🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Web3 Market

Web3 Market By Type (Private, Public, Hybrid, Consortium), By Application (Conversational AI, Data & Transaction Storage, Cryptocurrency, Smart Contracts, Payments, Others), By End-Use (Retail & E-commerce, IT & Telecom, Pharmaceuticals, BFSI, Media & Entertainment, Others), By Region and Companies)

Jun 2024

Information and Communication Technology

Pages: 110

ID: IMR1081

Web3 Market Overview

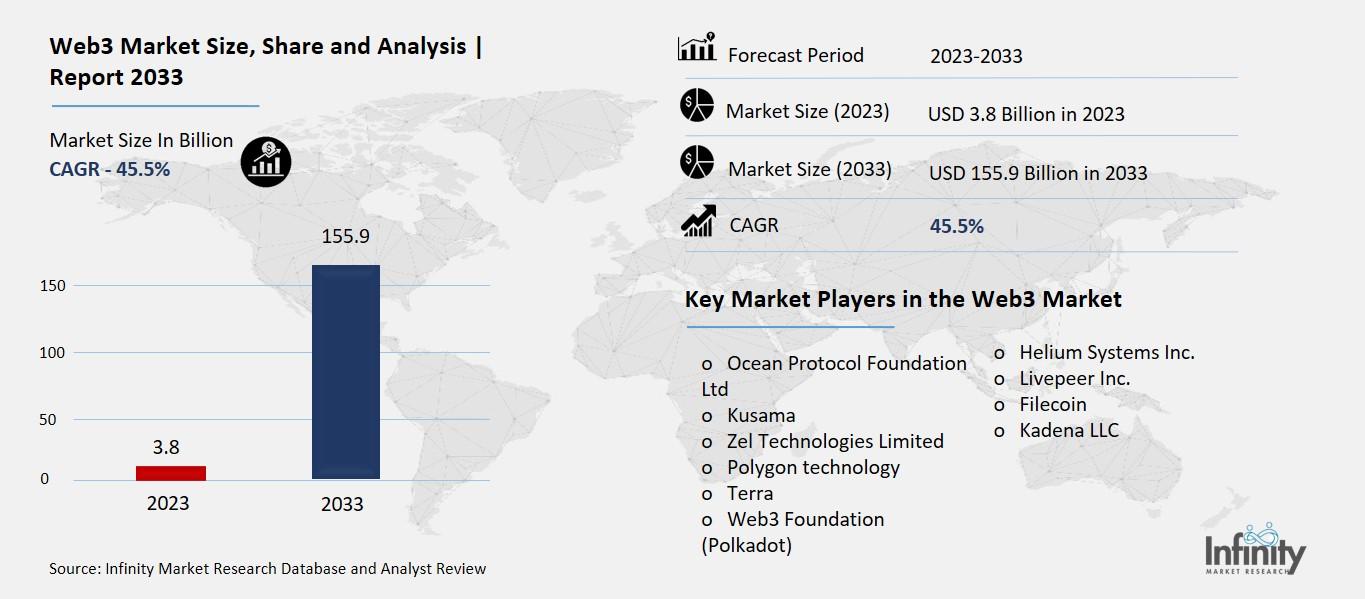

Global Web3 Market size is expected to be worth around USD 155.9 Billion by 2033 from USD 3.8 Billion in 2023, growing at a CAGR of 45.5% during the forecast period from 2023 to 2033.

Web3 refers to the third generation of the internet, aiming to decentralize how online services and applications work. Unlike Web 2.0, where companies like Facebook and Google collect and control our data, Web3 focuses on giving users more control over their information. It uses blockchain technology, which is like a digital ledger that records transactions securely. This allows people to interact directly without relying on a central authority, like a bank or a big tech company. In Web3, users can own their data and have more privacy, and they can even earn money by participating in networks.

The Web3 market is growing rapidly, with new projects and applications being developed. These include decentralized finance (DeFi), where people can lend, borrow, and trade assets without traditional banks. There are also decentralized social networks that don't collect user data and allow for more open communication. Web3 is not just about technology; it's also a movement towards a fairer and more transparent internet, where users have more say in how things are run.

Drivers for the Web3 Market

Blockchain Technology Advancements

Blockchain technology forms the backbone of Web3, enabling secure and transparent transactions without intermediaries. It ensures that data is stored securely across a decentralized network, making it resistant to tampering and ensuring trust between users. Advancements in blockchain, such as faster transaction speeds and lower costs, are driving the adoption of Web3 across various sectors.

Decentralized Finance (DeFi) Expansion

The expansion of DeFi platforms is a significant driver of the Web3 market. DeFi allows users to lend, borrow, and trade assets directly without relying on traditional financial intermediaries like banks. This decentralization enables faster transactions, lower fees, and greater accessibility to financial services globally, attracting both individual users and institutional investors to the Web3 ecosystem.

NFTs and Digital Ownership

Non-fungible tokens (NFTs) are another major driver of the Web3 market. NFTs use blockchain technology to verify ownership and authenticity of digital assets, including art, music, and virtual real estate. This has opened up new avenues for creators to monetize their work and for investors to participate in digital asset markets, driving innovation and growth in the Web3 space.

Privacy and Data Sovereignty

Privacy concerns and the desire for data sovereignty are pushing users towards Web3 solutions. Traditional Web 2.0 platforms often collect and monetize user data without consent, leading to privacy breaches and user distrust. Web3 solutions offer greater control over personal data, allowing users to decide how their information is shared and used, enhancing privacy and trust in digital interactions.

Energy Efficiency and Sustainability

Web3 technologies, such as proof-of-stake (PoS) and other consensus mechanisms, are more energy-efficient compared to traditional proof-of-work (PoW) systems used in Web 2.0. This focus on sustainability is attracting environmentally conscious users and businesses to Web3 platforms, reducing carbon footprints, and contributing to a more sustainable digital economy.

Regulatory Clarity and Institutional Adoption

Increasing regulatory clarity around cryptocurrencies and blockchain technologies is driving institutional adoption of Web3 solutions. Clear regulations provide legal certainty for businesses and investors, encouraging them to explore and invest in Web3 technologies. This institutional support and investment are crucial for the mainstream adoption and growth of the Web3 market.

Restraints for the Web3 Market

Regulatory Uncertainty and Compliance Challenges

The Web3 market faces significant challenges related to regulatory uncertainty and compliance. Governments around the world are still grappling with how to regulate cryptocurrencies, blockchain technology, and decentralized applications. This lack of clear regulations creates uncertainty for businesses and investors, potentially hindering the growth and adoption of Web3 solutions. Compliance with existing financial laws and regulations also poses challenges, as decentralized platforms may struggle to meet the same regulatory standards as traditional financial institutions.

Scalability Issues

Scalability remains a key restraint for the Web3 market. Blockchain networks, such as Ethereum, face limitations in terms of transaction speed and throughput. As the number of users and transactions on these networks grows, congestion and high fees can become significant issues. Solving scalability challenges is crucial for mainstream adoption of Web3 applications, as users expect fast and cost-effective transactions comparable to traditional centralized platforms.

User Experience and Accessibility

User experience (UX) and accessibility are barriers to the broader adoption of Web3 applications. Many decentralized platforms are still complex and difficult for non-technical users to navigate. Tasks such as managing private keys, interacting with smart contracts, and understanding blockchain transactions can be daunting for new users. Improving UX and making Web3 applications more intuitive and user-friendly will be essential to attract and retain a broader user base.

Environmental Concerns

Despite efforts to improve energy efficiency, environmental concerns related to blockchain technology persist. Proof-of-work (PoW) consensus mechanisms, used by some blockchain networks, consume significant amounts of energy and contribute to carbon emissions. As the Web3 market grows, addressing these environmental impacts will be crucial to mitigate criticism and ensure sustainable growth. Transitioning to more energy-efficient consensus mechanisms, such as proof-of-stake (PoS), is one approach to reducing the environmental footprint of Web3 platforms.

Interoperability and Standardization

Interoperability and standardization are challenges within the Web3 ecosystem. Different blockchain networks and decentralized applications often operate in silos, making it difficult for them to communicate and share data. Lack of interoperability limits the potential for collaboration and innovation across the Web3 space. Establishing common standards and protocols could facilitate interoperability, enabling seamless interaction between different Web3 platforms and applications.

Opportunity in the Web3 Market

Growing Demand for Decentralized Finance (DeFi)

The growing demand for decentralized finance (DeFi) presents a significant opportunity for the Web3 market. DeFi platforms enable users to access financial services such as lending, borrowing, and trading directly, without intermediaries like banks. This decentralized approach offers advantages such as lower fees, faster transactions, and greater accessibility, particularly for underserved populations. The global DeFi market has been expanding rapidly, with the total value locked (TVL) in DeFi protocols reaching billions of dollars. This growth is expected to continue as more users and institutional investors recognize the benefits of decentralized financial solutions.

Rise of Non-Fungible Tokens (NFTs)

The rise of non-fungible tokens (NFTs) presents a unique opportunity within the Web3 market. NFTs use blockchain technology to create digital scarcity and verify ownership of digital assets, including art, music, and virtual real estate. This has revolutionized the way creators monetize their work and engage with their audiences. The NFT market has witnessed exponential growth, with high-profile sales and collaborations driving mainstream adoption. The versatility of NFTs extends beyond art and entertainment, offering opportunities in gaming, real estate, and intellectual property rights.

Increased Privacy and Data Sovereignty Concerns

Increased concerns over privacy and data sovereignty present an opportunity for Web3 solutions. Traditional Web 2.0 platforms often collect and monetize user data without consent, leading to privacy breaches and user distrust. Web3 technologies, such as blockchain-based identity solutions and decentralized storage networks, offer users greater control over their data. This shift towards more transparent and privacy-centric digital interactions is driving demand for Web3 applications that prioritize data security and user sovereignty.

Innovation in Tokenization and Digital Assets

Innovation in tokenization and digital assets is another opportunity for the Web3 market. Blockchain technology enables the fractional ownership and trading of assets that were traditionally illiquid, such as real estate and fine art. This democratization of asset ownership opens up new investment opportunities and reduces barriers to entry for retail investors. The tokenization of assets also facilitates easier cross-border transactions and enhances liquidity in traditionally illiquid markets.

Emerging Blockchain Use Cases in Supply Chain and IoT

Emerging blockchain use cases in supply chain management and the Internet of Things (IoT) present opportunities for the Web3 market. Blockchain technology can provide transparency, traceability, and efficiency in supply chain operations, reducing costs and mitigating risks such as counterfeiting and fraud. In IoT, blockchain enables secure data sharing and automated transactions between connected devices, enhancing interoperability and reliability. These applications are driving adoption across industries, from logistics and manufacturing to healthcare and agriculture.

Trends for the Web3 Market

Rise of Decentralized Finance (DeFi) Platforms

The rise of decentralized finance (DeFi) platforms is a prominent trend in the Web3 market. DeFi platforms allow users to access financial services such as lending, borrowing, and trading directly without intermediaries. This trend is driven by the advantages of decentralized systems, including lower fees, faster transactions, and increased transparency. The DeFi sector has seen significant growth, with the total value locked (TVL) in DeFi protocols surpassing billions of dollars. Innovations within DeFi, such as yield farming, decentralized exchanges (DEXs), and synthetic assets, continue to attract both individual users and institutional investors.

Non-fungible tokens (NFTs) and Digital Collectibles

Non-fungible tokens (NFTs) have emerged as a major trend within the Web3 market, transforming the way digital content is bought, sold, and traded. NFTs use blockchain technology to create unique, verifiable digital assets, including art, music, videos, and virtual real estate. This trend has gained mainstream attention due to high-profile NFT sales and collaborations across various industries. NFTs offer creators new revenue streams and provide collectors with verifiable ownership of digital assets, driving innovation and adoption in the digital collectibles market.

Blockchain Gaming and Virtual Worlds

Blockchain gaming and virtual worlds are experiencing growth within the Web3 market. Blockchain technology enables the ownership and trade of in-game assets and virtual real estate using NFTs. Players can earn tokens and rewards that hold real-world value, fostering a new economy within gaming ecosystems. Virtual worlds powered by blockchain offer users ownership and control over digital spaces, promoting social interactions, creativity, and economic opportunities. This trend is expanding the gaming industry beyond entertainment to include economic incentives and community-driven experiences.

Decentralized Identity and Privacy Solutions

Decentralized identity and privacy solutions are gaining traction as essential trends in the Web3 market. Traditional Web 2.0 platforms often collect and monetize user data without consent, raising privacy concerns. Web3 technologies, such as decentralized identity management systems and privacy-focused blockchain networks, offer users greater control over their personal information. These solutions enable secure and anonymous transactions, protect user privacy, and build trust in digital interactions. The demand for decentralized identity solutions is driven by the need for data sovereignty and increased transparency.

Environmental Sustainability and Energy-Efficient Blockchains

Environmental sustainability is becoming a significant trend in the Web3 market, influencing the adoption of energy-efficient blockchain solutions. Traditional proof-of-work (PoW) consensus mechanisms consume large amounts of energy, contributing to carbon emissions. Web3 projects are transitioning to proof-of-stake (PoS) and other energy-efficient consensus algorithms to reduce environmental impact. Sustainable blockchain solutions are attracting environmentally conscious users and businesses, promoting a greener digital economy.

Segments Covered in the Report

By Type

-

Private

-

Public

-

Hybrid

-

Consortium

By Application

- Conversational AI

- Data & Transaction Storage

- Cryptocurrency

- Smart Contracts

- Payments

- Others

By End-Use

- Retail & E-commerce

- IT & Telecom

- Pharmaceuticals

- BFSI

- Media & Entertainment

Segment Analysis

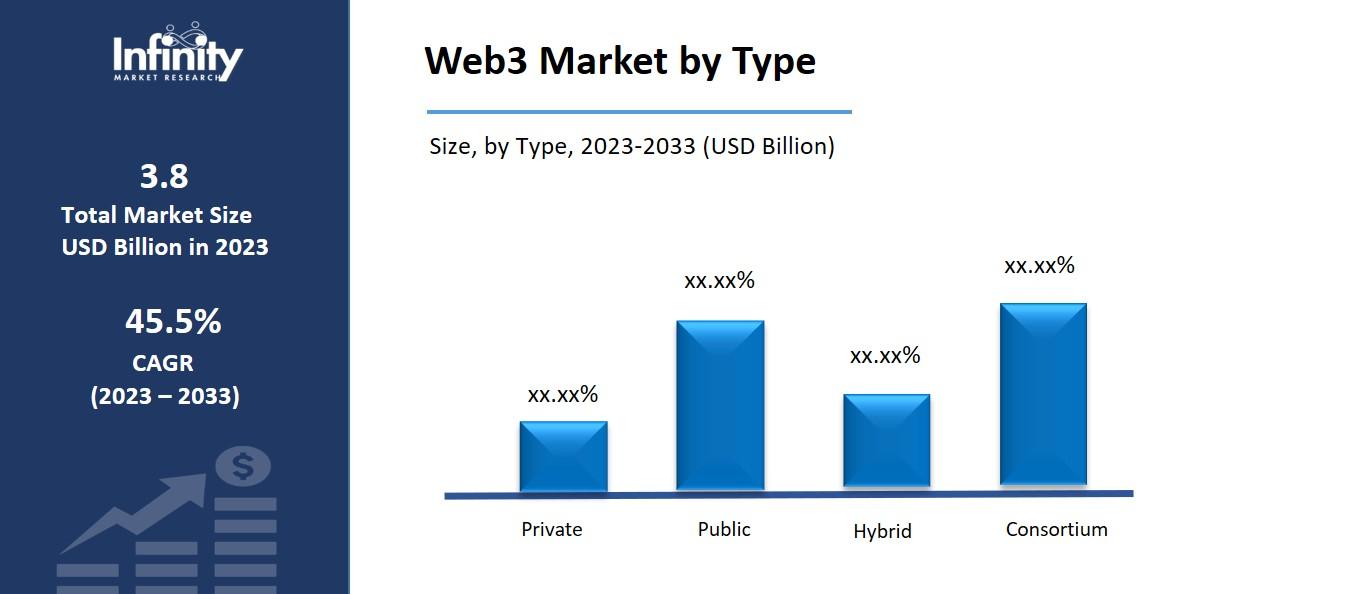

By Type

In 2023, the public sector held a dominant market share of 54.8% of global revenue. One of the main factors propelling the expansion of this market is the public blockchain networks' capacity to grant consumers unlimited access to the network wherever they are in the world. Anyone can join a public blockchain network, read, publish, and interact with the blockchain from anywhere in the globe. Public blockchain also provides more distribution, complete transparency, an open environment, high security, and decentralization.

Throughout the projected period, it is expected that the hybrid category will experience significant expansion. One major aspect propelling the hybrid segment's rise is its capacity to provide both permission-based and permissionless systems. A hybrid blockchain combines public and private ledgers, with some parts managed by the business and others made publicly accessible through the blockchain. A hybrid blockchain additionally gives users the option to access data via smart contracts.

By Application Analysis

In 2023, the market was dominated by the cryptocurrency category. Automation and digitalization are two examples of the rapid advances in technical innovation that have increased demand for high-performance cryptocurrency transaction services among businesses. Therefore, several participants worldwide are utilizing blockchain technology solutions in Bitcoin to effectively complete their transactions to meet the demand for high-performance cryptocurrency transactions. It is anticipated that the aforementioned elements will fuel segment expansion.

Throughout the projected period, it is expected that the smart contracts industry will increase significantly. A more transparent and cooperative work environment is made possible by Web 3.0 blockchain technology's immutable, traceable, and secure smart contracts. These built-in characteristics make smart contracts more likely to grow, enabling more companies to reduce expenses and speed up and secure transactions. These aspects are encouraging for the segment's growth.

By End-Use

In 2023, the BFSI sector held the highest revenue share of the market, accounting for 35.8%. The banking and financial industry's growing need for Web 3.0 blockchain because of its scalability, improved transaction speed, and lower processing costs is a key driver of the market's expansion. Furthermore, Web 3.0 blockchain transactions remove the requirement for external payment gateways, enabling quicker financial communications. Web 3.0 also makes it possible for insurance businesses to save decentralized data, which helps to stop cybercrimes.

Throughout the projection period, the retail and e-commerce industry is expected to develop at the fastest rate. Web 3.0 has several advantages for the retail and e-commerce sectors. Faster payments, lower expenses, more transparency, and enhanced security are some of these advantages, and they are a major reason for the segment's growth. Distributed ledger technology, another feature of Web 3.0, enables retail businesses to work directly and conveniently with suppliers along the supply chain, such as importers, wholesalers, and retailers.

Regional Analysis

North American regional market dominated with a 38.1% global sales share in 2023. The growing adoption of Web 3.0 across various operating systems, including blockchain-based systems, is one of the main factors propelling the regional market's expansion. Simultaneously, regional growth is being accentuated by the existence of significant blockchain solution providers like Web3 Foundation and Helium Systems Inc. in the area.

Asia Pacific market is anticipated to develop at the fastest rate. The primary driver of the Asia Pacific region's growth is the banking and financial industry's quick embrace of Web 3.0-based digitization. One of the main drivers of the blockchain business in the area is the expansion of the retail and e-commerce sectors at the same time. The aforementioned elements are encouraging the expansion of Web 3.0 blockchain technology in the Asia Pacific area.

Competitive Analysis

A few of the major companies in the market are Helium Systems Inc., Web3 Foundation (Polkadot), and Filecoin. Developed as a blockchain-based cooperative digital storage solution, Filecoin is an open-source cloud storage, digital payment, and cryptocurrency platform. A decentralized network of hotspots for wireless infrastructure is provided by Helium Systems, Inc.; it provides bandwidth and gathers data from neighboring Internet-of-things devices.

Recent Developments

November 2023: Amazon Web Services, Animoca Brands, and Polygon Labs agreed to an agreement to enable Web 3.0 developers and speed up the development of Web 3.0 goods and services. As part of their partnership, the firms unveiled the MoonRealm Express Accelerator program, which enables developers worldwide to expedite the advancement of cutting-edge fields like decentralized identification, GameFi, and SocialFi while also inspiring developers to create fresh concepts and solutions for Mocaverse.

September 2023: Coinbase Global Inc. To support Web3 and Blockchain technology, Coinbase Global, Inc., a well-known cryptocurrency exchange, partnered with Truflation, a source of economic data. The goal of this collaboration is to provide the real-time inflation data needed to grow the Web3 and blockchain ecosystems.

Key Market Players in the Web3 Market

-

Ocean Protocol Foundation Ltd

-

Kusama

-

Zel Technologies Limited

-

Polygon technology

-

Terra

-

Web3 Foundation (Polkadot)

-

Helium Systems Inc.

-

Livepeer Inc.

-

Filecoin

- Kadena LLC

|

Report Features |

Description |

|

Market Size 2023 |

USD 3.8 Billion |

|

Market Size 2033 |

USD 155.9 Billion |

|

Compound Annual Growth Rate (CAGR) |

45.5% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

- |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

Type, Service, End-Use Industry, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Ocean Protocol Foundation Ltd, Kusama, Zel Technologies Limited, Polygon technology, Terra, Web3 Foundation (Polkadot), Helium Systems Inc, Livepeer Inc, Filecoin, Kadena LLC |

|

Key Market Opportunities |

Growing Demand for Decentralized Finance (DeFi) |

|

Key Market Dynamics |

Blockchain Technology Advancements |

📘 Frequently Asked Questions

1. How much is the Web3 Market in 2023?

Answer: The EdTech Market size was valued at USD 155.9 Billion in 2023.

2. What would be the forecast period in the Web3 Market report?

Answer: The forecast period in the Web3 Market report is 2023-2033.

3. Who are the key players in the Web3 Market?

Answer: Ocean Protocol Foundation Ltd, Kusama, Zel Technologies Limited, Polygon technology, Terra, Web3 Foundation (Polkadot), Helium Systems Inc, Livepeer Inc, Filecoin, Kadena LLC

4. What is the growth rate of the Web3 Market?

Answer: Web3 Market is growing at a CAGR of 45.5% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.