🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Automated Irrigation Market

Global Automated Irrigation Market (By Automation Type (Time-based, Volume-based, Real-time-based, Computer-based Control System) By Component (Controllers, Sensors, Valves, Sprinklers, Other Component) By Irrigation (Sprinkler Irrigation, Drip Irrigation, Surface Irrigation,) By Application (Agriculture, Open fields, Greenhouse, Non-Agriculture, Golf Course, Residential, Sports Ground) By Region and Companies)

May 2024

Automobiles

Pages: 118

ID: IMR1040

Automated Irrigation Market Overview

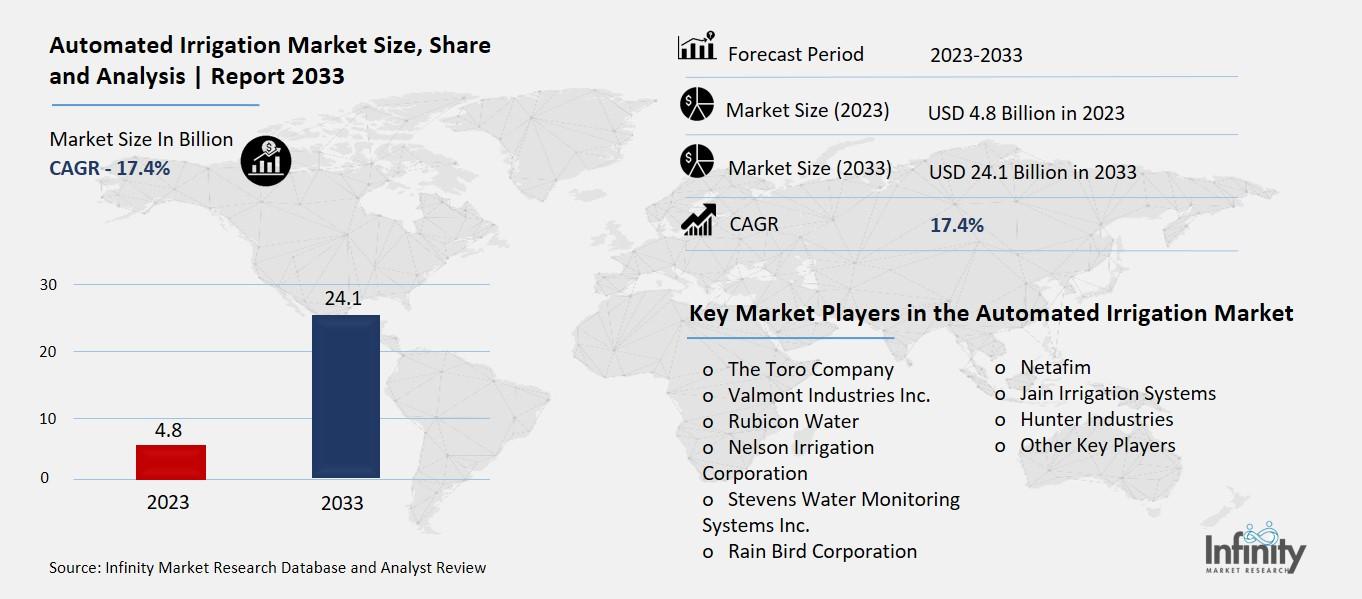

The global Automated Irrigation Market size was USD 4.8 billion in 2023 to USD 24.1 billion by 2033, exhibiting a CAGR of 17.4% during the forecast period from 2023-2033

The Automated Irrigation Market is all about using technology to make watering plants easier and more efficient. This market includes companies that create and sell systems designed to automate the process of watering crops, gardens, and landscapes. These systems use sensors, controllers, and other smart devices to monitor factors like soil moisture levels and weather conditions. With this data, they can adjust irrigation schedules and water application rates automatically, without the need for manual intervention. This not only saves time and effort for farmers and gardeners but also helps to conserve water resources by ensuring that plants receive the right amount of water at the right time.

According to recent data, the Automated Irrigation Market is experiencing significant growth due to the increasing adoption of smart irrigation technologies. These technologies offer benefits such as improved water efficiency, higher crop yields, and reduced labor costs. With rising concerns about water scarcity and environmental sustainability, there is a growing demand for automated irrigation systems that can optimize water usage and minimize wastage. As a result, companies in the Automated Irrigation Market are innovating and introducing new products and solutions to meet the evolving needs of farmers, landscapers, and homeowners seeking efficient and convenient ways to water their plants.

Drivers for Automated Irrigation Market

Addressing Water Scarcity Challenges: Ensuring Efficient Water Use

One of the key drivers fueling the growth of the automated irrigation market is the need to address water scarcity challenges in agriculture. As water resources become increasingly scarce due to climate change and growing population pressure, there is a heightened focus on efficient water management practices in the agricultural sector. Automated irrigation systems offer precise control over water distribution, allowing farmers to optimize water usage and minimize wastage. According to recent studies, automated irrigation technologies such as drip irrigation and precision irrigation can improve water use efficiency by up to 50% compared to conventional irrigation methods. This enhanced efficiency not only conserves water resources but also contributes to higher crop yields and improved farm profitability.

Enhanced Crop Productivity and Yield: Maximizing Agricultural Output

Another significant driver of the automated irrigation market is the potential for enhanced crop productivity and yield. By providing crops with the right amount of water at the right time, automated irrigation systems help optimize growing conditions and promote healthier plant growth. Research indicates that crops grown using automated irrigation methods often exhibit higher yields, improved quality, and reduced susceptibility to stress-related issues such as drought and waterlogging. Farmers are increasingly recognizing the value of automated irrigation technologies in maximizing agricultural output and mitigating production risks, particularly in regions prone to erratic weather patterns and water scarcity.

Labor and Cost Savings: Improving Operational Efficiency

Automated irrigation systems offer labor-saving benefits and operational efficiencies, driving their adoption among farmers. By automating the irrigation process, farmers can reduce the need for manual labor associated with traditional irrigation methods, such as moving hoses and adjusting water flow. This not only saves time and labor costs but also allows farmers to allocate resources more efficiently and focus on other essential farm tasks. Additionally, automated irrigation systems can help optimize fertilizer and pesticide application, further reducing input costs and minimizing environmental impact. Studies have shown that the implementation of automated irrigation technologies can lead to significant cost savings and improved farm profitability over time.

Technological Advancements and Adoption Support: Facilitating Market Growth

Advancements in technology, coupled with increasing support for adoption, are driving the growth of the automated irrigation market. Innovations such as sensor-based irrigation controllers, wireless communication systems, and cloud-based monitoring platforms have made automated irrigation systems more accessible, user-friendly, and cost-effective. Moreover, government initiatives, incentives, and subsidies aimed at promoting sustainable agriculture and water conservation are encouraging farmers to invest in automated irrigation solutions. As a result, the automated irrigation market is witnessing widespread adoption across various crop types, farm sizes, and geographical regions, driving market growth and expansion.

Restraints for Automated Irrigation Market

Initial Investment Costs: Affordability Barrier for Small Farmers

One significant restraint for the automated irrigation market is the high initial investment costs associated with installing automated irrigation systems. While automated irrigation technologies offer long-term benefits such as water savings, labor efficiency, and improved crop yields, the upfront investment required for purchasing and installing these systems can be prohibitive for small-scale farmers, particularly in developing countries. Recent studies indicate that the cost of automated irrigation equipment, including sensors, controllers, pumps, and installation infrastructure, can vary significantly depending on the system's complexity, scale, and technology sophistication. This affordability barrier limits the adoption of automated irrigation systems among smallholder farmers who may lack access to capital, financing options, or government support programs. Additionally, the return on investment (ROI) period for automated irrigation systems may be longer in regions with low crop prices or uncertain market conditions, further exacerbating financial challenges for farmers considering adoption.

Technological Complexity and Maintenance Requirements: Operational Challenges

Another restraint for the automated irrigation market is the technological complexity and maintenance requirements associated with automated irrigation systems. While these systems offer advanced features such as remote monitoring, precision control, and data analytics, they also require technical expertise and ongoing maintenance to ensure optimal performance and reliability. Farmers may face challenges in understanding and operating the complex components of automated irrigation systems, including sensors, actuators, controllers, and software interfaces. Moreover, issues such as sensor calibration, system integration, and software updates may necessitate regular maintenance and troubleshooting, adding to the operational complexity and potential downtime. Recent data suggests that inadequate technical support, training resources, and after-sales services can hinder the adoption and effective use of automated irrigation systems, particularly among farmers with limited technical skills or access to professional assistance. Addressing these technological and operational challenges requires investments in farmer education, training programs, and technical support networks to empower farmers to adopt and maintain automated irrigation systems successfully.

Water Quality and Environmental Concerns: Sustainability Considerations

Water quality and environmental concerns pose additional restraints for the automated irrigation market, particularly regarding the potential impacts of irrigation practices on water resources, soil health, and ecosystem integrity. While automated irrigation systems offer benefits such as water savings and precision irrigation, improper use or overreliance on irrigation may lead to issues such as soil erosion, salinization, nutrient runoff, and groundwater depletion. Recent studies highlight the importance of adopting sustainable irrigation practices that balance water conservation goals with environmental stewardship principles. Additionally, concerns about the quality and safety of irrigation water, including contamination from pollutants, pathogens, and agrochemical residues, may influence farmers' decisions regarding automated irrigation system adoption and usage. Addressing these water quality and environmental concerns requires holistic approaches that promote integrated water management strategies, soil conservation practices, and ecosystem-friendly irrigation techniques to ensure the long-term sustainability of agricultural landscapes and water resources.

Opportunity in the Automated Irrigation Market

Unlocking Water Savings and Efficiency: Meeting Sustainable Agriculture Goals

One major opportunity for the automated irrigation market lies in unlocking water savings and efficiency to meet sustainable agriculture goals. With increasing concerns about water scarcity, climate change, and environmental sustainability, there is a growing demand for innovative irrigation solutions that optimize water usage and minimize wastage. Automated irrigation systems offer precise control over water distribution, allowing farmers to tailor irrigation schedules based on real-time data such as soil moisture levels, weather conditions, and crop water requirements. Recent studies indicate that the adoption of automated irrigation technologies can lead to significant water savings ranging from 20% to 50% compared to conventional irrigation methods. This presents a compelling opportunity for farmers to enhance water efficiency, reduce irrigation costs, and improve crop yields while conserving precious water resources for future generations.

Expanding Adoption in Emerging Markets: Catering to Diverse Agricultural Needs

Another opportunity for the automated irrigation market is the expanding adoption of automated irrigation systems in emerging markets, where agriculture plays a crucial role in economic development and food security. As emerging economies experience rapid population growth, urbanization, and industrialization, there is a growing need to modernize agricultural practices and increase food production to meet rising demand. Automated irrigation systems offer scalable and customizable solutions that cater to diverse agricultural needs, crop types, and farming conditions in emerging markets. Recent data shows that the adoption of automated irrigation technologies is gaining momentum in regions such as Asia, Africa, and Latin America, driven by government initiatives, investment incentives, and technological advancements. This presents an opportunity for automated irrigation suppliers and service providers to tap into emerging markets, expand their customer base, and address the evolving needs of farmers in these regions.

Integration with Digital Farming Technologies: Enhancing Precision Agriculture

The integration of automated irrigation systems with digital farming technologies presents opportunities for enhancing precision agriculture practices and optimizing farm management operations. Automated irrigation systems can be seamlessly integrated with other digital tools such as remote sensing, satellite imagery, geographic information systems (GIS), and farm management software to create holistic farming solutions that improve decision-making, resource allocation, and productivity. By harnessing data analytics and predictive modeling techniques, farmers can gain insights into crop growth patterns, soil health indicators, and irrigation requirements, enabling them to make informed decisions and optimize inputs for maximum efficiency and profitability. Recent advancements in Internet of Things (IoT) connectivity, cloud computing, and artificial intelligence (AI) are driving innovation in digital farming platforms, creating opportunities for automated irrigation suppliers to offer integrated solutions that deliver value-added services, decision support tools, and actionable insights to farmers. This convergence of technologies holds the potential to revolutionize agriculture and drive sustainable growth in the automated irrigation market.

Trends for Automated Irrigation Market

Adoption of Smart Irrigation Technologies: Enhancing Precision and Efficiency

One significant trend in the automated irrigation market is the increasing adoption of smart irrigation technologies, which leverage sensors, controllers, and data analytics to optimize water usage and improve irrigation efficiency. Recent data suggests that smart irrigation systems, equipped with soil moisture sensors, weather forecasts, and remote monitoring capabilities, are gaining popularity among farmers worldwide. These systems enable precise control over irrigation schedules and water application rates based on real-time environmental conditions and plant needs, reducing water wastage and promoting healthier crop growth. With the advent of Internet of Things (IoT) technology and cloud-based platforms, smart irrigation solutions offer farmers greater flexibility, scalability, and accessibility, allowing them to monitor and manage their irrigation systems remotely from mobile devices or computers. This trend towards smart irrigation technologies is driven by the need for sustainable water management, increased farm productivity, and regulatory pressures to conserve water resources.

Integration of Artificial Intelligence (AI) and Machine Learning: Optimizing Irrigation Strategies

Another emerging trend in the automated irrigation market is the integration of Artificial Intelligence (AI) and machine learning algorithms to optimize irrigation strategies and decision-making processes. Recent advancements in AI technology have enabled the development of predictive models and optimization algorithms that analyze complex data sets, including weather patterns, soil characteristics, crop physiology, and historical irrigation data. By leveraging AI-driven insights, farmers can make data-driven decisions regarding irrigation scheduling, water allocation, and crop management practices, maximizing water efficiency and yield potential. Moreover, machine learning algorithms can adapt and learn from real-time data feedback, continuously improving irrigation strategies and adapting to changing environmental conditions. This trend towards AI-powered irrigation solutions is expected to drive innovation and efficiency in agriculture, enabling farmers to achieve higher yields, reduce input costs, and mitigate risks associated with water scarcity and climate variability.

Shift Towards Sustainable Irrigation Practices: Environmental and Regulatory Considerations

A notable trend reshaping the automated irrigation market is the growing emphasis on sustainable irrigation practices, driven by environmental concerns and regulatory requirements. Recent studies highlight the environmental impacts of conventional irrigation methods, such as water wastage, soil erosion, and nutrient runoff, prompting stakeholders to seek alternative approaches that minimize negative externalities. Automated irrigation systems offer sustainable solutions that promote water conservation, soil health, and ecosystem resilience, aligning with global sustainability goals and corporate responsibility initiatives. Additionally, regulatory frameworks and incentives aimed at promoting water conservation and environmental stewardship are encouraging farmers to adopt automated irrigation technologies as part of their sustainable farming practices. This trend towards sustainable irrigation practices reflects a broader shift towards more environmentally friendly and socially responsible agricultural systems, highlighting the role of automated irrigation in driving positive change in the industry.

Segments Covered in the Report

By Automation Type

o Time-based

o Volume-based

o Real-time-based

o Computer-based Control System

By Component

o Controllers

o Sensors

o Valves

o Sprinklers

o Other Component

By Irrigation

o Sprinkler Irrigation

o Drip Irrigation

o Surface Irrigation

By Application

o Agriculture

o Open fields

o Non-Agriculture

o Golf Course

o Residential

o Sports Ground

Segment Analysis

By Automation Type

Based on the type of automation, this market is subdivided into Time-based, Volume-based, Real-time-based, and Computer-based Control Systems. The market was led by the time-based automation type segment in 2023, which generated over 30.3% of global revenue. The benefits include total control over the irrigation process, cheaper labor expenses, and less fuel consumption the main cause of the high proportion. The user may control, intervene, and keep an eye on crops at various phases of irrigation at regular intervals thanks to the time-based automation system. The time-based approach is therefore more appropriate to harvest productivity.

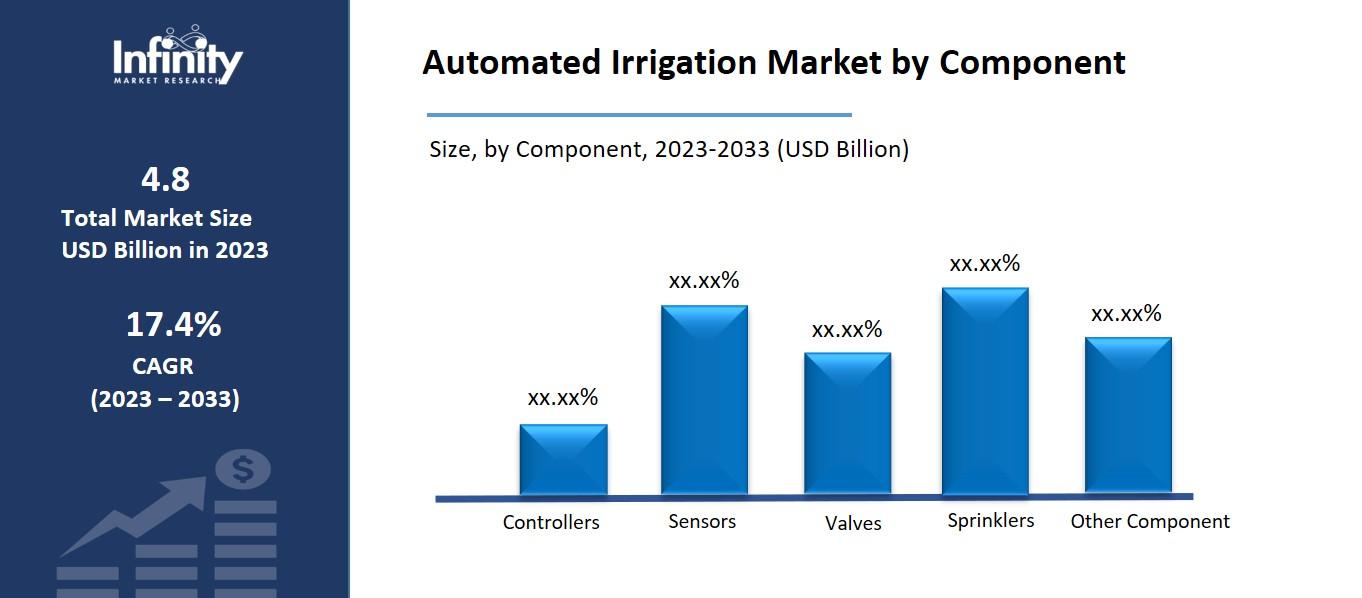

By Component Analysis

Based on Components, this market is further segmented into Controllers, Sensors, Valves, Sprinklers, and Others. With a CAGR of about 18.5%, the sensors segment is anticipated to develop at the fastest pace between 2023 and 2033. The use of sensors aids in the computation of irrigation needs and soil moisture levels in real time. Irrigators may access real-time data through a web-based interface or a smartphone app thanks to sensors, which also improve connectivity. Additionally, precise soil moisture temperature and measurement forecast solutions using sensors enable sprinklers and dripping systems to operate simultaneously with automated technology, increasing productivity with a reduced manual crew.

By Irrigation Analysis

The market is divided into three segments based on the type of irrigation: surface, drip, and sprinkler. With over 34.4% of global revenue in 2023, the drip irrigation type segment led the irrigation automation market. The segment is anticipated to continue dominating because of the system's almost ten-year life cycle throughout the forecast period. Because of this, the irrigation system is durable and highly effective, producing more constant yields. Additionally, water waste from runoff and evaporation in the field is eliminated via drip irrigation systems. Moreover, the segment is growing because of reasons like the ability to use less water and the lower cost of drip systems.

By Application Analysis

Based on application, this market is categorized into agriculture and non-agriculture. With a CAGR of about 17.1%, the non-agricultural application segment is anticipated to grow at the fastest rate between 2023 and 2033. The expansion of golf courses, sports fields, gardens, homes, pastures, turf, and landscapes globally is the cause of the increase. Irrigation automation technologies save water costs while enabling on-time watering with the necessary volume of water in various non-agricultural applications. Furthermore, golf course developers and owners can use automated irrigation systems to remotely control watering schedules and volume.

Regional Analysis

The North American automated irrigation market is anticipated to increase owing to the government's increasing efforts to promote water conservation and the use of irrigation systems in the area. The market is anticipated to expand at a 13.45% CAGR over the forecast period. For instance, the EPA has released three revised Water Sense standards for professional certification programs that cover irrigation system installation, design, maintenance, and system auditing. The main goal was to increase public knowledge of the benefits of using ecologically friendly irrigation methods and conserving water.

With the second-largest market share, the Asia-Pacific automated irrigation market is driven by factors like vast agricultural lands, rapidly shifting climate patterns, robust government support, a growing need to minimize water waste, and innovative irrigation technology. These factors are projected to maintain the region's dominance throughout the forecast period. Additionally, individuals are being compelled to employ sensor-based irrigation systems as a result of declining water levels in the region's river basins.

Competitive Analysis

The Toro Company, Netafim, and Hunter Industries are just a few of the companies that control the global automated irrigation market owing to their well-known brands, unique products, sound financial standing, astute business decisions, and varied regional presence. The players' primary focus is making R&D investments. To improve their market position and attract a sizable consumer base, they also implement strategic growth efforts such as partnerships, joint ventures, product launches, and expansion.

Key Market Players in the Automated Irrigation Market

o The Toro Company

o Valmont Industries Inc.

o Nelson Irrigation Corporation

o Stevens Water Monitoring Systems Inc.

o Rain Bird Corporation

o Netafim

o Jain Irrigation Systems

o Hunter Industries

o Other Key Players

|

Report Attribute |

Details |

|

Market Size 2023 |

USD 4.8 billion |

|

Market Size 2033 |

USD 24.1 billion |

|

Compound Annual Growth Rate (CAGR) |

17.4% |

|

Market Forecast Period |

2023-2033 |

|

Historical Data |

2018-2022 |

|

Region Covered |

North America, Europe, Asia-Pacific, South America, Middle East and Africa |

|

Market Scope |

Automation Type , Component, Irrigation, Application and Region |

|

Key Players |

The Toro Company, Valmont Industries Inc., Rubicon Water, Nelson Irrigation Corporation, Stevens Water Monitoring Systems Inc., Rain Bird Corporation, Netafim, Jain Irrigation Systems, Hunter Industries, Other Key Players

|

📘 Frequently Asked Questions

1. What would be the forecast period in the Automated Irrigation Market Research report?

Answer: The forecast period in the Automated Irrigation Market Research report is 2024-2032.

2. Who are the key players in the Automated Irrigation Market?

Answer: The Toro Company, Valmont Industries Inc., Rubicon Water, Nelson Irrigation Corporation, Stevens Water Monitoring Systems Inc., Rain Bird Corporation, Netafim, Jain Irrigation Systems, Hunter Industries, Other Key Players

3. How big is the Automated Irrigation Market?

Answer: Automated Irrigation Market Size Was Valued at USD 4.8 Billion in 2023, and is Projected to Reach USD 24.1 Trillion by 2032, Growing at a CAGR of 17.4% From 2024-2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.