🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Ferro Alloys Market

Ferro Alloys Market (By Product Type (Ferrochrome, Ferromanganese, Ferro Silico Manganese, Ferro Silicon), By Application (Carbon & Low Alloy Steel, Stainless Steel, Alloy Steel, Cast Iron, Other Applications), By Region and Companies)

Jul 2024

Chemicals and Materials

Pages: 140

ID: IMR1179

Ferro Alloys Market Overview

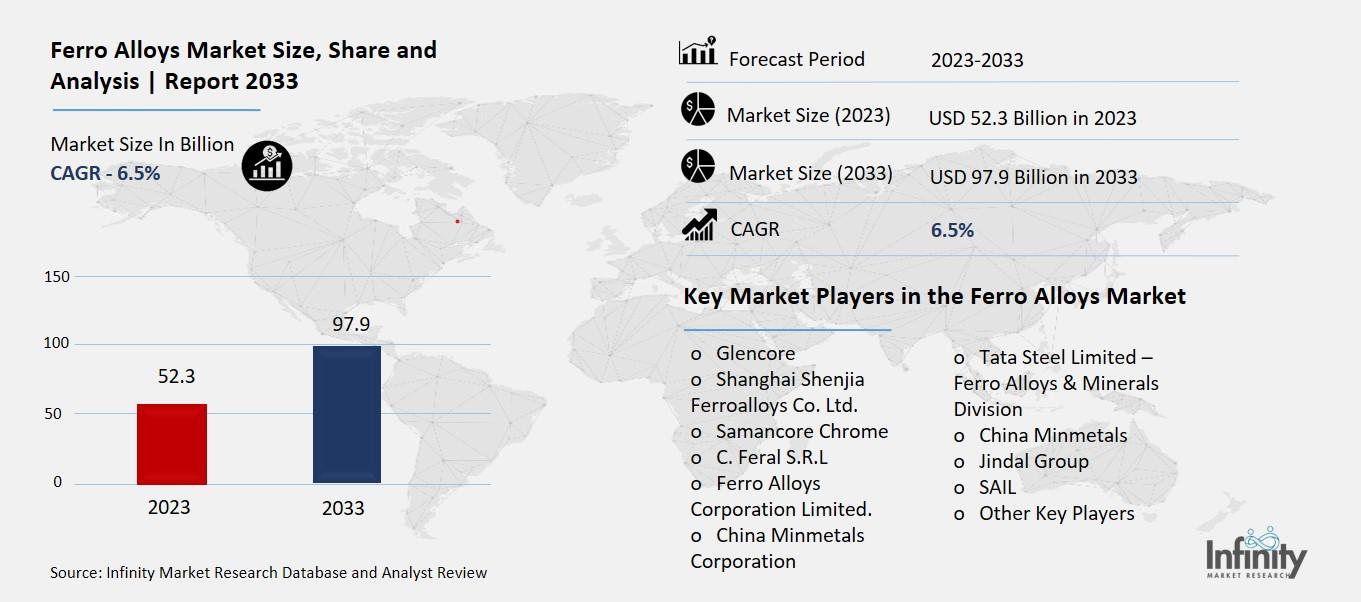

Global Ferro Alloys Market size is expected to be worth around USD 97.9 Billion by 2033 from USD 52.3 Billion in 2023, growing at a CAGR of 6.5% during the forecast period from 2023 to 2033.

The Ferro Alloys Market refers to the industry that produces and sells ferroalloys, which are special types of alloys made from iron and other elements. These alloys are used to enhance the properties of steel and other metals. Ferroalloys include products like ferrochrome, ferromanganese, and ferrosilicon, each adding specific qualities to the metal, such as strength, hardness, or resistance to corrosion. The market covers all aspects of these alloys, including their production, distribution, and usage in various industries.

In simple terms, the Ferro Alloys Market is all about the trade and use of these metallic blends that improve the performance of steel and other metal products. These alloys are essential in many industries, such as construction, automotive, and manufacturing, where strong and durable materials are needed. As industries grow and demand for high-quality metals increases, the ferroalloys market plays a crucial role in providing the necessary materials to support this growth.

Drivers for the Ferro Alloys Market

Growing Demand in the Steel Industry

One of the main drivers for the Ferro Alloys Market is the increasing demand for steel across various sectors. Ferro alloys are crucial for steel production as they improve the steel's properties, such as its strength, hardness, and resistance to corrosion. As industries like construction, automotive, and infrastructure continue to expand, the need for high-quality steel grows. For instance, the building of new infrastructure, such as bridges and skyscrapers, relies heavily on steel, which in turn drives the demand for ferro alloys. The steel industry’s continuous innovation and growth are thus a significant factor pushing the ferroalloys market forward.

Expansion of Automotive and Manufacturing Sectors

The expansion of the automotive and manufacturing sectors also boosts the ferroalloys market. Modern vehicles require strong and durable materials for safety and performance, making ferro alloys essential. These alloys are used to produce components that need high strength and resistance to wear and tear. The rise in vehicle production and the development of new manufacturing technologies increase the need for ferroalloys. As these industries grow and evolve, they drive higher demand for materials that enhance the quality and performance of their products.

Restraints for the Ferro Alloys Market

Volatility in Raw Material Prices

One significant restraint for the Ferro Alloys Market is the volatility in the prices of raw materials. Ferro alloys are made from materials like chromium, manganese, and silicon, which can experience significant price fluctuations due to factors such as supply disruptions, geopolitical tensions, and changes in mining regulations. These price swings can affect the overall cost of ferroalloys, making it challenging for producers to maintain stable pricing for their products. Consequently, the instability in raw material costs can impact the profitability of ferro alloy manufacturers and may lead to higher prices for end-users, potentially affecting market growth.

Environmental Regulations and Compliance Costs

Environmental regulations pose another challenge for the ferroalloys industry. The production of ferroalloys involves processes that can be harmful to the environment, such as high energy consumption and emissions of pollutants. Governments and environmental agencies are increasingly enforcing strict regulations to minimize the environmental impact of industrial activities. Compliance with these regulations often requires significant investments in pollution control technologies and waste management systems. These additional costs can strain the financial resources of ferroalloy producers, impacting their ability to compete in the market and affecting overall industry profitability.

Opportunity in the Ferro Alloys Market

Growing Infrastructure Development

One of the major opportunities in the Ferro Alloys Market is the surge in global infrastructure development. As countries around the world invest heavily in building and upgrading infrastructure, such as roads, bridges, and airports, the demand for high-quality steel increases. Ferroalloys play a crucial role in improving the strength and durability of steel used in these construction projects. This growing infrastructure investment creates a significant opportunity for ferro alloy producers to supply the materials needed for these essential projects, driving market growth and expanding their business opportunities.

Expanding Automotive and Aerospace Sectors

The automotive and aerospace industries offer substantial opportunities for the ferroalloys market. In the automotive sector, there is an increasing demand for lightweight yet strong materials to improve vehicle performance and fuel efficiency. Ferro alloys are used to manufacture components that require high strength and durability, such as engine parts and structural components. Similarly, the aerospace industry relies on ferro alloys for parts that must withstand extreme conditions and provide high performance. The expansion of these industries, driven by technological advancements and rising consumer demand, provides a growing market for ferroalloys.

Technological Advancements in Alloy Production

Technological advancements in alloy production present another opportunity for growth in the ferroalloys market. Innovations in production techniques, such as improved smelting processes and enhanced control over alloy composition, can lead to the development of new ferro alloys with superior properties. These advancements not only improve the efficiency and quality of ferroalloys but also open up new applications and markets. Companies that invest in these technological improvements can gain a competitive edge and expand their product offerings to meet the evolving needs of various industries.

Trends for the Ferro Alloys Market

Increased Use in Stainless Steel Production

One prominent trend in the Ferro Alloys Market is the growing use of ferroalloys in stainless steel production. Ferro alloys, such as ferrochrome and ferromanganese, are essential for producing stainless steel, which is widely used in various applications due to its corrosion resistance and strength. The demand for stainless steel is rising, driven by its use in industries like construction, automotive, and consumer goods. This trend is boosting the need for ferroalloys, as manufacturers require these materials to achieve the desired properties in their steel products.

Rising Demand from Emerging Markets

Emerging markets, particularly in Asia-Pacific and Africa, are experiencing rapid industrialization and urbanization, which is driving up the demand for ferro alloys. Countries in these regions are investing heavily in infrastructure, automotive production, and manufacturing, all of which require ferro alloys. The growing economies in these markets are creating new opportunities for ferro alloy producers as they seek to supply materials for construction projects, automotive components, and industrial applications. This trend highlights the potential for market expansion in these rapidly developing regions.

Segments Covered in the Report

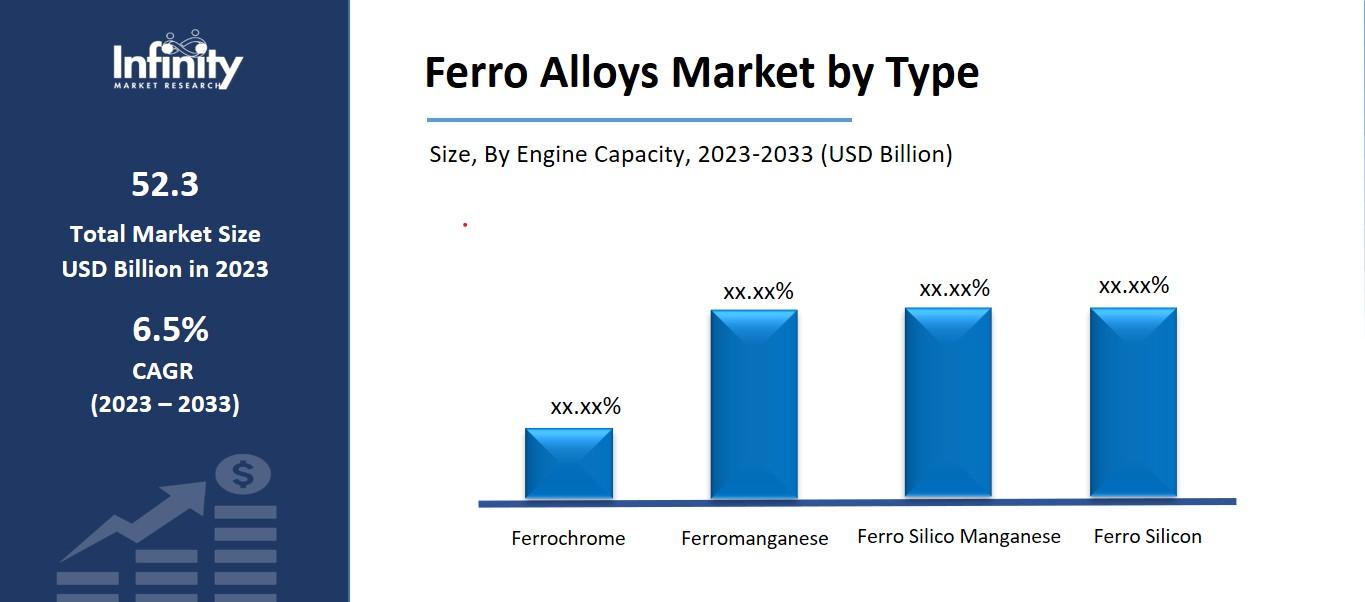

By Product Type

o Ferro chrome

o Ferro manganese

o Ferro Silico Manganese

By Application

o Carbon & Low Alloy Steel

o Stainless Steel

o Alloy Steel

o Cast Iron

o Other Applications

Segment Analysis

By Product Type Analysis

In 2023, the ferromanganese segment held a share of more than 34.9%. The steel and foundry industries are the main users of ferromanganese. Because of its sulfide and deoxidant former qualities, ferromanganese is mostly used as a desulphurizing agent in the steel industry, which drives demand for the material. Sulfur and manganese collaborate to prevent the production of iron sulfide, which can cause cracking.

Made by smelting the slag from high carbon ferromanganese, silicomanganese is a ferro alloy with 65–68% manganese, 1.52% carbon, and 16–21% silicon content. Additionally, it contains less of certain components including carbon, phosphorus, and sulfur. Because silicomanganese has a lower carbon content than manganese, it is employed as a ladle addition of both manganese and silicon in the steelmaking process.

From 2023 to 2033, the ferrosilicon segment is expected to see a compound annual growth rate (CAGR) of 7.5% in revenue. It is employed in processes like steel deoxidization to remove metals from their oxides. Additionally, it increases the strength and quality of iron and steel goods and offers corrosion resistance. Cast irons, alloy steel, carbon steel, electrical steel, and stainless steel are all produced using ferro silicon.

By Application Analysis

With a market share of more than 31.7% in 2023, the stainless steel category led the industry. Over the course of the forecast period, the segment is expected to grow at a profitable rate. China was the nation that produced the most stainless steel in 2020, accounting for over 59% of global production, according to The International Stainless Steel Forum (ISSF).

Over the course of the forecast period, cast iron is anticipated to continue to grow at the quickest rate in the market. A little amount of manganese, chromium, nickel, tungsten, and molybdenum are present in cast iron, which is a ferrous alloy. Benefits including cheap part manufacturing costs, superior casting qualities, increased compression strength, durability, and deformation resistance are anticipated to fuel the segment's expansion.

Cast iron is used in a variety of applications, including plumbing for the oil and gas sector, parts for machinery and equipment, automotive parts like flywheels, cylinder blocks, and manifolds for combustion engines, flanges, fittings, and pump impellers, as well as household utensils and pots.

Regional Analysis

In terms of both volume and revenue, the Asia Pacific region led the market and accounted for more than 60.8% of worldwide revenue in 2023. China, a major producer and user of ferroalloys, is expected to maintain its position as the market leader in the upcoming years. In the Asia Pacific region, Vietnam, Indonesia, Malaysia, and India are the growing regional markets for ferroalloys. Over the next few years, China and the aforementioned rising market should see profitable expansion.

While steel production in Canada and Mexico decreased in 2021, the North American market indicated a positive growth in steel production in the United States. The United States has a far greater market for ferroalloys than either Canada or Mexico because of its massive steel manufacturing. The rising steel output in this area is a significant driver of market expansion. In 2021, the regional ferroalloys market had a significant decline due to a decline in steel production of almost 18%.

Competitive Analysis

In the future, well-established businesses will likely make new investments in this fiercely competitive sector. Sinosteel Corporation subsidiary Zimasco announced a USD 35.0 million investment to increase ferrochrome output.

It is anticipated that the Kwekwe Ferrochrome Smelting Complex will begin a new project with an extra 72 kilotons of yearly capacity. The expanding production capacities to meet the steel demand will result in increased competition in this industry.

Recent Developments

July 2023: For the first time, an LNG-powered Capesize bulk carrier was used by Tata Steel to move raw materials from Australia to India.

July 2023: ArcelorMittal invested USD 5 million in CHAR Technologies and disclosed the outcomes of its XCarbTM Innovation Fund Accelerator Program.

Key Market Players in the Ferro Alloys Market

o Glencore

o Shanghai Shenjia Ferroalloys Co. Ltd.

o Samancore Chrome

o C. Feral S.R.L

o Ferro Alloys Corporation Limited.

o China Minmetals Corporation

o Tata Steel Limited – Ferro Alloys & Minerals Division

o China Minmetals

o Jindal Group

o SAIL

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 52.3 Billion |

|

Market Size 2033 |

USD 97.9 Billion |

|

Compound Annual Growth Rate (CAGR) |

6.5% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Product Type, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Glencore, Shanghai Shenjia Ferroalloys Co. Ltd., Samancore Chrome, C. Feral S.R.L, Ferro Alloys Corporation Limited., China Minmetals Corporation, Tata Steel Limited – Ferro Alloys & Minerals Division, China Minmetals, Jindal Group, SAIL, Other Key Players |

|

Key Market Opportunities |

Growing Infrastructure Development |

|

Key Market Dynamics |

Growing Demand in the Steel Industry |

📘 Frequently Asked Questions

1. What would be the forecast period in the Ferro Alloys Market?

Answer: The forecast period in the Ferro Alloys Market report is 2024-2033.

2. How much is the Ferro Alloys Market in 2023?

Answer: The Ferro Alloys Market size was valued at USD 52.3 Billion in 2023.

3. Who are the key players in the Ferro Alloys Market?

Answer: Glencore, Shanghai Shenjia Ferroalloys Co. Ltd., Samancore Chrome, C. Feral S.R.L, Ferro Alloys Corporation Limited., China Minmetals Corporation, Tata Steel Limited – Ferro Alloys & Minerals Division, China Minmetals, Jindal Group, SAIL, Other Key Players

4. What is the growth rate of the Ferro Alloys Market?

Answer: Ferro Alloys Market is growing at a CAGR of 6.5% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.