🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Glass Container Market

Global Glass Container Market (By Product Type (Glass Bottle, Glass Jar, Glass Vials, Candle Glass Container), By End-Use (Cosmetics & Perfume, Pharmaceuticals, Food Packaging, Beverage Packaging, Other End-Uses), By Region and Companies)

Jun 2024

Chemicals and Materials

Pages: 138

ID: IMR1054

Glass Container Market Overview

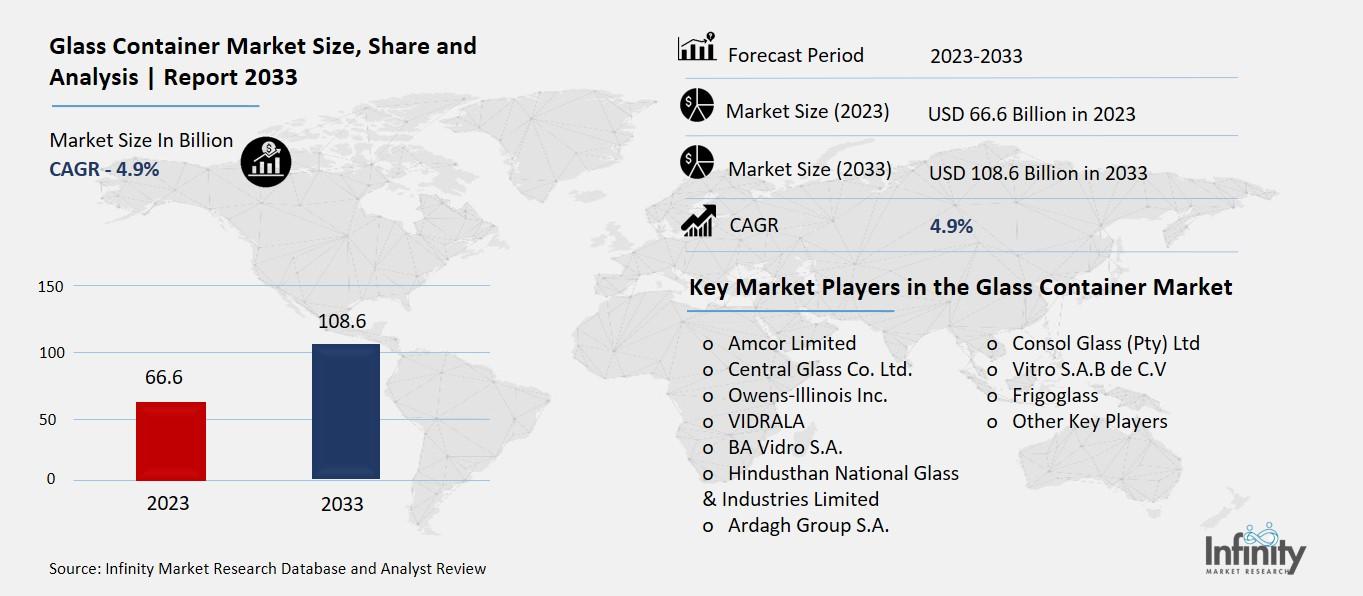

Global Glass Container Market size is expected to be worth around USD 108.6 Billion by 2033 from USD 66.6 Billion in 2023, growing at a CAGR of 4.9% during the forecast period from 2023 to 2033.

The glass container market refers to the industry involved in the production and distribution of glass packaging solutions like bottles, jars, and other containers used primarily for beverages, food, pharmaceuticals, and personal care products. Glass containers are valued for their durability, non-reactivity, and excellent barrier properties that protect contents from external contaminants, preserving freshness and quality. They are particularly favored for their ability to be recycled and their eco-friendly nature, aligning well with increasing consumer demand for sustainable packaging options.

The market is segmented into various types. This segment benefits from glass's premium feel and ability to preserve the taste and quality of high-end drinks like wine, spirits, and craft beverages. Glass containers are also extensively used in the food sector for packaging sauces, condiments, and preserved goods due to their inert nature and ability to maintain product integrity. Additionally, the cosmetics and pharmaceutical industries rely on glass packaging for its non-reactive properties and ability to protect sensitive products from contamination.

Drivers for the Glass Container Market

Growing Demand for Sustainable Packaging Solutions:

One of the primary drivers of the glass container market is the increasing global demand for sustainable packaging solutions. Glass containers are preferred over plastic and other materials because they are 100% recyclable and do not lose quality or purity during the recycling process. Consumers and businesses alike are increasingly prioritizing environmentally friendly packaging options, which has significantly boosted the demand for glass containers across various industries such as food and beverage, pharmaceuticals, cosmetics, and more.

Rising Consumption of Alcoholic Beverages:

The consumption of alcoholic beverages, such as beer, wine, and spirits, is a major driver of the glass container market. Glass bottles are the preferred packaging choice for alcoholic beverages due to their ability to preserve the taste and quality of the contents without altering their flavor. As global consumption of alcoholic beverages continues to rise, especially in emerging markets, the demand for glass containers is expected to grow correspondingly.

Advantages in Preserving Product Integrity:

Glass containers offer superior preservation qualities compared to other packaging materials. They are impermeable, non-reactive, and transparent, which helps preserve the taste, aroma, and integrity of food, beverages, and pharmaceutical products. This advantage has made glass containers the preferred choice for products that require long shelf lives and protection from external contaminants.

Shift Towards Premium and Luxury Packaging:

There is a growing trend towards premium and luxury packaging solutions across various consumer goods industries. Glass containers are often perceived as more premium and high-quality compared to plastic or metal packaging, making them ideal for premium products. This trend is particularly evident in the cosmetics and perfumes industry, where the aesthetic appeal and luxurious feel of glass containers contribute to brand value and consumer perception.

Regulatory Support and Consumer Awareness:

Government regulations promoting sustainable packaging practices and reducing plastic use have further fueled the demand for glass containers. Many countries and regions have implemented policies and initiatives to encourage the use of recyclable materials, benefiting the glass container market. Additionally, increasing consumer awareness about environmental issues and the benefits of recycling has prompted a shift towards eco-friendly packaging options, including glass containers.

Restraints for the Glass Container Market

Competition from Alternative Packaging Materials:

One of the major restraints for the glass container market is the increasing competition from alternative packaging materials, such as plastic, aluminum, and cartons. These materials often offer advantages like lighter weight, lower transportation costs, and greater design flexibility, which can be appealing to manufacturers and consumers alike. As a result, glass containers face stiff competition in various sectors, particularly in industries where cost-efficiency and convenience are prioritized over sustainability.

Fragility and Weight:

Glass containers, while advantageous in preserving product integrity, are also fragile and heavier compared to other packaging materials. This fragility makes them susceptible to breakage during transportation and handling, which can increase logistics costs and pose safety risks. Additionally, the weight of glass containers can contribute to higher transportation costs and carbon emissions, particularly over long distances, compared to lighter alternatives like plastic.

High Manufacturing Costs:

The manufacturing process for glass containers involves high energy consumption and capital investment, which contributes to higher production costs compared to other packaging materials. The melting and shaping of glass require significant energy inputs, and the infrastructure needed for glass manufacturing is expensive to build and maintain. These high manufacturing costs can make glass containers less competitive in price-sensitive markets and limit their adoption, especially in developing regions.

Limited Design Flexibility:

Glass containers have traditionally been associated with a more limited range of shapes and designs compared to materials like plastic. While advancements in glass manufacturing technology have allowed for some innovation in shapes and sizes, glass containers generally offer less flexibility in terms of customization and design compared to other packaging materials. This limitation can restrict their appeal in markets where unique packaging designs are valued, such as in the cosmetics and personal care industries.

Perception of Environmental Impact:

Despite being recyclable, there is a perception among some consumers and businesses that the production and recycling of glass containers have a significant environmental impact. This perception can influence purchasing decisions and lead to a preference for alternative packaging materials perceived to have a lower environmental footprint, such as biodegradable plastics or recycled materials.

Regulatory Challenges and Safety Concerns:

Glass containers are subject to stringent regulatory requirements and safety standards due to their fragility and potential risk of breakage. These regulations can vary significantly across different regions and industries, adding complexity and cost to the manufacturing and distribution processes. Moreover, concerns about the safety of handling and using glass containers in certain applications, such as in food and pharmaceuticals, can further limit their adoption in these markets.

Trends for the Glass Container Market

Shift Towards Lightweight and Sustainable Packaging:

One of the prominent trends in the glass container market is the shift toward lightweight and sustainable packaging solutions. Manufacturers are increasingly focusing on lightweight technologies to reduce the weight of glass containers while maintaining their strength and durability. This trend not only lowers transportation costs and carbon emissions but also enhances the overall sustainability profile of glass packaging. Additionally, there is a growing demand for eco-friendly packaging options, driven by consumer preferences for products that are recyclable and contribute to environmental conservation.

Rising Demand for Customization and Premiumization:

There is a rising trend towards customization and premiumization in the glass container market. Brands are seeking to differentiate their products through unique and aesthetically appealing packaging designs. Advancements in digital printing technology have enabled manufacturers to offer customized designs, colors, and graphics on glass containers, catering to the preferences of both brands and consumers. This trend is particularly evident in industries such as cosmetics, perfumes, and premium spirits, where packaging plays a crucial role in brand positioning and consumer perception.

Growing Adoption of Smart and Intelligent Packaging:

Smart and intelligent packaging solutions are gaining traction in the glass container market. These technologies incorporate features such as QR codes, NFC tags, and temperature sensors to provide consumers with real-time information about product authenticity, freshness, and usage. In the pharmaceutical industry, smart glass packaging is used to monitor medication adherence and dosage, enhancing patient safety and convenience. This trend is expected to expand as brands seek to leverage technology to improve consumer engagement and product differentiation.

Expansion in Pharmaceutical and Healthcare Applications:

Glass containers are increasingly being used in pharmaceutical and healthcare applications due to their inherent properties of chemical inertness, non-reactivity, and impermeability. These properties ensure the integrity and stability of pharmaceutical products, protecting them from contamination and degradation. The pharmaceutical industry's stringent quality and safety standards make glass containers the preferred choice for packaging medications, vaccines, and diagnostic products. As the global pharmaceutical market grows, so does the demand for high-quality glass packaging solutions.

Adoption of Circular Economy Principles:

The adoption of circular economy principles is a growing trend in the glass container market. Manufacturers and brands are focusing on implementing closed-loop recycling systems, where glass containers are collected, sorted, and recycled back into new packaging materials. This approach reduces the environmental impact of glass production and disposal, promotes resource efficiency, and supports sustainable supply chain practices. Governments and regulatory bodies are also implementing policies to promote the use of recycled content in glass packaging, further driving this trend.

Innovation in Packaging Design and Material Handling:

Innovation in packaging design and material handling is another significant trend in the glass container market. Manufacturers are exploring new shapes, sizes, and closure systems to enhance convenience and functionality for consumers. Additionally, advancements in automated handling and filling technologies are improving production efficiency and reducing operational costs for manufacturers. These innovations are crucial for meeting the evolving demands of the food and beverage, cosmetics, and pharmaceutical industries.

Segments Covered in the Report

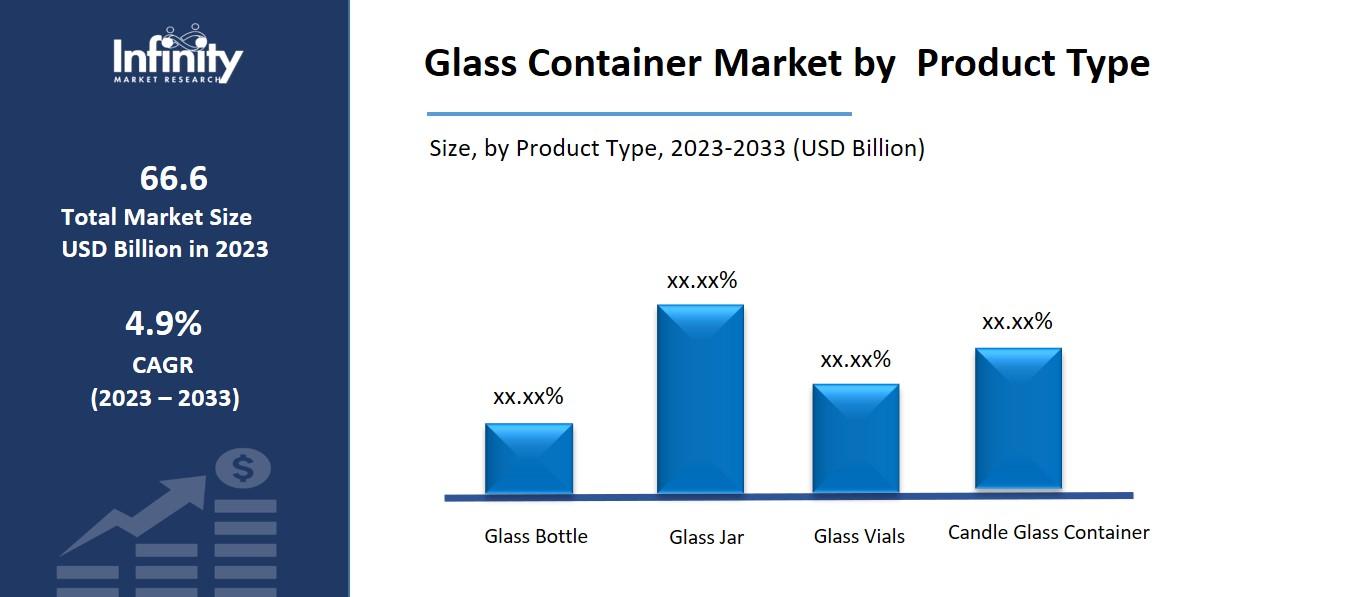

By Product Type

o Glass Bottle

o Glass Jar

o Glass Vials

o Candle Glass Container

By End-Use

o Cosmetics & Perfume

o Pharmaceuticals

o Food Packaging

o Beverage Packaging

o Other End-Uses

Segment Analysis

By Product Type Analysis

The global Glass Container market is divided into four product types: glass bottles, glass jars, glass vials, and candle glass containers. The glass bottle category is the largest section in the market, accounting for 60.1% of the worldwide market in 2023. Bottles are among the most popular and widely used forms of glass containers. They are versatile and suitable for a wide range of industries, including those manufacturing food, drinks, medicines, and personal care products. Glass bottles provide various advantages, including being non-reactive, preserving the product's quality and flavor, and giving it a more upscale appearance. They come in a variety of shapes, sizes, and closures to fulfill the needs of a wide range of products.

Glass bottles are used to package both alcoholic and non-alcoholic beverages, such as juices, soft drinks, and water. Glass bottles are used in the food industry to package condiments such as sauces, oils, dressings, and preserves. The pharmaceutical industry packages prescription medications, vitamins, and dietary supplements in glass bottles. Glass bottles are used by the personal care industry to package cosmetics, lotions, and scents. Glass bottles are an appealing alternative for environmentally conscious consumers because they are recyclable and environmentally friendly, which helps to achieve sustainability goals.

By End-Use Analysis

The global Glass Container market is divided into five segments based on End-Uses: cosmetic and perfume, pharmaceutical, food packaging, beverage packaging, and others. In 2023, the beverage packaging category held the greatest market share at 40.8%. Glass containers are commonly used in the beverage business to package a wide range of drinks, both alcoholic and non-alcoholic. Premium beverages such as wine, spirits, beer, and high-end mineral water are frequently packed in glass bottles. Glass containers provide a unique, sophisticated appearance that enhances the beverage's branding and perceived quality. They are oxygen-impermeable, which prevents oxidation and keeps the drink fresh and flavorful. Glass is a recyclable and sustainable material that meets the growing customer need for eco-friendly packaging choices.

Regional Analysis

The Asia-Pacific Glass Container market had the greatest market share of 41.2% in 2023 and is predicted to grow at a considerable CAGR of 4.2% over the study period. Glass containers are widely utilized for a variety of packaging purposes throughout Asia Pacific. Glass bottles and jars are used in the food and beverage industry to package sauces, condiments, beverages, and alcoholic drinks. Glass's transparency allows customers to see the contents, while its inertness ensures that the items' taste and quality are kept. Glass containers are valued for their perceived luxury image and ability to preserve the freshness and aroma of packaged items.

Glass containers are widely utilized in Asia Pacific's cosmetic and personal care industries. Glass bottles and jars are widely used to package perfumes, skincare products, lotions, and creams. Glass packaging radiates richness and sophistication, which is consistent with the region's growing demand for high-end cosmetic products. Furthermore, glass containers provide superior protection against outside effects like as light and air, ensuring the stability and efficacy of cosmetic formulations. In China, glass containers serve several functions. Glass bottles and jars are widely used in the food and beverage industry to package alcoholic beverages such as baijiu (Chinese liquor), beer, and wine, as well as sauces, oils, and canned goods. Glass containers are preferred because they maintain product cleanliness and quality. Glass dinnerware and storage containers are among the many household products manufactured in enormous quantities in China. Glass containers are commonly used to package medications, skincare products, and fragrances in the pharmaceutical and cosmetic industries. Despite recycling initiatives, China's enormous population and rapid urbanization continue to make it difficult to manage glass waste.

Because of its versatility, durability, and aesthetic appeal, glass containers are widely used in numerous sectors across North America. In North America, glass containers are commonly used to package food and beverages. Glass bottles and jars are commonly used to store sauces, dressings, condiments, jams, jellies, and pickled foods. Glass beverage bottles are used for wine, beer, spirits, carbonated drinks, and a variety of nonalcoholic beverages. The transparency of glass allows buyers to see the goods within, which improves the aesthetic appeal and dependability of the package. Because of their resistance to oxygen and lack of chemical leaching, glass containers serve to maintain the quality and freshness of the food and beverages they hold.

Competitive Analysis

With a strong presence in multiple verticals and geographies, the Glass Container Market is highly competitive and dominated by established pure-play suppliers. Many suppliers cater to this industry, and they are always innovating their solutions to satisfy the changing needs of organizations by incorporating new technologies and improvements to make quick lubrication filters more effective. These vendors have a large geographic footprint and a strong partner ecosystem to serve a wide range of consumer categories. The Glass Container Market is extremely competitive, with numerous suppliers providing identical products and services.

Key Market Players in the Glass Container Market

o Central Glass Co. Ltd.

o VIDRALA

o BA Vidro S.A.

o Hindusthan National Glass & Industries Limited

o Consol Glass (Pty) Ltd

o Vitro S.A.B de C.V

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 66.6 Billion |

|

Market Size 2033 |

USD 108.6 Billion |

|

Compound Annual Growth Rate (CAGR) |

4.9% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

- |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

Product Type, End-Use, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Amcor Limited, Central Glass Co. Ltd., Owens-Illinois Inc., VIDRALA, BA Vidro S.A., Hindusthan National Glass & Industries Limited, Ardagh Group S.A., Consol Glass (Pty) Ltd, Vitro S.A.B de C.V, Frigoglass, Other Key Players |

|

Key Market Opportunities |

Increasing Demand for Sustainable Packaging Solutions |

|

Key Market Dynamics |

Advantages in Preserving Product Integrity |

📘 Frequently Asked Questions

1. How much is the Glass Container Market in 2023?

Answer: The Glass Container Market size was valued at USD 179.0 Billion in 2023.

2. What would be the forecast period in the Glass Container Market?

Answer: The forecast period in the Glass Container Market report is 2023-2033.

3. Who are the key players in the Glass Container Market?

Answer: Amcor Limited, Central Glass Co. Ltd., Owens-Illinois Inc., VIDRALA, BA Vidro S.A., Hindusthan National Glass & Industries Limited, Ardagh Group S.A., Consol Glass (Pty) Ltd, Vitro S.A.B de C.V, Frigoglass, Other Key Players

4. What is the growth rate of the Glass Container Market?

Answer: Glass Container Market is growing at a CAGR of 4.9% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.