🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Cold Storage Market

Cold Storage Market By Temperature Type (Chilled Storage and Frozen Storage), By Application (Food & Beverages, Pharmaceuticals, Chemicals, and Others), By Storage Type (Bulk Storage, Warehouse Storage, Refrigerated Containers, and Others), By End-User (Food Retailers, Food Service Providers, Food Processors, Pharmaceutical Companies, and Others), By Region (North America, Europe, APAC, South America and MEA), Key Market Players- Forecast (2024-2033)

Jun 2024

Packaging and Transports

Pages: 180

ID: IMR1084

Cold Storage Market Overview

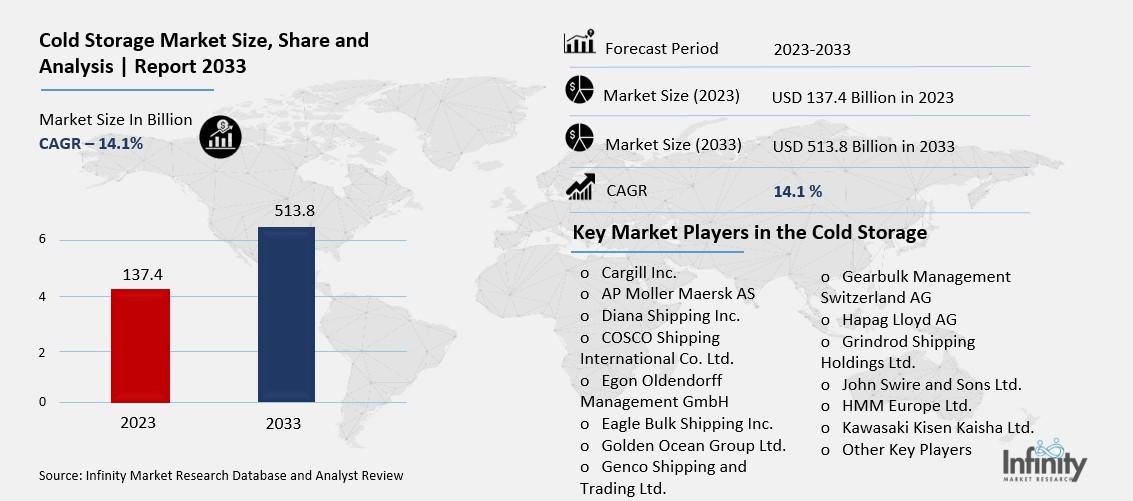

The Cold Storage Market size is expected to be valued at USD 137.4 billion in 2023 and is anticipated to reach upto 513.8 billion in 2033, exhibiting a CAGR of 14.1% during the forecast period from 2024 to 2033.

The cold storage market plays a vital role in maintaining the quality, safety, and availability of perishable goods across various industries. It encompasses facilities and infrastructure designed to store products at controlled temperatures, typically ranging from chilled to frozen conditions. Primarily driven by the food and beverage sector, where preserving freshness is paramount, the cold storage market caters to a wide array of products including fruits, vegetables, dairy, meat, seafood, and processed foods.

Additionally, pharmaceutical companies heavily rely on cold storage solutions to maintain the potency and efficacy of temperature-sensitive drugs and vaccines throughout the supply chain. The market is characterized by a range of storage types, including warehouse storage, refrigerated containers, and specialized facilities such as blast freezers, tailored to different industry needs. Advanced technologies like mechanical refrigeration dominate the market, offering precise temperature control and scalability.

Segment Overview

By Temperature Type Analysis

On the basis of Temperature Type segment, the market is divided into chilled storage and frozen storage. The frozen segment is expected to dominate the market during the forecast period with the 57.1% of market revenue. Frozen storage addresses a wide range of industries including food, pharmaceuticals, and chemicals, offering solutions for long-term preservation of products at sub-zero temperatures. With the global food industry increasingly relying on frozen storage to extend shelf life, reduce food waste, and maintain product quality, the demand for frozen storage facilities has surged.

Additionally, frozen storage is crucial for storing perishable goods during transportation and distribution, ensuring they reach consumers in optimal condition. Moreover, technological advancements in freezing techniques and storage infrastructure have enhanced the efficiency and reliability of frozen storage solutions, further driving their adoption. As consumer preferences shift towards convenience foods and frozen products, particularly in urban areas, the demand for frozen storage facilities is expected to continue its upward trajectory, consolidating its position as the dominant segment in the cold storage market.

By Application Analysis

On the basis of Application segment, the market is divided into food & beverages, pharmaceuticals, chemicals, and others. The food & beverages segment was anticipated to hold the prominent market share of 32.1% in the overall market. This dominance stems from the critical role that cold storage plays in preserving the freshness, quality, and safety of perishable food items throughout the supply chain. With the global population steadily rising and consumer preferences shifting towards fresh and minimally processed foods, the demand for cold storage solutions within the food and beverage industry has surged. These facilities cater to a diverse range of products including fruits, vegetables, dairy, meat, seafood, and processed foods, requiring specific temperature-controlled environments to prolong shelf life and prevent spoilage.

Moreover, stringent regulatory requirements and food safety standards further emphasize the importance of cold storage in maintaining product integrity and mitigating risks associated with foodborne illnesses. As the food and beverage industry continues to expand and innovate, driven by evolving consumer preferences and market dynamics, the demand for cold storage solutions is expected to remain robust, consolidating the food & beverages segment's prominent position in the cold storage market.

By Storage Type Analysis

On the basis of Storage Type segment, the market is divided into on-road vehicles and on-road vehicles. Among these, warehouse storage was expected to acquire most of the market share of 42.5% in the market. warehouse storage facilities offer extensive storage capacity and flexibility, accommodating large volumes of perishable goods across diverse industries including food, pharmaceuticals, and chemicals. These facilities are equipped with temperature-controlled environments, allowing for precise regulation of temperature and humidity levels to ensure optimal conditions for product preservation.

Additionally, warehouse storage facilitates efficient inventory management, order fulfillment, and distribution processes, enabling businesses to streamline operations and meet customer demands effectively. With the global supply chain becoming increasingly complex and interconnected, the need for warehouse storage solutions continues to rise, driven by factors such as urbanization, e-commerce growth, and evolving consumer preferences. As companies prioritize logistics optimization and supply chain resilience, warehouse storage is poised to maintain its prominent position in the cold storage market, serving as a cornerstone for efficient and sustainable cold chain management strategies.

By End-User Analysis

On the basis of end-user, the market is divided into food retailers, food service providers, food processors, pharmaceutical companies, and others. Among these, food retailers segment was expected to collect maximum share of 37%. This dominance is rooted in the fundamental need for food retailers to maintain the freshness and quality of perishable goods throughout the supply chain. With a growing global population and changing consumer preferences, the demand for fresh produce, dairy, meat, and other perishable items has surged. Food retailers, including supermarkets, grocery stores, and specialty food shops, rely heavily on cold storage facilities to preserve the integrity of their products, prolong shelf life, and minimize food waste. These facilities enable retailers to stock a diverse range of perishable goods while ensuring compliance with food safety regulations and quality standards.

Market Segments

By Temperature Type

o Chilled Storage

o Frozen Storage

By Application

o Food & Beverages

o Pharmaceuticals

o Chemicals

o Others

By Storage Type

o Bulk Storage

o Warehouse Storage

o Refrigerated Containers

o Others

By End-User

o Food Retailers

o Food Service Providers

o Food Processors

o Pharmaceutical Companies

o Others

Regional Overview

North America

o The US

o Canada

Europe

o Germany

o United Kingdom

o France

o Italy

o Spain

o Rest of Europe

Asia-Pacific

o China

o India

o Japan

o South Korea

o Rest of Asia-Pacific

South America

o Brazil

o Argentina

o Rest of South America

Middle East and Africa

o GCC

o South Africa

o Rest of MEA

Driver

Increasing Demand for Perishable Goods

The increasing demand for perishable goods, such as fresh produce, dairy products, and frozen foods, stands as a significant driving force behind the growth of the cold storage market. This surge in demand is intricately tied to several intertwined factors shaping modern consumer behavior and market dynamics. Firstly, changing consumer lifestyles have led to a preference for fresher and healthier food options, emphasizing the need for efficient cold storage solutions to maintain product quality and freshness.

Additionally, rapid urbanization trends worldwide have resulted in a shift towards urban living, where access to fresh and diverse food choices is paramount. As urban populations continue to grow, the demand for perishable goods escalates, further driving the need for cold storage infrastructure in densely populated areas. Moreover, the rise in disposable incomes, particularly in emerging economies, has empowered consumers to indulge in a wider variety of perishable foods, including imported and specialty items. This increased purchasing power fuels the demand for cold storage facilities to preserve and distribute these goods efficiently.

Restraints

Energy Consumption and Environmental Concerns

Cold storage facilities play a pivotal role in maintaining the freshness and quality of perishable goods, but their operation comes with significant energy demands, contributing to high operational costs and environmental considerations. These facilities require continuous refrigeration and temperature control to preserve products at optimal conditions, leading to substantial energy consumption. The energy-intensive nature of cold storage operations translates into elevated operational expenses for companies, including expenditures on electricity, maintenance, and equipment.

Additionally, the reliance on conventional refrigeration systems, often powered by fossil fuels, exacerbates environmental concerns by contributing to greenhouse gas emissions and climate change. The release of refrigerants, such as hydrofluorocarbons (HFCs), used in cooling systems, further compounds environmental impacts due to their high global warming potential. As sustainability becomes a pressing issue in today's business landscape, the environmental footprint of cold storage facilities comes under scrutiny.

Opportunity

Expansion of Cold Chain Networks

The expansion of cold chain networks into previously untapped geographic regions and diverse market segments, particularly in healthcare and pharmaceuticals, presents a significant opportunity for service providers to broaden their offerings and penetrate new markets. As globalization accelerates and supply chains become increasingly interconnected, there is a growing demand for reliable cold chain logistics to ensure the safe and efficient transportation of temperature-sensitive products, including vaccines, biologics, and pharmaceuticals, across borders and regions.

The healthcare and pharmaceutical industries, in particular, require stringent temperature-controlled environments to maintain the integrity and efficacy of their products throughout the entire supply chain, from manufacturing to distribution to end-user delivery. By expanding cold chain networks into new regions and market segments, service providers can cater to the evolving needs of these industries and capitalize on emerging opportunities. This expansion allows for the provision of specialized services tailored to the unique requirements of healthcare and pharmaceutical logistics, such as temperature monitoring, validation, and regulatory compliance.

Trends

Sustainable Cold Storage Practices

The implementation of sustainable practices within the cold storage industry, encompassing measures such as the adoption of energy-efficient refrigeration systems, utilization of renewable energy sources, and incorporation of eco-friendly packaging materials, reflects a growing alignment with consumer preferences for environmentally responsible products and practices. In an era marked by heightened environmental awareness and concern for sustainability, consumers are increasingly inclined towards supporting businesses that demonstrate a commitment to minimizing their ecological footprint. Cold storage facilities, known for their energy-intensive operations, are under pressure to transition towards more sustainable practices to mitigate their environmental impact.

By investing in energy-efficient refrigeration systems, which utilize advanced technologies to optimize cooling processes and minimize energy consumption, cold storage operators can achieve significant reductions in operational costs and greenhouse gas emissions while maintaining product integrity. Furthermore, the integration of renewable energy sources such as solar, wind, or hydroelectric power into cold storage operations offers a dual benefit of reducing reliance on fossil fuels and lowering carbon emissions associated with electricity generation.

Regional Analysis

North America has dominated the Market with the Highest Revenue Share

North America acquired the majority of share of 37% in the cold storage market. The region boasts a robust and well-established cold chain infrastructure, comprising a network of advanced cold storage facilities, distribution centers, and transportation systems. This extensive infrastructure enables efficient and reliable storage and transportation of perishable goods across various industries, including food and beverages, pharmaceuticals, and chemicals.

Additionally, North America's affluent consumer base, characterized by high purchasing power and a strong preference for fresh and high-quality perishable products, drives substantial demand for cold storage solutions. As consumer lifestyles continue to evolve, with an increasing emphasis on convenience, health, and sustainability, the demand for perishable goods, including fresh produce, dairy products, and frozen foods, remains consistently high.

Competitive Analysis

A competitive analysis of the cold storage market involves examining the dynamics and strategies of key players within the industry to understand their strengths, weaknesses, opportunities, and threats. This analysis encompasses various aspects, including market share, product offerings, pricing strategies, distribution channels, and competitive positioning. Key players in the cold storage market compete on factors such as the breadth and quality of their storage facilities, technological capabilities, geographic reach, and customer service. Market leaders leverage their extensive networks and economies of scale to offer comprehensive cold chain solutions tailored to the diverse needs of industries such as food and beverages, pharmaceuticals, and chemicals.

Additionally, technological innovation plays a significant role in driving competitive differentiation, with companies investing in advanced refrigeration systems, automation, and data analytics to enhance operational efficiency, product quality, and customer satisfaction. Pricing strategies vary across competitors, with some focusing on cost leadership to capture market share, while others differentiate themselves through premium services and value-added offerings.

Recent Development

In March 2023, Americold has invested in Dubai-based RSA Cold Chain to expand its presence locally and explore growth opportunities in the Middle East and nearby markets, while also connecting RSA Cold Chain to Americold's global network.

In June 2022, Americold opened its first facility in Dunkirk, New York, featuring LEED certification, 181,000 square feet of space, and 25,000 pallet positions to meet the area's cold storage demands.

Key Players

Various key players in the global Cold Storage market are:

o Oceana Group Limited

o Agro Merchants Group

o Burris Logistics

o Cloverleaf Cold Storage

o Oxford Logistics Group

o Henningsen Cold Storage Company

o Al Rai Logistica K.S.C

o LINEAGE LOGISTICS HOLDING, LLC

o Preferred Freezer

o Other Key Players

|

Report Attribute |

Details |

|

Market Size 2023 |

USD 137.4 Bn |

|

Market Size 2033 |

USD 513.8 Bn |

|

Compound Annual Growth Rate (CAGR) |

14.1% |

|

Market Forecast Period |

2023-2033 |

|

Historical Data |

2018-2022 |

|

Region Covered |

North America, Europe, Asia-Pacific, South America, Middle East and Africa |

|

Market Scope |

Temperature Type, Application, Storage Type, End-User, and Region |

|

Key Players |

Oceana Group Limited, Americold Logistics, Inc., Agro Merchants Group, Kloosterboer, Barloworld Limited, Burris Logistics, Cloverleaf Cold Storage, RSA Logistics, Oxford Logistics Group, Henningsen Cold Storage Company, Al Rai Logistica K.S.C, LINEAGE LOGISTICS HOLDING, LLC, Gulf Drug LLC, Nordic Logistics, Preferred Freezer, and Other Key Players. |

📘 Frequently Asked Questions

1. How much is the Cold Storage Market in 2023?

Answer: The Cold Storage Market size was valued at USD 137.4 Billion in 2023.

2. What would be the forecast period in the Cold Storage Market?

Answer: The forecast period in the Cold Storage Market report is 2023-2033.

3. Who are the key players in the Cold Storage Market?

Answer: Oceana Group Limited, Americold Logistics, Inc., Agro Merchants Group, Kloosterboer, Barloworld Limited, Burris Logistics, Cloverleaf Cold Storage, RSA Logistics, Oxford Logistics Group, Henningsen Cold Storage Company, Al Rai Logistica K.S.C, LINEAGE LOGISTICS HOLDING, LLC, Gulf Drug LLC, Nordic Logistics, Preferred Freezer, and Other Key Players.

4. What is the growth rate of the Cold Storage Market?

Answer: Cold Storage Market is growing at a CAGR of 14.1%% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.