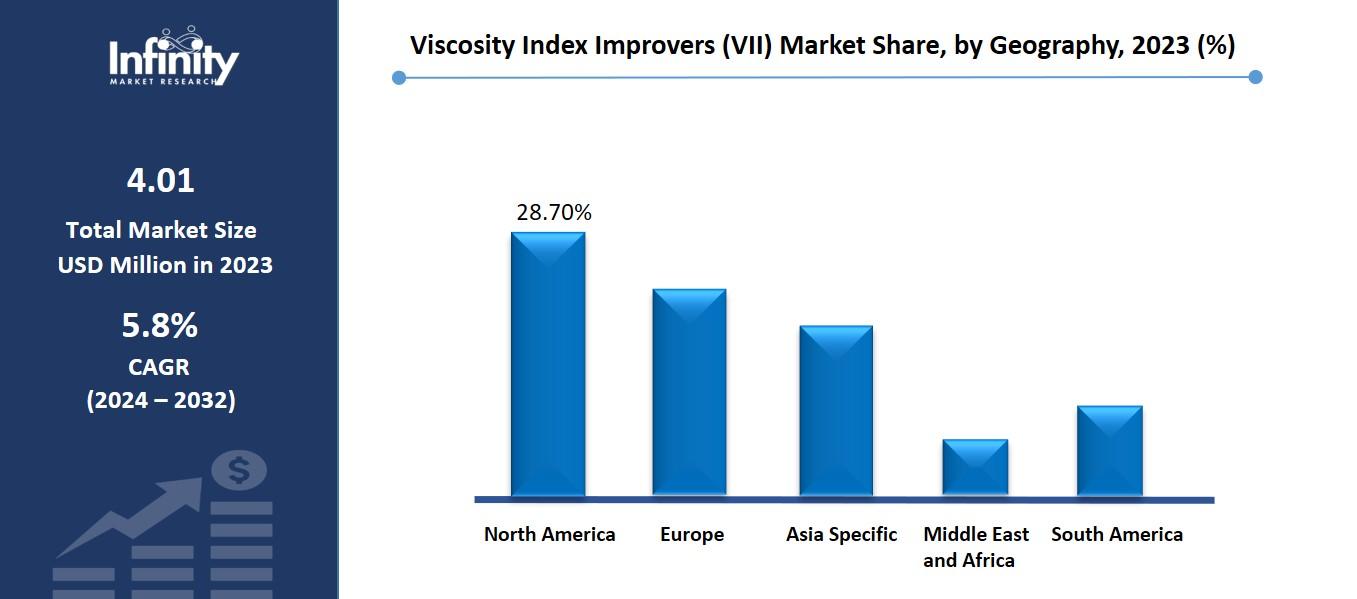

Viscosity Index Improvers (VII) Market Regional Insights

North America is Expected to Dominate the Market Over the Forecast period

This particular market is on a rise especially in North America because of the rising emission control requirements set by AAIA to have better Viscosity Index Improvers or VII. These regulations require that the lubricants should possess suitable viscosity at different temperatures in order to decrease the wear of the engine together with increasing the fuel consumption or to increase the overall efficiency which in turn increases the demand for the Viscosity Index Improvers. Increased use and availability of synthetic oils, known to provide better competition and to resist extreme temperatures, are paying this call for these additives. Also concerning the usage of advanced lubricants, sophisticated Engine Oils containing Viscosity Index Improvers, the automotive sector’s unending campaign for enhanced efficiency and durability of automobile engines call for increased use of advanced lubricants.

The United States must be regarded as the leading market in North America, given the automotive and industrial sectors’ presence. However, both Canada and Mexico are also having the increasing demand for these additives, behind by the growing manufacturing industries and expanding auto industry capacities. In the case of Canadian market demand, favourable attitude to environmentally friendly materials and more investments in the oil and gas business are the drivers of the market in this region. Likewise, the fast growing industrial sector of Mexico especially the automobile industry and machinery is fostering the need for high performance lubrication thus demanding Viscosity Index Improvers by the region.

Viscosity Index Improvers (VII) Market Share, by Geography, 2023 (%)

Active Key Players in the Viscosity Index Improvers (VII) Market

o The Lubrizol Corporation

o Infineum International Limited

o Chevron Oronite Company LLC

o Evonik Industries AG

o Afton Chemical Corporation

o BASF SE

o Sanyo Chemical Industries, Ltd.

o Croda International Plc

o LANXESS AG

o Mitsui Chemicals, Inc.

o Shenyang Great Wall Lubricating Oil Manufacturing Co., Ltd.

o BRB International BV (Petronas)

o BPT Chemicals Co., Ltd.

o Nanjing Runyou Chemical Industry Additive Co., Ltd.

o Other key Players

Global Viscosity Index Improvers (VII) Market Scope

|

Global Viscosity Index Improvers (VII) Market | |||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.01 Billion |

|

Forecast Period 2024-32 CAGR: |

5.8% |

Market Size in 2032: |

USD 7.11 Billion |

|

|

By Product Type |

· Olefins Copolymers (OCP) · Polymethacrylates (PMA) · Hydrogenated Styrene-Diene Copolymers (HSD) · Other | |

|

By Application |

· Engine Oils · Hydraulic Fluids · Gear Oils · Transmission Fluids · Others | ||

|

By End-User Industry |

· Automotive · Industrial · Marine · Aerospace · Others | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Increasing Demand for High-Performance Lubricants Across Industries | ||

|

Key Market Restraints: |

· High Raw Material Costs and Its Impact on VII Additives Pricing | ||

|

Key Opportunities: |

· High Raw Material Costs and Its Impact on VII Additives Pricing | ||

|

Companies Covered in the report: |

· The Lubrizol Corporation, Infineum International Limited, Chevron Oronite Company LLC, Evonik Industries AG, Afton Chemical Corporation, BASF SE, Sanyo Chemical Industries, Ltd., Croda International Plc, LANXESS AG, Mitsui Chemicals, Inc., Shenyang Great Wall Lubricating Oil Manufacturing Co., Ltd., BRB International BV (Petronas), BPT Chemicals Co., Ltd., Nanjing Runyou Chemical Industry Additive Co., Ltd. and Other Major Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Viscosity Index Improvers (VII) Market research report?

Answer: The forecast period in the Market research report is 2024-2032.

2. Who are the key players in the Viscosity Index Improvers (VII) Market?

Answer: The Lubrizol Corporation, Infineum International Limited, Chevron Oronite Company LLC, Evonik Industries AG, Afton Chemical Corporation, BASF SE, Sanyo Chemical Industries, Ltd., Croda International Plc, LANXESS AG, Mitsui Chemicals, Inc., Shenyang Great Wall Lubricating Oil Manufacturing Co., Ltd., BRB International BV (Petronas), BPT Chemicals Co., Ltd., Nanjing Runyou Chemical Industry Additive Co., Ltd. and Other Major Players.

3. What are the segments of the Viscosity Index Improvers (VII) Market?

Answer: The Viscosity Index Improvers (VII) Market is segmented into By Product Type, By Application, By End-Use Industry and region. By Product Type, the market is categorized into Olefins Copolymers (OCP), Polymethacrylates (PMA), Hydrogenated Styrene-Diene Copolymers (HSD), Others. By Application, the market is categorized into Engine Oils, Hydraulic Fluids, Gear Oils, Transmission Fluids, Others. By End-Use Industry, the market is categorized into Automotive, Industrial, Marine, Aerospace, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Viscosity Index Improvers (VII) Market?

Answer: The Viscosity Index Improvers (VII) market concentrates on chemical products known as VII that can improve on the viscosity-temperature characteristics of lubricants and oils. VIIs allow these fluids to have high and low temperature viscosity to perform its function in high temperature and low temperatures. A VII is used in automotive, industrial machinery, hydraulic systems and many other applications where the durability and stability of the lubricant results in less wear and tear in mechanical applications. The market includes, but is not limited to polymers like polyalkylmethacrylates, olefin copolymers, and styrene based copolymers for high performance lubricants to fulfill the requirement of efficient industries focusing on sustainability.

5. How big is the Permethrin Market?

Answer: Viscosity Index Improvers (VII) Market acquired the significant revenue of 4.01 Billion in 2023 and expected to be worth around USD 7.11 Billion by 2032 with the CAGR of 5.8% during the forecast period of 2024 to 2032.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.