🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Electric Truck Market

Global Electric Truck Market (By Propulsion (BEV, PHEV, FCEV, Other Propulsion), By Vehicle Type (Light Duty Trucks, Medium Duty Trucks, Heavy Duty Trucks), By Range (150 Miles, 151-300 Miles, Above 300 Miles), By Region and Companies)

Sep 2024

Automobiles

Pages: 138

ID: IMR1240

Electric Truck Market Overview

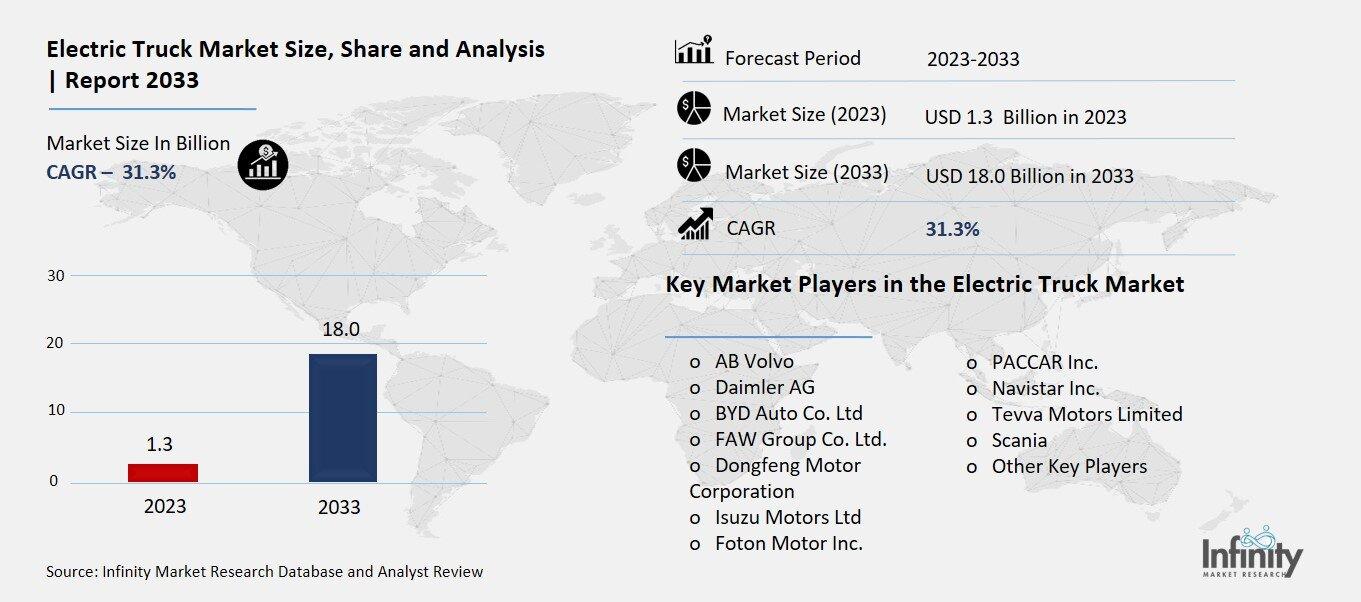

Global Electric Truck Market size is expected to be worth around USD 18.0 Billion by 2033 from USD 1.3 Billion in 2023, growing at a CAGR of 31.3% during the forecast period from 2023 to 2033.

The electric truck market refers to the industry that develops, manufactures, and sells vehicles powered by electricity rather than traditional diesel or gas engines. Electric trucks are intended to minimize pollution, save fuel costs, and run more silently than traditional trucks. The global desire for cleaner, more sustainable transportation options is driving the growth of this industry.

To Get An Overview , Request For Sample

Governments throughout the world are enacting stronger emissions standards and providing incentives for electric vehicles, encouraging businesses to invest in electric trucks. Furthermore, advances in battery technology are making electric trucks more viable, with longer driving distances and faster charging periods. Major automakers and start-ups are fighting in this market, developing a range of electric trucks, from light-duty delivery vehicles to heavy-duty.Electric vehicles are especially appealing for short-haul urban deliveries, where their silent operation and zero exhaust emissions can significantly reduce pollution. However, as technology advances, these trucks are becoming increasingly viable for long-distance freight delivery.

Drivers for the Electric Truck Market

Environmental Concerns and Emission Regulations

One of the biggest factors driving the electric truck market is the increasing concern over environmental pollution and the need to reduce greenhouse gas emissions. Governments around the world are implementing stricter emission regulations to combat climate change, prompting companies to switch to cleaner energy alternatives like electric trucks. For instance, Europe and North America have set ambitious goals to phase out traditional diesel and gasoline trucks in favor of zero-emission vehicles, which has been a significant push toward electric trucks.

Advancements in Battery Technology

The advancement in battery technology is another crucial factor driving growth. Innovations have led to the development of more efficient batteries, that have longer ranges, and charge faster. This has made electric trucks more feasible for commercial use, even for longer-distance transport. Batteries with capacities between 50-250 kWh are becoming particularly popular because they strike a good balance between cost, charging speed, and energy efficiency. Additionally, the costs of batteries are declining, making electric trucks more affordable for businesses.

Cost Savings on Fuel and Maintenance

Electric trucks offer significant cost savings compared to traditional diesel trucks. The operational cost of running an electric truck is lower since electricity is cheaper than diesel fuel, and electric vehicles have fewer moving parts, leading to reduced maintenance costs. This financial benefit is encouraging businesses to invest in electric truck fleets, especially in industries like e-commerce and logistics that rely on efficient transportation solutions.

Government Incentives and Investments

Governments are not only enforcing regulations but also offering various incentives to accelerate the adoption of electric trucks. These include subsidies, tax rebates, and funding for research and development in electric vehicle technology. Additionally, governments are investing in charging infrastructure, which is critical for the widespread use of electric trucks. In North America, for example, several initiatives are underway to create extensive charging networks to support commercial electric vehicles, including trucks.

Corporate Sustainability Goals

Many companies are setting ambitious sustainability goals, with a focus on reducing their carbon footprint. Large corporations in industries like retail, logistics, and manufacturing are increasingly committing to using electric trucks for their operations. These companies see electric trucks as a way to meet their sustainability objectives while also improving their brand image. For instance, leading manufacturers like Volvo, Daimler, and Tesla are working on electric truck models to cater to this growing demand from businesses aiming to reduce emissions.

Technological Partnerships and Collaborations

Partnerships between electric truck manufacturers and technology companies are also a driving force in the market. Many electric truck makers are teaming up with battery producers, software companies, and logistics firms to develop cutting-edge electric trucks that offer better performance and operational efficiency. Collaborations between automotive giants like Tesla, Volvo, and BYD with battery producers and logistics companies are helping drive innovation and the expansion of electric truck offerings globally.

Restraints for the Electric Truck Market

One of the main issues is the lack of charging infrastructure. Although governments in many countries are promoting the use of electric vehicles, the infrastructure to support large-scale adoption, especially for heavy-duty electric trucks, is insufficient. In many regions, charging stations are sparse, particularly in rural areas and along long-haul routes, where electric trucks would be most useful. This limits their practicality and adds range anxiety for companies considering switching to electric fleets. For instance, countries like India are pushing electric vehicle initiatives, but the limited number of charging stations holds back wider adoption.

Another significant challenge is the high upfront cost of electric trucks. Electric trucks, particularly those designed for heavy-duty tasks, require expensive components, especially large battery systems. The production costs are further elevated by the need for advanced materials and complex manufacturing processes. As a result, these vehicles are much more expensive than their diesel or gasoline counterparts. This cost disparity makes it difficult for smaller companies, or those operating in price-sensitive markets, to justify the switch to electric trucks, despite the potential long-term savings in fuel and maintenance.

Battery limitations also present a restraint for the electric truck market. Currently, most electric truck batteries have limitations in terms of energy density, which restricts their range. For long-haul operations, where trucks need to cover vast distances without frequent stops, current battery technology falls short. Improvements in battery technology are needed to increase both the range and charging speed of electric trucks. Until such advancements are made, many companies may hesitate to adopt electric trucks for long-distance transportation.

Insufficient government support in certain regions hinders the market’s growth. While some countries offer incentives and subsidies for electric vehicle purchases, not all regions have robust policies in place. The lack of consistent global support makes it harder for manufacturers to scale their production and for businesses to adopt electric trucks universally.

Trends for the Electric Truck Market

Rapid Market Growth

The electric truck market is projected to expand significantly, with a compound annual growth rate (CAGR) of approximately 52.40% in North America from 2024 to 2032 IEA. This growth is fueled by increasing demand for cleaner transportation options, particularly in the logistics and delivery sectors.

Government Regulations and Incentives

Governments worldwide are implementing stricter emissions regulations and offering incentives for electric vehicle (EV) adoption. These policies encourage companies to transition their fleets to electric models, especially as many countries aim for net-zero emissions by 2050. For instance, the U.S. has launched programs to support infrastructure development for electric trucks, enhancing charging station availability.

Advances in Battery Technology

Innovations in battery technology are crucial for the electric truck market. Manufacturers are developing batteries with higher capacities that allow for longer ranges, making electric trucks more practical for various applications. Battery costs are also decreasing, which helps lower the overall price of electric trucks.

Diverse Vehicle Offerings

The market is seeing a variety of electric truck types, including light-duty, medium-duty, and heavy-duty vehicles. Each category serves different applications, from urban delivery to long-haul freight. Companies like AB Volvo and Daimler Truck AG are leading the charge with a range of models designed to meet the needs of various industries.

Focus on Sustainability and Reduced Operating Costs

Electric trucks are increasingly recognized for their lower operating costs compared to traditional diesel trucks. They require less maintenance due to fewer moving parts and produce no tailpipe emissions, which contributes to environmental sustainability. This aspect is particularly appealing to businesses aiming to enhance their corporate social responsibility profiles.

Investment in Charging Infrastructure

To support the growing number of electric trucks, significant investments are being made in charging infrastructure. Both private companies and governments are working to expand charging networks, ensuring that electric trucks can operate efficiently over long distances. This development is crucial as range anxiety has been a significant barrier to electric vehicle adoption.

Technological Integration

The integration of smart technologies, such as telematics and connectivity features, is becoming common in electric trucks. These technologies help fleet managers monitor vehicle performance, optimize routes, and enhance overall efficiency.

Segments Covered in the Report

By Propulsion

o BEV

o PHEV

o FCEV

o Other Propulsion

By Vehicle Type

o Light Duty Trucks

o Medium Duty Trucks

o Heavy Duty Trucks

By Range

o 150 Miles

o 151-300 Miles

o Above 300 Miles

Segment Analysis

By Propulsion Analysis

This market can be classified into three propulsion categories: battery electric vehicles (BEV), plug-in hybrid electric vehicles (PHEV), and fuel cell electric vehicles (FCEV). BEVs had the highest market share because of widespread adoption in nations like China, the United States, and Europe. In 2022, China accounted for approximately 90% of all electric truck registrations. BEV sales and new advancements will fuel significant growth in the electric truck sector.

The PHEV sector held the second biggest market share. This segment offers improved comfort and overall performance. Key firms are focused on the research and development of plug-in hybrid trucks. These elements will boost the segment's growth. The FCEV segment accounted for the third greatest market share. This segment's expansion can be ascribed to its benefits and the emergence of significant transportation businesses.

By Vehicle Type Analysis

This market is classified into three categories: light-duty trucks, medium-duty vehicles, and heavy-duty trucks. In 2023, light-duty trucks had the biggest market share. Light-duty truck sales have grown. China was the biggest market for light-duty vehicles in 2023. This rise can be attributed to important players and OEMs in the country.

Europe held the second-largest market share in 2023, owing to its increased adherence to carbon dioxide performance regulations. In 2023, the medium-duty truck sector held the second-greatest market share. The United States and Europe have a higher demand for medium-duty vehicles than China.

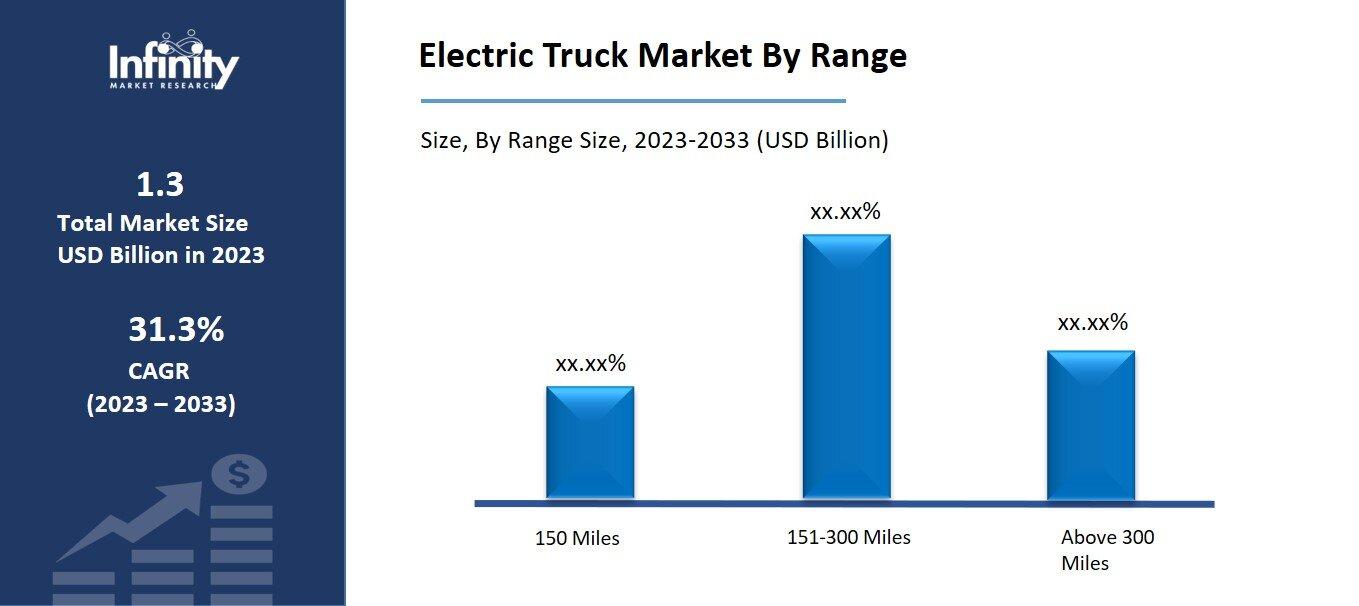

By Range Analysis

The target market can be classified into three categories based on its range: 150, 151-300, and more than 300 miles. In 2023, the 151-300 mile segment had the highest market share. This segment's rise can be attributable to increased registration and sales of electric trucks in Asia Pacific.

To Learn More About This Report , Request For Sample

In 2023, the 150-mile category accounted for the second biggest market share. The market's leading players have made substantial advances, which have supported the segment's expansion. With the most recent developments by the major companies, the sector greater than 300 miles held the third biggest market share.

Regional Analysis

North America's electric truck market dominates the global market. It is predicted to grow significantly over the projection period. The North American electric truck market is predicted to be driven by a large number of industry players and considerable research and development.

Ford, for example, is investing more than $6 billion to build the F-150 hybrid electric vehicle at a Michigan plant. In 2020, the company introduced a new F-150 hybrid electric automobile as well as an F-150 hybrid electric truck. The electric truck industry in North America is predicted to expand as demand for zero-emission commercial vehicles rises.

Europe accounts for the second-greatest market share for electric trucks. In response to growing environmental concerns, European governments and environmental organizations are enacting stringent emission regulations and laws. This is increasing the demand for electric cars across the continent.

The European Union (EU), for example, is committed to meeting its 20% greenhouse gas reduction target for the Kyoto Protocol's second phase. The EU aims to eradicate all greenhouse gas emissions by 2050. The German electric truck sector dominated the market, while the UK electric truck market was Europe's fastest expanding.

Competitive Analysis

The electric truck market is extremely competitive, with both large and small firms. BYD Auto Company Ltd., Dongfeng Motor Corporation, PACCAR Inc., Daimler AG, and Scania are the market's dominant players. These companies provide a wide range of electric trucks and can serve the transportation, logistics, and municipal sectors. These market participants are likewise focused on developing fuel-cell electric trucks with greater ranges and improved performance.

Recent Developments

May 2023: Freightliner's eM2 pick-up and delivery truck will begin manufacturing in the fall of this year and is now available for order. Freightliner's innovative eM2 medium-duty vehicle aims to learn from customer experiences in vocational applications.

April 2023: Daimler Truck has launched a new electric medium-duty truck brand in the United States. Rizon plans to produce Class 4 and 5 trucks utilizing lithium iron phosphate battery technology beginning in the third quarter of 2023. Distribution would begin with an exclusive partnership with Velocity Vehicle Group. Rizon trucks have a range of 75 to 110 miles or 110 to 160 miles.

Key Market Players in the Electric Truck Market

o AB Volvo

o Daimler AG

o BYD Auto Co. Ltd

o FAW Group Co. Ltd.

o Dongfeng Motor Corporation

o Foton Motor Inc.

o Navistar Inc.

o Tevva Motors Limited

o Scania

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 1.3 Billion |

|

Market Size 2033 |

USD 18.0 Billion |

|

Compound Annual Growth Rate (CAGR) |

31.3% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Propulsion, Vehicle Type, Range, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

AB Volvo, Daimler AG, BYD Auto Co. Ltd, FAW Group Co. Ltd., Dongfeng Motor Corporation, Isuzu Motors Ltd, Foton Motor Inc., PACCAR Inc., Navistar Inc., Tevva Motors Limited, Scania, Other Key Players |

|

Key Market Opportunities |

Government policies supporting clean energy initiatives |

|

Key Market Dynamics |

Environmental Concerns and Emission Regulations |

📘 Frequently Asked Questions

1. Who are the key players in the Electric Truck Market?

Answer: AB Volvo, Daimler AG, BYD Auto Co. Ltd, FAW Group Co. Ltd., Dongfeng Motor Corporation, Isuzu Motors Ltd, Foton Motor Inc., PACCAR Inc., Navistar Inc., Tevva Motors Limited, Scania, Other Key Players

2. How much is the Electric Truck Market in 2023?

Answer: The Electric Truck Market size was valued at USD 1.3 Billion in 2023.

3. What would be the forecast period in the Electric Truck Market?

Answer: The forecast period in the Electric Truck Market report is 2023-2033.

4. What is the growth rate of the Electric Truck Market?

Answer: Electric Truck Market is growing at a CAGR of 31.3% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.