🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Hexachlorodisilane Market

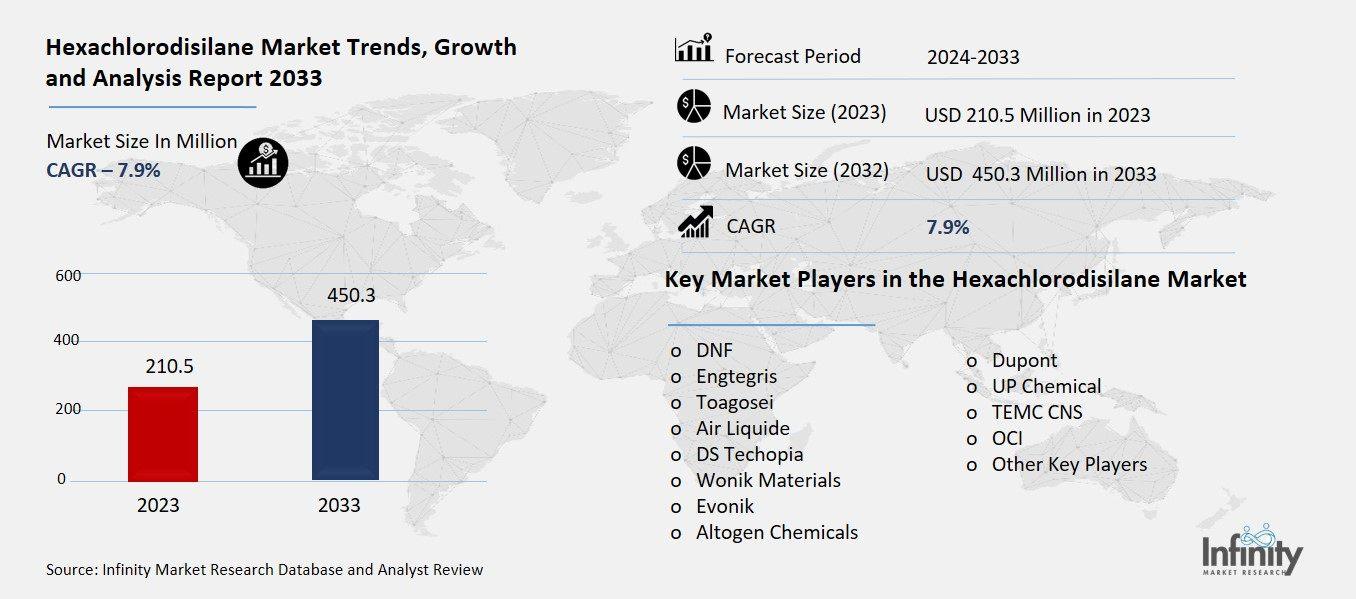

Global Hexachlorodisilane Market (By Type, Low Purity Type and High Purity Type; By Application, Fiber Optics, Semiconductors, Solar Energy, Aerospace Industry, and Other Applications; By Region and Companies), 2024-2033

Jun 2025

Chemicals and Materials

Pages: 138

ID: IMR2073

Hexachlorodisilane Market Overview

Global Hexachlorodisilane Market acquired the significant revenue of 210.5 Million in 2023 and expected to be worth around USD 450.3 Million by 2033 with the CAGR of 7.9% during the forecast period of 2024 to 2033. Hexachlorodisilane market can be cited to be a specialized market and a growing market under chemical and the major drive for this market is the semiconductor and electronics segment. It becomes apparent that hexachlorodisilane play important roles in CVD applications and high silicon films in semiconductor device, photovoltaic solar cell and high microelectronic device production.

The market is driven by the increased utilization of transport technologies like 5G; the increasing use of IoT devices; and… Region wise the Asia-Pacific holds the largest share of the market due to its semiconductor industry dominance in the countries such as China, South Korea, and Japan. The market is also witnessing new developments designed to increase HCDS purity standards in view of present day rigid specifications in backup electronics.

Drivers for the Hexachlorodisilane Market

Increasing Demand for Semiconductors

The rate at which industries like the 5G industry, IoT, and artificial intelligence industries are developing is increasing the need for semiconductors with better performance especially for signal frequency and large data processing. In the same way, IoT devices such as home appliances and industry sensors need little compact and efficient semiconductors that enable operation in a complex networking environment. Machine learning and data analytics dominate other AI uses because these need higher performing chips that can process data at a faster rate. In combination, these technologies are continuing to fuel novel developments in the area of semiconductor design, fabrication and materials for use; at the same time, it has generated a large demand of precision based components including hexachlorodisilane to be used in thin-film deposition process.

Restraints for the Hexachlorodisilane Market

Limited Supplier Base

The hexachlorodisilane (HCDS) market is heavily reliant on a limited number of key suppliers, which poses significant challenges for the industry. This dependency limits competition, often leading to higher prices and reduced bargaining power for end-users, such as semiconductor manufacturers. Additionally, a concentrated supplier base increases vulnerability to supply chain disruptions caused by geopolitical tensions, natural disasters, or operational challenges at production facilities. For instance, a production halt or logistical issue at a major supplier could lead to delays in semiconductor manufacturing, impacting industries reliant on these components. Diversifying the supplier base and investing in localized production facilities could help mitigate these risks and enhance the resilience of the supply chain.

Opportunity in the Hexachlorodisilane Market

Expansion of Semiconductor Manufacturing in Emerging Markets

Countries like India and Vietnam are emerging as key players in the global semiconductor manufacturing landscape, driven by significant investments and government initiatives aimed at reducing reliance on imports and boosting domestic production. In India, programs like the "Semicon India" initiative and incentives for semiconductor fabrication plants are attracting global companies to establish manufacturing facilities.

Vietnam, with its strategic location and growing electronics industry, is also becoming a favored destination for semiconductor assembly and testing operations. These developments are creating new demand for materials like hexachlorodisilane (HCDS), which is essential for chemical vapor deposition processes in semiconductor production. The expansion of these markets offers growth opportunities for HCDS manufacturers to cater to the increasing needs of these emerging semiconductor hubs.

Trends for the Hexachlorodisilane Market

Collaborations Across the Value Chain

Partnerships between chemical manufacturers and semiconductor companies are becoming increasingly important to ensure a steady supply of high-quality precursors like hexachlorodisilane (HCDS). Such collaborations allow semiconductor manufacturers to secure reliable access to critical materials while enabling chemical companies to align their production capabilities with the specific needs of their clients. By working closely together, these partners can address challenges such as purity standards, supply chain disruptions, and cost optimization. For instance, joint ventures or long-term supply agreements can help stabilize supply, reduce lead times, and foster innovation in precursor development to meet the evolving requirements of advanced technologies. These partnerships not only enhance operational efficiency but also strengthen the resilience of the semiconductor supply chain in a highly competitive and rapidly evolving market.

Segments Covered in the Report

By Type

o Low Purity Type

o High Purity Type

By Application

o Fiber Optics

o Semiconductors

o Solar Energy

o Aerospace Industry

o Other Applications

Segment Analysis

By Type Analysis

On the basis of type, the market is divided into low purity type and high purity type. Among these, high purity type segment acquired the significant share in the market owing to its critical application in the semiconductor industry, where ultra-high-purity materials are essential to meet stringent quality standards for thin-film deposition processes. High-purity HCDS is indispensable for manufacturing advanced microelectronics, including integrated circuits and photovoltaic cells, as it ensures optimal performance and minimal defects in the final products. The increasing demand for high-performance semiconductors in technologies like 5G, IoT, and AI further amplifies the need for high-purity HCDS, positioning this segment as a key driver of market growth.

By Application Analysis

On the basis of application, the market is divided into fiber optics, semiconductors, solar energy, aerospace industry, and other applications. Among these, semiconductors segment held the prominent share of the market due to the crucial role of HCDS in the chemical vapor deposition (CVD) process used for manufacturing silicon-based thin films in semiconductors. The rapid expansion of the semiconductor industry, driven by advancements in technologies like 5G, IoT, artificial intelligence, and consumer electronics, has significantly increased the demand for high-performance and miniaturized semiconductor components.

Additionally, the stringent quality and purity requirements in semiconductor fabrication align with the unique properties of HCDS, further cementing its importance in this application. The continued growth of the electronics and technology sectors ensures the sustained prominence of the semiconductor segment in the market.

Regional Analysis

Asia Pacific Dominated the Market with the Highest Revenue Share

Asia Pacific held the most of the share of 32.1% of the market due to its leadership in semiconductor manufacturing and electronics production. Countries such as China, South Korea, Japan, and Taiwan are global powerhouses in the semiconductor industry, with major players like TSMC, Samsung, and Intel establishing large-scale fabrication facilities in the region. The demand for high-purity HCDS is driven by the need for advanced materials in the production of semiconductor components used in technologies such as 5G, IoT, AI, and consumer electronics.

Additionally, the APAC region is home to a well-established supply chain, making it a central hub for the production and distribution of essential materials like HCDS. The region's continued investments in cutting-edge technology and infrastructure, along with government incentives to boost local manufacturing, have further solidified its dominant position in the HCDS market.

Competitive Analysis

Competitive analysis in the hexachlorodisilane (HCDS) market involves assessing the strategies, strengths, and weaknesses of key players operating in the industry. Major companies in the market focus on expanding their production capacities, enhancing product quality, and developing strategic partnerships with semiconductor manufacturers to secure long-term supply agreements. These players often invest heavily in research and development to improve the purity and performance of HCDS, which is critical for advanced applications in semiconductors, solar energy, and fiber optics. Competition is intensified by the limited number of high-quality HCDS suppliers, creating opportunities for market consolidation through mergers and acquisitions.

Recent Developments

In April 2022, DS Techopia planned to expand its production capacity for hexachlorodisilane (HCDS), a precursor used in the production of NAND flash memory chips, by up to 50% during the third quarter.

Key Market Players in the Hexachlorodisilane Market

o DNF

o Engtegris

o Toagosei

o Air Liquide

o DS Techopia

o Wonik Materials

o Evonik

o Dupont

o UP Chemical

o TEMC CNS

o OCI

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 210.5 Million |

|

Market Size 2033 |

USD 450.3 Million |

|

Compound Annual Growth Rate (CAGR) |

7.9% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Million) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Type, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

DNF, Engtegris, Toagosei, Air Liquide, DS Techopia, Wonik Materials, Evonik, Altogen Chemicals, Dupont, UP Chemical, TEMC CNS, OCI, and Other Key Players |

|

Key Market Opportunities |

Expansion of Semiconductor Manufacturing in Emerging Markets |

|

Key Market Dynamics |

Increasing Demand for Semiconductors |

📘 Frequently Asked Questions

1. Who are the key players in the Hexachlorodisilane Market?

Answer: DNF, Engtegris, Toagosei, Air Liquide, DS Techopia, Wonik Materials, Evonik, Altogen Chemicals, Dupont, UP Chemical, TEMC CNS, OCI, and Other Key Players

2. How much is the Hexachlorodisilane Market in 2023?

Answer: The Hexachlorodisilane Market size was valued at USD 210.5 Million in 2023.

3. What would be the forecast period in the Hexachlorodisilane Market?

Answer: The forecast period in the Hexachlorodisilane Market report is 2023-2033.

4. What is the growth rate of the Hexachlorodisilane Market?

Answer: Hexachlorodisilane Market is growing at a CAGR of 7.9% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.