🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Aerospace Cold Forgings Market

Global Aerospace Cold Forgings Market (By Process Type, Precision Forging, Multi-Stroke Forging, Single Stroke Forging, and Cold Heading; By Material Type, Nickel Alloys, Aluminum Alloys, Steel Alloys, and Titanium Alloys; By Application, Engine Components, Airframe Components, Landing Gear Components, Fasteners, and Other Components; By End-Use, General Aviation, Commercial Aviation, and Military Aviation; By Region and Companies), 2024-2033

Jan 2025

Aerospace and Defense

Pages: 138

ID: IMR1398

Aerospace Cold Forgings Market Overview

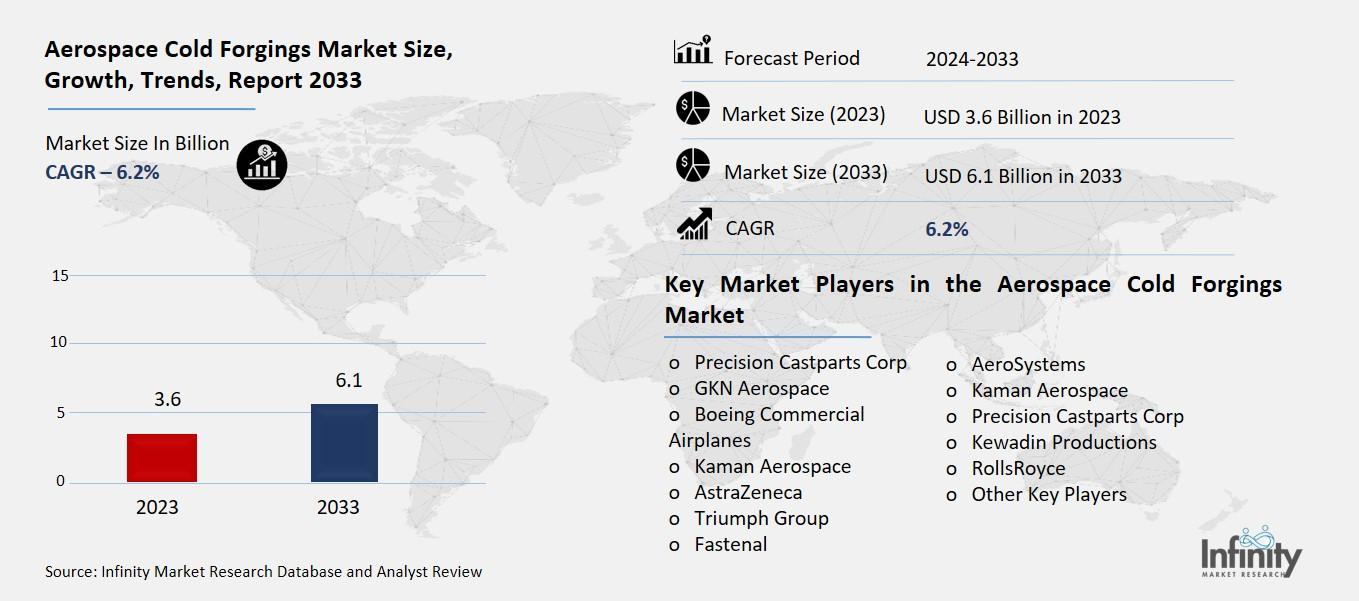

Global Aerospace Cold Forgings Market acquired the significant revenue of 3.6 Billion in 2023 and expected to be worth around USD 6.1 Billion by 2033 with the CAGR of 6.2% during the forecast period of 2024 to 2033. Aerospace cold forgings market means the market of aerospace products and components relation to cold forging processes. Cold forming, also known as cold working, is shaping of material at ambient temperatures, can provide greater strength and accuracy than turning, for example. This process is especially helpful in aerospace manufacturing because here the requirements include lightweight, high strength and high durability for items including; engine, landing gear, fasteners and structural sections.

The drivers are flouting demand for better fuel efficient and performance aircraft, new material technology, and the rising pressure to cut down manufacturing costs. Cold forging gives the following advantages: enhanced mechanical properties, lesser waste, and therefore is ideal for the manufacturing of intricate parts that may be used in aerospace applications.

Drivers for the Aerospace Cold Forgings Market

Fuel Efficiency and Performance Requirements

Cold-forged parts are crucial to the construction of fuel-efficient, high-performance aircraft because of higher strength to weight ratio. Cold forging process involves the formation of fade parts from metal at room temperature, which increases its mechanical properties of the component so that the forged parts can easily outperform other components, which have been produced by other manufacturing techniques. It also added an increased strength that enables aircraft manufacturers to apply lighter materials still with the required stiffness.

Components of lesser mass mean a lighter plane, and for this reason, they use less fuel to move around in the air. Furthermore, it is easier to achieve the required accuracy and reproducibility through cold forging to classify these components as ideal for aerospace applications; they have high fatigue limit and perform optimally under harsh conditions.

Restraints for the Aerospace Cold Forgings Market

Limited Availability of Skilled Workforce

Cold forging is a highly specialized manufacturing process that requires skilled operators to ensure the quality, accuracy, and precision of the final components. The process involves intricate control of variables such as temperature, pressure, and material flow, which can significantly impact the mechanical properties and dimensions of the parts. Skilled operators are essential to monitor these factors and make real-time adjustments to prevent defects or inconsistencies. A shortage of trained professionals with expertise in cold forging can pose a significant challenge to the growth of the market. Without a sufficient workforce of skilled technicians, manufacturers may struggle to meet the increasing demand for high-quality aerospace components, potentially affecting production timelines, increasing costs, and reducing the overall efficiency of the manufacturing process.

Opportunity in the Aerospace Cold Forgings Market

Rising Demand for Lightweight Aircraft Components

As the aviation industry increasingly focuses on fuel efficiency and reducing environmental impact, the demand for lightweight aircraft has surged. Cold-forged components present a significant opportunity to meet these demands due to their unique combination of strength and low weight. The cold forging process enhances the mechanical properties of metals, making them stronger and more durable without adding unnecessary weight. This is crucial in the aerospace sector, where even small reductions in weight can lead to substantial improvements in fuel efficiency.

By using cold-forged components, manufacturers can produce high-performance parts that maintain structural integrity while minimizing weight. This not only contributes to the overall fuel efficiency of the aircraft but also aligns with the growing push for sustainability in the aviation industry. As airlines and aircraft manufacturers continue to prioritize environmental performance, the adoption of cold-forged components is expected to expand, offering a key solution to the industry's evolving needs.

Trends for the Aerospace Cold Forgings Market

Increased Adoption of Automation and AI

The integration of automation and artificial intelligence (AI) in cold forging processes is revolutionizing the manufacturing of aerospace components by significantly enhancing efficiency, precision, and reducing human error. Automation streamlines the production process by controlling and regulating key variables such as temperature, pressure, and material flow in real time. This results in more consistent and accurate outputs, reducing the likelihood of defects and material waste.

AI, on the other hand, plays a crucial role in optimizing the cold forging process by analyzing vast amounts of data to predict and adjust for potential issues before they arise. This predictive capability helps improve the overall quality of parts while minimizing downtime and maintenance costs. By automating repetitive tasks and employing AI-driven decision-making, manufacturers can achieve faster production cycles, increase throughput, and ensure that each component meets the rigorous quality standards required in the aerospace industry.

Segments Covered in the Report

By Process Type

o Precision Forging

o Multi-Stroke Forging

o Single Stroke Forging

o Cold Heading

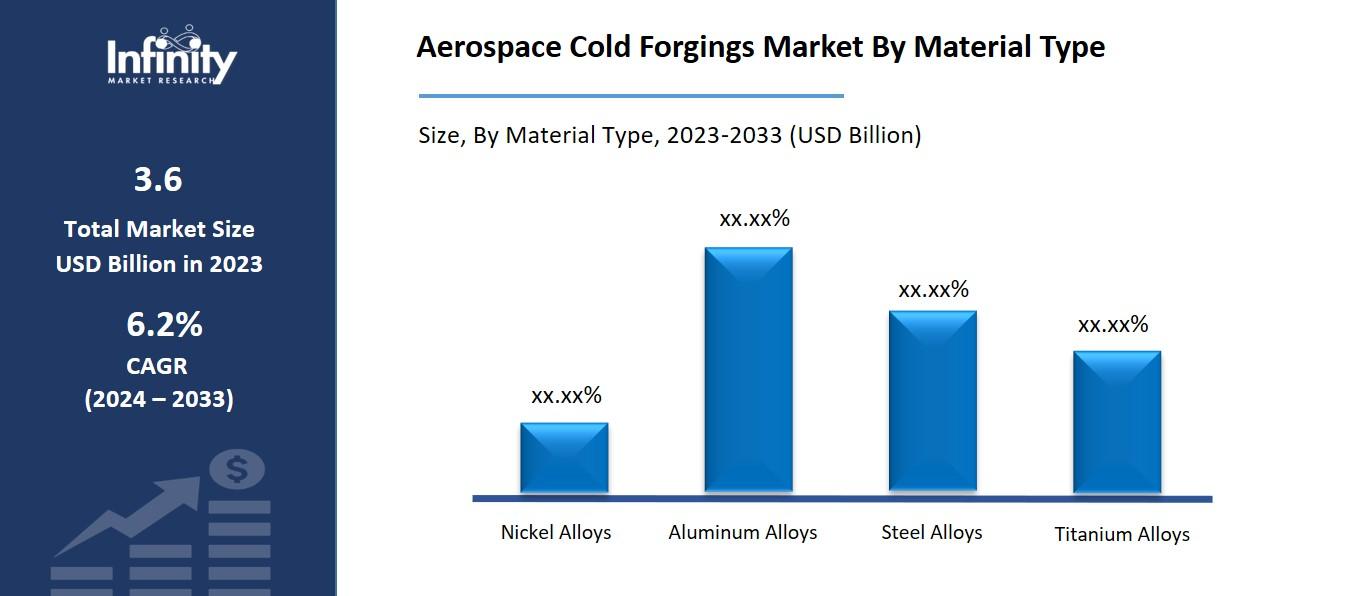

By Material Type

o Aluminum Alloys

o Steel Alloys

o Titanium Alloys

By Application

o Engine Components

o Airframe Components

o Landing Gear Components

o Fasteners

o Other Components

By End-Use

o General Aviation

o Commercial Aviation

o Military Aviation

Segment Analysis

By Process Type Analysis

On the basis of process type, the market is divided into precision forging, multi-stroke forging, single stroke forging, and cold heading. Among these, precision forging segment acquired the significant share in the market owing to its ability to produce high-precision, complex parts that meet the stringent requirements of the aerospace industry. Precision forging involves using advanced die designs and precise control over the material flow, pressure, and temperature to produce components with tight tolerances and superior mechanical properties. This makes it ideal for manufacturing critical aerospace components, such as engine parts, structural elements, and landing gear, which require high strength, durability, and reliability.

By Material Type Analysis

On the basis of material type, the market is divided into nickel alloys, aluminum alloys, steel alloys, and titanium alloys. Among these, aluminum alloys segment held the prominent share of the market due to their excellent combination of strength, lightweight properties, and cost-effectiveness, making them ideal for aerospace applications. Aluminum alloys are widely used in the manufacturing of various aerospace components, including aircraft structures, wings, and fuselage parts, where weight reduction is critical for improving fuel efficiency and performance. The aerospace industry increasingly prioritizes the use of lightweight materials to meet the demand for more fuel-efficient and environmentally friendly aircraft, which gives aluminum alloys a distinct advantage in this market.

By Application Analysis

On the basis of application, the market is divided into engine components, airframe components, landing gear components, fasteners, and other components. Among these, engine components segment held the significant share of the market. Engine components, such as turbine blades, compressor discs, and other high-performance parts, require exceptional strength, durability, and precision, which cold forging provides. The cold forging process ensures that these components have superior mechanical properties, including high fatigue resistance and the ability to withstand extreme temperatures and pressures, which are essential for the demanding conditions within aircraft engines.

By End-Use Analysis

On the basis of end-use, the market is divided into general aviation, commercial aviation, and military aviation. Among these, commercial aviation segment held the most of the share of the market. Commercial aviation includes the production of components for passenger jets, cargo planes, and other aircraft used by airlines for global transportation. This segment is driven by the continuous growth in air travel, the expansion of airline fleets, and the increasing need for fuel-efficient, high-performance aircraft. As commercial airlines prioritize cost-efficiency and sustainability, there is a strong demand for lightweight, durable, and high-strength components, which cold forging processes can provide. Cold-forged components such as engine parts, airframe structures, and fasteners are essential for ensuring the safety, performance, and fuel efficiency of commercial aircraft.

Regional Analysis

North America Dominated the Market with the Highest Revenue Share

North America held the most of the share of 32.7% of the market due to its well-established aerospace industry, strong demand for advanced manufacturing technologies, and significant investments in both commercial and military aviation sectors. The United States, in particular, is home to some of the largest aerospace manufacturers, including Boeing, Lockheed Martin, and Raytheon, which continuously drive demand for high-quality cold-forged components in both commercial and defense aircraft.

Additionally, North America is at the forefront of technological innovation, with manufacturers adopting advanced cold forging techniques, automation, and artificial intelligence to enhance production efficiency and precision. The region's strong focus on aerospace research and development, combined with the demand for fuel-efficient, high-performance aircraft, further contributes to its dominant position in the market. Moreover, North America's robust infrastructure, skilled workforce, and favorable regulatory environment also support the growth of the aerospace cold forging market, making it a leader in both production and innovation.

Competitive Analysis

The competitive landscape of the global aerospace cold forging market is characterized by the presence of several key players that focus on innovation, technological advancements, and strategic partnerships to maintain their market position. Leading companies in this market include manufacturers such as Arconic, Carpenter Technology, All Metals & Forge Group, and Precision Castparts Corp. These players are heavily investing in research and development to enhance their cold forging capabilities, improve product quality, and meet the increasing demand for lightweight, high-strength components required in modern aerospace applications.

Recent Developments

In May 2023, RTI International announced the opening of a new aerospace cold forging facility in India, aiming to produce high-precision components for the aerospace industry.

Key Market Players in the Aerospace Cold Forgings Market

o Precision Castparts Corp

o Boeing Commercial Airplanes

o Kaman Aerospace

o AstraZeneca

o Triumph Group

o Fastenal

o AeroSystems

o Kaman Aerospace

o Precision Castparts Corp

o Kewadin Productions

o RollsRoyce

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 3.6 Billion |

|

Market Size 2033 |

USD 6.1 Billion |

|

Compound Annual Growth Rate (CAGR) |

6.2% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Process Type, Material Type, Application, End-Use, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Precision Castparts Corp, GKN Aerospace, Boeing Commercial Airplanes, Kaman Aerospace, AstraZeneca, Triumph Group, Fastenal, AeroSystems, Kaman Aerospace, Precision Castparts Corp, Kewadin Productions, RollsRoyce, and Other Key Players. |

|

Key Market Opportunities |

Rising Demand for Lightweight Aircraft Components |

|

Key Market Dynamics |

Fuel Efficiency and Performance Requirements |

📘 Frequently Asked Questions

1. Who are the key players in the Aerospace Cold Forgings Market?

Answer: Precision Castparts Corp, GKN Aerospace, Boeing Commercial Airplanes, Kaman Aerospace, AstraZeneca, Triumph Group, Fastenal, AeroSystems, Kaman Aerospace, Precision Castparts Corp, Kewadin Productions, RollsRoyce, and Other Key Players.

2. How much is the Aerospace Cold Forgings Market in 2023?

Answer: The Aerospace Cold Forgings Market size was valued at USD 3.6 Billion in 2023.

3. What would be the forecast period in the Aerospace Cold Forgings Market?

Answer: The forecast period in the Aerospace Cold Forgings Market report is 2024-2033.

4. What is the growth rate of the Aerospace Cold Forgings Market?

Answer: Aerospace Cold Forgings Market is growing at a CAGR of 6.2% during the forecast period, from 2024 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.