🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Flow Cytometry Market

Flow Cytometry Market Global Industry Analysis and Forecast (2024-2033) by Product & Services (Instruments, Reagents & Consumables, and Software & Services), Technology (Cell Based and Bead Based), Application (Clinical and Research), End-User (Pharmaceutical & Biotechnology Industries, Academic & Research Organizations, Hospital & Diagnostics, and Other End-Users), and Region

Jul 2025

Healthcare

Pages: 138

ID: IMR2100

Flow Cytometry Market Synopsis

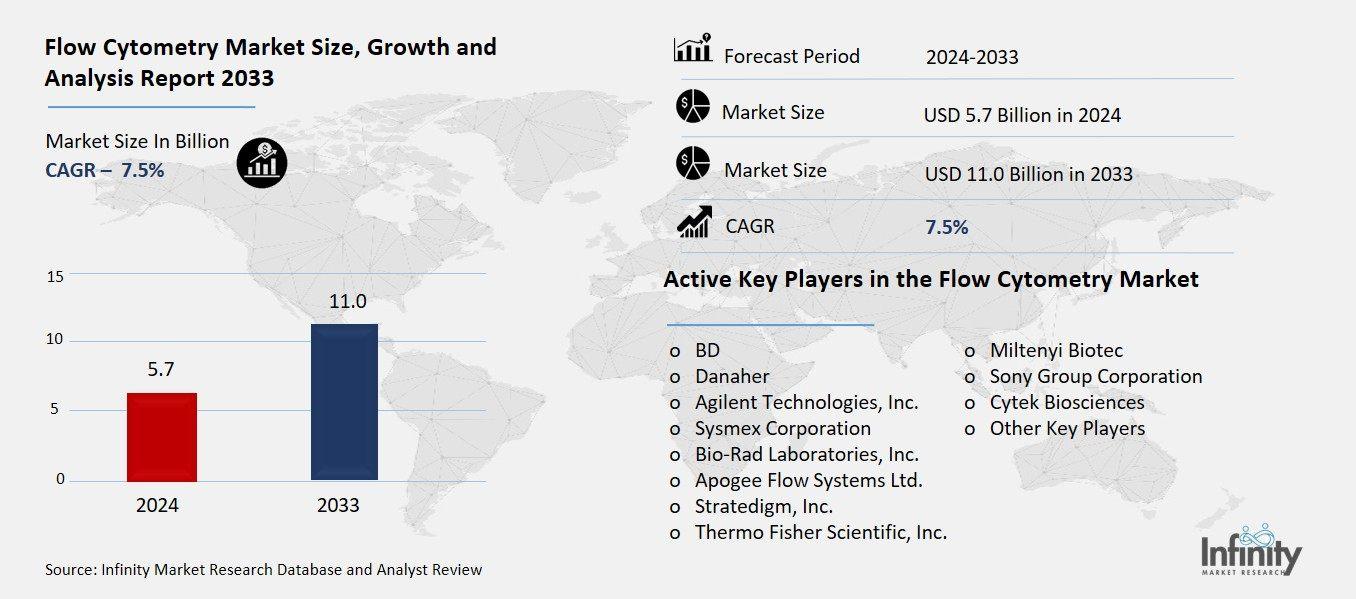

The Global Flow Cytometry Market was valued at USD 5.3 billion in 2023 and is expected to grow from USD 5.7 billion in 2024 to USD 11.0 billion by 2033, reflecting a CAGR of 7.5% over the forecast period.

Enhancement in biotechnology and growth in the burden of chronic diseases, and the growing demand of fast and precise diagnostic tools, among others are leading to the strong growth of the flow cytometry market. Flow cytometry is commonly used both in the research and clinical setting to analyze cells, allowing in-depth study of cell populations using size, complexities, and biomarkers. The main drivers that are helping the market grow include, the rising application of flow cytometry in drug discovery, cancer diagnostics and immunology, and the rising funding in healthcare infrastructure and research and development (R&D) activities.

Flow Cytometry Market Driver Analysis

Rising Incidence of Chronic and Infectious Diseases

Increasing cancer, HIV and auto immune diseases are largely motivating the demand of complex diagnostic devices like flow cytometry. The diseases have to be detected properly and in time to successfully treat and follow the development of the disease and flow cytometry can provide high-throughput multiparametric cell analysis and thus it would be perfect technology to use with the disease. Examples flow cytometry is applied in cancer to study the characteristics of tumor cells, to track minimal residual disease and to study immune cell populations. This is also the case in the case of HIV where it is important in management of CD4+ T-cell counts and these play an essential role in determining the progression of the disease or the way the disease responds to the treatment.

Flow Cytometry Market Restraint Analysis

Complexity of Data Analysis

Flow cytometry experiments generate multi-dimensional, high-dimensional data: multiple parameters of fluorescence per cell. Effective analysis of this data will be needed using advanced analytical tools and statistics to find the meaningful patterns and cell populations. Manual gating and data interpretation may be very slow, inaccurate, and inconsistent without more sophisticated software options, e.g., machine learning algorithms, specific cytometry analysis systems, like FlowJo, FCS Express, or Cytobank. Also, laboratories with no skilled workers and/or training will have a difficulty in accessing the tools because they require the user to be very familiar with immunophenotyping, fluorophore compensation, and gating strategies.

Flow Cytometry Market Opportunity Analysis

Development of Portable and User-Friendly Systems

Portable and affordable-flow cytometry solutions in specimen-to-information flow are becoming increasingly necessary, especially in remote or underserved areas where access to centralized laboratories is restricted. They are not easily achievable in such settings since the conventional flow cytometers are large, costly truckloads, and they need stable infrastructure and manpower to operate. With this, the manufacturers are finding ways to produce small scale, patient friendly devices capable of providing accurate outcomes at the point of care. Such developments allow quick diagnostics of such diseases as HIV, tuberculosis, and malaria right in the disease clinic or the field. Moreover, such devices are easier to use, even by non-specialized users because of simplified workflows and analysis software written into the device.

Flow Cytometry Market Trend Analysis

Growing Use in Veterinary and Agricultural Research

Traditionally grounded in human healthcare and biomedical research, flow cytometry is finding increased applications in veterinary medicine and agricultural sciences, introducing novel opportunities to expand the market. It is also utilised in animal health to do immunophenotyping, livestock and companion animal vaccine development and disease diagnosis. This will contribute to the augmenting interest in environmentally safe and sustainable animal husbandry. Flow cytometry is used in crop science to size the genome of plants, to study their cell cycle, and as the basis of taking measures of genetic stability in breeding programs.

Flow Cytometry Market Segment Analysis

The Flow Cytometry Market is segmented on the basis of Product & Services, Technology, and Application.

By Product & Services

o Instruments

o Analyzer

o Sorter

o Reagents & Consumables

o Software & Services

By Technology

o Cell Based

o Bead Based

By Application

o Clinical

o Research

By End-User

o Pharmaceutical & Biotechnology Industries

o Academic & Research Organizations

o Hospital & Diagnostics

o Other End-Users

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Product & Services, Instrument Segment is Expected to Dominate the Market During the Forecast Period

The product & services discussed in this research study, the instrument segment is expected to account for the largest market share of flow cytometry market in the forecast period. The need to have new technologies in flow cytometry instruments is fueling this dominance, including flow cytometry instruments that are high throughput and multi-parametric analyzers and those that are compact and portable and designed specifically in clinical and research practices. The growing demand of benchtop and advanced cell analyzers in hospitals, clinical laboratories and research institutes is also leading to growth. Moreover, increased attention to automation and integration with digital-based platforms and convenient user interface made modern instruments more accessible and more efficient.

By Technology, the Cell Based Segment is Expected to Held the Largest Share

The cell based segment is likely to dominate the market. This superiority is explained by considering that the cell-based flow cytometry finds a wide application in both scientific and clinical diagnostics and in the studies of immunology, oncology, and stem cells in particular. The technology allows the cell size, granularity, surface and intracellular marker and cell viability and functionality to be studied in detail, which is important in the mechanism of the diseases and therapeutic reactions.

By Application, the Clinical Segment is Expected to Held the Largest Share

The clinical segment is expected to dominate the flow cytometry market by application during the forecast period. This is mostly attributable to the fact that flow cytometry is broadly used in the diagnosis, and monitoring of diseases such as cancer (particularly haematologic malignancies, HIV/AIDS, and autoimmune disorders, as well as immunodeficiencies. Flow cytometry is a mandatory part of the routine diagnostic process in clinical labs and hospitals because of immunophenotyping, detection of minimal residual disease (MRD), enumeration of stem cells, etc. The rising development of chronic and infectious ailments and progressively consciousness of early and accurate diagnostics is driving demand in clinical application of flow cytometry.

By End-User, the Academic & Research Organizations Segment is Expected to Held the Largest Share

The academic and research organizations segment is anticipated to hold the largest share of the flow cytometry market by end-user during the forecast period. It is mostly motivated by the fact that flow cytometry has found extensive applications in basic and applied research in areas that include immunology, cell biology, cancer biology and in stem cell research. Flow cytometry is used in universities, research institutes and government-funded laboratories because it allows rapid multiparametric cell populations analysis.

Flow Cytometry Market Regional Insights

North America is Expected to Dominate the Market Over the Forecast period

North America is projected to lead the flow cytometry market during the forecast period, driven by a combination of advanced healthcare infrastructure, strong research and development capabilities, and high adoption of innovative technologies. The region also enjoys the availability of large players in the market, long enough academic and clinical facilities engaged in research and development and high funding both governmental and otherwise on life sciences research. Moreover, high rates of chronic and infectious disorders, growing attention to precision medicine, extensive application of flow cytometry in diagnostics and drug discovery also drive the development of the market. Particularly, the United States has been leading as it has a prolific biopharmaceutical industry, qualified workforce, and regulators, which are friendly. All of these place North America as the main regional market of flow cytometry.

Recent Development

In January 2025, BD (Becton, Dickinson and Company) partnered with Biosero, a provider of laboratory automation solutions, to integrate robotic arms with BD’s flow cytometry instruments. This collaboration aims to automate traditionally manual tasks involved in drug discovery and development, thereby improving efficiency, consistency, and throughput in laboratory workflows.

In March 2024, Beckman Coulter Life Sciences has received 510(k) clearance from the U.S. FDA to market its DxFLEX Clinical Flow Cytometer in the United States. This regulatory approval marks a significant step in expanding access to high-complexity flow cytometry testing, enabling laboratories to perform advanced diagnostics without incurring substantial additional costs.

Active Key Players in the Flow Cytometry Market

o BD

o Danaher

o Sysmex Corporation

o Apogee Flow Systems Ltd.

o Stratedigm, Inc.

o Thermo Fisher Scientific, Inc.

o Miltenyi Biotec

o Sony Group Corporation

o Cytek Biosciences

o Other Key Players

Global Flow Cytometry Market Scope

|

Global Flow Cytometry Market | |||

|

Base Year: |

2024 |

Forecast Period: |

2024-2033 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.3 Billion |

|

Market Size in 2024: |

USD 5.7 Billion | ||

|

Forecast Period 2024-33 CAGR: |

7.5% |

Market Size in 2033: |

USD 11.0 Billion |

|

Segments Covered: |

By Product & Services |

· Instruments o Analyzer o Sorter · Reagents & Consumables · Software & Services | |

|

By Technology |

· Cell Based · Bead Based | ||

|

By Application |

· Clinical · Research | ||

|

By End-User |

· Pharmaceutical & Biotechnology Industries · Academic & Research Organizations · Hospital & Diagnostics · Other End-Users | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Rising Incidence of Chronic and Infectious Diseases | ||

|

Key Market Restraints: |

· Complexity of Data Analysis | ||

|

Key Opportunities: |

· Development of Portable and User-Friendly Systems | ||

|

Companies Covered in the report: |

· BD, Danaher, Agilent Technologies, Inc., Sysmex Corporation and Other Key Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Flow Cytometry Market Research report?

Answer: The forecast period in the Flow Cytometry Market Research report is 2024-2033.

2. Who are the key players in the Flow Cytometry Market?

Answer: BD, Danaher, Agilent Technologies, Inc., Sysmex Corporation and Other Key Players.

3. What are the segments of the Flow Cytometry Market?

Answer: The Flow Cytometry Market is segmented into Product & Services, Technology, Application, and Regions. By Product & Services, the market is categorized into Instruments, Reagents & Consumables, and Software & Services. By Technology, the market is categorized into Cell Based and Bead Based. By Application, the market is categorized into Clinical and Research. By End-User, the market is categorized into Pharmaceutical & Biotechnology Industries, Academic & Research Organizations, Hospital & Diagnostics, and Other End-Users. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Flow Cytometry Market?

Answer: Flow cytometry market is the international business of developing, manufacturing, and selling equipment, reagents, software, and services needed to conduct flow cytometry. Flow cytometry is a lab technique to observe, measure and interpret physical and chemical attributes of cells or particles beneath a laser beam in a flow of liquid. It is also relevant in other fields like immunology, cancer research, hematology and drug exploration as it is able to analyse thousands of cells per second with a high throughput.

5. How big is the Flow Cytometry Market?

Answer: The Global Flow Cytometry Market was valued at USD 5.3 billion in 2023 and is expected to grow from USD 5.7 billion in 2024 to USD 11.0 billion by 2033, reflecting a CAGR of 7.5% over the forecast period.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.