🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

C9 Aromatic Solvent Market

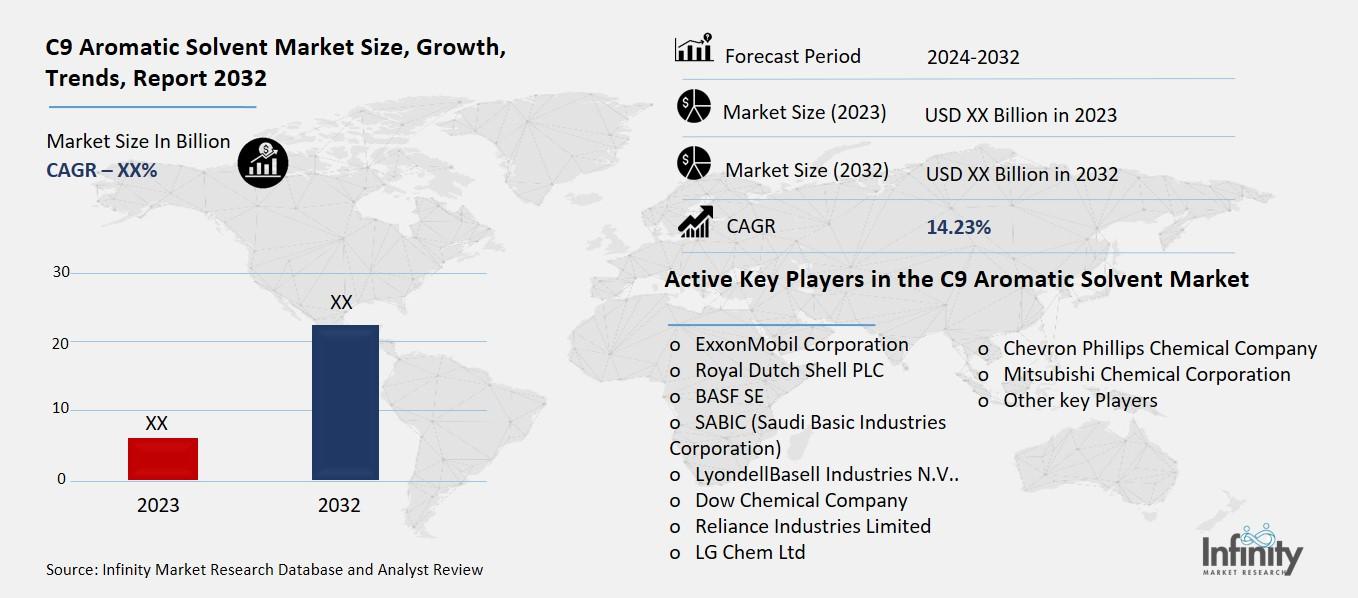

C9 Aromatic Solvent Market Global Industry Analysis and Forecast (2024-2032) By Type (Pure C9 Aromatic Solvents, Mixed C9 Aromatic Solvents) By Application (Paints & Coatings, Adhesives, Cleaning & Degreasing, Rubber & Plastic Industry, Others) By End-Use Industry (Automotive, Construction, Chemical Processing, Pharmaceuticals, Consumer Goods) and Region

Jan 2025

Chemicals and Materials

Pages: 138

ID: IMR1496

C9 Aromatic Solvent Market Synopsis

C9 Aromatic Solvent Market Size Was Valued at USD XX Billion in 2023, and is Projected to Reach USD XX Billion by 2032, Growing at a CAGR of XX% From 2024-2032.

C9 aromatic solvent market means the industry classification relating to the production and sale of C9 aromatic hydrocarbon, a substance containing benzene, toluene and xylenes. Due to these excellent qualities these solvents find its utility in paints, coatings, adhesives, printing inks and chemical manufacturing industries where it plays the role of an efficient solvent capable of dissolving a variety of materials. C9 aromatic solvents commonly contain a high aromatic content, low mobility, and unparalleled solubility thus enjoying wide application in automotive, construction, and industrial coating industries. The market is touched on factors like demand in end user industries, environmental factor and the raw material prices of the products.

The C9 aromatic solvent has now become an important industry player in many applications due to flexibility of its chemical nature and essentiality within many production or manufacturing chains. C9 aromatic solvents that are obtained through distillation of crude oil are relevant particularly in sectors that organisation request solvents that dissolve organic substances including oils, resins as well as rubbers. These solvents are used in paint, coating, adhesive and cleaning agents industries as well as other related industries. Automotive, construction and manufacturing industries are some of the biggest user of C9 aromatic solvents because these solvents contribute to the requirement of high standard coating and adhesive performance necessary in car industry, construction and machinery industry. The market of construction equipment has remained stable because of the growth of these sectors worldwide and especially in emergent countries, where the tendencies toward industrialization and urbanization represent the main driving forces concerning infrastructure development. The ever growing demand for the product that is durable, efficient and has high performance chemicals, compile the future market of C9 aromatic solvents and made it an indispensable part of the modern chemical world.

The trends associated with sustainable practices in the industrial production have also played a role in the evolution of the C9 aromatic solvent market. As the environmental standards continue to be raised all over the world, particularly on VOC emission standards, so the demand for low-VOC or green solvents continues to be on the rise. This trend has provided the necessary market pressure forcing the manufacturers of the aromatic solvents to make new products hence development of C9 aromatic solvents with high standards of regulation. Further, the trend is not only being propped up by legislation but also the growing prospects of markets insisting on environmentally friendly products. This shift in demand is making the market participants consider developing formulations that are not only good performers but that also have enhanced solvency and solynd accompaniments. Hence, customers and end-users are witnessing fresh innovations and developments with products claiming to utilize environment-friendly solvents yet offering optimal performance. The pursuit of environment-friendly products will be a major factor favoring the C9 aromatic solvent market, primarily owing to the growing spending by automotive, construction, and consumer goods sectors.

Globally the C9 aromatic solvent market has been experiencing high growth in Asia-Pacific region and is projected to remain the key contributor to the overall market growth in future. The growth in automobile, construction industries as well as infrastructure development particularly C9 aromatic solvents in the countries like China and India are showing impressive growth. The rising usage of industrial solvents in developing countries is driving the market forward, which is continuously investing in infrastructure, production, and construction industries. North American and European markets are also important, although there information focus is on innovation, being environmentally friendly and meeting all possible environmental standards. The US for instance is a large consumer of C9 aromatic solvents because its auto and construction industries relies heavily on high performance coating and adhesive products. Moreover due to environmental legislations and stringent environmental control measures that have cropped up in Europe, high demands for low VOC emitting C9 aromatic solvents are anticipated to be in high demand and this is an area that manufacturer can tap into in order to increase its market share. However, despite the positive growth slope, the C9 aromatic solvent market has some issues: First, the cost of crude oil is not constant and influences the price of C9 aromatic solvents because they are derived from it. Also, technical issues as the environment, especially the solvents disposition and wastes, are becoming critical factors that demand harmonized legal compliance and search for environmentally friendly measures. In response to these factors, key stakeholders are turning their attentions to the concept of efficiency enhancement of the production and providing the other solvent options that are friendly to the environment and customers.

In summary, the C9 aromatic solvent remains to be a core component of aromatics industry and is expected to continue to experience steady market progression influenced by the research for environmentally friendly solutions. By the current tireless innovation of usable environmentally sustainable production mechanisms, the industry is regarded to be transforming to accommodate both the set rules and necessary customer expectations. From the current trend of industries moving toward higher performance and low environmental impact solvents, it can be forecast that the C9 aromatic solvent market will may experience new product development and add new segment in the future. The strong continuing and new demand from developing countries and the need for innovative, environmentally friendly and sustainable products and processes places the C9 aromatic solvent as a key product of the global chemical industry.

C9 Aromatic Solvent Market Trend Analysis

A major factor behind growth in the C9 aromatic solvent market is the continuing need for these solvents in the formulation of paints, coatings, and adhesives. C9 aromatic solvents are used to the greatest extent due to their good performance characteristics: high rate of evaporation, high solubility, low toxicity. These features make them suitable for use in situation that demand enhanced drying mechanism and enhanced polishing for instance in paints and adhesive products. Combined with the fact that solvents dissolve many substances and at the same time, evaporate almost instantly, they are crucial for achieving essentially non-glossy and durable films with almost maximum adhesion. Therefore, those industries that use these products, especially automotive, construction and furniture, are playing a central role in the expansion of the market.

Consumers in the construction and automotive industries, where rates of coatings and adhesives usage for manufacturing are high, are also contributing to C9 aromatic solvents’ growth. The growing application of paints and coatings on vehicles, buildings, infrastructures requires solvents that can prosect the longevity and quality of the finish. Moreover, there is a highly increasing development in the automotive industry which includes the production of electric vehicles where there is a stronger demand for advanced materials which also serve as a factor for the importance of solvent solutions. With growth in these sectors, the market for C9 aromatic solvents is ever growing proving to play a vital role in industrial processes in the modern world.

Rising Demand for C9 Aromatic Solvents in Paints, Coatings, and Adhesives

Drivers

Rising Demand for High-Performance Solvents in Paints, Coatings, and Adhesives

The C9 aromatic solvent market is expected to be primarily propelled by the increased need for effective solvents in segments like paints and coatings, as well as other applications like adhesives. These solvents play an important role of defining the exact characteristics of the final products in terms of cohesiveness, time taken to dry and solidity. With high solvation power and fast evaporation in the dry phase, C9 aromatic solvents are especially sought after in formulations of paints and coatings. With the higher specialty of construction industry and automotive industry, the requirement of high-quality coatings and adhesion is driving the demand for appropriate solvent, C9 aromatic one in this case. In addition to the above, these solvents can be used to meet high performance levels hence extending their use in numerous applications.

Furthermore, the development of the manufacturing sector is boosting solvent consumption because solvents prove useful in multiple technical processes where accurate chemical reactions are vital. For instance, automotive with its keen demand on appealing surface and durable coating relies much on solvents for an ideal enhancement and film forming. The increasing global requirements for durable and high-performance products in these industries are instrumental in the growth of the C9 aromatic solvent business. The current and future development of these industries indicates that C9 aromatic types shall also steadily increase and develop hence the need for advanced solvents.

Restraints

Environmental Regulatory Constraints

One of the major issues hindering the growth of the C9 Aromatic Solvent market is the volatility of crude oil prices which act as the major input for the manufacture of the C9 Aromatic Solvents. These throw costs sky high and low, this inconsistency destabilizes manufacturing earnings leaving profits in a toss up. Since formulation price depends on the crude oil prices as a result of geopolitics, calamity, and supply-demand shifts, solvent producers end up having no choice but increase prices or absorb elevated costs affecting their profitability levels. This has been accented by the fluctuations of the world economy pulling production cost more greatly making it difficult to balance or predict this aspect.

Besides, price fluctuation, the second important factor that limits the market is the high extent of regulation that has been placed on the environment in the production process. National and international governmental and regulatory organizations have constantly implemented more stringent (%) controls on the utilization and discharge of solvents especially regarding the release of VOCs and other pollutants. Most of these regulations compel manufacturers to incur high costs on compliance activities including embracing cleaner production technologies, or adjusting the chemical formulation of products to emit low levels of pollution. However, these measures are important for the environmental effects since they also increase the production cost and may reduce the range of available formulations based on solvents that affect the abilities of producers to meet both the regulatory requirements and the consumers’ demands.

Opportunities

Increasing Demand in Key Industries

The rising requirement for better solvents in painted and coated areas, adhesives, automotive industries is one of the main contributing factors to the growth of the C9 Aromatic Solvent market. Since these sectors keep on growing, especially in developing nations, there are increased demands for advanced cost-effective and diverse solvent compare to C9 Aromatic Solvents. These solvents are used extensively in production of paints, coatings, and cleaning agents because these solvents should possess high solvency power and low volatility. When added to those end-use industries, this versatility, coupled with the increasing industrialization across the world, presents a good market opportunity for C9 Aromatic Solvents to cater to that demand more so in the developing countries where the demand for such uses is rapidly increasing.

Further, the gradually emerging trend for green and sustainable options in international manufacturing offers the major C9 Aromatic Solvent producers a strong potential. With concern for environmental protection and green chemistry strengthening globally in various regulators, there is pressure on manufacturers to release environmentally friendly products. This helps the C9 Aromatic Solvent producers to adapt to such trends showing the market products that are environmental friendly and meet the performance criteria in one way or another. By paying attention to the costs of production and the concerns of the market, andadditional, producers realize a chance to meet consumers’ and regulatory agents’ demands for safer, environment-friendly solvents.

C9 Aromatic Solvent Market Segment Analysis

C9 Aromatic Solvent Market Segmented on the basis of By Type, By Application, By End-Use Industry

By Type, Pure C9 Aromatic Solvents segment is expected to dominate the market during the forecast period

These are pure C9 aromatic solvents, which are highly refined solvents obtained from the distillation of petroleum products faction. They are constituted mostly of nine carbon atoms in aromatic structure which provides them high solvency power. This gives them great benefits when used in products which require a high level of purity and effective solvent properties, these include paint, coating, adhesive, cleaner and other applications. Due to satisfactory solubility of resins, oils and pigments, their importance features in industries where strict formulation is demanded. Since these solvents have high solvency strength, they also apply to produce products that need both clarity and effectiveness.

The need to employ pure C9 aromatic solvents is well understood in industries where environmental standards and product quality standards are critical. These industries e.g., pharmaceuticals and related chemical industries essentially use high purity solvents for consistency, safety and effectiveness of products. Due to its quality and performances, industries in the manufacturing of medicines, chemicals, and other high-performance materials require high quality C9 solvents and thiscan only be offered with the adoption of tough safety measures nurturing high standard quality outputs. With emerging new regulations and stringent rules in these industries, the demand for purely C9 aromatic solvents would go high, thus, boosting the market growth.

By End-Use Industry, Automotive segment expected to held the largest share

C9 aromatic solvents are highly demanded in production of paints and coatings for automotive industries.. Although these solvents are vital when it comes to delivering finishes that not only beautify automobiles but also protect them from the effects of environment ranging from ultraviolet light, moisture and abrasive wear. Aromatic solvents are incorporated into automotive coatings to give the right viscosity, flow characteristics, and drying time which are paramount in the application of these products. The automotive industry is also expected to continue to demand C9 aromatic solvents for quality and durability, as automotive manufacturers introduce new and improved coating formulations for new models of both civilian and commercial vehicles.• Besides the paints and coatings sectors, the C9 aromatic solvents find application in adhesive industry of automotive industry.solvents are crucial in achieving finishes that not only enhance the aesthetic appeal of vehicles but also provide long-lasting protection against environmental factors such as UV rays, moisture, and abrasion. The use of aromatic solvents in automotive coatings ensures optimal viscosity, flow, and drying properties, which are vital for smooth application and durability. As automotive manufacturers continue to prioritize quality and durability, the demand for C9 aromatic solvents in this sector remains strong, supporting the growing need for advanced coating formulations in both passenger and commercial vehicle production.

In addition to paints and coatings, C9 aromatic solvents play an essential role in the automotive industry's adhesive formulations. In vehicular manufacturing adhesives are used in connection with assembling diverse auto body parts these include; interiors, wind screen, and structural automotive parts. Aromatic solvent helps dissolve resin compounds that increase bonding strength and performance of adhesives. With the growth of automotive industry across the world let alone the fast developing countries the need for effective solvents used in adhesives is still expected to rise. The advanced manufacturing technologies consequently boosting the vehicle manufacturing are the production of aromatic solvents to meet the functional as well as compliance needs.

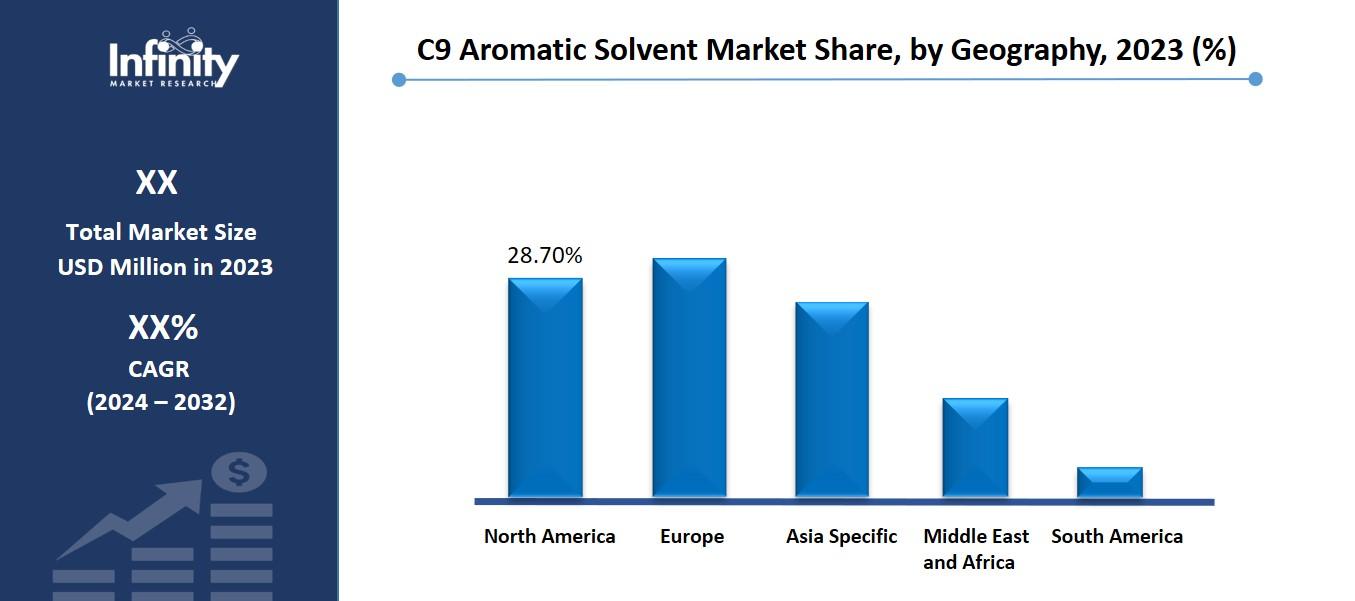

C9 Aromatic Solvent Market Regional Insights

North America is Expected to Dominate the Market Over the Forecast period

C9 aromatic solvent market is growing progressively in North America through high demands across important industries including paints & Coating, Automotive, as well as the chemical manufacturing business. The availability of major chemical organizations such as chemical manufacturing plant and large scale production centers in the US and Canada are critical for the enhancement of demand for C9 solvents. These solvents are used in many applications such as paint and coat, adhesives and sealant, and cleaning solvents among others. Thus, selling automotive components as well as applying the agents of these solvents in manufacturing processes and car maintenance also leads to the growth of the market. Also, the chemical manufacturing industry that uses solvents as its solvents increases; therefore, C9 aromatic solvents are demanded as well.

However, some testing markets are facing limitations in North America as the result of environmental regulations covering the reduction of VOCs and HAPs, which have a negative impact on air quality. This external pressure in regulation has forced industries to move to low-VOC and sustainable solvent solutions. To this end, there has been a growing concern among companies on the optimisation of production methods for C9 aromatic solvents to conform to these environment standards. Further research on solvent performance improvement and sustainability is crucial in managing these challenges in order to attain regulatory compliance, high performance of products and industrial application.

C9 Aromatic Solvent Market Share, by Geography, 2023 (%)

Active Key Players in the C9 Aromatic Solvent Market

o BASF SE

o SABIC (Saudi Basic Industries Corporation)

o LyondellBasell Industries N.V..

o Dow Chemical Company

o Reliance Industries Limited

o LG Chem Ltd

o Chevron Phillips Chemical Company

o Mitsubishi Chemical Corporation

o Other key Players

Global C9 Aromatic Solvent Market Scope

|

Global C9 Aromatic Solvent Market | |||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD XX Billion |

|

Forecast Period 2024-32 CAGR: |

XX% |

Market Size in 2032: |

USD XX Billion |

|

|

By Type |

· Pure C9 Aromatic Solvents · Mixed C9 Aromatic Solvents | |

|

By Application |

· Paints & Coatings · Adhesives · Cleaning & Degreasing · Rubber & Plastic Industry · Others | ||

|

By End-Use Industry |

· Automotive · Construction · Chemical Processing · Pharmaceuticals · Consumer Goods | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Rising Demand for High-Performance Solvents in Paints, Coatings, and Adhesives | ||

|

Key Market Restraints: |

· Environmental Regulatory Constraints | ||

|

Key Opportunities: |

· Increasing Demand in Key Industries | ||

|

Companies Covered in the report: |

· ExxonMobil Corporation, Royal Dutch Shell PLC, BASF SE, SABIC (Saudi Basic Industries Corporation), LyondellBasell Industries N.V.., Dow Chemical Company, Reliance Industries Limited, LG Chem Ltd, Chevron Phillips Chemical Company, Mitsubishi Chemical Corporation and Other Major Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the C9 Aromatic Solvent Market research report?

Answer: The forecast period in the Market research report is 2024-2032.

2. Who are the key players in the C9 Aromatic Solvent Market?

Answer: ExxonMobil Corporation, Royal Dutch Shell PLC, BASF SE, SABIC (Saudi Basic Industries Corporation), LyondellBasell Industries N.V.., Dow Chemical Company, Reliance Industries Limited, LG Chem Ltd, Chevron Phillips Chemical Company, Mitsubishi Chemical Corporation and Other Major Players.

3. What are the segments of the C9 Aromatic Solvent Market?

Answer: The C9 Aromatic Solvent Market is segmented into By Type, By Application, By End-Use Industry and region. By Type, the market is categorized into Pure C9 Aromatic Solvents, Mixed C9 Aromatic Solvents. By Application, the market is categorized into Paints & Coatings, Adhesives, Cleaning & Degreasing, Rubber & Plastic Industry, Others. By End-Use Industry, the market is categorized into Automotive, Construction, Chemical Processing, Pharmaceuticals, Consumer Goods. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the C9 Aromatic Solvent Market?

Answer: The C9 aromatic solvent market refers to the industry involved in the production and distribution of C9 aromatic hydrocarbons, which are a mixture of benzene, toluene, and xylene derivatives. These solvents are widely used in various applications, including paints, coatings, adhesives, printing inks, and chemical manufacturing, due to their effective solvent properties and ability to dissolve a broad range of substances. C9 aromatic solvents are valued for their high aromatic content, low volatility, and excellent dissolving capacity, making them essential in industries such as automotive, construction, and industrial coatings. The market is influenced by factors such as demand from end-user industries, environmental regulations, and fluctuations in raw material prices.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.