🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Wafer Shippers and Carriers Market

Wafer Shippers and Carriers Market Global Industry Analysis and Forecast (2024-2032) By Product Type( Wafer Shippers, Wafer Carriers), By Material( Plastic, Metal, Other Materials), By Application(Semiconductor, Electronics, Other Industries), By End User(Foundries, Fabless Companies, OSAT (Outsourced Semiconductor Assembly and Test), Other End Users) and Region

Feb 2025

Semiconductor and Electronics

Pages: 138

ID: IMR1673

Wafer Shippers and Carriers Market Synopsis

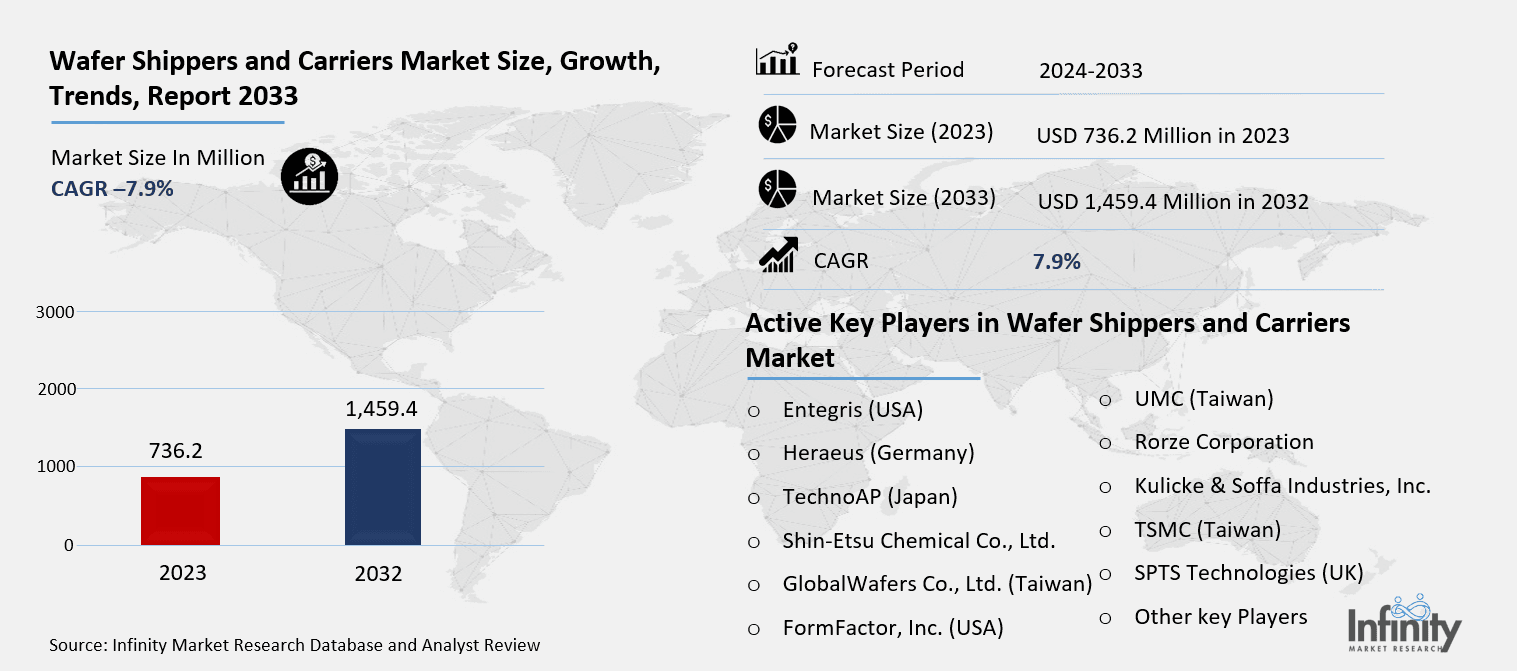

Wafer Shippers and Carriers Market Size Was Valued at USD 736.2 Million in 2023, and is Projected to Reach USD 1,459.4 Million by 2032, Growing at a CAGR of 7.9% From 2024-2032.

Wafer Shippers and Carriers Market is defined as the industry that is involved in provision, use and sale of materials for carrying, shipping and handling semiconductor wafers and microelectronics in a secure manner. These products include, wafer shippers, and carriers are used to protect the wafers from damage and impacts in the course of transportation and storage while they are held in the best conditions for further processing in semiconductor production.

The Wafer Shippers and Carriers Market is essential in semiconductor industry by providing ideal material handling equipment for the protection of delicate semiconductor wafers during shipping. With the daily increase of the electronic devices used in our every day lives because of electronics, automobiles, and consumer devices, telecommunications among others, there is an increased demand for semiconductors and therefore an equivalent need for efficient wafer packaging. The market is fueled by CT’s growing use of both the wafer-scale integration and ongoing trends toward miniaturization and advanced power-performance-efficiency metrics of semiconductors. Some carriers are commonly used for long haul usage, however; other carriers are used to store and transport wafers locally during the manufacturing of circuits.

These are designed and manufactured in a way that will not allow any harm, including contamination, warping or cracking, on the wafers. With increasing geometries and complexity in designs of the semiconductor, it has recently shifted towards new packaging materials and formats to protect from the environment. In the market there is intensive competition between many suppliers mostly international, who engage in production of superior wafer, a, reduction of costs and quality to suit the different technologies involved in the wafers. Apart from this, another growth driver of the market is a rising use of automation in combination with the sophistication of the processes of wafer manufacturing. Semiconductor manufacturing as a critical input in technology advancement across industries means that wafer shippers and carriers are inevitably packaging and transportation solution in ensuring that the end and intermediary products are properly contained and handled throughout the value chain.

Wafer Shippers and Carriers Market Outlook, 2023 and 2032: Future Outlook

Wafer Shippers and Carriers Market Trend Analysis

Trend: Advanced Materials and Designs

Owing to the current trends that show customers requiring slim and much lighter wafers in the semiconductor business, the wafer shippers as well as the carriers are also being developed to provide enhanced safety and durability. One of those is the anti-static, conductive and temperature resistance that have been incorporated into the protection of wafers during transportation and storage. These materials assist to avoid such problems as discharges of static electricity, contaminations, and impacts on environment which all cause-stop and low yield price. This shift toward utilizing materials that are more environmentally friendly as well as energy efficient is also slowly advancing as more manufacturers strive to address increasing measures of sustainability expectations and policies.

To meet these higher protection needs, both, the wafer shippers and carriers are also gradually getting more versatile. W wafer makers are now directed to work on creating packaging solutions that fulfill the requirements of the customers according to the size, shape and fragility of the wafer. This level of customization enables companies to carry more delicate or sensitive wafers and also reduce on the likelihood of their damage during transportation. Furthermore, in order to track the status of the wafers throughout the supply chain, new smart packaging method is beeing developed as packaging with integrated tracking systems and sensors. This guarantees wafers’ transportation and storage at optimal environment which advocates for quality check as well as improvement in customer satisfaction within the semiconductor industry.

Opportunity: Growth in Semiconductor Demand

With the increasing demand for semiconductors globally the wafer shippers and carriers market is poised for greater growth. The consumer electronics business, automotive industry, telecommunication fields, artificial intelligence, etc., the growth of these industries fuel the need for better semiconductor devices, then, the need for better wafer transport solutions rises with it. Overall electronic semiconductor wafers production and transportation intensity is going to increase with the rise of new technologies including 5G, electric vehicles, as well as IoT. This opens up possibilities for the current wafer shippers or carriers to consider addition of capabilities that cover packages for their high volume or highly sensitive semiconductor products.

Apart from this, new markets of Asia especially China and India are exponentially coming up with more and more semiconductor manufacturing and thus a new requirement of wafer packaging has emerged. These markets along with increasing localization pressures for semiconductors are opportunities currently available in the global semiconductor markets. So as the demand for local production rises, both the wafer shippers and carriers should position themselves to offer those solutions that would address the emerging markets of these regions well. Manufacturers are likely to experience more sells as the producing of semiconductors is gradually increased to meet the global market.

Driver: Technological Advancements in Semiconductor Manufacturing

Current developments in the semiconductor manufacturing technology is a prime factor to the wafer shippers and carriers market. When the circuitry within semiconductor devices grows ever more intricate, and with the enhancement of its feature size as well as the refinement of its sensitivity, the necessity of developing specific package solutions has emerged. New generations of wafers and especially developments like 3D stacking or multichip modules put demands on high wafer stability during the packaging and delivering process. Furthermore, as fabs become increasingly automated and proven to be highly integrated, the need for efficient transport media such as wafer carriers and shippers cannot be underestimated within the improved chip manufacturing excellent comparable environments.

The application of miniaturization or compactness and sophisticated packaging requirements typical of semiconductors have also raised the need for wafer shipper as well as form carriers that offer additional safeguard without occupying so much space. Therefore, research on lighter yet more durable materials is rapidly increasing since manufacturers realize the importance of protective packaging. Such development is not only useful for improving the protection of the wafers during transportation but also comprises the higher throughput demands of manufacturing facilities of semiconductors.

Restraints: Rising Costs of Advanced Materials

The wafer shippers and carriers market faces risks such as increases in the costs of using high end packaging materials. The semiconductor sector’s requirements for package materials have improved, especially on anti-static, high temperature resistant and high durability. These materials offer excellent protection of wafers; however, they are relatively expensive in the production process. This is as a consequence of increased material costs for manufacturers of wafer shippers and carriers, which is expressed in a higher cost of the final product. Increasing costs of the components including high-performance plastics, composite and metals has created pressure to suppliers to offer innovative products at low costs.

This pricing pressure seems to have favoured cost efficiency in both the manufacturing of the waver shipper and the carrier. They are in search of options, for having efficiency and effectiveness in business with minimum compromise with cost. These are things like increasing production line efficiency, exploring different material, and changing the way that products are made. However, the cost charged is a major put off for small manufacturing industries, which is unable to compete with other industries or really invest in new technologies and new products innovations.

Wafer Shippers and Carriers Market Segment Analysis

Wafer Shippers and Carriers Market Segmented on the basis of product type, material application and end user.

By Product Type

o Wafer Shippers

o Wafer Carriers

By Application

o Semiconductor

o Electronics

o Other Industries

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Product Type, Wafer Shippers segment is expected to dominate the market during the forecast period

The distinction between wafer shippers and carrier is important factors contributing to the manufacturing process of semiconductor wafers as both are occupying crucial roles to safeguard the wafers. Long distance transport is imperative as many semiconductor producers globalize their supply chain logistics with the help of its beneficiaries, the wafer shippers. As the production of wafers rises in a given region particularly in Asia and North America, the requirement of the appropriate type of shipment that can adequately protect and transport wafers safely has been on the rise. Another factor that strengthens the requirement for the transport shippers is the increase in the size of semiconductor wafers where new giants and enhanced breakable products underlines that size also matters.

However, wafer carriers are already essential within the semiconductor manufacturing industry because wafers undergo multiple transfers in different processing steps. Erasing the complexities of both: wafers designs and the of sizes it comes with this calls for carriers that can safely store as well as transport wares within such environments. This increasing need for wafer carriers is correlated with the ever-increasing automation of semiconductor manufacturing, which requires carriers that can be handled by robots and integrated into automated manufacturing systems.

By Application, Semiconductor segment expected to held the largest share

The semiconductor business consumes most of the wafer shippers and carriers and the market can be intimately correlated to the volume of semiconductor manufacturing. The production of electronics and consumer goods, especially smartphones, computing devices, automotive, and other such applications has risen significantly; therefore, high-quality wafers are needed. The semiconductor industry needs packaging systems that can protect wafers from any damage that occurs from transport and storage until they are ready for processing into chips.

Other electronics producers also create a market for the wafer shippers and carriers especially since the density of electronics products escalates. Growing dependence on 5G smartphones, wearables, and IoT devices has created more awareness of protective semiconductor packaging solutions capable of protecting highly delicate wafers. The miniaturization and the integration concept in electronic devices make them more sensitive and thus require good packaging systems to ensure that the delicate wafers used are not damaged

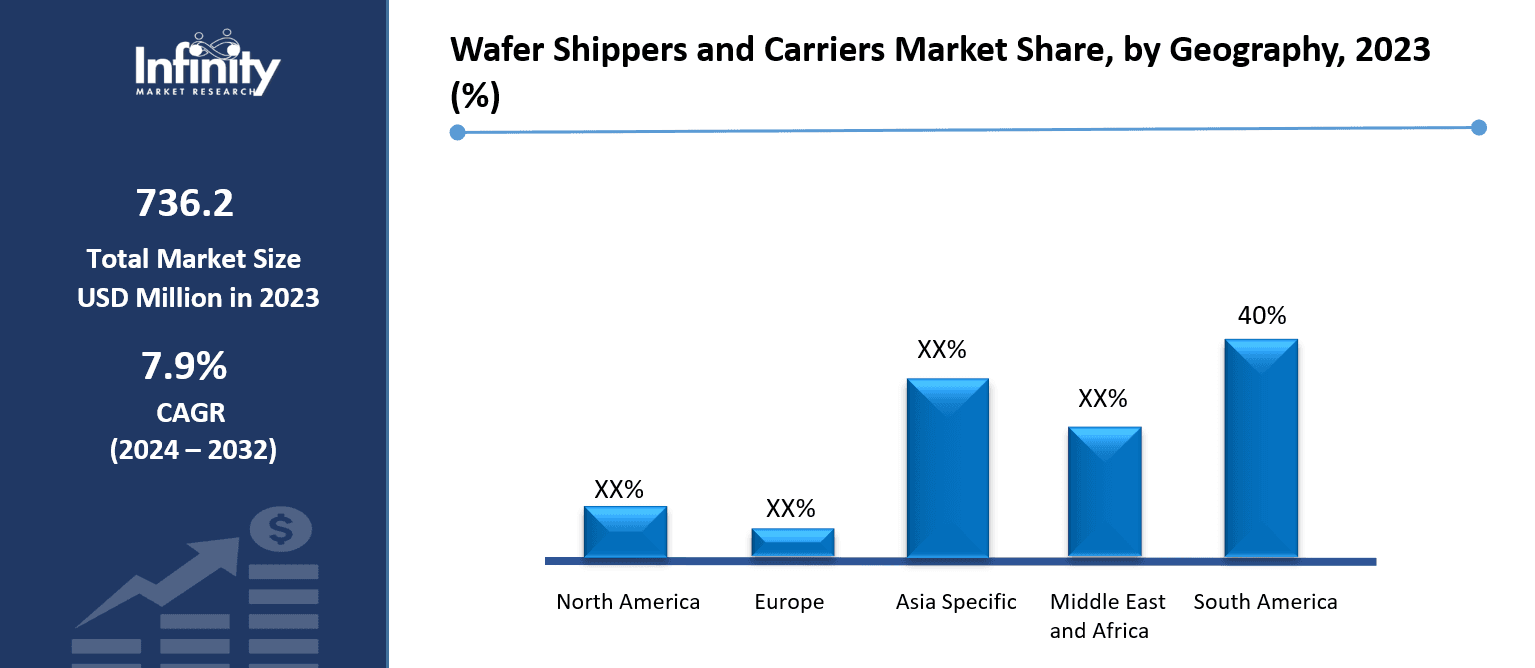

Wafer Shippers and Carriers Market Regional Insights

North America is Expected to Dominate the Market Over the Forecast period

North America has the highest market shares in the Wafer Shippers and Carriers Market owing to the vast number of semiconductor manufacturing companies and well-developed technology. The emphasis on the production of superior quality semiconductors for applications in telecommunication, automobile manufacturing, and consumer electronics industries are the factors have led to the growth of this market in the region. Because many semiconductor fabs and research centers are located globally in the United States and Canada, the requirements for wafer packaging are fairly high, which places North America at the level of the market for shipping and carrying wafers.

In addition, technological advancement and automation witnessed in North America especially in semiconductor manufacturing drives the advancement of wafer packaging solutions. It has fueled a need for more advanced wafer shippers and carriers in the region that matches the research and development in semiconductor industry to create products of next level. With growth in the market requirements of high-killed semiconductor technologies, North America is predicted to possess the lead position in the wafer shippers and carriers market.

Wafer Shippers and Carriers Market Share, by Geography, 2023 (%)

Active Key Players in the Wafer Shippers and Carriers Market

o Entegris (USA)

o Heraeus (Germany)

o TechnoAP (Japan)

o Shin-Etsu Chemical Co., Ltd. (Japan)

o GlobalWafers Co., Ltd. (Taiwan)

o FormFactor, Inc. (USA)

o IMT (USA)

o UMC (Taiwan)

o Rorze Corporation (Japan)

o Kulicke & Soffa Industries, Inc. (USA)

o TSMC (Taiwan)

o SPTS Technologies (UK)

o Other key Players

Global Wafer Shippers and Carriers Market Scope

|

Global Wafer Shippers and Carriers Market | |||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 736.2 Million |

|

Forecast Period 2024-32 CAGR: |

7.9% |

Market Size in 2032: |

USD 1,459.4 Million |

|

Segments Covered: |

By Product Type |

· Wafer Shippers · Wafer Carriers | |

|

By Application |

· Semiconductor · Electronics · Other Industries | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Technological Advancements in Semiconductor Manufacturing | ||

|

Key Market Restraints: |

· Rising Costs of Advanced Materials | ||

|

Key Opportunities: |

· Growth in Semiconductor Demand | ||

|

Companies Covered in the report: |

· Entegris (USA), Heraeus (Germany), TechnoAP (Japan), Shin-Etsu Chemical Co., Ltd. (Japan), Global Wafers Co., Ltd. (Taiwan), FormFactor, Inc. (USA), IMT (USA), UMC (Taiwan), and Other Major Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Wafer Shippers and Carriers Market research report?

Answer: The forecast period in the Wafer Shippers and Carriers Market research report is 2024-2032.

2. Who are the key players in the Wafer Shippers and Carriers Market?

Answer: Entegris (USA), Heraeus (Germany), TechnoAP (Japan), Shin-Etsu Chemical Co., Ltd. (Japan), Global Wafers Co., Ltd. (Taiwan), FormFactor, Inc. (USA), IMT (USA), UMC (Taiwan), and Other Major Players.

3. What are the segments of the Wafer Shippers and Carriers Market?

Answer: The Wafer Shippers and Carriers Market is segmented into Product Type, Material, Application, End User and region. By Product Type, the market is categorized into Wafer Shippers, Wafer Carriers. By Material, the market is categorized into Plastic, Metal, Other Materials. By Application, the market is categorized into Semiconductor, Electronics, Other Industries. By End User, the market is categorized into Foundries, Fabless Companies, OSAT (Outsourced Semiconductor Assembly and Test), Other End Users. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Wafer Shippers and Carriers Market?

Answer: Wafer Shippers and Carriers Market is defined as the industry that is involved in provision, use and sale of materials for carrying, shipping and handling semiconductor wafers and microelectronics in a secure manner. These products include, wafer shippers, and carriers are used to protect the wafers from damage and impacts in the course of transportation and storage while they are held in the best conditions for further processing in semiconductor production.

5. How big is the Wafer Shippers and Carriers Market?

Answer: Wafer Shippers and Carriers Market Size Was Valued at USD 736.2 Million in 2023, and is Projected to Reach USD 1,459.4 Million by 2032, Growing at a CAGR of 7.9% From 2024-2032.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.