🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Dietary Supplements Market

Dietary Supplements Market (By Ingredient (Vitamins, Botanicals, Minerals, Protein & Amino Acids, Fibers & Specialty Carbohydrates, Omega Fatty Acids, Probiotics, Prebiotics & Postbiotics, Other Ingredients), By Form (Tablets, Capsules, Soft gels, Powders, Gummies, Liquids, Other Forms), By Application (Energy & Weight Management, General Health, Bone & Joint Health, Gastrointestinal Health, Immunity, Cardiac Health, Diabetes, Anti-cancer, Lungs Detox/Cleanse, Skin/ Hair/ Nails, Sexual Health, Brain/Mental Health, Insomnia, Menopause, Anti-aging, Prenatal Health, Other Applications), By End-User (Infants, Children, Adults, Pregnant Women, Geriatric), By Type (OTC and Prescribed), By Distribution Channel (Online and Offline), By Region and Companies)

May 2024

Food Beverage and Nutrition

Pages: 117

ID: IMR1044

Dietary Supplements Market Overview

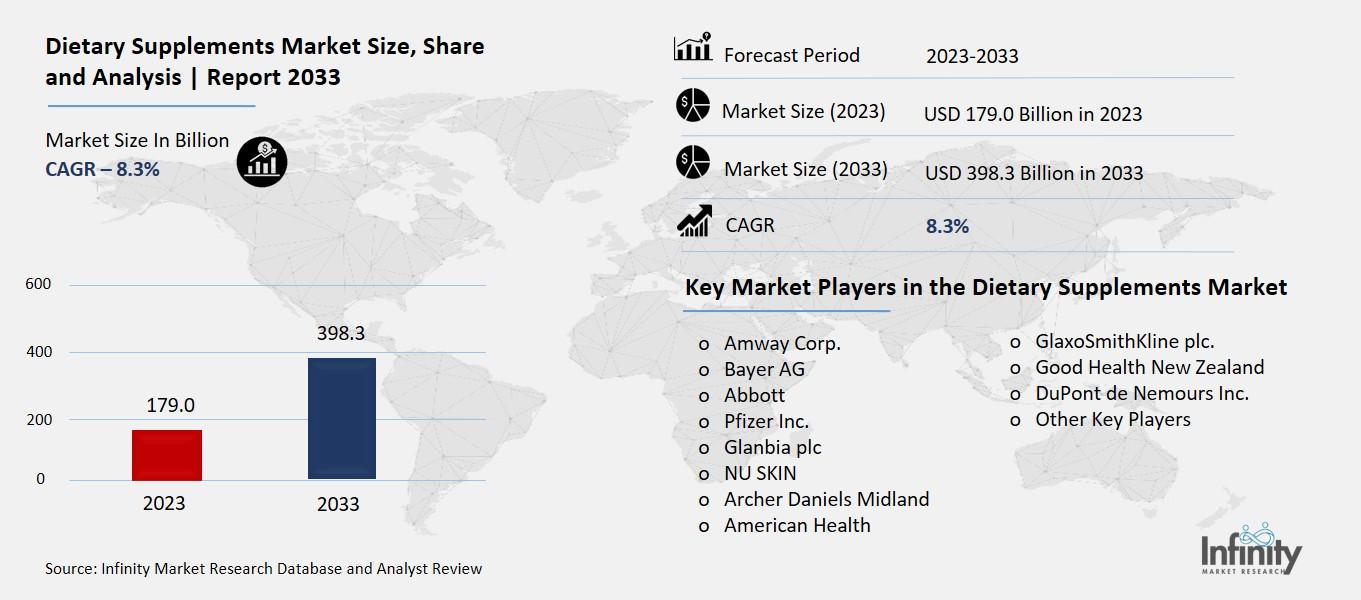

Global Dietary Supplements Market size is expected to be worth around USD 398.3 Billion by 2033 from USD 179.0 Billion in 2023, growing at a CAGR of 8.3% during the forecast period from 2033 to 2033.

The Dietary Supplements Market refers to the industry where companies make and sell products that individuals take to add extra nutrients to their diet. These supplements usually come in the form of pills, powders, liquids, or gummies, and they contain vitamins, minerals, herbs, or other substances that people might not get enough of from their regular meals. Think of them as helpers for your body, filling in the gaps in your diet to ensure you get all the essential nutrients your body needs to stay healthy and function properly.

This market is quite big and offers a wide variety of products designed for different purposes. Some supplements aim to boost overall health and well-being, while others target specific health concerns like joint pain, digestion issues, or low energy levels. Athletes and fitness enthusiasts often use supplements to support their workouts and recovery, while others may take them to address dietary restrictions or preferences that limit their intake of certain nutrients. With so many options available, people can choose supplements based on their individual needs and health goals.

Government authorities regulate the dietary supplements market to make sure that these products are safe, of high quality, and work. Manufacturers have to follow strict rules about where they get their ingredients, how they make the supplements, and what they put on the labels. It's also important for people to talk to their doctors before starting any new supplement, especially if they have medical conditions or take medications that might interact with the supplements. Overall, the dietary supplements market offers a convenient and accessible way for people to support their health and well-being, but it's essential to be informed and cautious when choosing and using these products.

Drivers for the Dietary Supplements Market

Increasing Health Awareness and Wellness Trends

One of the key drivers for the Dietary Supplements Market is the rising awareness of health and wellness among consumers. With more people becoming conscious of the importance of maintaining a healthy lifestyle, there's a growing demand for products that can support overall well-being and address specific health concerns. Market data shows that as lifestyles become more fast-paced and stressful, people are looking for convenient and effective ways to improve their health, such as taking dietary supplements. Whether it's to fill in nutritional gaps in their diet, support immune function, or enhance energy levels, dietary supplements offer a convenient solution for those seeking to optimize their health and feel their best.

Aging Population and Wellness Focus

Another driver for the dietary supplements market is the aging population and the increasing focus on healthy aging. As people age, their nutritional needs may change, and they may require additional support to maintain optimal health and vitality. Market research indicates that older adults are turning to dietary supplements to address age-related health concerns, such as joint health, cognitive function, and bone density. Additionally, with advancements in healthcare and increased life expectancy, there's a growing emphasis on proactive health management and preventive care. Many older adults are taking proactive steps to support their health and well-being through lifestyle modifications, including the use of dietary supplements, contributing to the growth of the market.

Growing Fitness and Sports Nutrition Trends

The dietary supplements market is also driven by the growing fitness and sports nutrition trends. With the rising popularity of fitness activities, sports participation, and active lifestyles, there's a heightened demand for supplements that can support athletic performance, muscle recovery, and overall fitness goals. Market data indicates that athletes, bodybuilders, and fitness enthusiasts often use dietary supplements such as protein powders, amino acids, and pre-workout formulas to enhance their workouts, improve recovery times, and achieve their fitness objectives. Additionally, with the increasing awareness of the importance of nutrition in achieving fitness goals, more people are incorporating dietary supplements into their fitness routines, driving growth in the sports nutrition segment of the market.

Rising Disposable Income and Consumer Spending

The dietary supplements market is also influenced by rising disposable income and increased consumer spending on health and wellness products. As economies develop and incomes rise, people have more discretionary income to spend on goods and services that enhance their quality of life, including dietary supplements. Market research indicates that consumers are willing to invest in products that offer health benefits and contribute to their overall well-being, even if they come at a premium price. Additionally, with the growing availability of dietary supplements through various retail channels, including pharmacies, supermarkets, health food stores, and online platforms, consumers have greater access to a wide range of products to meet their health needs and preferences. This combination of increased disposable income and accessibility contributes to the growth of the dietary supplements market worldwide.

Restraints for the Dietary Supplements Market

Regulatory Challenges and Compliance Burdens

One of the significant restraints for the Dietary Supplements Market is regulatory challenges and compliance burdens imposed by government authorities. Market data reveals that dietary supplements are subject to stringent regulations and oversight to ensure their safety, quality, and efficacy. However, varying regulatory frameworks across different countries and regions can create complexities for manufacturers, distributors, and retailers operating in the global market. For example, manufacturers must navigate a maze of regulations related to ingredient safety, labeling requirements, advertising claims, and good manufacturing practices (GMP). Additionally, regulatory agencies may periodically update or revise regulations in response to emerging scientific evidence, safety concerns, or public health issues, requiring industry stakeholders to stay informed and adapt to regulatory changes promptly. Compliance with regulatory requirements can be time-consuming and costly, particularly for small and medium-sized enterprises (SMEs) with limited resources and expertise, leading to barriers to entry and market consolidation.

Negative Public Perception and Skepticism

Another restraint for the dietary supplements market is negative public perception and skepticism surrounding the safety, efficacy, and necessity of dietary supplements. Market research indicates that despite the widespread use of dietary supplements, there is lingering skepticism among consumers regarding their benefits and potential risks. High-profile incidents of adulteration, contamination, or mislabeling of dietary supplements have eroded trust in the industry and fueled concerns about product quality and safety. Additionally, conflicting or inconclusive scientific evidence regarding the efficacy of certain supplements in preventing or treating health conditions has led to skepticism among healthcare professionals and consumers. Market data shows that negative media coverage, consumer advocacy campaigns, and regulatory actions aimed at addressing safety and quality issues can influence consumer perceptions and purchasing behavior, leading to a decline in demand for dietary supplements. Overcoming negative public perception and building trust in the safety and efficacy of dietary supplements require concerted efforts from industry stakeholders, including transparent labeling, quality assurance measures, and evidence-based marketing practices.

Market Fragmentation and Competitive Pressures

Market fragmentation and competitive pressures represent significant restraints for the dietary supplements market, particularly for manufacturers and retailers vying for market share in a crowded and competitive landscape. Market data reveals a proliferation of dietary supplement products and brands available in the market, ranging from established multinational corporations to small-scale niche players and private-label brands. This fragmentation creates challenges for companies in terms of brand differentiation, product innovation, and pricing strategies. Additionally, intense competition among manufacturers and retailers can lead to price wars, margin pressures, and commoditization of products, affecting profitability and sustainability in the long term. Furthermore, the rise of e-commerce platforms and direct-to-consumer (DTC) channels has lowered barriers to entry for new entrants and increased competition, disrupting traditional distribution channels and shifting consumer purchasing behavior. Navigating the competitive landscape requires companies to develop distinctive brand identities, differentiate product offerings, and invest in marketing and distribution strategies to stand out in the market and maintain market share.

Trends for the Dietary Supplements Market

Shift Towards Natural and Plant-Based Ingredients

A notable trend in the Dietary Supplements Market is the increasing consumer preference for products made with natural and plant-based ingredients. Market data indicates a growing awareness of the health benefits associated with plant-derived nutrients, such as vitamins, minerals, antioxidants, and phytonutrients. As consumers become more health-conscious and environmentally aware, they are seeking out dietary supplements that are free from artificial additives, preservatives, and synthetic leather chemicals. According to industry reports, sales of natural and plant-based supplements have been on the rise in recent years, driven by factors such as the desire for clean-label products, sustainability concerns, and the perception of natural ingredients as safer and more effective. Companies in the dietary supplements market are responding to this trend by formulating products with plant extracts, botanicals, herbal supplements, and superfoods to meet consumer demand for natural, wholesome, and sustainable health solutions.

Focus on Immune Support and Wellness

Another trend shaping the dietary supplements market is the increased focus on immune support and overall wellness, particularly in response to global health challenges such as the COVID-19 pandemic. Market data reveals a surge in demand for immune-boosting supplements, vitamins, and minerals, as consumers seek to bolster their immune systems and protect against illness. Additionally, there is growing interest in supplements that promote general health and well-being, including products targeting stress relief, mental health, sleep quality, and digestive wellness. According to industry analysts, the pandemic has heightened awareness of the importance of preventive healthcare and self-care practices, leading to sustained demand for dietary supplements that support immune function and overall wellness. Companies are capitalizing on this trend by introducing new product formulations, immune-boosting ingredients, and wellness-focused marketing campaigns to meet evolving consumer needs and preferences in the post-pandemic landscape.

Rise of Personalized Nutrition and Functional Foods

A significant trend driving innovation in the dietary supplements market is the rise of personalized nutrition and functional foods tailored to individual health needs and preferences. Market data shows a growing interest among consumers in personalized health and wellness solutions that take into account factors such as genetics, lifestyle, dietary habits, and health goals. Dietary supplements play a key role in personalized nutrition by providing targeted nutrients and bioactive compounds to address specific health concerns or support personalized health goals. Additionally, there is increasing demand for functional foods and beverages fortified with added nutrients, probiotics, prebiotics, and other bioactive ingredients that offer health benefits beyond basic nutrition. Companies are leveraging advancements in technology, such as genetic testing, digital health platforms, and data analytics, to offer personalized dietary supplement recommendations and develop functional food products that cater to individual preferences and dietary requirements.

Expansion of E-commerce and Direct-to-Consumer Channels

An emerging trend in the dietary supplements market is the expansion of e-commerce and direct-to-consumer (DTC) channels as preferred retail channels for purchasing supplements. Market data indicates a significant shift in consumer purchasing behavior towards online shopping, driven by factors such as convenience, accessibility, and the proliferation of digital platforms and mobile devices. E-commerce platforms offer consumers a wide selection of dietary supplement products, competitive pricing, and convenient delivery options, making it easier for them to research, compare, and purchase supplements from the comfort of their homes. Additionally, direct-to-consumer brands are gaining popularity by offering subscription-based services, personalized recommendations, and transparent pricing models that resonate with modern consumers seeking transparency, convenience, and value. As online sales continue to grow, companies in the dietary supplement market are investing in digital marketing, e-commerce platforms, and DTC strategies to reach and engage with consumers directly, driving growth and innovation in the online supplement market.

Segments Covered in the Report

By Ingredient

o Vitamins

o Botanicals

o Minerals

o Protein & Amino Acids

o Fibers & Specialty Carbohydrates

o Omega Fatty Acids

o Probiotics

o Prebiotics & Postbiotics

o Other Ingredients

By Form

o Tablets

o Capsules

o Soft gels

o Powders

o Gummies

o Liquids

o Other Forms

By Application

o Energy & Weight Management

o General Health

o Bone & Joint Health

o Gastrointestinal Health

o Immunity

o Cardiac Health

o Diabetes

o Lungs Detox/Cleanse

o Skin/ Hair/ Nails

o Sexual Health

o Brain/Mental Health

o Insomnia

o Menopause

o Anti-aging

o Prenatal Health

o Other Applications

By End-User

o Infants

o Children

o Adults

o Pregnant Women

o Geriatric

By Type

o OTC

o Prescribed

By Distribution Channel

o Online

o Offline

Segment Analysis

By Ingredient Analysis

In 2023, vitamin dietary supplements held a significant market share of 29.7%. Vitamin A (carotenoids and retinol), vitamin B (folic acid), vitamin C (ascorbic acid), and vitamin D (cholecalciferol) are just a few of the forms in which these supplements are accessible. Not only are vitamin A supplements touted as miracle cures for eye health, but they also boost immunity in general.

Since vitamin D is essential for the absorption of calcium and a lack can have major health consequences, it is the most widely sold type of independent supplement. Compared to other vitamins, these supplements have a larger market penetration and are frequently prescribed by doctors.

From 2023 to 2033, protein and amino acid supplements are expected to expand at a CAGR of 12.8%. Since amino acids are necessary nutrients, external formulations containing them must be eaten. Since they are the components of protein, there will likely always be a strong market for them. Customers are using products that can meet their nutritional needs since they are more health-conscious. Supplementing with amino acids and protein is thought to be a practical and efficient way to guarantee sufficient consumption, particularly for people with busy schedules or specific dietary needs.

By Form Analysis

In terms of form, the tablets segment had a 31.9% revenue share in 2023. Excipients are used in high-quality supplements to facilitate the absorption and disintegration of tablets. The natural covering, however, dissolves more readily. The most widely used form of dietary supplements at the moment is tablets.

Owing to their ease of use and better integration into other food items, powdered dietary supplements are predicted to rise over the projection period. Through 2033, the liquid dietary supplement market is expected to expand at a CAGR of 12.6%. A liposomal substance that has been uniformly dissolved in water for easy absorption is a liquid dietary supplement. This makes it possible to incorporate liquid dietary supplements into smoothies, energy drinks, yogurt, and water. The market for these items is anticipated to be strong during the projection period since they are readily absorbed and favored by adults and Generation X.

By Application Analysis

In 2023, the market was dominated by energy and weight management supplements, with demand surpassing 29.7%. The market for protein and vitamin supplements in diets is mostly influenced by sports fans. These supplements help athletes reduce physical wear and tear, increase muscle endurance, and replenish their energy. Furthermore, the market is expected to increase due to the increasing demand for dietary supplements containing collagen and vitamin D, which can be linked to various health goals like strengthening bones and muscles, promoting weight loss, and improving joint health.

The CAGR for the other segments is expected to exceed 11.2% between 2023 and 2033. Along with hangover remedies, the market comprises products that help with vision, mood, and neurological and urinary system functioning. Dietary supplements reduce the chance of illness and promote consumers' best health. Good prognosis for eye health due to the growing emphasis on an active lifestyle and the increased consumer knowledge of the advantages of protein, vitamin, mineral, and collagen supplements are anticipated to be a major factor in driving dietary supplement consumption worldwide in the years to come.

By End-User Analysis

In 2023, adults accounted for 45.9% of supplement sales, making them the biggest customers. It is anticipated that working individual's increased use of dietary supplements to maintain a healthy lifestyle will continue to be a driving force in the industry. Additionally, throughout the projection period, it is anticipated that growing awareness of the importance of healthy diets among working adults and athletes to preserve the nutritional balance in their bodies will expand the market for dietary supplements.

From 2023 to 2033, the infant category is expected to expand at the fastest CAGR of almost 13.8%. Growing consumption of breast milk substitutes, which closely mimic the content and functionality of breast milk, is expected to fuel growth in research and development efforts related to baby nutrition over the forecast period.

By Type Analysis

In 2023, OTC sales of dietary supplements accounted for 75.1% of total revenue. OTC sales of dietary supplements are expected to increase steadily as consumers become more aware of the items' health advantages and nutritional worth. Another significant factor boosting the demand for over-the-counter dietary supplements is self-medication for conditions connected to the immune system and gastrointestinal tract. Sales of these dietary supplements should be aided by the affordability and ease of direct purchasing.

From 2023 to 2033, prescribed dietary supplements are expected to expand at a CAGR of 8.9%. The need for prescribed dietary supplements is predicted to increase due to strict regulations by regulatory organizations about over-the-counter dietary supplements and a decreased awareness among citizens about self-medication in emerging nations. Segment growth is also anticipated to be aided by rising R&D spending and financing from the public and private sectors.

By Distribution Channel Analysis

Over 79.5% of revenue from the sale of dietary supplements came from offline sales in 2023. Offline sales are anticipated to be positively impacted by a surge in several dietary supplements prescribed by physicians to address gastrointestinal diseases, immunity-related conditions, bone health, folic acid deficiencies, heart health, and age-related macular degeneration.

From 2023 to 2033, the online segment is expected to expand at a compound annual growth rate of 9.5%. Dietary supplement sales online are predicted to rise as e-commerce usage rises quickly and customers become more self-reliant.

Regional Analysis

In 2023, the dietary supplement market in Asia Pacific accounted for 34.2% of the global market. Demand for dietary supplements will increase in the region as major corporations introduce their brands to Southeast Asia's unexplored markets. Owing to their substantial consumer bases, China, Japan, and India rank among the Asia Pacific region's biggest markets for nutritional supplements.

With a share of more than 40.4% in 2023, the Chinese dietary supplement market was the largest in the Asia-Pacific region. Growing awareness of the health advantages of dietary supplements in Australia and Japan over the years is anticipated to support regional market expansion over the forecast period.

The Middle East and Africa are expected to increase at a CAGR of 9.8% from 2023 to 2033 and will be crucial to the development of the industry. The region's expanding healthcare sector is anticipated to play a significant role in this market's expansion. The region's shifting demographics, such as the growth of the youthful and working population, have led to an increase in the amount spent on health and wellness-related products. This will increase product sales and revenue, especially in the Middle East where discretionary money is considerable.

Furthermore, the millennial generation's growing product consumption and the government's increased emphasis on raising public knowledge of the advantages of dietary supplements for health are driving the market in South Africa.

The European dietary supplements market is expected to grow at a compound annual growth rate of 6.6%. European consumers' obesity and lactose intolerance have increased the demand for probiotic health supplements. Moreover, growing clinical data supporting the advantages & efficacy of these supplements in the management of illness and preservation of general health is driving the German market. In the nation, dietary supplements are being used more frequently to treat lactose intolerance, infectious diarrhea, and Inflammatory Bowel Disease (IBD).

Competitive Analysis

The market for dietary supplements is highly competitive globally. Key market players are concentrating on initiatives including new product releases, partnerships, mergers & acquisitions, worldwide expansion, and others, according to brand share analysis. Initiating initiatives to obtain a competitive edge in the market has been a proactive approach by publicly traded corporations. Given the growing number of companies in the sector, privately held market participants are anticipated to follow suit soon.

Key Market Players in the Dietary Supplements Market

o Amway Corp.

o Bayer AG

o Abbott

o Pfizer Inc.

o Glanbia plc

o NU SKIN

o American Health

o GlaxoSmithKline plc.

o Good Health New Zealand

o DuPont de Nemours Inc.

o Other Key Players

|

Report Attribute |

Details |

|

Market Size 2023 |

USD 179.0 Billion |

|

Market Size 2033 |

USD 398.3 Billion |

|

Compound Annual Growth Rate (CAGR) |

8.3% |

|

Market Forecast Period |

2023-2033 |

|

Historical Data |

2018-2022 |

|

Region Covered |

North America, Europe, Asia-Pacific, South America, Middle East and Africa |

|

Market Scope |

Type, Ingredient, End-User, End-User, Form, Application, Distribution Channel and Region |

|

Key Players |

Amway Corp., Bayer AG, Abbott, Pfizer Inc., Glanbia plc, NU SKIN, Archer Daniels Midland, American Health, GlaxoSmithKline plc., Good Health New Zealand, DuPont de Nemours Inc., Other Key Players

|

📘 Frequently Asked Questions

1. How much is the Dietary Supplements Market in 2023?

Answer: The Dietary Supplements Market size was valued at USD 179.0 Billion in 2023.

2. What would be the forecast period in the Dietary Supplements Market?

Answer: The forecast period in the Dietary Supplements Market report is 2023-2033.

3. Who are the key players in the Dietary Supplements Market?

Answer: Amway Corp., Bayer AG, Abbott, Pfizer Inc., Glanbia plc, NU SKIN, Archer Daniels Midland, American Health, GlaxoSmithKline plc., Good Health New Zealand, DuPont de Nemours Inc., Other Key Players

4. What is the growth rate of the Dietary Supplements Market?

Answer: Dietary Supplements Market is growing at a CAGR of 8.3% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.