🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Ethylene Market

Ethylene Market (By Feedstock (Naphtha, Ethane, Propane, Butane, and Others), By Application (Polyethylene (PE), Polyethylene Terephthalate (PET), Polyvinyl Chloride (PVC), Polystyrene (PS), Fibers & Other Organic Chemicals), By End-User (Automotive, Packaging, Healthcare, Textile, Agrochemical, Building & Construction), By Region and Companies)

Jun 2024

Chemicals and Materials

Pages: 136

ID: IMR1060

Ethylene Market Overview

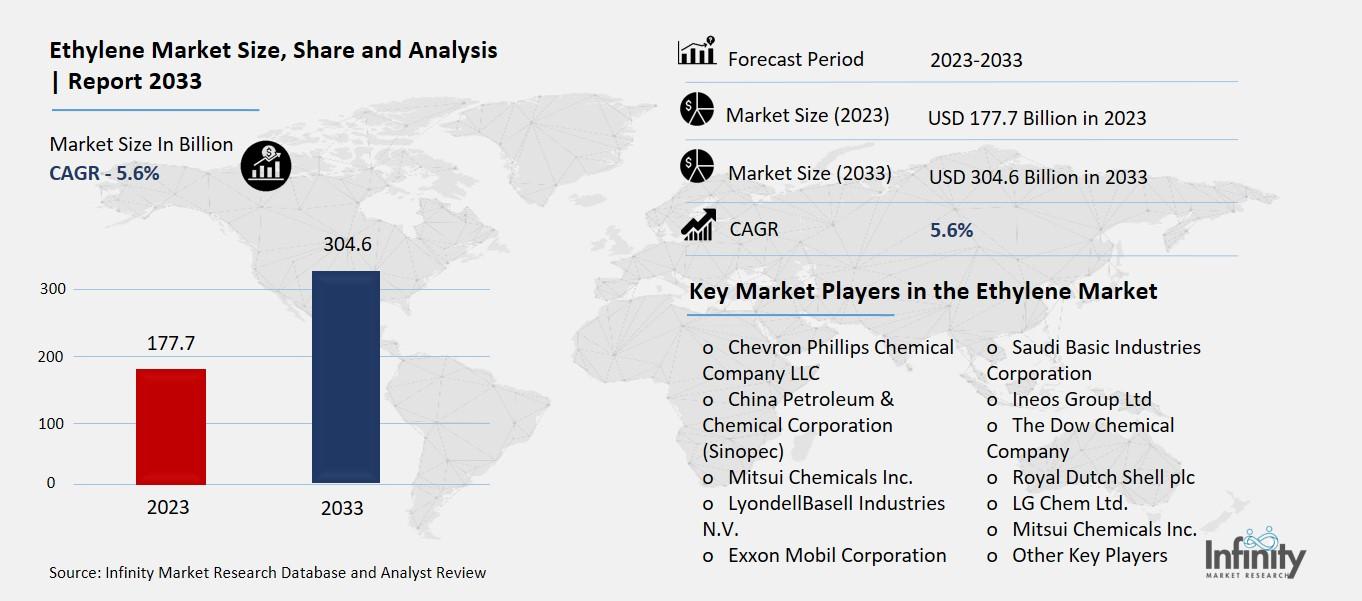

Global Ethylene Market size is expected to be worth around USD 304.6 Billion by 2033 from USD 177.7 Billion in 2023, growing at a CAGR of 5.6% during the forecast period from 2023 to 2033.

The ethylene market refers to the global industry focused on the production, distribution, and sale of ethylene, which is a key raw material in the chemical industry. Ethylene is primarily used to manufacture polyethylene, the most common plastic, as well as other chemicals like ethylene oxide, ethylene dichloride, and ethylbenzene. These chemicals are essential in producing a wide range of products, including packaging materials, automotive parts, and construction materials. The ethylene market is influenced by various factors, including raw material costs, production capacity, and demand from end-use industries.

The market dynamics of ethylene are complex and vary by region. For example, in North America, the ethylene market has experienced fluctuations due to changes in raw material costs and demand from international markets. In Europe, ethylene prices have been impacted by supply chain issues and varying demand levels. In the Asia-Pacific region, economic conditions in major economies like China play a significant role in shaping market trends. Overall, the ethylene market is expected to grow, driven by increasing demand for plastics and other derivatives, although challenges such as overcapacity and economic slowdowns can impact this growth.

Drivers for the Ethylene Market

Growing Demand for Polyethylene

The ethylene market is experiencing substantial growth, largely driven by the increasing demand for polyethylene, the most widely used plastic in the world. Polyethylene's versatility and durability make it essential for the packaging industry, where it is used to manufacture products such as plastic bags, bottles, and films. The rise in e-commerce and food delivery services has significantly boosted the need for packaging materials, contributing to the surge in polyethylene demand. Additionally, ethylene derivatives like ethylene oxide, which are used in the production of antifreeze, detergents, and polyester, are in high demand across various industries, further propelling the ethylene market.

Impact of Industrialization and Urbanization

Rapid industrialization and urbanization, particularly in emerging economies such as China and India, are major drivers of the ethylene market. These countries are experiencing significant growth in their construction sectors, which in turn increases the demand for materials like polyvinyl chloride (PVC) and polyethylene. These materials are extensively used in building infrastructure, including pipes, wires, and insulation. Furthermore, the automotive industry is increasingly adopting lightweight plastics to improve fuel efficiency and reduce emissions. Ethylene-based products, such as ethylene propylene rubber and polyethylene, are crucial in this transition towards lightweight materials. The rise in middle-class income levels and urban population also contributes to the higher consumption of consumer goods, which drives the demand for ethylene.

Environmental Concerns and Regulatory Pressures

Environmental concerns and regulatory pressures are also playing a significant role in shaping the ethylene market. There is a growing emphasis on sustainability and reducing carbon footprints, leading to the development and adoption of bio-based ethylene. Bio-based green polyethylene, derived from renewable resources like sugarcane, offers an eco-friendly alternative to traditional petroleum-based plastics. This shift towards greener products is supported by both consumers and regulatory bodies aiming to reduce plastic waste and greenhouse gas emissions. Companies are investing in research and development to improve the production processes and efficiency of bio-based ethylene, aligning with global sustainability goals.

Technological Advancements and Innovation

Technological advancements and innovation are further driving the ethylene market. The development of more efficient production methods and the exploration of alternative feedstocks are helping to meet the growing demand for ethylene. Innovations such as the use of shale gas for ethylene production have reduced costs and increased supply, particularly in regions like North America.

Restraints for the Ethylene Market

Economic Challenges and Feedstock Costs

The ethylene market faces several significant restraints, primarily driven by economic challenges and fluctuating feedstock costs. Ethylene is derived from hydrocarbons such as naphtha, ethane, and propane, whose prices are highly volatile and influenced by global oil market trends. The unpredictability of these costs can severely impact the profitability of ethylene production. For example, a spike in crude oil prices can increase the cost of naphtha, making ethylene production more expensive and less competitive compared to alternative materials. This volatility creates financial uncertainty for manufacturers, which can deter investment and long-term planning in the ethylene industry.

Environmental Regulations and Sustainability Concerns

Another major restraint is the increasing stringency of environmental regulations. Governments worldwide are imposing stricter emissions and waste management standards on chemical industries to combat climate change and pollution. Ethylene production is energy-intensive and generates significant greenhouse gas emissions, leading to regulatory pressures to adopt cleaner technologies and processes. Compliance with these regulations often requires substantial capital investment in new technologies and infrastructure, which can be a financial burden for companies. Furthermore, there is a growing consumer and industrial demand for sustainable and eco-friendly materials, which pressures the ethylene industry to innovate and potentially transition away from traditional petrochemical-based processes.

Market Competition and Substitutes

The ethylene market also faces intense competition and the threat of substitutes. As global production capacity increases, especially in regions like Asia-Pacific and North America, the market experiences oversupply, which drives down prices and margins. This competitive landscape is further complicated by the emergence of alternative materials that can replace ethylene in various applications. For instance, bio-based plastics and other sustainable materials are gaining traction as viable substitutes, particularly in packaging and consumer goods. These alternatives not only appeal to environmentally conscious consumers but also comply with stringent environmental regulations, posing a significant challenge to traditional ethylene producers.

Technological and Operational Challenges

Technological advancements and operational efficiencies are crucial for maintaining competitiveness in the ethylene market, but they also present challenges. The adoption of advanced technologies such as catalytic cracking and steam reforming requires significant investment and technical expertise. Smaller companies may struggle to keep up with these advancements due to limited financial and technical resources. Additionally, operational challenges such as plant maintenance, downtime, and efficiency losses can affect production volumes and costs, further complicating the market dynamics. The need for continuous improvement and innovation in production processes to reduce costs and improve yields is a constant pressure on companies within the ethylene market.

Geopolitical and Trade Issues

Geopolitical tensions and trade issues also play a critical role in shaping the ethylene market. Trade policies, tariffs, and sanctions can disrupt supply chains and affect the availability and pricing of raw materials. For instance, trade disputes between major economies like the US and China can lead to tariffs on petrochemical products, affecting global trade flows and pricing structures. Such uncertainties can deter investments and hinder the growth of the ethylene market. Moreover, geopolitical instability in key oil-producing regions can lead to supply disruptions and price volatility, adding another layer of risk for ethylene producers.

Trends for the Ethylene Market

Increasing Demand for Lightweight and Sustainable Materials

The ethylene market is experiencing significant growth, driven by the rising demand for lightweight and sustainable materials. As industries shift towards more environmentally friendly solutions, there is an increasing adoption of bio-based green polyethylene compounds. These compounds are derived from renewable sources and offer similar versatility and durability as traditional plastics while being more energy-efficient in production. Additionally, the automotive and packaging industries are major consumers of ethylene, using it to produce lightweight plastics that contribute to fuel efficiency and reduce overall environmental impact.

Expansion in the Asia-Pacific Region

The Asia-Pacific region remains a crucial driver of the ethylene market's expansion. Countries like China, India, and South Korea are seeing rapid industrialization and urbanization, which boosts the demand for ethylene-based products. The region's significant economic growth, coupled with increasing investments in petrochemical industries, contributes to higher consumption of ethylene. For instance, China's continuous expansion in the production of ethylene derivatives supports the region's dominant market position. This growth is further fueled by the rising demand for petrochemical derivatives in various applications such as packaging, construction, and automotive sectors.

Technological Advancements and Strategic Investments

Technological advancements and strategic investments play a pivotal role in shaping the ethylene market trends. Companies are investing in new technologies to enhance production efficiency and reduce environmental impacts. For example, projects like PetroChina's ethane-to-ethylene initiative aim to bolster domestic production capabilities and decrease reliance on foreign technology. Furthermore, the introduction of ethylene futures contracts by the Intercontinental Exchange (ICE) highlights the growing need for market participants to manage price risks effectively. These developments not only improve production processes but also ensure a stable supply chain, catering to the ever-increasing market demands.

Regulatory and Environmental Challenges

Despite the positive trends, the ethylene market faces challenges related to stringent environmental regulations and the depletion of raw material sources. Governments worldwide are implementing strict regulations to mitigate the environmental hazards posed by ethylene production, which is flammable and carcinogenic. These regulations necessitate significant investments in cleaner technologies and more sustainable practices. Additionally, the volatility in crude oil prices and the dwindling availability of fossil fuels pose significant challenges to the market. Companies must navigate these obstacles by innovating and adopting more sustainable raw materials to ensure long-term growth and compliance with environmental standards

Segments Covered in the Report

By Feedstock

o Naphtha

o Ethane

o Propane

o Butane

o Others

By Application

o Polyethylene (PE)

o Polyethylene Terephthalate (PET)

o Polyvinyl Chloride (PVC)

o Polystyrene (PS)

o Fibers & Other Organic Chemicals

By End-User

o Automotive

o Packaging

o Healthcare

o Textile

o Agrochemical

o Building & Construction

Segment Analysis

By Feedstock

Ethane, naphtha, propane, butane, and other fuels are separated in the feedstock section. With a market share of about 37.8% in 2023, the naphtha sector led the industry. It is one of the feedstocks that is most frequently used in the petroleum industry and is also used to make fertilizers. It's also utilized to synthesize ammonia, which is used to make public gas or fertilizers. Nowadays, almost all ethylene is produced by naphtha steam cracking. Pyrolysis Naphtha can be used to produce a variety of petroleum feedstocks, including propylene, mixed-C4, ethylene, and pyrolysis gasoline (PG).

By Application

Based on application, the polyethylene sector held the biggest market share for ethylene globally and is projected to expand at a rate of about 6.1% throughout the projection period. The growing use of polyethylene in the production of plastics has an impact on its high demand. Major market growth is also being provided by the expanding usage of low and high-density polyethylene in a variety of applications and sectors. Due to its superior tensile strength, longevity, and non-toxic qualities, high-density polyethylene (HDPE) is becoming more and more in demand for food packaging. The Indian Institute of Packaging (IIP) reports that in 2019–2020, the annual usage of packaging rose from 4.3 kg per person to around 8.5 kg per person. Moreover, polyethylene finds widespread use in food packaging, bottles, films, and other plastic production processes. The worldwide ethylene sector is expected to experience growth throughout the anticipated time frame owing to the strong demand for polyethylene polymers in a variety of packaging applications.

By End-User

The packaging category is the largest end-user in the global ethylene market and is expected to increase at a compound annual growth rate (CAGR) of more than 5.9% over the forecast period. The packaging industry's growth in ethylene is attributed to its increasing demand and use in plastic packaging forms, primarily polyethylene. In the packaging industry, ethylene is mostly used for fresh produce and food packaging, among other uses. Because vinyl acetate, high-density polyethylene, and low-density polyethylene have superior qualities such as strength, non-toxicity, and extended shelf life, their use in the packaging industry is growing. India's Associated Chambers of Commerce and Industry predict that the packaged food market will generate USD 102 million in revenue by 2020. Furthermore, the increasing utilization of ethylene in plastics for the packaging industry is providing a significant push to the market and is expected to increase development prospects for the global ethylene market in the years to come.

Regional Analysis

In 2023, the Asia-Pacific region accounted for 43.13% of the overall sales. The market's revenue growth has been attributed to many causes such as the increased demand for petrochemical derivatives, positive demographic and economic trends, and others. Other important factors driving market revenue development include the availability of conventional feedstock and the growing capacity for expansion of industry participants. This business is driven primarily by the need for ethylene-based derivatives in end-use sectors such as packaging, automotive, and construction. Throughout the projected period, the region will continue to dominate the global market due to the growth of the manufacturing sector in countries like China, India, and Japan. With a 26.80% revenue share in 2023, North America is expected to expand at a faster compound annual growth rate (CAGR) than the rest of the globe throughout the forecast period. Strong car sales, more building activity, rising shale oil output, and a flourishing flexible packaging industry are all expected to drive greater demand for ethylene in the United States. Furthermore, rising demand for plastics and basic chemicals, technical advancements, and the region's growing ethylene production will all help to boost market revenue.

Europe accounted for the third-largest revenue share in 2023. Europe's building and packaging industries are still growing, which has led to a rise in both public and private investment in this region. The end-use industries—such as packaging, construction, and automotive—may no longer serve as the primary driver of growth for the European construction sector. Rising expenditures on residential, non-residential, and civil engineering operations in numerous European Union (EU) nations, including Germany, the United Kingdom, and France, among others, are driving product demand in this sector.

Competitive Analysis

The ethylene industry is highly competitive, with firms vying for customers by creating novel and inventive goods and services that might outlive those of their rivals. The increasing pace of technology improvements is expected to significantly expand the competitive landscape. Key companies are focusing on acquisitions and product innovation to expand their clientele and global reach.

Key Market Players in the Ethylene Market

o Chevron Phillips Chemical Company LLC

o China Petroleum & Chemical Corporation (Sinopec)

o Mitsui Chemicals Inc.

o LyondellBasell Industries N.V.

o Saudi Basic Industries Corporation

o The Dow Chemical Company

o Royal Dutch Shell plc

o LG Chem Ltd.

o Mitsui Chemicals Inc.

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 177.7 Billion |

|

Market Size 2033 |

USD 304.6 Billion |

|

Compound Annual Growth Rate (CAGR) |

5.6% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

- |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

Feedstock, Application, End-User, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Chevron Phillips Chemical Company LLC, China Petroleum & Chemical Corporation (Sinopec), Mitsui Chemicals Inc., LyondellBasell Industries N.V., Exxon Mobil Corporation, Saudi Basic Industries Corporation, Ineos Group Ltd, The Dow Chemical Company, Royal Dutch Shell plc, LG Chem Ltd., Mitsui Chemicals Inc., Other Key Players |

|

Key Market Opportunities |

Growth in Packaging Industry |

|

Key Market Dynamics |

Growing Demand for Polyethylene |

📘 Frequently Asked Questions

1. What would be the forecast period in the Ethylene Market Research report?

Answer: The forecast period in the Ethylene Market Research report is 2024-2033.

2. Who are the key players in the Ethylene Market?

Answer: Chevron Phillips Chemical Company LLC, China Petroleum & Chemical Corporation (Sinopec), Mitsui Chemicals Inc., LyondellBasell Industries N.V., Exxon Mobil Corporation, Saudi Basic Industries Corporation, Ineos Group Ltd,

3. How big is the Ethylene Market?

Answer: Global Ethylene Market size is expected to be worth around USD 304.6 Billion by 2033 from USD 177.7 Billion in 2023, growing at a CAGR of 5.6% during the forecast period from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.