🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Waste Management Market

Waste Management Market (By Waste Type (Municipal Waste, Medical Waste, Industrial Waste, E-waste, Other Waste Type), By Service Type (Collection, Transportation, Disposal, Other Service Types), By End-User (Residential, Commercial, Industrial, Other End-User), By Region and Companies)

Aug 2024

Chemicals and Materials

Pages: 138

ID: IMR1198

Waste Management Market Overview

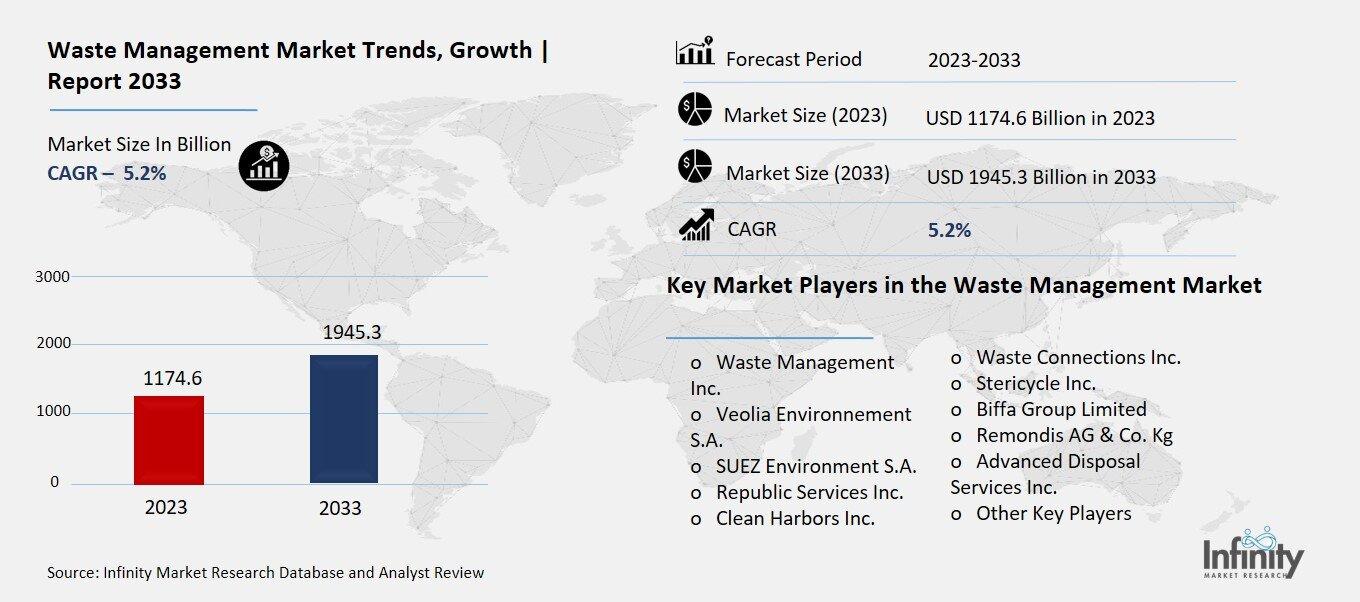

Global Waste Management Market size is expected to be worth around USD 1945.3 Billion by 2033 from USD 1174.6 Billion in 2023, growing at a CAGR of 5.2% during the forecast period from 2023 to 2033.

The Waste Management Market is the industry that handles the collection, disposal, and recycling of waste materials. This includes all kinds of waste, from household trash to industrial by-products. Companies in this market offer services and solutions to manage waste effectively, ensuring it is disposed of properly or turned into useful materials through recycling. The goal is to minimize the impact of waste on the environment and human health.

In simple terms, the Waste Management Market deals with everything related to getting rid of garbage safely and efficiently. This market is crucial because it helps keep our surroundings clean and reduces pollution. It involves various processes, such as picking up garbage from homes and businesses, recycling materials to be used again, and safely treating or disposing of harmful waste.

Drivers for the Waste Management Market

Growing Urbanization and Population

As cities and towns continue to expand and populations increase, the amount of waste generated is rising significantly. More people living in urban areas means more households, businesses, and industries producing waste. This surge in waste creation drives the need for efficient waste management solutions. To handle this growing waste load, municipalities, and private companies are investing in better collection, recycling, and disposal technologies to keep cities clean and sustainable.

Increased Environmental Awareness

There is a growing awareness about environmental issues and the impact of waste on the planet. People and governments are becoming more conscious of the need to reduce waste and recycle materials to prevent pollution and conserve resources. This heightened awareness is pushing both individuals and organizations to adopt better waste management practices. As a result, there is a higher demand for services and technologies that support recycling, composting, and waste reduction.

Stringent Regulations and Policies

Governments worldwide are implementing stricter regulations and policies regarding waste management. These rules often include mandates for recycling, proper disposal of hazardous materials, and reducing landfill use. Compliance with these regulations requires businesses and local authorities to invest in advanced waste management systems. These regulations drive market growth by creating a need for new technologies and services that help meet legal requirements and avoid penalties.

Technological Advancements

Innovations in technology are transforming the waste management industry. New technologies, such as smart waste collection systems, advanced sorting machines, and improved recycling processes, are making waste management more efficient and cost-effective. These advancements help in better monitoring of waste, reducing manual labor, and increasing the effectiveness of recycling programs. As technology continues to evolve, it creates new opportunities and drives the market forward.

Growing Focus on Sustainability

The global push towards sustainability is another key driver for the waste management market. Businesses and governments are increasingly focusing on reducing their environmental footprint and adopting sustainable practices. This includes implementing waste-to-energy technologies, promoting circular economy principles, and encouraging zero-waste initiatives. The emphasis on sustainability is leading to increased investments in waste management solutions that align with these goals.

Rising Industrial Waste

Industries generate a significant amount of waste, including hazardous materials that require special handling. As industrial activities expand, the need for specialized waste management solutions grows. Companies are looking for effective ways to manage and treat industrial waste to meet environmental standards and reduce operational risks. This demand for tailored waste management services boosts market growth and encourages the development of new solutions.

Restraints for the Waste Management Market

High Costs of Advanced Waste Management Technologies

One major restraint for the waste management market is the high cost associated with advanced technologies. Implementing state-of-the-art systems for waste sorting, recycling, and disposal often requires significant financial investment. For many municipalities and businesses, these upfront costs can be a barrier, particularly in regions with limited budgets. Although these technologies can improve efficiency and effectiveness in the long run, the initial expenditure remains a challenge for widespread adoption.

Limited Infrastructure in Developing Regions

In many developing regions, the infrastructure for effective waste management is inadequate. This includes insufficient waste collection systems, a lack of recycling facilities, and poorly managed landfills. The absence of proper infrastructure limits the ability to implement modern waste management practices and technologies. As a result, these areas face difficulties in managing increasing waste volumes and maintaining environmental standards, hindering overall market growth.

Regulatory and Policy Challenges

Navigating the complex web of regulations and policies related to waste management can be challenging. Different countries and regions have varying rules concerning waste disposal, recycling, and hazardous material handling. Compliance with these regulations requires significant administrative effort and resources. The complexity and variability of waste management regulations can create obstacles for companies trying to expand or operate internationally, slowing down market growth.

Public Resistance to Waste Management Initiatives

Public resistance can also impact the effectiveness of waste management programs. Some communities may be unwilling to adopt new waste management practices, such as recycling programs or waste separation, due to a lack of awareness or inconvenience. Overcoming this resistance often requires extensive education and outreach efforts, which can be time-consuming and costly. Addressing public resistance is crucial for the success of waste management initiatives but can be a significant hurdle.

Environmental and Health Concerns with Waste Facilities

Waste management facilities, such as landfills and incinerators, can raise environmental and health concerns. Landfills may cause soil and water contamination, while incinerators can emit pollutants into the air. These environmental impacts can lead to opposition from local communities and regulatory bodies, complicating the development and operation of waste management facilities. Addressing these concerns requires additional investments in technology and practices to minimize negative effects, further adding to costs.

Technological and Operational Challenges

Implementing and maintaining waste management systems involves various technological and operational challenges. For instance, waste sorting technologies require regular maintenance and upgrades to keep up with evolving waste streams. Additionally, operational challenges such as logistical issues and workforce management can impact the efficiency of waste management systems. Overcoming these challenges demands continuous investment and expertise, which can be a constraint for some organizations.

Opportunity in the Waste Management Market

Growing Demand for Recycling and Circular Economy Solutions

One of the significant opportunities in the waste management market is the growing emphasis on recycling and the circular economy. As societies become more conscious of environmental issues, there is an increased demand for recycling programs that reduce waste and recycle materials back into the economy. Governments and organizations are investing in technologies and infrastructure to enhance recycling rates and develop closed-loop systems where waste materials are continuously reused. This shift not only reduces the amount of waste sent to landfills but also creates new business opportunities in the recycling and material recovery industries.

Advancements in Waste-to-Energy Technologies

Waste-to-energy (WTE) technologies are advancing rapidly, offering new opportunities for the waste management market. These technologies convert waste materials into energy, such as electricity or heat, through processes like incineration, gasification, and anaerobic digestion. With growing energy needs and increasing waste volumes, WTE technologies provide a dual benefit: they help manage waste effectively while generating valuable energy. Investments in WTE infrastructure and innovations can help address waste disposal challenges and meet energy demands sustainably.

Expansion of Smart Waste Management Solutions

The rise of smart technology presents opportunities for innovation in waste management. Smart waste management solutions, such as sensor-equipped bins and data-driven waste collection systems, optimize waste collection and disposal processes. These technologies use real-time data to monitor waste levels, improve collection routes, and enhance recycling efforts. By incorporating smart technologies, municipalities and businesses can achieve greater efficiency, reduce costs, and improve overall waste management services.

Increasing Focus on Organic Waste Management

Organic waste management is gaining attention as an essential aspect of sustainable waste practices. Organic waste, including food and garden waste, can be processed into valuable resources like compost or biogas. With more communities and industries recognizing the benefits of managing organic waste effectively, there are growing opportunities for composting facilities and biogas plants. This focus on organic waste not only helps reduce landfill waste but also supports sustainable agricultural practices and renewable energy production.

Rising Awareness and Regulatory Support for Waste Reduction

The increasing awareness of environmental issues and strong regulatory support for waste reduction are creating opportunities for the waste management market. Governments around the world are implementing stricter regulations to minimize waste generation and encourage sustainable waste management practices. Policies such as waste reduction targets, extended producer responsibility, and landfill bans drive demand for advanced waste management solutions. Companies that align with these regulations and offer innovative waste-reduction technologies are well-positioned to benefit from these regulatory trends.

Development of Advanced Waste Sorting and Processing Technologies

Advancements in waste sorting and processing technologies are opening new avenues for the waste management market. Innovations such as automated sorting systems, advanced separation techniques, and high-efficiency processing methods are improving the efficiency and effectiveness of waste management operations. These technologies help enhance material recovery rates, reduce contamination, and lower operational costs. Companies investing in cutting-edge sorting and processing technologies can capture market share and meet the increasing demand for efficient waste management solutions.

Trends for the Waste Management Market

Growth of Recycling Initiatives

Recycling continues to be a dominant trend in the waste management market. Many cities and countries are enhancing their recycling programs to reduce the amount of waste sent to landfills. Innovations in sorting and processing technologies have made recycling more efficient, enabling the recovery of valuable materials such as metals, plastics, and paper. Governments and private organizations are increasingly investing in advanced recycling infrastructure and public awareness campaigns to boost recycling rates. This trend is driven by the desire to conserve resources, reduce environmental impact, and create a more sustainable waste management system.

Expansion of Waste-to-Energy Technologies

Waste-to-energy (WTE) technologies are gaining traction as a solution to both waste management and energy generation. These technologies convert waste into energy, such as electricity or heat, through various processes like incineration or anaerobic digestion. The growing emphasis on renewable energy sources and the need to manage increasing waste volumes are fueling the expansion of WTE facilities. Innovations in this field are improving the efficiency and environmental performance of waste-to-energy plants, making them a viable option for sustainable waste management and energy production.

Adoption of Smart Waste Management Solutions

Smart waste management solutions are becoming more prevalent, leveraging technology to enhance efficiency and effectiveness. Systems equipped with sensors and data analytics are being used to monitor waste levels in real time, optimize collection routes, and improve sorting processes. This trend towards smart waste management helps municipalities and businesses reduce operational costs, increase recycling rates, and minimize environmental impact. As technology advances, the integration of artificial intelligence and machine learning into waste management systems is expected to further enhance their capabilities.

Increased Focus on Organic Waste Processing

The management of organic waste is receiving increased attention due to its potential benefits for sustainability. Organic waste, such as food scraps and yard waste, can be processed into compost or biogas, contributing to soil health and renewable energy. Many regions are implementing composting programs and anaerobic digestion facilities to handle organic waste more effectively. This trend is driven by the recognition of organic waste's value and the need to reduce methane emissions from landfills.

Rising Regulatory Pressures and Environmental Standards

Stricter environmental regulations and rising public awareness are driving changes in waste management practices. Governments are introducing policies that mandate waste reduction, increase recycling rates, and limit landfill use. Companies are responding by adopting more sustainable practices and investing in technologies that comply with these regulations. The focus on reducing waste and improving environmental performance is reshaping the waste management landscape and pushing for innovation and better practices.

Emergence of Circular Economy Concepts

The circular economy is gaining momentum as a guiding principle for waste management. This concept emphasizes reducing waste by reusing, recycling, and repurposing materials rather than disposing of them. Companies and governments are increasingly adopting circular economy practices to close the loop on product lifecycles and minimize environmental impact. This trend is driving the development of new business models and technologies that support sustainable resource management and waste reduction.

Segments Covered in the Report

By Waste Type

o Municipal Waste

o Medical Waste

o Industrial Waste

o E-waste

o Other Waste Type

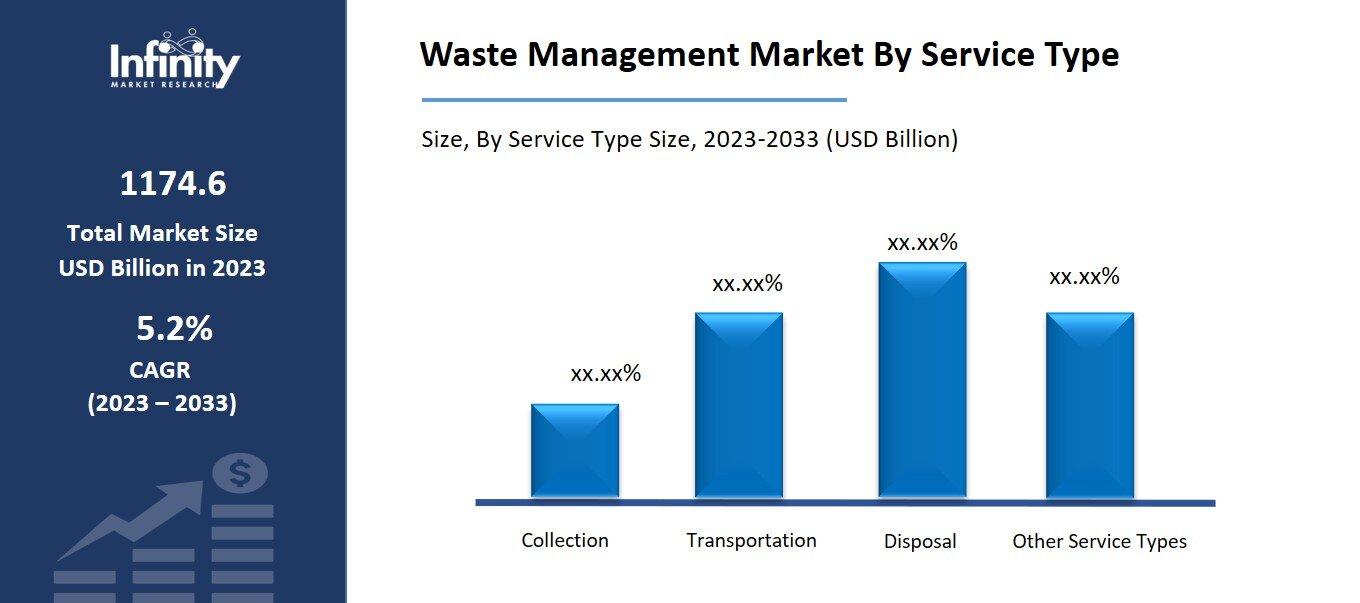

By Service Type

o Collection

o Transportation

o Disposal

o Other Service Types

By End-User

o Residential

o Commercial

o Industrial

o Other End-User

Segment Analysis

By Waste Type Analysis

The industrial waste segment holds an 80.2% market share. The market is segmented into four waste types: municipal garbage, medical waste management, industrial waste, and e-waste. The industrial waste management market size segment leads the market because Industrialization and fast urbanization are the primary contributors to the rise of industrial waste. Managing industrial waste can pollute lakes and groundwater, causing harm to wildlife and vegetation.

According to "Our World in Data", over 7 billion people are anticipated to live in cities by 2050. This will quickly increase the generation of urban garbage. Several countries, notably the United States, India, and China, implemented a lockdown in 2020 to limit the spread of the COVID-19 pandemic. As a result, more people worked from home in 2020, contributing to an increase in urban garbage. Over the projected period, the e-waste sector is expected to develop at the highest CAGR (7.4%).

By Service Type Analysis

The collection segment holds a 60.1% market share. The market is separated into three service types: collection, transportation, and disposal. The collection segment dominates the market. trash collection comprises segregation, loading, and unloading, determining a place suitable for trash storage, establishing this area at a minimum distance from where the waste was generated, and managing the waste.

Companies that collect rubbish must keep these storage sites clean and maintained regularly. To avoid spills and leaks, garbage must be transported appropriately. Liquid waste must be kept safe and leak-proof while being transported. Hazardous waste from industrial and commercial locations must be delivered in vehicles that offer some level of protection. Non-hazardous goods can be taken straight to recycling.

By End-User Analysis

According to end-user research, the residential segment dominates the market with a 46.8% share. End-users classify the market into three categories: residential, commercial, and industrial. The residential segment dominates the market since it contains garbage from both multi-family and single-family residences. Consumer durables (CD), fast-moving consumer goods (FMCG), and e-waste account for the majority of household waste. Additional packaging supplies are also included.

Plastic waste in the residential sector is also increasing as disposable incomes rise and customers choose to shop online. Industrial waste is another significant segment. The construction, oil and gas, chemical, nuclear, and agricultural industries generate and collect industrial waste. This waste consists of solids, liquids, and gasses. This garbage contains both hazardous and non-hazardous substances.

Regional Analysis

Asia Pacific dominated the sector, accounting for more than 25.4% in 2023. Government initiatives such as Swacch Bharat Abhiyan and several Asia Pacific countries' zero waste plans are likely to raise awareness about trash management. This is expected to have a beneficial impact on market growth in Asia Pacific.

Factors such as increased garbage generation, stringent government waste management rules, and illicit dumping are expected to fuel waste management demand in North America. Furthermore, significant technological improvements, such as the incorporation of PET bottle recycling technology into waste management procedures, are likely to boost demand in North America.

The Middle East and Africa are expected to grow at a CAGR of 5.6% throughout the projection period. The expansion is linked to an increased understanding of the long-term advantages and benefits of reusing and recycling waste materials. However, a lack of funds and poor infrastructure to implement proper collection and recycling in the majority of African countries has resulted in unlawful disposal sites, limiting market expansion.

Increasing population, urbanization, economic expansion, and unsustainable consumption and production habits are some of the causes driving waste generation in Central and South America. Furthermore, increased awareness of garbage recycling in the region is likely to boost market growth during the forecast period.

Competitive Analysis

Major businesses in the industry are vertically integrated throughout the supply chain, including garbage collection, transportation, and disposal services. This leads to lower operational costs and higher profit margins, allowing the enterprises to gain a considerable portion of the industry. Some major participants in the global waste management market are:

Recent Developments

June 2024: Assembly session. K. N. Nehru, Minister of Tamil Nadu, announced on behalf of the government. Other long-term objectives of the Tamil Nadu government include improving solid waste and sewage management, as well as constructing infrastructure to address urbanization-related issues.

November 2023:Biffa Ltd, a prominent waste management firm, completed the acquisition of Hamilton Waste and Recycling Limited, which is now the largest provider of construction and demolition waste services in the UK. Biffa's present recognition is a positive step toward widening the waste materials associated with the building and demolition sectors. Thus, it contributes to carbon-reducing vehicles and plants without pollutants and complements.

Key Market Players in the Waste Management Market

o Waste Management Inc.

o SUEZ Environment S.A.

o Republic Services Inc.

o Waste Connections Inc.

o Stericycle Inc.

o Remondis AG & Co. Kg

o Advanced Disposal Services Inc.

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 1174.6 Billion |

|

Market Size 2033 |

USD 1945.3 Billion |

|

Compound Annual Growth Rate (CAGR) |

5.2% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Waste Type, Service Type, End-User, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Waste Management Inc., Veolia Environnement S.A, SUEZ Environment S.A, Republic Services Inc., Clean Harbors Inc., Waste Connections Inc., Stericycle Inc., Biffa Group Limited, Remondis AG & Co. Kg, Advanced Disposal Services Inc., Other Key Players |

|

Key Market Opportunities |

Growing Demand for Recycling and Circular Economy Solutions |

|

Key Market Dynamics |

Increased Environmental Awareness |

📘 Frequently Asked Questions

1. What would be the forecast period in the Waste Management Market?

Answer: The forecast period in the Waste Management Market report is 2024-2033.

2. How much is the Waste Management Market in 2023?

Answer: The Waste Management Market size was valued at USD 1174.6 Billion in 2023.

3. Who are the key players in the Waste Management Market?

Answer: Waste Management Inc., Veolia Environnement S.A, SUEZ Environment S.A, Republic Services Inc., Clean Harbors Inc., Waste Connections Inc., Stericycle Inc., Biffa Group Limited, Remondis AG & Co. Kg, Advanced Disposal Services Inc., Other Key Players

4. What is the growth rate of the Waste Management Market?

Answer: Waste Management Market is growing at a CAGR of 5.2% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.