🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Water and Wastewater Treatment Equipment Market

Water and Wastewater Treatment Equipment Market (By Type (Filtration, Disinfection, Adsorption, Desalination, Testing, Others), By Equipment (Membrane Separation, Biological, Disinfection, Sludge Treatment, Other Equipment), By Process (Primary, Secondary, Tertiary), By Application (Municipal, Industrial, Other Applications), By Region and Companies)

Jun 2024

Industrial Automation and Equipment

Pages:

ID: IMR1114

Water and Wastewater Treatment Equipment Market Overview

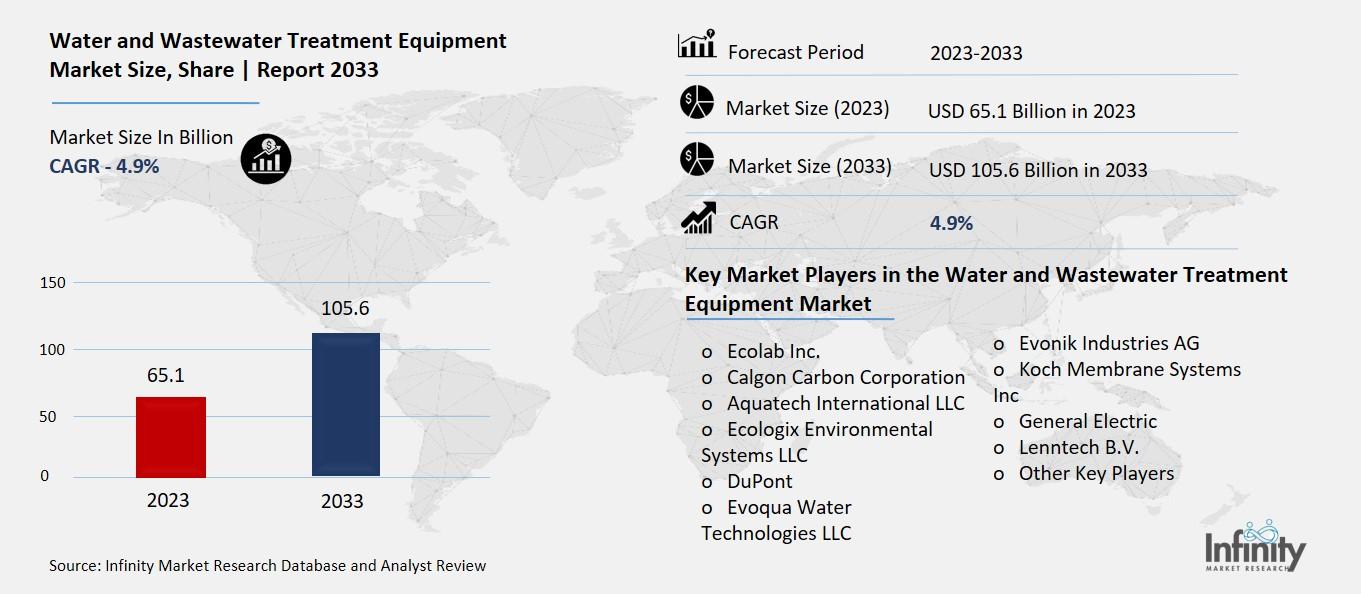

Global Water and Wastewater Treatment Equipment Market size is expected to be worth around USD 105.6 Billion by 2033 from USD 65.1 Billion in 2023, growing at a CAGR of 4.9% during the forecast period from 2023 to 2033.

The Water and Wastewater Treatment Equipment Market is the industry that provides tools and machines to clean water. This equipment helps make water safe to drink and use by removing harmful substances and pollutants. It's also used to treat wastewater, which is the dirty water from homes, businesses, and factories, so it can be reused or safely released back into the environment.

This market is growing because clean water is essential for health and daily life, and there is a rising need to manage and treat wastewater due to increasing population and industrial activities. Companies in this market make a wide range of equipment, from simple filters to advanced systems that use chemicals and technology to purify water. This helps ensure that communities have access to safe water and that the environment is protected from pollution.

Drivers for the Water and Wastewater Treatment Equipment Market

The growing global population and rapid urbanization are major drivers for the Water and Wastewater Treatment Equipment market. As more people move to cities, the demand for clean water increases significantly. Urban areas require efficient water treatment systems to supply safe drinking water and manage wastewater. According to the United Nations, the global urban population is expected to grow by 2.5 billion by 2050, with nearly 70% of the world's population living in cities. This surge in urban population creates a pressing need for advanced water and wastewater treatment solutions to ensure sustainable and safe water management.

Stringent Environmental Regulations

Stringent environmental regulations imposed by governments and regulatory bodies are pushing the adoption of water and wastewater treatment equipment. These regulations aim to reduce water pollution and protect water resources. For instance, the Clean Water Act in the United States sets standards for water quality and requires industries to treat wastewater before discharging it into water bodies. Similarly, the European Union's Water Framework Directive mandates member states to achieve good water status for all water bodies. Compliance with these regulations necessitates the use of advanced treatment equipment, driving the market growth.

Industrial Growth and Wastewater Generation

The expansion of industrial activities is another key driver for the water and wastewater treatment equipment market. Industries such as manufacturing, chemicals, pharmaceuticals, and food processing generate large volumes of wastewater containing harmful pollutants. Proper treatment of this wastewater is essential to prevent environmental contamination and ensure regulatory compliance. As industrial sectors continue to grow, the demand for efficient wastewater treatment solutions increases. According to the World Bank, global industrial water consumption is expected to rise by 40% by 2030, further boosting the market for treatment equipment.

Technological Advancements

Technological advancements in water and wastewater treatment equipment are enhancing efficiency and effectiveness, driving market adoption. Innovations such as membrane filtration, UV disinfection, and advanced oxidation processes offer improved treatment performance and lower operational costs. Additionally, the integration of IoT and automation technologies enables real-time monitoring and control of treatment processes, optimizing efficiency and ensuring compliance with quality standards. These advancements make water treatment more accessible and cost-effective, encouraging wider adoption across various sectors.

Rising Awareness of Water Scarcity

Increasing awareness of water scarcity and the need for sustainable water management practices are fueling the demand for water and wastewater treatment equipment. Water scarcity affects over 40% of the global population, and this figure is projected to rise due to climate change and population growth. Governments, organizations, and communities are investing in advanced treatment solutions to recycle and reuse water, reducing the strain on freshwater resources. The implementation of water reuse and recycling programs drives the market for treatment equipment, as these systems are essential for treating and purifying reclaimed water.

Public Health Concerns

Public health concerns related to waterborne diseases and contamination are significant drivers for the water and wastewater treatment equipment market. Contaminated water can cause serious health issues, including cholera, dysentery, and other waterborne infections. Ensuring access to clean and safe water is critical for public health. The World Health Organization (WHO) emphasizes the importance of water treatment in preventing water-related diseases. This focus on public health drives the demand for reliable and efficient treatment equipment to safeguard water quality and protect communities.

Restraints for the Water and Wastewater Treatment Equipment Market

High Initial Costs and Investment

One of the major restraints for the Water and Wastewater Treatment Equipment market is the high initial cost and investment required for setting up advanced treatment systems. The cost of purchasing, installing, and maintaining sophisticated equipment such as membrane filters, UV disinfection units, and advanced oxidation processes can be substantial. For many municipalities and small to medium-sized enterprises, these costs can be prohibitive, especially when budget constraints are a significant concern. This financial barrier can slow down the adoption of new and efficient treatment technologies, limiting market growth.

Complexity and Technical Challenges

The complexity and technical challenges associated with operating and maintaining advanced water and wastewater treatment equipment pose another significant restraint. These systems often require specialized knowledge and skilled personnel to operate effectively. Training staff and ensuring they have the expertise to manage these complex systems can be time-consuming and costly. Additionally, the maintenance and repair of advanced equipment can be challenging, as it may require specific technical expertise and the availability of specialized parts, which can lead to increased downtime and operational inefficiencies.

Regulatory and Compliance Issues

While stringent environmental regulations drive the need for water and wastewater treatment equipment, they can also act as a restraint due to the complexity and cost of compliance. Different regions have varying regulations and standards, making it difficult for companies to develop one-size-fits-all solutions. Ensuring compliance with these diverse regulations can require significant time and financial resources. Non-compliance can lead to hefty fines and legal challenges, further adding to the burden on companies and municipalities. This regulatory landscape can deter investment in new technologies and slow down market expansion.

Environmental and Operational Limitations

Environmental and operational limitations can also restrain the Water and Wastewater Treatment Equipment market. For example, certain advanced treatment processes, such as membrane filtration, can generate significant amounts of waste, such as sludge, which requires proper disposal. Managing and disposing of this waste can be environmentally challenging and costly. Additionally, some treatment processes may have high energy consumption, leading to increased operational costs and environmental impacts. These factors can limit the adoption of certain technologies and encourage stakeholders to seek more sustainable and cost-effective alternatives.

Economic and Market Uncertainties

Economic and market uncertainties, such as fluctuations in raw material prices, economic downturns, and changes in government policies, can impact the Water and Wastewater Treatment Equipment market. For instance, an economic recession can lead to reduced government spending on infrastructure projects, including water and wastewater treatment facilities. Similarly, changes in government policies and priorities can shift focus away from environmental initiatives, impacting funding and support for water treatment projects. These uncertainties can create a challenging environment for market growth, as companies may be hesitant to invest in new technologies and projects.

Trends for the Water and Wastewater Treatment Equipment Market

Adoption of Advanced Treatment Technologies

One major trend in the Water and Wastewater Treatment Equipment market is the adoption of advanced treatment technologies. Innovations such as membrane filtration, ultraviolet (UV) disinfection, and advanced oxidation processes (AOP) are becoming more popular because they offer higher efficiency and effectiveness in removing contaminants from water. These technologies provide better performance compared to traditional methods, ensuring that the treated water meets stringent regulatory standards. The global membrane filtration market, for example, is projected to grow at a compound annual growth rate (CAGR) of over 8% from 2020 to 2027, highlighting the increasing adoption of advanced treatment technologies.

Increasing Use of Smart Water Management Systems

The increasing use of smart water management systems is another key trend. These systems incorporate Internet of Things (IoT) technologies and smart sensors to monitor water quality and treatment processes in real time. They enable utilities and industries to detect and address issues quickly, optimize treatment processes, and reduce operational costs. Smart water management systems also help in predictive maintenance, preventing equipment failures before they occur. The global smart water management market is expected to grow significantly, driven by the need for efficient water management solutions and the benefits of real-time data analytics.

Focus on Sustainable and Energy-Efficient Solutions

There is a growing focus on sustainable and energy-efficient solutions in the water and wastewater treatment industry. Companies are developing equipment that uses less energy and reduces the environmental impact of treatment processes. For example, energy-efficient pumps and blowers, solar-powered treatment plants, and systems that recover energy from wastewater are gaining traction. This trend is driven by increasing awareness of climate change and the need to reduce carbon footprints. The market for energy-efficient water treatment solutions is expected to grow as more organizations commit to sustainability goals and seek to minimize their environmental impact.

Rising Demand for Decentralized Treatment Systems

The rising demand for decentralized treatment systems is another important trend. Decentralized systems treat water and wastewater at or near the point of use, rather than relying on large, centralized treatment facilities. These systems are particularly beneficial in rural areas, remote locations, and developing regions where centralized infrastructure may not be feasible or cost-effective. Decentralized treatment systems offer flexibility, and scalability, and can be tailored to local conditions. The market for decentralized water treatment is expected to grow as communities and industries look for efficient and cost-effective ways to manage water resources.

Implementation of Water Reuse and Recycling Programs

The implementation of water reuse and recycling programs is gaining momentum as a trend in the water and wastewater treatment market. Water reuse involves treating wastewater to a level where it can be reused for various purposes, such as agricultural irrigation, industrial processes, and even potable water supply. This trend is driven by increasing water scarcity and the need to conserve freshwater resources. According to the United Nations, water scarcity affects over 40% of the global population, and this figure is expected to rise. Implementing water reuse programs can help address this challenge and ensure sustainable water management.

Growth in Public-Private Partnerships

Growth in public-private partnerships (PPPs) is another significant trend in the water and wastewater treatment equipment market. Governments are increasingly collaborating with private companies to develop and manage water treatment infrastructure. These partnerships help leverage private sector expertise, technology, and funding to improve water and wastewater management. PPPs can accelerate the implementation of advanced treatment solutions and enhance service delivery. The success of such partnerships in improving water infrastructure is encouraging more governments to adopt this model, driving market growth.

Segments Covered in the Report

By Type

o Filtration

o Disinfection

o Adsorption

o Desalination

o Testing

o Others

By Equipment

o Membrane Separation

o Biological

o Disinfection

o Sludge Treatment

o Other Equipment

By Process

o Primary

o Secondary

o Tertiary

By Application

o Municipal

o Industrial

o Other Applications

Segment Analysis

By Type Analysis

Filtration dominated the market in 2023, accounting for more than 33.9% of the share. This part, which is essential for purifying water, makes use of several techniques, including membrane technologies, activated carbon, and sand filters. Because filtration techniques are so versatile in cleaning wastewater as well as drinking water, they have become widely used in environmental protection and clean water supply assurance.

The next important step was disinfection, which is essential for guaranteeing water safety by getting rid of dangerous bacteria. There has been widespread use of technologies including ozonation, ultraviolet (UV) radiation, and chlorination. This segment's contribution to the prevention of waterborne illnesses, serving both industrial and municipal water supplies, highlights its significance. The goal of ongoing disinfection method development is to decrease chemical use and byproducts while increasing efficiency.

Adsorption has become a noteworthy technology in the market. This method, which involves removing contaminants from solid surfaces by physical or chemical attraction, works particularly well for heavy metals and organic chemicals. In this market, activated carbon is widely used because of its efficiency in treating industrial effluents and contaminating drinking water. Adsorption technologies' versatility and effectiveness attest to their continued importance in the treatment of water.

Desalination, which turns salt water into fresh water, was a vital step in the answer to the world's water crisis. Desalination, using techniques like distillation and reverse osmosis, has become essential in areas with insufficient freshwater resources. Technological developments aiming at lowering energy usage and environmental effects are driving the segment's growth, indicating it as a critical area for future investment.

Testing apparatus was crucial for keeping an eye on water quality and ensuring that health regulations were being followed. This section includes a variety of analytical instruments and kits intended for disease, contaminant, and chemical property detection. Growing regulatory regulations and public health concerns are driving the need for precise, quick testing procedures, underscoring the segment's significance in the market as a whole.

By Equipment Analysis

Membrane Separation had a commanding market share of more than 42.7% in 2023. This technology is essential for removing dangerous particles from water, owing to its efficacy and efficiency, it has been widely adopted. It is essential to today's water treatment operations because of its wide variety of applications, which include the filtration of drinking water and the treatment of industrial effluent. The requirement for high-quality water and the escalating environmental laws are likely to fuel an increase in the demand for membrane separation technologies.

Biological treatment techniques become the second-largest category after Membrane Separation. These methods, which used living things to degrade pollutants, made up a sizable chunk of the market. Biological treatments are popular because they are environmentally benign, sustainable, and require few chemicals—a trend that is in line with worldwide environmental movements. Their use in the treatment of wastewater from cities and businesses highlights their adaptability and increasing significance.

Technologies for disinfection were also very important to the business. This section protects public health and safety by removing germs from water. Installing disinfection techniques including ozonation, UV radiation, and chlorination is essential for drinking water and wastewater treatment plants. These technologies are developing and becoming more eco-friendly as a result of continuous developments.

Technologies for sludge treatment, which deal with the waste products from water treatment, were essential to the market. Sludge management is a significant task, with approaches concentrating on resource recovery, stability, and volume reduction. This category of innovations highlights a move toward the circular economy principles by looking at ways to turn garbage into energy or valuable resources in addition to reducing environmental impact.

By Process Analysis

Primary treatment accounted for almost 48.8% of the market in 2023, indicating its leading position. This first stage of the water treatment process is essential because it concentrates on employing sedimentation and flotation to remove particles and organic materials from wastewater. Its significant market share attests to the importance of this stage in getting water ready for additional purification.

The need for effective primary treatment options keeps rising as environmental laws become more stringent and wastewater volume rises. The segment's contribution to lowering the burden on later treatment phases and improving system efficiency makes it even more significant.

Another crucial step in the water treatment process is secondary treatment, which uses biological processes to further remove organic waste and contaminants. This step is crucial for reaching the levels of water purity mandated by regulatory requirements because it uses microorganisms to break down organic materials.

Secondary treatment is important because it can make a big difference in the quality of the water before it is released back into the environment or goes through any further purification processes. The demand for solutions that can successfully combine performance, cost, and environmental impact is what motivates investments in this market.

Even though it has a smaller market share, tertiary treatment is essential for purifying water, particularly in situations where high-quality effluent is required. This sophisticated treatment method removes certain impurities, such as nutrients, and filters and disinfects the water. Stricter environmental restrictions and rising demands for water recycling and reuse are to blame for the growing significance of tertiary treatment.

This segment's technologies are critical for applications including irrigation, replenishing water bodies, and industrial reuse since they aim to achieve the greatest possible levels of water quality. The dedication to sustainable water management and the preservation of water resources for future generations is emphasized by the investment in tertiary treatment technology.

By Application Analysis

Municipal applications commanded a commanding market share of almost 69.1% in 2023. This industry, which includes municipal water treatment facilities, is essential to maintaining environmental sustainability and public health.

The substantial infrastructure needed to supply clean water and treat wastewater in urban areas is reflected in the high percentage. The need to replace outdated infrastructure, regulatory demands, and growing populations are the main drivers of investments in extending and modernizing municipal treatment systems. This sector focuses on technology that can effectively handle vast amounts of water while adhering to strict quality requirements.

Even though it is smaller, the industrial segment is nevertheless important since it serves the unique requirements of many different industries, including manufacturing, medicines, power generation, and more. The need for specialized treatment solutions to handle a variety of contaminants, such as heavy metals, chemicals, and organic waste, is what defines industrial applications.

The simultaneous requirements of ensuring regulatory compliance and minimizing environmental damage highlight the significance of this area. Sustainable practices, resource recovery, and operational efficiency are some of the causes driving industrial sector investments in water and wastewater treatment. For enterprises looking to minimize discharge volumes and reuse water, adopting innovative treatment technology in this area is essential to complying with global sustainability goals.

Regional Analysis

With a commanding market share of 37.9%, the Asia Pacific area is a prominent force in the global market for water and wastewater treatment equipment. The increasing need for cutting-edge water treatment solutions across a range of industries, including municipal and industrial uses, is responsible for this noteworthy increase. The region's market expansion is greatly aided by the rise in industrial activity and urbanization, especially in nations like China, Japan, India, Australia, South Korea, and New Zealand.

The market for water and wastewater treatment equipment is expanding significantly in North America as a result of both the growing demand for sustainable water management solutions and economic developments. The market is being driven ahead in large part by consumer shifts toward ecologically friendly activities, particularly in the United States and Canada.

The market for water and wastewater treatment equipment is expanding rapidly in Europe, mostly due to the rising need for effective water treatment solutions in a variety of industries, such as industrial operations and municipal services. Europe's dedication to improving water quality and encouraging sustainable water usage practices places it in a key position in the global market environment.

Competitive Analysis

Water and wastewater treatment equipment manufacturers use a variety of strategies, including joint ventures, mergers, acquisitions, new product development, and geographic expansions, to meet the evolving technological demand for equipment from a variety of applications and increase their market penetration.

Recent Developments

November 2022: Under the terms of their agreement, WABAG LIMITED and the Asian Development Bank ('ADB') would issue unlisted, non-convertible debt instruments with tenors of five years and three months to generate INR 200 crores, or roughly USD 24.6 million. ADB will subscribe to it for a period of 12 months for its water treatment operations.

August 2022: An Israeli company named Huliot Pipes launched ClearBlack Sewage Treatment Plant especially for the Indian market to recycle and reuse wastewater.

Key Market Players in the Water and Wastewater Treatment Equipment Market

o Aquatech International LLC

o Ecologix Environmental Systems LLC

o DuPont

o Evoqua Water Technologies LLC

o Evonik Industries AG

o Koch Membrane Systems Inc

o General Electric

o Lenntech B.V.

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 65.1 Billion |

|

Market Size 2033 |

USD 105.6 Billion |

|

Compound Annual Growth Rate (CAGR) |

4.9% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

- |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Type, Equipment, Process, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Ecolab Inc., Calgon Carbon Corporation, Aquatech International LLC, Ecologix Environmental Systems LLC, DuPont, Evoqua Water Technologies LLC, Evonik Industries AG, Koch Membrane Systems Inc, General Electric, Lenntech B.V., Other Key Players |

|

Key Market Opportunities |

Growing Demand for Clean Water |

📘 Frequently Asked Questions

1. How much is the Water and Wastewater Treatment Equipment Market in 2023?

Answer: The Water and Wastewater Treatment Equipment Market size was valued at USD 65.1 Billion in 2023.

2. What would be the forecast period in the Water and Wastewater Treatment Equipment Market report?

Answer: The forecast period in the Water and Wastewater Treatment Equipment Market report is 2023-2033.

3. Who are the key players in the Water and Wastewater Treatment Equipment Market?

Answer: Ecolab Inc., Calgon Carbon Corporation, Aquatech International LLC, Ecologix Environmental Systems LLC, DuPont, Evoqua Water Technologies LLC, Evonik Industries AG, Koch Membrane Systems Inc, General Electric, Lenntech B.V., Other Key Players

4. What is the growth rate of the Water and Wastewater Treatment Equipment Market?

Answer: Water and Wastewater Treatment Equipment Market is growing at a CAGR of 4.9% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.