🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Freight and Logistics Market

Freight and Logistics Market (By Shipping Type (Airways, Railways, Roadways, Waterways), By Service (Inventory Management, Packaging, Warehousing, Transportation, Distribution, Custom Clearance, Other), By End-Use Industry (Manufacturing and Automotive, Oil and Gas, Mining, Quarrying, Agriculture, Fishing, Forestry, Construction, Distributive Trade, Health Care, Pharmaceutical, Chemicals, Telecommunications), By Region and Companies)

Jul 2024

Packaging and Transports

Pages: 160

ID: IMR1131

Freight and Logistics Market Overview

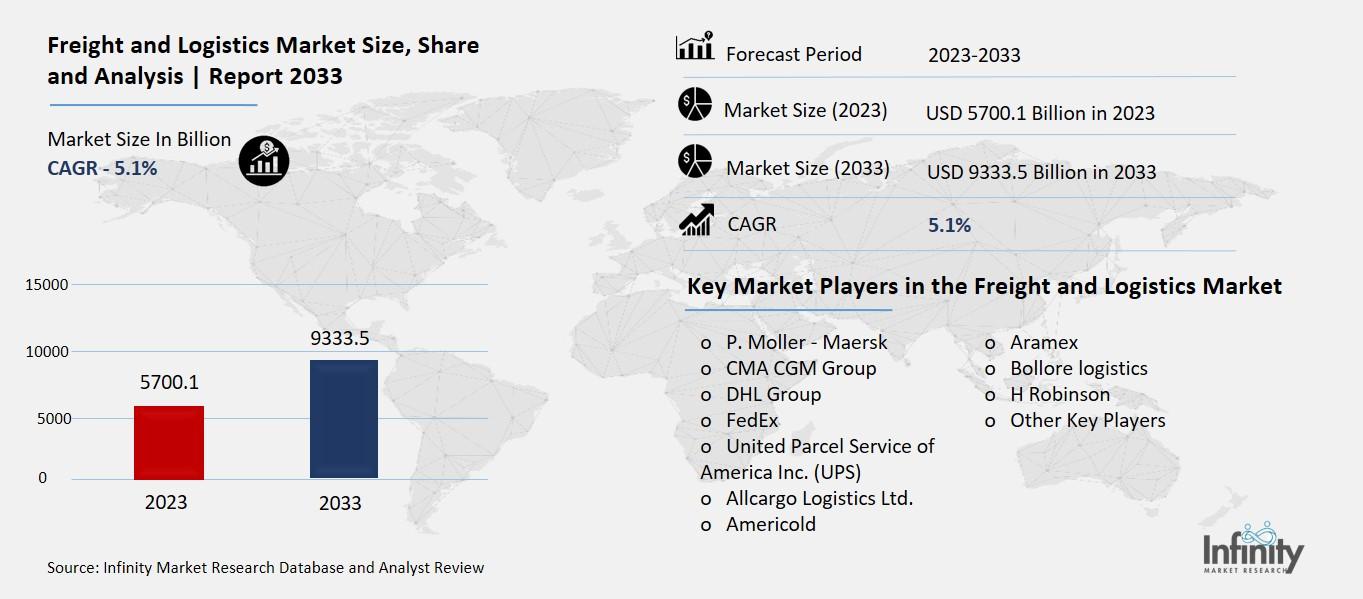

Global Freight and Logistics Market size is expected to be worth around USD 9,333.5 Billion by 2033 from USD 5,700.1 Billion in 2023, growing at a CAGR of 5.1% during the forecast period from 2023 to 2033.

The freight and logistics market is all about the movement and storage of goods. It includes everything involved in getting products from one place to another, such as transportation by trucks, ships, trains, and airplanes. It also covers the warehousing and handling of these goods, making sure they are stored safely and efficiently until they reach their final destination. This market is crucial for businesses to deliver their products to customers and keep their supply chains running smoothly.

In simpler terms, think of the freight and logistics market as the big system that helps get your online orders, groceries, and other items where they need to go. Companies in this market work behind the scenes to manage all the steps, from picking up goods from manufacturers to delivering them to stores or directly to your doorstep. They use advanced technology and efficient processes to ensure everything moves quickly and correctly, so you get what you need when you need it.

Drivers for the Freight and Logistics Market

E-commerce Boom

The explosive growth of e-commerce has been a major driver for the freight and logistics market. As more people shop online, the demand for fast and efficient delivery services has skyrocketed. Companies like Amazon and other online retailers need robust logistics networks to handle the vast volume of packages. This surge in online shopping has led to increased investments in warehousing, transportation, and last-mile delivery solutions to meet consumer expectations for quick and reliable shipping.

Global Trade Expansion

The expansion of global trade has significantly boosted the freight and logistics market. With more goods being traded internationally, there is a higher demand for transportation and logistics services to move products across borders. Free trade agreements and economic partnerships between countries have also facilitated smoother and more efficient trade flows. As a result, logistics companies are expanding their networks and services to cater to the growing needs of international trade, driving market growth.

Technological Advancements

Technological advancements are transforming the freight and logistics industry, making operations more efficient and reliable. Innovations like GPS tracking, Internet of Things (IoT) devices, and automated warehouses have revolutionized how goods are stored, tracked, and delivered. These technologies help companies optimize routes, reduce delays, and improve overall supply chain management. The adoption of advanced logistics technologies is a key driver of market growth as it enhances efficiency and customer satisfaction.

Urbanization and Infrastructure Development

Rapid urbanization and infrastructure development in emerging markets are fueling the growth of the freight and logistics market. As cities expand and new urban areas are developed, there is a greater need for efficient transportation and logistics solutions to support the movement of goods. Governments are investing in improving road, rail, and port infrastructure to facilitate smoother logistics operations. This infrastructure development not only supports local supply chains but also boosts regional and global trade, driving market growth.

Demand for Cold Chain Logistics

The increasing demand for cold chain logistics is another significant driver of the freight and logistics market. Industries such as pharmaceuticals, food and beverages, and biotechnology require temperature-controlled environments to transport and store their products safely. The growth of these industries has led to a higher demand for specialized logistics services that can handle perishable and temperature-sensitive goods. This trend is driving investments in cold chain infrastructure and technology, further propelling market growth.

Sustainability and Green Logistics Initiatives

The growing emphasis on sustainability and green logistics is shaping the future of the freight and logistics market. Companies are increasingly adopting eco-friendly practices to reduce their carbon footprint and meet regulatory requirements. This includes investing in electric and hybrid vehicles, optimizing routes to reduce emissions, and implementing energy-efficient warehouse practices. The push towards sustainable logistics solutions is not only beneficial for the environment but also drives innovation and efficiency in the industry, contributing to market growth.

Restraints for the Freight and Logistics Market

High Operational Costs

One of the main restraints in the freight and logistics market is the high operational costs associated with transportation and warehousing. Fuel prices, labor costs, maintenance of vehicles, and investments in infrastructure and technology can significantly impact profitability. Additionally, fluctuating fuel prices add unpredictability to budgeting and financial planning, making it challenging for logistics companies to manage expenses effectively.

Regulatory Challenges

Regulatory challenges pose another significant restraint on the freight and logistics market. The industry is heavily regulated, with various rules and standards governing transportation safety, environmental impact, and cross-border trade. Compliance with these regulations can be costly and time-consuming, requiring companies to invest in training, equipment, and administrative processes. Furthermore, differences in regulations between countries complicate international logistics operations, adding layers of complexity and potential delays.

Infrastructure Limitations

Inadequate infrastructure is a major barrier to efficient logistics operations, particularly in developing regions. Poor road conditions, limited rail networks, and congested ports can lead to delays and increased operational costs. These infrastructure limitations hinder the smooth movement of goods, affecting delivery times and reliability. Governments' slow pace in upgrading and expanding logistics infrastructure exacerbates these challenges, limiting market growth potential in these areas.

Environmental Concerns and Sustainability Issues

The growing focus on environmental sustainability presents challenges for the freight and logistics market. Companies are under increasing pressure to reduce their carbon footprint and adopt green practices. While this shift towards sustainability is essential, it can be costly to implement. Investing in eco-friendly vehicles, optimizing routes for lower emissions, and adopting energy-efficient technologies require substantial financial resources. Balancing the need for sustainability with profitability is a significant restraint for many logistics providers.

Skilled Labor Shortage

A shortage of skilled labor is another critical restraint affecting the freight and logistics market. The industry relies heavily on a skilled workforce, including drivers, warehouse operators, and logistics planners. However, attracting and retaining qualified personnel is becoming increasingly difficult. Factors such as long working hours, the demanding nature of the job, and competition from other sectors contribute to this labor shortage. Without enough skilled workers, logistics companies struggle to maintain efficient operations and meet growing demand.

Opportunity in the Freight and Logistics Market

Growth of E-commerce

The explosive growth of e-commerce offers a massive opportunity for the freight and logistics market. As more people shop online, the demand for fast and reliable delivery services is skyrocketing. Logistics companies have the chance to expand their operations and enhance their delivery networks to meet the increasing volume of packages. Innovations in last-mile delivery solutions, such as drone deliveries and autonomous vehicles, can further boost efficiency and customer satisfaction, driving growth in this sector.

Advancements in Technology

Technological advancements present significant opportunities for the freight and logistics market. The adoption of automation, artificial intelligence (AI), and Internet of Things (IoT) technologies can revolutionize logistics operations. Automated warehouses, real-time tracking systems, and predictive analytics can improve efficiency, reduce errors, and optimize supply chain management. Embracing these technologies allows logistics companies to offer faster and more accurate services, attracting more clients and boosting profitability.

Expansion into Emerging Markets

Emerging markets offer substantial growth potential for the freight and logistics industry. Regions like Asia-Pacific, Latin America, and Africa are experiencing rapid economic growth and urbanization, leading to increased demand for logistics services. Investments in infrastructure development and the rise of e-commerce in these regions further amplify this demand. Logistics companies that expand their presence and build robust networks in emerging markets can tap into new customer bases and drive significant revenue growth.

Focus on Sustainability

The growing emphasis on sustainability provides opportunities for innovation and differentiation in the freight and logistics market. Companies that adopt green logistics practices, such as using electric or hybrid vehicles, optimizing routes to reduce emissions, and investing in energy-efficient warehouses, can appeal to environmentally conscious consumers and businesses. Additionally, regulatory incentives for sustainable practices can reduce operational costs and enhance competitiveness, positioning logistics providers as leaders in the green economy.

Diversification of Services

Diversifying service offerings is another key opportunity for logistics companies. Beyond traditional transportation and warehousing, companies can offer value-added services such as supply chain consulting, inventory management, and integrated logistics solutions. By providing comprehensive services that address various aspects of the supply chain, logistics providers can become indispensable partners to their clients, fostering long-term relationships and securing consistent revenue streams.

Strategic Partnerships and Collaborations

Forming strategic partnerships and collaborations can unlock new opportunities in the freight and logistics market. By partnering with technology companies, logistics firms can leverage cutting-edge innovations to enhance their operations. Collaborations with e-commerce giants, manufacturers, and retailers can streamline supply chains and improve service delivery. These alliances enable logistics companies to expand their capabilities, enter new markets, and offer more competitive services, driving growth and market share.

Trends for the Freight and Logistics Market

Digitalization and Technology Integration

One of the key trends in the freight and logistics market is the increasing use of digital technology. Freight forwarders are investing heavily in advanced tech solutions like track-and-trace capabilities and generative AI. These technologies help improve visibility, enhance customer service, and optimize operations by predicting and responding to crises. Many companies are now recognizing that without digitalization, their businesses might not survive in the competitive market. This trend is driven by customer demands for better services and the need for greater operational efficiency.

Sustainability and Green Logistics

Sustainability is another significant trend shaping the freight and logistics industry. Companies are increasingly committed to making their supply chains more environmentally friendly. This includes adopting sustainable practices, reducing carbon emissions, and using eco-friendly materials. Despite the higher costs associated with green logistics, many businesses see it as an essential part of their long-term strategy. The challenge remains whether customers will accept the added costs, but the momentum for sustainability continues to grow.

Capacity and Rate Dynamics

The dynamics of capacity and rates are crucial trends in the freight and logistics market. The balance between supply and demand is constantly shifting, affecting freight rates. For example, increased capacity on certain trade lanes has made backhaul capacity more available, which can influence shipping costs. However, disruptions like those in the Suez Canal can create significant fluctuations in effective capacity and rates. The market is expected to see further rate adjustments as these disruptions resolve and capacity continues to align with demand.

Economic and Macroeconomic Influences

Economic factors significantly impact the freight and logistics market. Global GDP growth, inflation rates, and consumer purchasing power all play a role in shaping market dynamics. For instance, while global GDP growth projections for 2024 are optimistic, ongoing conflicts and economic policies can create uncertainty. In North America, rising prices and inflation are influencing consumer behavior and freight demand. Understanding these macroeconomic trends helps companies anticipate changes and adjust their strategies accordingly.

Consumer Behavior and Industrial Activity

Consumer purchasing patterns and industrial activities are vital trends affecting the freight and logistics sector. Increased spending on goods and machinery, higher production orders, and a decrease in inventories suggest improving freight demand fundamentals. Additionally, consumer exhaustion from cost pressures is balanced by a willingness to spend on necessary products and services. This behavior influences how companies manage their logistics and supply chain operations, aiming to meet consumer demand effectively.

Regional and Trade Lane-Specific Trends

Different regions and trade lanes exhibit unique trends in the freight and logistics market. For instance, in North America, there is a focus on improving the manufacturing sector, which positively affects freight demand. Trade lanes such as those from Asia to the US or Europe are experiencing changes in capacity and rate dynamics. Understanding these regional nuances is crucial for companies to navigate the complexities of the global market effectively.

Segments Covered in the Report

By Shipping Type

-

Airways

-

Railways

-

Roadways

-

Waterways

By Service

-

Inventory Management

-

Packaging

-

Warehousing

-

Transportation

-

Distribution

-

Custom Clearance

-

Other

By End-Use Industry

-

Manufacturing and Automotive

-

Oil and gas

-

Mining

-

Quarrying

-

Agriculture

-

Fishing

-

Forestry

-

Construction

-

Distributive Trade

-

Health Care

-

Pharmaceutical

-

Chemicals

-

Telecommunications

Segment Analysis

By Shipping Type Analysis

Based on the type of shipping, the worldwide freight and logistics market is divided into four segments: air, rail, road, and water. According to projections, the Waterways sector, which dominated the freight and logistics market in 2023, would expand at a notable CAGR throughout the projected period. The advantages offered by waterways logistics, such as crowded and dependable transit, may be the reason for their growing popularity. The advantages of canal logistics over trucks and railcars include increased loading capacity, lower emissions, effective payload transfer, and optimal fuel consumption. These factors will soon be fueling segment expansion in the freight and logistics sector.

By Service Analysis

The global freight and logistics market is divided into segments based on services, which include distribution, transportation, warehousing, inventory management, packaging, and customs clearance, among others. In 2023, the transportation sector dominated the freight and logistics. Throughout the forecast period, it is expected to increase at a high CAGR. The worldwide freight forwarding industry is anticipated to gain from the anticipated significant growth in freight volumes during the forecast period. The expanding network of agreements will increase trade and investment opportunities, increasing the nation's ability to benefit from the expansion of the global freight and logistics market. The investment frameworks of these agreements help to promote greater economic integration in the global freight and logistics market and a more enticing investment environment.

By End-Use Industry Analysis

The manufacturing and automotive, oil and gas, mining, quarrying, agriculture, fishing, forestry, construction, distributive commerce, health care, pharmaceutical, chemicals, and telecommunications sectors are included in the global freight and logistics market segmentation based on End-Use. The freight and logistics industry will be dominated by the commerce and transportation sector in 2023, and this segment is expected to continue to have the biggest market share for the duration of the forecast. Throughout the forecast period, a notable growth rate is anticipated for the manufacturing and construction industry.

Regional Analysis

The freight and logistics market is led by Asia Pacific in 2023, and over the forecast period, it is anticipated to maintain its dominant position. The major nations in the area are seeing a rise in the use of technology in logistics. Eighty percent of freight in India is delivered by road, and truckers are using advanced tracking equipment to track and forecast arrival dates more accurately. Thailand is enhancing shipment tracking using the blockchain project of IBM and Maersk. Growing intra-Asian trade and increasing imports of consumer goods in addition to industrial inputs are characteristics of Asian logistics.

As Beijing aims to integrate with Asian and European markets and exercise political weight on a regional scale, China's Belt and Road Initiative has led to huge investment in regional transportation infrastructure. Most of the cargo is headed for Europe and the United States through the main East-West trade routes. Nonetheless, the importance of intra-Asian trade has grown during the past few years. To meet the demand for containerized goods, other Asia Pacific nations are spending billions of dollars on improvements, even though China, Japan, and South Korea have sizable, contemporary container ports.

Competitive Analysis

Many companies in the fiercely competitive global freight and logistics market provide a variety of software solutions. The competitive environment is defined by the existence of established businesses up-and-coming startups and niche competitors. Product launches and strategic collaborations are only two of the tactics that these organizations are using to improve their market position and draw in a large consumer base.

Recent Developments

March 2024: With the opening of a new regional office in Riyadh, Aramex has increased its presence in Saudi Arabia. This move will help Aramex better serve both new and existing businesses in the region, improve the Kingdom's logistics infrastructure, and advance Vision 2030's objective of making Saudi Arabia a hub for global logistics.

March 2024: In the United Arab Emirates (UAE), Aramex has added a fleet of all-electric motorbikes to its last-mile delivery network. This program is a component of Aramex's long-term strategic objective, which is in line with the Science Based Targets initiative (SBTi) target that Aramex is committed to, to have 98% of its fleet be electric vehicles (EVs) by 2030. The e-bikes were unveiled following extensive testing of other models and manufacturers; Aramex ultimately decided on the chosen model because of its reliable performance and stability, especially in the local climate.

Key Market Players in the Freight and Logistics Market

-

P. Moller - Maersk

-

FedEx

-

United Parcel Service of America Inc. (UPS)

-

Allcargo Logistics Ltd.

-

Americold

-

Aramex

-

Bollore logistics

-

H Robinson

-

Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 5,700.1 Billion |

|

Market Size 2033 |

USD 9,333.5 Billion |

|

Compound Annual Growth Rate (CAGR) |

5.1% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

- |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Shipping Type, Service, End-Use Industry, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

A.P. Moller - Maersk, CMA CGM Group, DHL Group, FedEx, United Parcel Service of America Inc. (UPS), Allcargo Logistics Ltd., Americold, Aramex, Bollore logistics, C.H Robinson, Other Key Players |

|

Key Market Opportunities |

Advancements in Technology |

|

Key Market Dynamics |

E-commerce Boom |

📘 Frequently Asked Questions

1. How much is the Freight and Logistics Market in 2023?

Answer: The Freight and Logistics Market size was valued at USD 5700.1 Billion in 2023.

2. What would be the forecast period in the Freight and Logistics Market report?

Answer: The forecast period in the Freight and Logistics Market report is 2023-2033.

3. Who are the key players in the Freight and Logistics Market?

Answer: A.P. Moller - Maersk, CMA CGM Group, DHL Group, FedEx, United Parcel Service of America Inc. (UPS), Allcargo Logistics Ltd., Americold, Aramex, Bollore logistics, C.H Robinson, Other Key Players

4. What is the growth rate of the Freight and Logistics Market?

Answer: Freight and Logistics Market is growing at a CAGR of 5.1% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.