🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Aerospace Cyber Security Market

Global Aerospace Cyber Security Market (By Component, Services and Solutions; By Type, Network Security, Wireless Security, Cloud Security, and Content Security; By Deployment, On-Premise and Cloud; By Application, Aircraft, Drones, and Satellite; By Region and Companies), 2024-2033

Nov 2024

Information and Communication Technology

Pages: 138

ID: IMR1322

Aerospace Cyber Security Market Overview

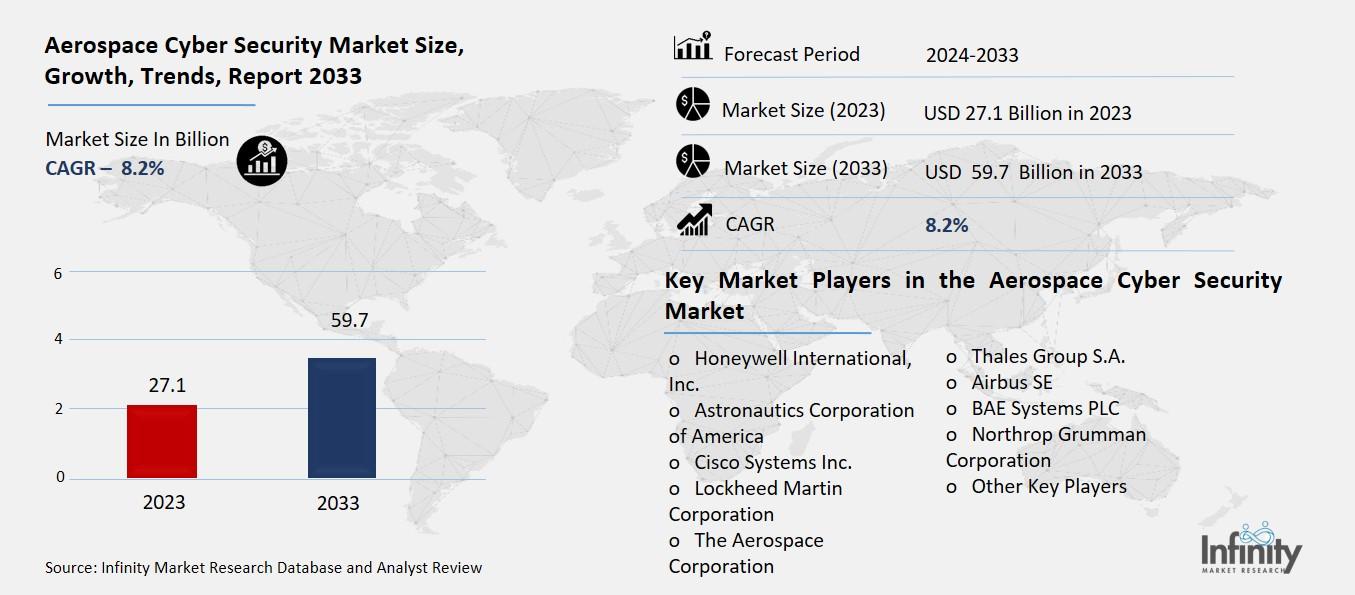

Global Aerospace Cyber Security Market acquired the significant revenue of 27.1 Billion in 2023 and expected to be worth around USD 59.7 Billion by 2033 with the CAGR of 8.2% during the forecast period of 2024 to 2033. The market size of aerospace cybersecurity across the world is rapidly developing due to growing concerns in the implementation of cybersecurity for aerospace systems, both civil and military. Thus, as technology in aviation increases especially by the use of connected devices, self-flying aircraft and programs that run flight operations activities, the chances of cyber-attack increases. Many of these can put to danger flight safety, efficiency and security of a country’s assets and interests.

As a result, aerospace companies and government authorities are actively seeking reliable solutions protecting avionic systems, air traffic control, as well as data exchange between an aircraft and other segments of ground infrastructure. The market is also fueled by increased regulatory standards and compliance around the world including EASA and FAA which have set specific and stringent requirements toward incorporating higher levels of cybersecurity.

Drivers for the Aerospace Cyber Security Market

Growing Adoption of Digital Technologies

The connectivity and IoT elements in the aerospace industry encompass various appliances and tools such as having connected aircraft, cloud computing facilities, and IoT aircraft, which is a paradigm shift of operations transforming aircraft, airports, and ground management to make them more efficient for data collection and communication. Still, this integration has brought new risks for aerospace systems and made them more exposed to cyber attacks.

Almost any object used in an aircraft can connect with the outside world, thereby creating several points of vulnerability for hackers. The advantage of large-scale cloud storage of operational data, maintenance reports and real time flight data together with the scalability and flexibility created higher risks of hacking and unauthorized access.

Restraints for the Aerospace Cyber Security Market

Complexity of Aerospace Systems

The highly complex and legacy nature of aerospace systems presents significant challenges when it comes to integrating modern cybersecurity solutions. Many aerospace systems, particularly in military and commercial aircraft, were designed and deployed decades ago with limited consideration for the advanced digital threats faced today. These legacy systems were not built with modern cybersecurity requirements in mind, making it difficult to retrofit them with the necessary protection mechanisms without disrupting critical functions. For example, avionics systems, flight control software, and air traffic management tools often use proprietary technologies or outdated protocols, which can be incompatible with newer, more secure cybersecurity solutions.

Opportunity in the Aerospace Cyber Security Market

Advancements in Artificial Intelligence and Machine Learning

The application of Artificial Intelligence (AI) and Machine Learning (ML) for predictive threat analysis and automated system defense holds significant promise for enhancing cybersecurity in the aerospace industry. These advanced technologies enable the development of proactive defense mechanisms that can identify and respond to potential threats in real-time, greatly improving the security of critical aerospace systems.

AI and ML algorithms can analyze vast amounts of data from various sources, including aircraft systems, flight operations, and air traffic control, to detect anomalies and unusual patterns that may indicate a cyber-threat. This predictive capability allows for the early identification of potential attacks, enabling quick interventions before damage can occur.

Trends for the Aerospace Cyber Security Market

Shift Toward AI-Powered Cybersecurity

The aerospace industry is increasingly adopting AI and machine learning-driven security systems to enhance its ability to detect and respond to cyber threats in real-time. These advanced technologies offer a significant leap forward in the efficiency and effectiveness of cybersecurity measures, especially as aerospace systems become more interconnected and digitally complex. AI algorithms are capable of continuously monitoring vast amounts of data generated by aircraft, avionics, and ground operations, identifying potential threats or irregularities that might go unnoticed by traditional security methods. Machine learning models, with their ability to adapt and learn from new data, enhance this capability by recognizing patterns and anomalies that indicate an evolving threat landscape, such as a cyberattack attempting to manipulate flight control systems or hijack communication networks.

Segments Covered in the Report

By Component

o Services

o Solutions

By Type

o Network Security

o Wireless Security

o Content Security

By Deployment

o On-Premise

o Cloud

By Application

o Aircraft

o Drones

o Satellite

Segment Analysis

By Component Analysis

On the basis of component, the market is divided into services and solutions. Among these, solutions segment acquired the significant share in the market owing to the increasing demand for advanced security technologies to protect complex aerospace systems. These solutions encompass a range of products designed to safeguard critical infrastructure, including network security tools, encryption software, and intrusion detection systems. The growing complexity and connectivity of aerospace systems have heightened the need for robust security measures, driving the adoption of comprehensive solutions.

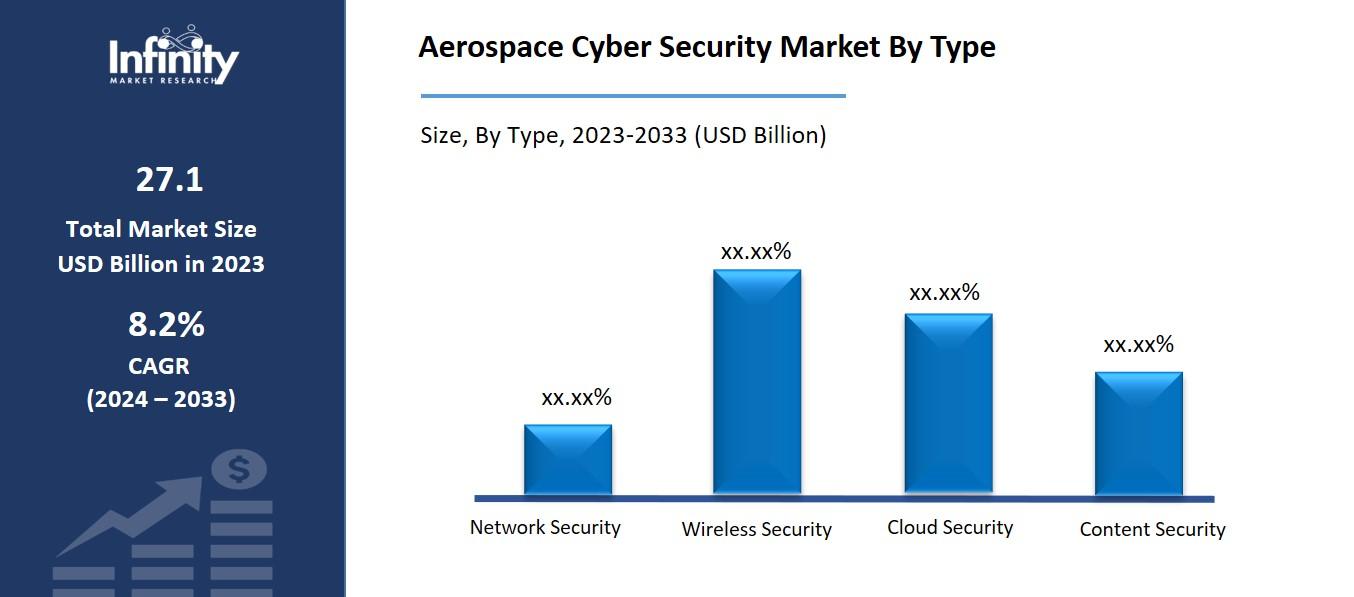

By Type Analysis

On the basis of type, the market is divided into network security, wireless security, cloud security, and content security. Among these, network security held the prominent share of the market due to the critical importance of safeguarding communication channels and data transmission within aerospace systems. As the industry increasingly relies on interconnected networks for operations such as flight control, navigation, and real-time data exchange, ensuring the integrity and confidentiality of these networks is paramount.

Network security solutions, including firewalls, intrusion detection systems, and encryption protocols, are essential to protect against cyber threats that could compromise the safety and efficiency of aerospace operations. The growing complexity and connectivity of aerospace systems have heightened the need for robust network security measures, driving the adoption of comprehensive solutions to mitigate potential risks.

By Deployment Analysis

On the basis of deployment, the market is divided into on premise and cloud. Among these, cloud deployment held the significant share of the market because of its scalability, cost-effectiveness, and ability to handle large volumes of data generated by aerospace operations. Aerospace organizations manage vast amounts of sensitive information, including design specifications, manufacturing processes, and operational data. Cloud services offer efficient solutions for storing and processing this data, enabling aerospace companies to manage large datasets effectively.

By Application Analysis

On the basis of application, the market is divided into aircraft, drones, and satellite. Among these, aircraft segment held the most of the share of the market due to the critical importance of ensuring the safety and security of commercial and military aircraft operations. Aircraft systems are increasingly reliant on complex digital technologies for navigation, communication, and control, making them prime targets for cyber threats. Protecting these systems is essential to prevent potential breaches that could compromise flight safety and operational efficiency. For instance, in 2022, the aircraft segment accounted for more than half of the global aerospace cybersecurity market revenue, highlighting its dominant position in the market.

Regional Analysis

North America Dominated the Market with the Highest Revenue Share

North America held the most of the share of the market due to its strong aerospace industry infrastructure, technological advancements, and stringent cybersecurity regulations. The United States, in particular, is home to some of the world’s largest aerospace manufacturers, defense contractors, and government agencies, such as NASA and the Department of Defense, all of which have prioritized the protection of critical aerospace systems from cyber threats.

The region’s extensive investment in both commercial and military aviation, alongside rapid technological innovations in areas like cloud computing, AI, and IoT, has driven the demand for robust cybersecurity solutions. Furthermore, North America’s stringent cybersecurity regulations and compliance requirements, such as those set by the Federal Aviation Administration (FAA) and the Department of Homeland Security (DHS), have propelled the adoption of advanced security measures.

Competitive Analysis

The aerospace cybersecurity market is highly competitive, with key players focusing on innovation, strategic partnerships, and the development of comprehensive security solutions to stay ahead in a rapidly evolving landscape. Major companies, including Boeing, Thales Group, Northrop Grumman, Raytheon Technologies, and Lockheed Martin, are at the forefront, leveraging their deep industry expertise and extensive resources to offer cutting-edge cybersecurity solutions tailored to the unique needs of aerospace systems.

Recent Developments

In January 2023, the Aerospace Corporation developed the Space Attack Research and Tactic Analysis (SPARTA) framework to identify the specific risks that hackers could present to space systems.

In March 2022, Northrop Grumman Corporation announced the establishment of the 100th U.S. Air Force training site on its Distributed Mission Operations Network (DMON), allowing Combat Air Force (CAF) crews worldwide to securely connect with other sites for virtual training and exercises.

Key Market Players in the Aerospace Cyber Security Market

o Honeywell International, Inc.

o Astronautics Corporation of America

o Cisco Systems Inc.

o Lockheed Martin Corporation

o Thales Group S.A.

o Airbus SE

o BAE Systems PLC

o Northrop Grumman Corporation

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 27.1 Billion |

|

Market Size 2033 |

USD 59.7 Billion |

|

Compound Annual Growth Rate (CAGR) |

8.2% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Component, Type, Deployment, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Honeywell International, Inc., Astronautics Corporation of America, Cisco Systems Inc., Lockheed Martin Corporation, The Aerospace Corporation, Thales Group S.A., Airbus SE, BAE Systems PLC, Northrop Grumman Corporation, and Other Key Players. |

|

Key Market Opportunities |

Advancements in Artificial Intelligence and Machine Learning |

|

Key Market Dynamics |

Growing Adoption of Digital Technologies |

📘 Frequently Asked Questions

1. Who are the key players in the Aerospace Cyber Security Market?

Answer: Honeywell International, Inc., Astronautics Corporation of America, Cisco Systems Inc., Lockheed Martin Corporation, The Aerospace Corporation, Thales Group S.A., Airbus SE, BAE Systems PLC, Northrop Grumman Corporation, and Other Key Players.

2. How much is the Aerospace Cyber Security Market in 2023?

Answer: The Aerospace Cyber Security Market size was valued at USD 27.1 Billion in 2023.

3. What would be the forecast period in the Aerospace Cyber Security Market?

Answer: The forecast period in the Aerospace Cyber Security Market report is 2024-2033.

4. What is the growth rate of the Aerospace Cyber Security Market?

Answer: Aerospace Cyber Security Market is growing at a CAGR of 8.2% during the forecast period, from 2024 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.