🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Aerospace Composites Market

Aerospace Composites Market (Fiber Type (Carbon Fiber Composites, Ceramic Fiber Composites, Glass Fiber Composites, Other Fiber Types) By Aircraft Type (Commercial Aircraft, Business & General Aviation, Civil Helicopter, Military Aircraft, Other Aircraft Types), By Application (Interior and Exterior), By Region and Companies)

Jun 2024

Chemicals and Materials

Pages: 190

ID: IMR1048

Aerospace Composites Market Overview

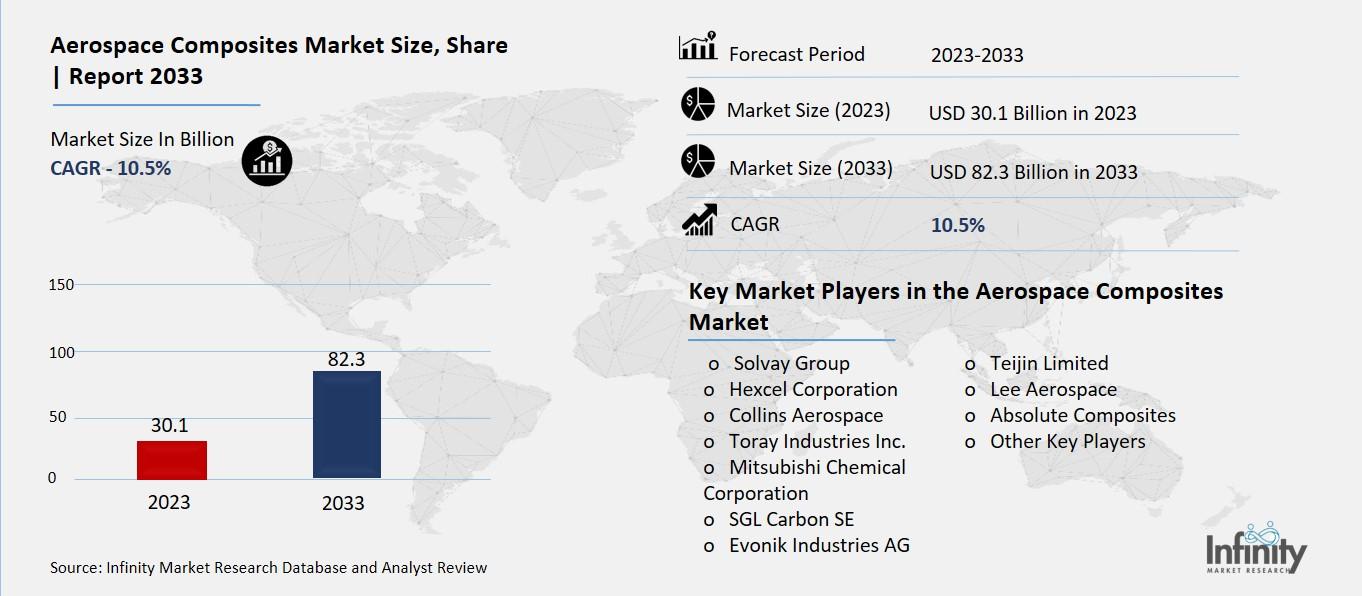

Global Aerospace Composites Market size is expected to be worth around USD 82.3 Billion by 2033 from USD 30.1 Billion in 2023, growing at a CAGR of 10.5% during the forecast period from 2023 to 2033.

The use of composites has become more common in various aircraft components and structural applications owing to their properties, including resistance to temperature and chemicals, high stiffness, lightweight, dimensional stability, and flex performance. Several factors propel the aerospace composites business, including lower maintenance, fewer parts, longer design life, and lower tooling and assembly costs.

Before the pandemic, over the last ten years, there has been a notable surge in demand for new-generation aircraft purchases owing to the huge increase in passenger traffic and the implementation of stricter emission laws. Newer, lightweight engines that perform better are needed as aircraft makers create new models for the general aviation, military, and commercial aviation markets. The focus on more recent material technologies, such as composites, is increasing as a result.

Drivers for the Aerospace Composites Market

Need for Lightweight Materials

One major driver is the increasing need for lightweight materials in the aerospace industry. Aircraft manufacturers are seeking ways to make planes lighter to improve fuel efficiency and reduce operating costs. Recent data indicates that aerospace composites offer the perfect solution, providing strength without the extra weight. This is crucial for meeting the demand for fuel-efficient aircraft, especially with environmental regulations becoming stricter and fuel prices soaring. Aerospace companies are turning to composites to replace traditional materials like metals, leading to a surge in demand for these advanced materials in the aerospace sector.

Technological Innovation

Another major driver of growth in the Aerospace Composites Market is the relentless pace of technological innovation. Manufacturers are constantly pushing the boundaries of composite materials, introducing new products with enhanced mechanical properties, durability, and resistance to extreme conditions. Recent data suggests that advancements in manufacturing techniques, such as automated lay-up processes and resin infusion methods, are revolutionizing the production of aerospace composites. These innovations allow for the creation of intricate composite structures with greater precision and efficiency, further driving adoption across various aerospace applications, from aircraft components to interior fittings.

Booming Commercial Air Travel

Furthermore, the booming commercial air travel industry is fueling the demand for aerospace composites. With air passenger traffic on the rise, airlines are expanding their fleets and modernizing their aircraft to meet growing demand. Recent data shows that emerging economies, in particular, are experiencing a surge in air travel demand, driven by rising incomes and changing lifestyles. To keep up with this demand, airlines are turning to lightweight composites to improve fuel efficiency, reduce maintenance costs, and enhance passenger comfort. Moreover, with increasing concerns about sustainability and environmental impact, aerospace composites offer a greener alternative to traditional materials, further driving their adoption in the aviation industry.

Government Regulations and Initiatives

Additionally, government regulations and initiatives are playing a significant role in driving the Aerospace Composites Market forward. Governments worldwide are imposing strict emissions standards and fuel efficiency regulations on the aerospace industry to address environmental concerns and reduce greenhouse gas emissions from aircraft. Recent data indicates that aerospace manufacturers are under pressure to comply with these regulations, leading to increased adoption of lightweight materials like composites. Moreover, government-funded research programs and incentives aimed at advancing composite technologies are further bolstering market growth. Overall, these driving forces are reshaping the Aerospace Composites Market landscape, with technological innovation, sustainability, and regulatory compliance leading the way toward continued expansion in the aerospace sector.

Restraints for the Aerospace Composites Market

Cost Considerations

One of the significant restraints for the Aerospace Composites Market is the high cost associated with composite materials. According to recent industry data, aerospace composites can be considerably more expensive to manufacture than traditional materials like metals. This cost disparity stems from several factors, including the raw material costs, specialized manufacturing processes, and quality control measures required for composite production. As a result, aerospace companies may hesitate to adopt composites, especially for large-scale applications, due to concerns about cost-effectiveness and return on investment. Additionally, the initial investment required to establish composite manufacturing facilities and train personnel further adds to the financial burden, posing a challenge for the widespread adoption of aerospace composites.

Supply Chain Constraints

Another restraint facing the Aerospace Composites Market is the complexity and limitations of the composite supply chain. Market research indicates that aerospace composites require a sophisticated supply chain involving multiple suppliers, raw materials, and manufacturing processes. However, the availability and consistency of composite materials, such as carbon fiber and resin systems, can be variable, leading to supply chain disruptions and delays in production. Moreover, the specialized equipment and expertise required for composite manufacturing may be limited, particularly in emerging markets, further exacerbating supply chain constraints. These challenges can hinder the scalability and reliability of composite production, impacting the ability of aerospace manufacturers to meet demand and fulfill orders promptly.

Certification and Regulatory Compliance

Additionally, certification and regulatory compliance pose significant restraints for the Aerospace Composites Market. Aerospace composites must meet stringent industry standards and regulatory requirements to ensure safety, reliability, and performance in aircraft applications. However, obtaining certifications and approvals for composite materials and components can be a lengthy and complex process, involving rigorous testing, validation, and documentation. Market data reveals that delays in obtaining regulatory approvals can prolong the development and certification timelines for aerospace composite products, leading to increased costs and market uncertainty. Moreover, changes in regulatory frameworks or the introduction of new regulations can impact market dynamics and require additional investments in compliance measures, further adding to the challenges faced by aerospace composite manufacturers.

Technological Limitations

Furthermore, technological limitations present significant restraints for the Aerospace Composites Market. While composites offer numerous advantages, they also come with inherent limitations and challenges. Market research indicates that composite materials may exhibit complex behaviors under certain conditions, such as impact resistance, fatigue properties, and susceptibility to environmental degradation. Addressing these technological limitations requires ongoing research and development efforts to improve composite materials, manufacturing processes, and performance characteristics. However, overcoming these challenges may require significant investments in research, testing, and innovation, posing barriers to entry for smaller companies and startups in the aerospace composites market. Overall, these restraints underscore the complexities and challenges associated with the adoption and implementation of aerospace composites in the aviation industry.

Trends for the Aerospace Composites Market

Increasing Adoption of Carbon Fiber Composites

One of the prominent trends shaping the Aerospace Composites Market is the increasing adoption of carbon fiber composites. Market data indicates that carbon fiber composites offer a superior strength-to-weight ratio compared to traditional materials like metals, making them ideal for aerospace applications. Recent advancements in carbon fiber manufacturing processes have led to cost reductions and improved material properties, driving their widespread adoption in aircraft manufacturing. Aerospace companies are increasingly incorporating carbon fiber composites into aircraft structures, such as fuselages, wings, and empennages, to reduce weight, improve fuel efficiency, and enhance overall performance. This trend is expected to continue as aerospace manufacturers seek to meet the demand for lightweight and fuel-efficient aircraft in response to environmental regulations and rising fuel prices.

Growing Demand for Thermoplastic Composites

Another trend in the Aerospace Composites Market is the growing demand for thermoplastic composites. Market research suggests that thermoplastic composites offer several advantages over traditional thermoset composites, including faster processing times, recyclability, and improved impact resistance. Recent industry data indicates that aerospace manufacturers are increasingly adopting thermoplastic composites for aircraft interior components, such as cabin panels, seat structures, and overhead bins, due to their lightweight, durable, and flame-retardant properties. Moreover, advancements in manufacturing technologies, such as automated tape laying and additive manufacturing, are driving the production of complex thermoplastic composite parts with greater efficiency and precision, further fueling market growth.

Rising Focus on Sustainable Composite Materials

Furthermore, there is a rising focus on sustainable composite materials in the Aerospace Composites Market. Market analysis reveals that aerospace manufacturers and suppliers are increasingly prioritizing sustainability and environmental responsibility in their product development and manufacturing processes. Recent data suggests that bio-based resins, recycled carbon fibers, and natural fiber composites are gaining traction as sustainable alternatives to traditional composite materials. Aerospace accumulator companies are exploring innovative approaches to reduce the environmental impact of composite manufacturing, such as using renewable energy sources, optimizing material usage, and implementing recycling programs. This trend aligns with the industry's broader efforts to reduce carbon emissions, minimize waste generation, and promote circular economy principles, driving the adoption of sustainable composite materials in aerospace applications.

Integration of Additive Manufacturing Technologies

Moreover, the integration of additive manufacturing technologies is emerging as a key trend in the Aerospace Composites Market. Additive manufacturing, also known as 3D printing, enables the rapid prototyping and production of complex composite parts with intricate geometries and customized designs. Market data indicates that aerospace manufacturers are leveraging additive manufacturing technologies to produce lightweight composite structures, tooling, and components for aircraft and spacecraft applications. Recent advancements in additive manufacturing materials, processes, and equipment are expanding the capabilities and scalability of composite production, enabling cost-effective and on-demand manufacturing solutions. This trend is expected to drive innovation and efficiency in the Aerospace security Market, facilitating the development of next-generation aerospace products and systems. Overall, these trends highlight the dynamic and evolving nature of the Aerospace Composites Market, with continuous advancements and innovations shaping the future of aerospace materials and technologies.

Segments Covered in the Report

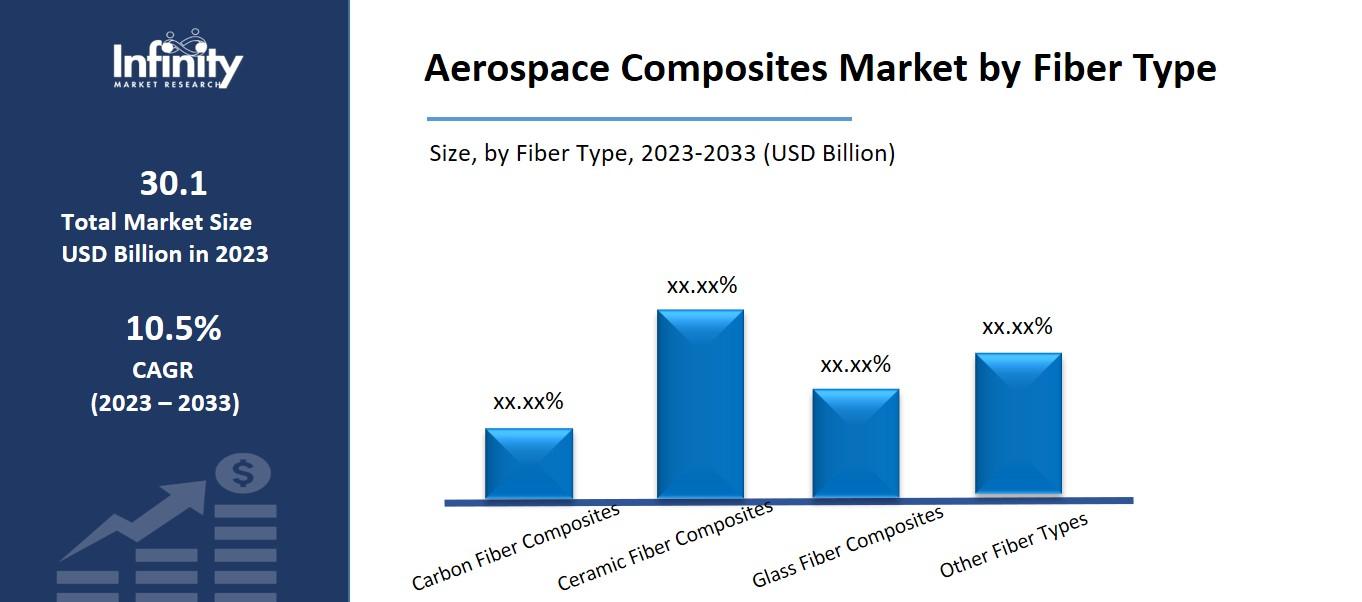

By Fiber Type

o Carbon Fiber Composites

o Ceramic Fiber Composites

o Glass Fiber Composites

o Other Fiber Types

By Aircraft Type

o Commercial Aircraft

o Business & General Aviation

o Civil Helicopter

o Military Aircraft

o Other Aircraft Types

By Application

o Interior

o Exterior

Segment Analysis

By Fiber Type Analysis

The market is divided into four segments based on the type of fiber carbon fiber composites, ceramic fiber composites, glass fiber composites, and others. With more than 35% of the total fiber, the carbon fiber category dominated the aerospace composites industry. Carbon fiber is utilized for space shuttles and airplanes because it is roughly twice as stiff as glass and aramid fibers. Furthermore, because carbon fiber is lightweight, it improves engine performance and uses less fuel because it makes an aircraft lighter. The National Renewable Energy Laboratory (NREL) anticipates that the overall demand for carbon fiber will increase by 10% yearly between 2016 and 2024 to sustain the expansion of the segment based on carbon fiber.

By Aircraft Type Analysis

Based on the aircraft type this market is divided into four categories: commercial, military, business & general aviation, civil helicopter, and others. Within the global aircraft composites industry, the commercial aerospace sector holds a substantial market share. Owing to major developments in the civilian aircraft industry and the replacement of the fleet that is set to retire, it is anticipated that the commercial aerospace segment will maintain its position. Manufacturers are anticipated to release variant designs as a result of the growing demand for midsize commercial aircraft and the success of using composite in their construction. This would further boost the aerospace composites industry. The growing use of composite materials in military aircraft is another factor contributing to the market's anticipated significant growth throughout the forecast period.

By Application Analysis

The external application market is expected to develop at a rate of about 7.2%. Composites with superior curing characteristics and greater operating temperatures are needed for exterior aircraft applications. They provide robust aerospace frameworks, which will increase industry revenue even more. Because of their extraordinary strength, better stiffness-to-density ratio, and superior physical qualities, composite materials are being used more often in commercial and military applications as a result of ongoing research and development aimed at improving performance. Aerospace composites also offer a 20% weight reduction, have a higher damage tolerance during manufacture, and shorten production times.

Regional Analysis

North American aerospace composite accounted for one-third of the market share, or a 10.9% compound annual growth rate, making it the most significant revenue contributor. In the aircraft sector, aerospace composites are widely utilized in North America for a range of purposes. When assembling aircraft constructions, composite parts like wings, fuselage sections, and tail aspects are frequently utilized. They offer an exceptional strength-to-weight ratio, which is necessary to reduce the weight of regular planes and increase fuel efficiency. The United States of America is a global leader in aircraft innovation and technology, and it heavily uses aerospace composites. One of the biggest aerospace companies in the world, Boeing Company, uses a lot of composites in their business aircraft. One such aircraft is the Boeing 785, which features a full-size piece of composite materials in its construction.

Between 2023 and 2033, the Asia-Pacific Aerospace Composites Market is anticipated to expand at the fastest CAGR. Mid-sized commercial aircraft are in high demand since they support the growth of developing nations' aerospace industries, such as China and India. Additionally, it is anticipated that growing military budgets and the price of fighter planes in nations like India will present profitable expansion prospects for industry participants. Furthermore, China maintained the largest market share in the Asia-Pacific region for aerospace composites, but India's market expanded at the fastest rate.

Competitive Analysis

It is anticipated that the companies' cooperation with OEMs for the development of aviation parts and components to boost end-user profitability would present new market prospects for the established players. Companies may be able to expand their market presence by investing in sophisticated composites for space-based applications.

Key Market Players in the Aerospace Composites Market

o Collins Aerospace

o Toray Industries Inc.

o Mitsubishi Chemical Corporation

o SGL Carbon SE

o Evonik Industries AG

o Teijin Limited

o Lee Aerospace

o Absolute Composites

o Other Key Players

|

Report Attribute |

Details |

|

Market Size 2023 |

USD 30.1 Billion |

|

Market Size 2033 |

USD 82.3 Billion |

|

Compound Annual Growth Rate (CAGR) |

10.5% |

|

Market Forecast Period |

2023-2033 |

|

Historical Data |

2018-2022 |

|

Region Covered |

North America, Europe, Asia-Pacific, South America, Middle East and Africa |

|

Market Scope |

Fiber Type, Aircraft Type, Application, and Region |

|

Key Players |

Solvay Group, Hexcel Corporation, Collins Aerospace, Toray Industries Inc., Mitsubishi Chemical Corporation, SGL Carbon SE, Evonik Industries AG, Teijin Limited, Lee Aerospace, Absolute Composites, Other Key Players

|

📘 Frequently Asked Questions

1. How much is the Aerospace Composites Market in 2023?

Answer: The Aerospace Composites Market size was valued at USD 30.1 Billion in 2023.

2. What would be the forecast period in the Aerospace Composites Market?

Answer: The forecast period in the Aerospace Composites Market report is 2023-2033.

3. Who are the key players in the Aerospace Composites Market?

Answer: Solvay Group, Hexcel Corporation, Collins Aerospace, Toray Industries Inc., Mitsubishi Chemical Corporation, SGL Carbon SE, Evonik Industries AG, Teijin Limited, Lee Aerospace, Absolute Composites, Other Key Players

4. What is the growth rate of the Aerospace Composites Market?

Answer: Aerospace Composites Market is growing at a CAGR of 10.5% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.