🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Cross-Border Payments Market

Global Cross-Border Payments Market (By Transaction Type, Business to Business (B2B), Business to Customer (B2C), Customer to Business (C2B), and Customer to Customer (C2C); By Enterprise Size, Large Enterprise Size and Small and Medium-sized Enterprises; By Channel, Bank Transfer, Card Payment, Money Transfer Operator, and Other Channels; By End-User, Individuals and Businesses; By Region and Companies), 2024-2033

Nov 2024

Financial Services & Insurance

Pages: 138

ID: IMR1307

Cross-Border Payments Market Overview

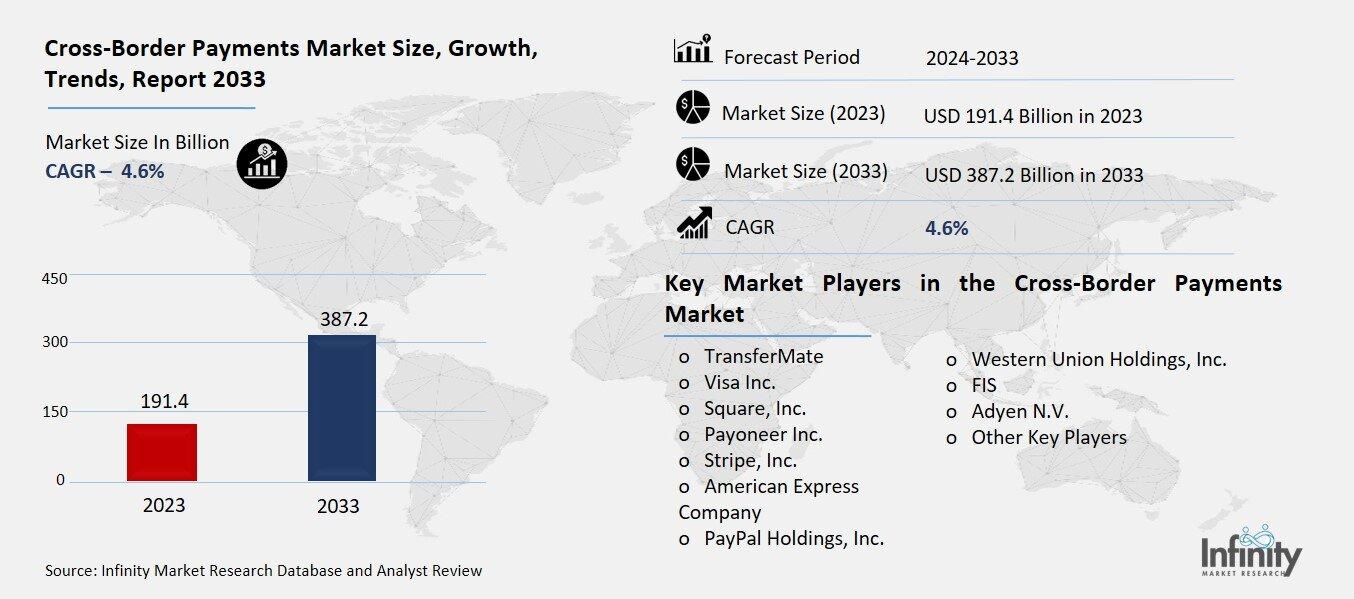

Global Cross-Border Payments Market acquired the significant revenue of 191.4 Billion in 2023 and expected to be worth around USD 387.2 Billion by 2033 with the CAGR of 7.3% during the forecast period of 2024 to 2033. The cross border payment market involves the movement of value across borders in different currency, is a core of international trade and ecommerce. So, it has bank transfers, credit/debit card payments, and those relatively newer concepts like blockchain and fintech.

Direct credit transfer, the most common international bank payment method, often takes a long time to process, is expensive because several intermediaries are involved, and has serious compliance issues. However, the developments in market have been fast tracked by more demanding consumers demanding faster and less costly methods of payment such as the use of digital payments, peer to -peer platforms as well as real time payment systems. Hence why fintech firms follow the same course by entering into the market and offering efficient services that are charged at reasonable rates compared to the time-consuming and frequently obscure services from banks.

Drivers for the Cross-Border Payments Market

Globalization and E-commerce Growth

Globalization and the era of the world wide web has led to higher employment of cross-border transactions with existing international trade and the increase use of the internet for shopping. Now, any enterprise starting with the multinational corporation and ending with the small online shop can deliver goods to the customer across the globe, which increases the demand for fast and reliable international payment systems. For businesses, it is crucial to be able to connect with customers all over the world since this will enable such firms to expand within worldwide markets and service differing needs of these customers.

While using cross border payment has its obvious benefits, it also has the following disadvantages; These are some of the complications that are likely to make cross border payment a problem operationally; Currently, there is increased need for payments solutions that offer not only efficient and secure methods of payment but also free from hidden charges and exchange rates.

Restraints for the Cross-Border Payments Market

Currency Volatility and Exchange Rate Risks

Frequent fluctuations in exchange rates are a significant challenge in cross-border payments, as they can dramatically impact transaction costs and reduce profitability for businesses operating globally. Currency values can shift rapidly due to economic, political, or market factors, meaning the amount received from international sales can differ from the amount expected. This uncertainty creates risks for revenue stability, as businesses might face unexpected losses or reduced profit margins if exchange rates move unfavorably after a transaction is initiated.

Additionally, hedging strategies or financial instruments designed to manage these risks can add complexity and cost, impacting cash flow and operational planning. For small and medium-sized enterprises (SMEs) with limited resources, such currency volatility can be especially challenging, as they may lack the sophisticated tools or resources to mitigate these fluctuations effectively.

Opportunity in the Cross-Border Payments Market

Growth in Digital Currencies and Blockchain Solutions

Cryptocurrencies and blockchain technology have introduced a promising alternative for cross-border payments by offering a faster, more cost-effective, and secure way to transfer value across borders. Unlike traditional banking methods, which rely on multiple intermediaries and can involve high fees and lengthy processing times, blockchain-based payments enable near-instantaneous transactions with lower transaction costs. Cryptocurrencies eliminate the need for currency conversions by providing a universal digital currency, while blockchain’s decentralized nature enhances transparency and security through its immutable, distributed ledger. These features reduce risks related to fraud and chargebacks, making blockchain a particularly attractive solution for businesses and individuals engaged in international trade.

Trends for the Cross-Border Payments Market

Increased Use of Artificial Intelligence (AI) and Machine Learning

Artificial intelligence (AI) is transforming the cross-border payments landscape by enhancing security, efficiency, and user experience. In fraud detection, AI algorithms analyze vast amounts of transaction data to identify unusual patterns or behaviors that may indicate fraudulent activities. By continuously learning from new data, AI systems can adapt to evolving fraud tactics, providing real-time alerts and significantly reducing the risk of financial loss. This proactive approach to fraud detection is particularly valuable in cross-border transactions, where varying regulations and increased complexity can make fraud harder to detect manually.

Segments Covered in the Report

By Transaction Type

o Business to Business (B2B)

o Business to Customer (B2C)

o Customer to Business (C2B)

o Customer to Customer (C2C)

By Enterprise Size

o Large Enterprise Size

o Small and Medium-sized Enterprises

By Channel

o Bank Transfer

o Card Payment

o Money Transfer Operator

o Other Channels

By End-User

o Individuals

o Businesses

Segment Analysis

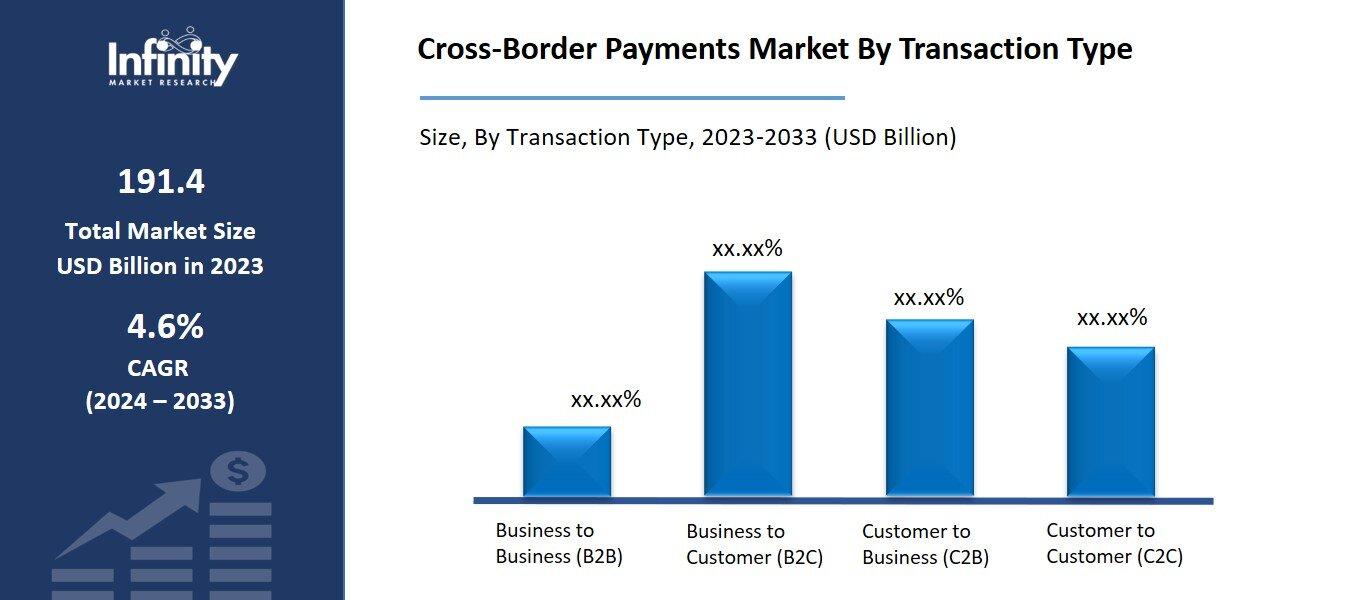

By Transaction Type Analysis

On the basis of transaction type, the market is divided into business to business (B2B), business to customer (B2C), customer to business (C2B), and customer to customer (C2C). Among these, business to business (B2B) segment acquired the significant share in the market owing to the substantial volume and value of international trade between businesses, necessitating efficient and reliable cross-border payment solutions. While other segments like Business-to-Consumer (B2C), Consumer-to-Business (C2B), and Consumer-to-Consumer (C2C) are growing, especially with the rise of e-commerce and global remittances, B2B transactions continue to lead in market share due to the scale and frequency of business transactions across borders.

By Enterprise Size Analysis

On the basis of enterprise size, the market is divided into large enterprise size and small & medium-sized enterprises. Among these, large enterprise held the prominent share of the market due to their extensive international operations and higher transaction volumes. These organizations often engage in significant global trade, necessitating efficient and reliable cross-border payment solutions. However, small and medium-sized enterprises (SMEs) are increasingly contributing to market growth.

SMEs make up 90% of the world's businesses and are crucial contributors to many regional economies. As globalization and e-commerce expand, SMEs are participating more in international trade, driving demand for cost-effective and efficient cross-border payment solutions tailored to their needs.

By Channel Analysis

On the basis of channel, the market is divided into bank transfer, card payment, money transfer operator, and other channels. Among these, bank transfer held the significant share of the market. Banks offer a range of services, including wire transfers and foreign exchange, which cater to the diverse needs of their customers. Despite the emergence of various digital payment solutions, many businesses and individuals still prefer to use banks for their international transactions, valuing the trust and reliability associated with these institutions. However, the increasing adoption of digital payment methods, such as money transfer operators and card payments, is gradually altering the market dynamics, offering consumers more options for cross-border transactions.

By End-User Analysis

On the basis of end-user, the market is divided into individuals and businesses. Among these, businesses held the most of the share of the market owing to the substantial volume and value of international trade between businesses, necessitating efficient and reliable cross-border payment solutions. While other segments like Business-to-Consumer (B2C), Consumer-to-Business (C2B), and Consumer-to-Consumer (C2C) are growing, especially with the rise of e-commerce and global remittances, B2B transactions continue to lead in market share due to the scale and frequency of business transactions across borders.

Regional Analysis

North America Dominated the Market with the Highest Revenue Share

North America held the most of the share of 34.1% of the market. The region’s high volume of international trade and significant remittance flows contribute to its substantial market share, as businesses and individuals frequently engage in cross-border transactions.

Furthermore, the presence of major financial institutions and a growing fintech ecosystem in North America has spurred innovation in payment technologies, making cross-border transactions more efficient, secure, and cost-effective. The increasing adoption of digital payment solutions and the expansion of e-commerce further reinforce North America's leading position in the global cross-border payments market.

Competitive Analysis

The cross-border payments market is highly competitive, with a mix of traditional financial institutions, fintech companies, and emerging technologies all vying for market share. Major players in the market include large banks, payment service providers (PSPs), and money transfer operators like PayPal, Western Union, and SWIFT, which have long dominated the landscape by offering reliable, established solutions for international transactions. However, the rise of fintech startups and digital payment platforms, such as Revolut, TransferWise (now Wise), and Ripple, has disrupted the market with innovative offerings that emphasize lower fees, faster transactions, and transparency.

Recent Developments

In September 2023, YES Bank introduced a cross-border payments solution in collaboration with BriskPe, unveiling BriskPe A2A, a suite of services designed for importers and exporters. Through this platform, BriskPe customers will be able to receive payments from over 180 countries and in more than 36 foreign currencies.

In July 2023, Jeeves, a financial operating system, launched global cross-border payments and prepaid local cards, expanding its corporate services across three continents. Initially offering corporate credit cards, Jeeves has experienced a significant rise in demand for its cross-border payments solution, particularly in Latin America.

Key Market Players in the Cross-Border Payments Market

o TransferMate

o Visa Inc.

o Square, Inc.

o Payoneer Inc.

o Stripe, Inc.

o American Express Company

o PayPal Holdings, Inc.

o Western Union Holdings, Inc.

o FIS

o Adyen N.V.

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 191.4 Billion |

|

Market Size 2033 |

USD 387.2 Billion |

|

Compound Annual Growth Rate (CAGR) |

4.6% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Transaction Type, Enterprise Size, Channel, End-User, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

TransferMate, Visa Inc., Square, Inc., Payoneer Inc., Stripe, Inc., American Express Company, PayPal Holdings, Inc., Western Union Holdings, Inc., FIS, Adyen N.V., and Other Key Players. |

|

Key Market Opportunities |

Growth in Digital Currencies and Blockchain Solutions |

|

Key Market Dynamics |

Globalization and E-commerce Growth |

📘 Frequently Asked Questions

1. Who are the key players in the Cross-Border Payments Market?

Answer: TransferMate, Visa Inc., Square, Inc., Payoneer Inc., Stripe, Inc., American Express Company, PayPal Holdings, Inc., Western Union Holdings, Inc., FIS, Adyen N.V., and Other Key Players.

2. How much is the Cross-Border Payments Market in 2023?

Answer: The Cross-Border Payments Market size was valued at USD 191.4 Billion in 2023.

3. What would be the forecast period in the Cross-Border Payments Market?

Answer: The forecast period in the Cross-Border Payments Market report is 2024-2033.

4. What is the growth rate of the Cross-Border Payments Market?

Answer: Cross-Border Payments Market is growing at a CAGR of 4.6% during the forecast period, from 2024 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.