🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Flexible Packaging Market

Flexible Packaging Market (By Material (Plastic, Paper, Metal, Bioplastics), By Product (Pouches, Bags, Films & Wraps, Others), By Application (Food & Beverage, Pharmaceutical, Cosmetics, Other Applications), By Region and Companies)

Jun 2024

Packaging and Transports

Pages: 156

ID: IMR1055

Flexible Packaging Market Overview

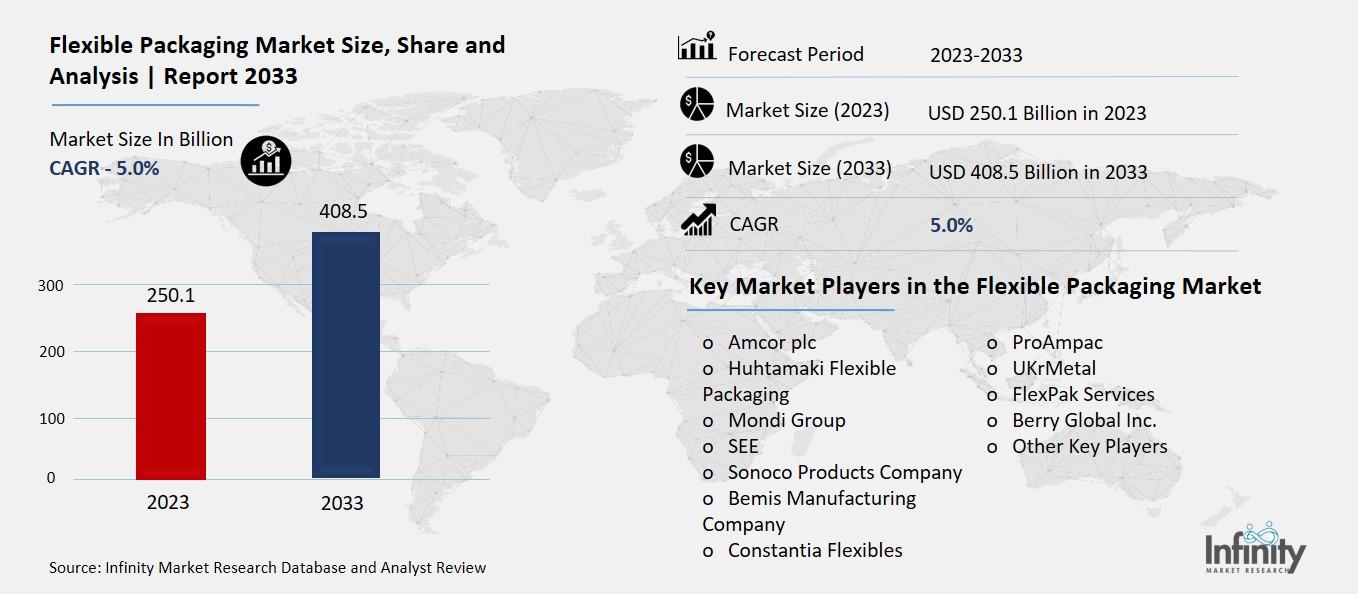

Global Flexible Packaging Market size is expected to be worth around USD 408.5 Billion by 2033 from USD 250.1 Billion in 2023, growing at a CAGR of 5.0% during the forecast period from 2023 to 2033.

The flexible packaging market refers to the industry focused on producing packaging materials that can easily change shape. This type of packaging includes products like bags, pouches, films, and wraps made from materials such as plastic, paper, and aluminum foil. Flexible packaging is popular because it’s lightweight, versatile, and often more cost-effective than rigid packaging options like glass or metal containers.

Flexible packaging is used in many industries, especially food and beverages, pharmaceuticals, and personal care. For example, snack foods, coffee, and tea are commonly packaged in flexible materials to keep them fresh and protect them from moisture and contamination. The market has grown significantly due to its advantages in reducing shipping costs, enhancing product shelf life, and allowing innovative design possibilities. Moreover, it's seen as more environmentally friendly because it typically uses less material and energy to produce and transport.

Drivers for the Flexible Packaging Market

Increasing Demand for Convenient Food Packaging

Flexible packaging is gaining popularity because it meets the growing need for convenient and cost-effective solutions in the food and beverage industry. As people lead busier lives, there's a rising preference for ready-to-eat meals, snacks, and beverages that are easy to carry and store. Flexible packaging, such as pouches and bags, is ideal for these products because it is lightweight, durable, and space-efficient. This type of packaging also helps preserve the freshness and extend the shelf life of food products, which is a significant advantage for both consumers and manufacturers. The food and beverage sector, in particular, heavily relies on flexible packaging to meet consumer demands for convenience and longer shelf life.

Environmental and Sustainability Concerns

Another important factor driving the growth of the flexible packaging market is the increasing focus on sustainability and environmental concerns. Flexible packaging generally requires fewer resources and energy to produce compared to rigid packaging, and it generates less waste. Many companies are investing in developing recyclable and biodegradable materials to meet consumer demand for eco-friendly products. Regulatory pressures in various regions are also pushing manufacturers to adopt more sustainable practices. For instance, governments are implementing policies to reduce plastic waste, encouraging the use of alternative materials like paper and bioplastics in flexible packaging. This shift towards greener packaging solutions not only benefits the environment but also helps companies improve their brand image and meet the expectations of environmentally conscious consumers.

Technological Advancements and Market Innovations

Technological advancements are playing a crucial role in the flexible packaging market. Innovations in packaging materials and production technologies have enhanced the functionality and appeal of flexible packaging. For example, advancements in barrier properties and print quality have made flexible packaging more effective at protecting contents and more attractive on store shelves. Companies are also exploring smart packaging solutions that can provide consumers with additional information about the product, such as freshness indicators and QR codes for product tracking. These innovations are helping manufacturers meet the diverse needs of their customers and stay competitive in a rapidly evolving market.

Regional Market Dynamics

The flexible packaging market is experiencing significant growth across various regions. Asia-Pacific, in particular, is a leading market due to its large population and increasing consumption of packaged foods. Countries like China and India are major contributors to this growth, driven by expanding distribution channels and rising demand for pharmaceutical and food packaging. North America is also a key market, with high demand for flexible packaging in the United States driven by the popularity of ready-to-eat meals and busy lifestyles. Europe is focusing on sustainability, with many companies in the region adopting eco-friendly packaging solutions to comply with stringent environmental regulations. These regional dynamics highlight the diverse factors influencing the growth of the flexible packaging market globally.

Restraints for the Flexible Packaging Market

Environmental Concerns and Recycling Issues

One of the major restraints in the flexible packaging market is the environmental impact associated with its use. Flexible packaging often relies heavily on plastics, which can be difficult to recycle and contribute to pollution. The growing awareness about the environmental consequences of plastic waste has led to increased pressure from consumers and regulators for more sustainable packaging solutions. This is especially challenging for the flexible packaging industry because many of the materials used are not easily recyclable, leading to significant waste management issues. Despite advancements in recycling technologies and efforts to improve the sustainability of flexible packaging, the industry still faces criticism and regulatory challenges aimed at reducing plastic use and promoting greener alternatives.

Higher Operational Costs

Another significant challenge for the flexible packaging market is the high operational costs involved. The production of flexible packaging materials often requires substantial investment in specialized equipment and technology, which can be expensive to maintain and upgrade. Additionally, fluctuations in the prices of raw materials, such as plastics and aluminum, can lead to increased production costs. These costs are often passed on to consumers, making flexible packaging less competitive compared to more traditional packaging solutions. The need to balance cost efficiency with the demand for high-quality, durable, and attractive packaging further complicates the economic landscape for manufacturers in this market.

Fragmented Market and Intense Competition

The flexible packaging market is highly fragmented, with numerous small and medium-sized enterprises competing alongside a few large players. This fragmentation leads to intense competition, which can drive down prices and profit margins. Smaller companies often struggle to keep up with the innovations and economies of scale achieved by larger corporations, making it difficult for them to maintain a competitive edge. The market's fragmentation also means that standardizing sustainable practices and recycling efforts is more complicated, as each company may follow different guidelines and technologies, further hindering overall progress toward sustainability.

Technological and Regulatory Barriers

The industry also faces technological and regulatory barriers that can impede growth. Developing new, eco-friendly materials and packaging solutions requires significant research and development, which can be costly and time-consuming. Moreover, stringent regulations regarding food safety, pharmaceutical packaging standards, and environmental protections can limit the flexibility and innovation within the market. Companies must navigate complex regulatory environments, which vary by region, to ensure compliance while trying to innovate and reduce costs. These regulatory hurdles can slow down the introduction of new products and technologies, impacting the market's ability to respond swiftly to changing consumer demands and environmental concerns.

Trends for the Flexible Packaging Market

Sustainability and Eco-Friendly Solutions

One of the biggest trends in the flexible packaging market is the push towards sustainability. Consumers are increasingly concerned about the environmental impact of plastic packaging, and companies are responding by developing more eco-friendly solutions. This includes using biodegradable materials, increasing the use of recycled content, and improving the recyclability of packaging products. Bioplastics, which are derived from renewable resources like corn starch, are becoming more popular as they offer a potential solution to reducing plastic waste. Additionally, the reduction of packaging weight and the use of flexible packaging help decrease transportation emissions and overall environmental footprint.

Technological Advancements

Technology is playing a pivotal role in the evolution of flexible packaging. The integration of artificial intelligence (AI) and robotics is helping manufacturers optimize their packaging processes. For example, AI can determine the most efficient packaging methods, reducing material waste and energy consumption. Robotics is being used to improve sorting and recycling processes, ensuring that more materials can be reused effectively. Furthermore, innovations such as smart packaging, which includes sensors and QR codes, are enhancing product tracking and providing consumers with interactive experiences. This technological leap is not only improving efficiency but also meeting consumer demands for transparency and connectivity.

Customization and Personalization

The trend towards customization and personalization in packaging is growing, particularly influenced by the preferences of younger generations like Gen Z. Flexible packaging offers brands the ability to create unique, eye-catching designs that cater to individual consumer preferences. This trend is especially evident in the beauty and personal care sectors, where personalized packaging can significantly enhance the consumer experience. The rise of social media platforms has also driven this trend, as visually appealing and customizable packaging helps brands stand out in a crowded market.

Convenience and Practicality

Flexible packaging is favored for its convenience and practicality. As consumer lifestyles become busier, there is a growing demand for packaging solutions that offer ease of use, such as resealable pouches, single-serve packets, and lightweight materials that are easy to carry. This type of packaging is particularly popular in the food and beverage industry, where it helps extend shelf life, maintain product freshness, and reduce food waste. The practicality of flexible packaging makes it a preferred choice for on-the-go consumers and those seeking convenient meal solutions.

Segments Covered in the Report

By Material

o Plastic

o Paper

o Metal

o Bioplastics

By Product

o Pouches

Refill Pouch

o Bags

o Films & Wraps

Stretch & Shrink Labels

o Others

By Application

o Food & Beverage

o Pharmaceutical

o Cosmetics

o Other Applications

Segment Analysis

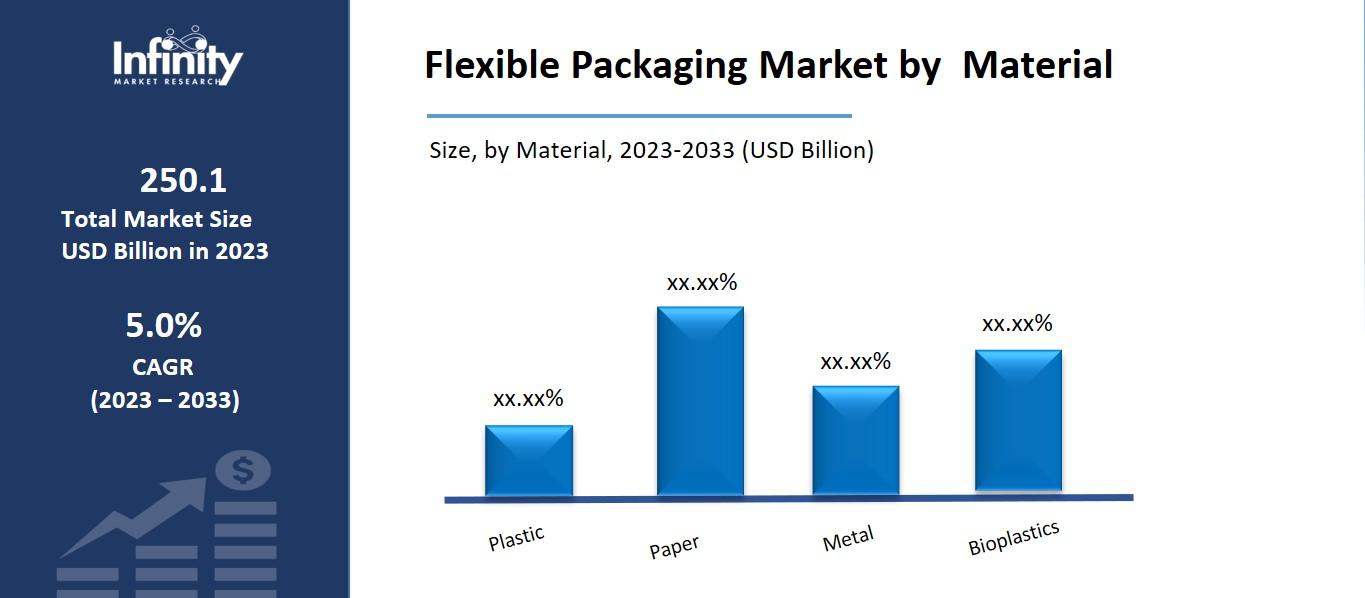

By Material Analysis

The flexible packaging market is divided into four material segments: plastic, paper, metal, and bioplastics. In 2023, the plastic sector had the largest market share in terms of revenue, accounting for more than 68.8%. The availability of a diverse range of alternatives, as well as their better tensile strength as compared to metal counterparts, are projected to drive demand over the projection period.

The bioplastics segment is expected to develop at the fastest pace of 6.1% over the projected period. They have grown in favor across a variety of industries, including flexible packaging, as a potential solution to metal waste and reduce reliance on fossil fuels. According to Plastic Europe, flexible packaging has emerged as the top global application category for bioplastics, accounting for 695.6 kilotons of bioplastics consumed in 2022 alone.

The paper category had a sizable market share in the base year 2023. The increased need for environmentally friendly packaging materials has boosted demand for paper in flexible packaging applications. It is made of wood pulp and is noted for being lightweight, tear-resistant, thick, and strong. Its coarse texture, caused by highly aligned fibers, provides better protection than many other packaging materials. Its biodegradable nature also enables for easy disposal or recycling.

The metals section is expected to develop at a considerable CAGR throughout the forecast period. This is owing to its widespread applicability in several types of industries, including food and beverage and pharmaceutical packaging. Aluminum foil has an excellent moisture, gas, and light barrier, making it ideal for use in flexible laminates for food, beverage, and industrial applications.

By Product Analysis

The flexible packaging market is divided into several product categories, including pouches, bags, films and wraps, and others. In 2023, the pouches segment had the greatest market share in terms of sales, accounting for more than 37.7%. This high market share is owing to food and beverage firms' rising use of refill pouches to cut packaging costs. The bag segment is expected to develop at a CAGR of 5.1% during the forecast period. This market expansion is driven by the widespread use of these bags to pack bulk products such as vehicle components, agricultural products, chemicals, and detergents.

The films and wraps sector had a considerable market share in 2023 owing to qualities such as improved shrinking, twist retention, and transparency. These films are used to protect packaged goods during the packing, distribution, and storage processes. They are typically used on outside flexible packaging to boost tearing resistance.

By Application Analysis

The market is divided into categories based on application, including food and beverage, pharmaceuticals, cosmetics, and others. Among them, the food and beverage segment emerged as the most significant application segment for flexible packaging in 2023, accounting for more than 54.6% of the market. Growing demand for packaged foods, such as ready-to-eat meals, frozen meals, snack foods, and cake mixes, is likely to push manufacturers to boost production capacity, hence increasing product demand over the forecast period.

Pharmaceutical applications are anticipated to increase at a CAGR of 6.1% over the forecast period. This increase can be due to its widespread use in packaging and safeguarding a wide range of medical drug items, such as powders, tablets, and capsules. Pouches, blister packages, and strip packages are the most popular types of flexible packaging in the pharmaceutical industry.

The cosmetics industry is being driven by numerous shampoo manufacturers releasing samples and trial packs in flexible single-serving sachets or pillow pouches. Customers may now try out new beauty products before purchasing a complete bottle, saving money. Cosmetic product producers see samples in single-use packets as an excellent marketing tool for increasing brand recognition and encouraging low-risk trials.

Regional Analysis

In 2023, the Asia Pacific region retained the greatest share, accounting for more than 37.9%. The flexible packaging industry is expected to grow at a rapid pace over the forecast period. Domestic demand for flexible packaging in Asia Pacific is increasing significantly as a result of rapid urbanization in China and India, which are the top consumers of packaged foods. The most flexible packaging used in Asia Pacific is for packaged food, such as noodles and snacks. Flexible metal is valued for its food preservation properties, cost, and convenience.

China held the region's highest market share in 2023, thanks to rigorous government rules aimed at reducing packaging waste and promoting package sustainability, which can help China's flexible packaging industry thrive. For example, in September 2021, China's State Administration for Markets issued Regulation GB 23350-2021 'Requirements of Restricting Excessive Package - Foods and Cosmetics', an amendment to standards published in 2009 that requires cosmetic and food companies to redesign their product packaging. This standard is planned to go into effect in September 2023.

Europe is expected to have a significant need for flexible metal packaging solutions due to the rapid growth of the healthcare, food and beverage, and personal care industries. The European market is comprised of both international and domestic players. The market's leading manufacturers have manufacturing facilities in countries such as the United Kingdom, Germany, and Italy.

North America is expected to develop at a CAGR of 4.5% over the forecast period due to lightweight solutions in the region, combined with consumer lifestyle trends that require portability and convenience of products, which has increased demand for flexible packaging solutions. Another major aspect driving the sector is the increased use of innovative packaging technology. This is owing to the numerous advantages provided by flexible metal packaging solutions, including cheap package costs, warehouse costs, transportation costs, and energy usage.

The market in Central and South America is expanding rapidly owing to increased demand for flexible packaging from the food and beverage industries. Central and South American countries such as Brazil, Argentina, and Chile have well-established tomato puree processing industries. Brazil has a substantial position in the fruit juice market and is one of the largest fruit exporters.

A trend toward sustainability, as well as altering consumer behavior toward healthier products, is predicted to drive up demand for flexible packaging throughout the Middle East and Africa. Population increase, combined with rising consumer disposable income in the region, has created a high demand for quality and organic food. However, the region's manufacturing industry is growing at a slower rate than other regions due to unfavorable geography and a lack of raw material availability. This is expected to have an impact on the regional manufacturing of flexible packaging solutions.

Competitive Analysis

Key companies use repeated mergers and acquisitions to obtain market share in a specific region. In some circumstances, firms make multiple acquisitions to create a more advanced product with greater performance qualities and thus boost revenue. For example, in August 2023, Amcor plc agreed to acquire Phoenix Flexibles, a Gujarat-based flexible packaging producer. Amcor plc now has four packaging plants in India, and this acquisition is intended to help the firm grow its market presence in India.

Key Market Players in the Flexible Packaging Market

o Huhtamaki Flexible Packaging

o SEE

o Bemis Manufacturing Company

o Constantia Flexibles

o ProAmpac

o UKrMetal

o Berry Global Inc.

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 250.1 Billion |

|

Market Size 2033 |

USD 408.5 Billion |

|

Compound Annual Growth Rate (CAGR) |

5.0% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

- |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

Product, Material, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Amcor plc, Huhtamaki Flexible Packaging, Mondi Group, SEE, Sonoco Products Company, Bemis Manufacturing Company, Constantia Flexibles, ProAmpac, UKrMetal, FlexPak Services, Berry Global Inc., Other Key Players |

|

Key Market Opportunities |

Growing E-commerce Sector |

|

Key Market Dynamics |

Increasing Demand for Convenient Food Packaging |

📘 Frequently Asked Questions

1. How much is the Flexible Packaging Market in 2023?

Answer: The Flexible Packaging Market size was valued at USD 250.1 Billion in 2023.

2. What would be the forecast period in the Flexible Packaging Market?

Answer: The forecast period in the Flexible Packaging Market report is 2023-2033.

3. Who are the key players in the Flexible Packaging Market?

Answer: Amcor plc, Huhtamaki Flexible Packaging, Mondi Group, SEE, Sonoco Products Company, Bemis Manufacturing Company, Constantia Flexibles, ProAmpac, UKrMetal, FlexPak Services, Berry Global Inc., Other Key Players

4. What is the growth rate of the Flexible Packaging Market?

Answer: Flexible Packaging Market is growing at a CAGR of 5.0% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.