High Solids (Great than 60%) SBR Market

Global High Solids (Great than 60%) SBR Market (By Type, Type I, Type II, Type III, and Type IV; By Application, Adhesives and Coatings, Foam Products, and Asphalt Modification; By Region and Companies), 2024-2033

December 2024

Semiconductor and Electronics

Pages: 138

ID: IMR1377

High Solids (Great than 60%) SBR Market Overview

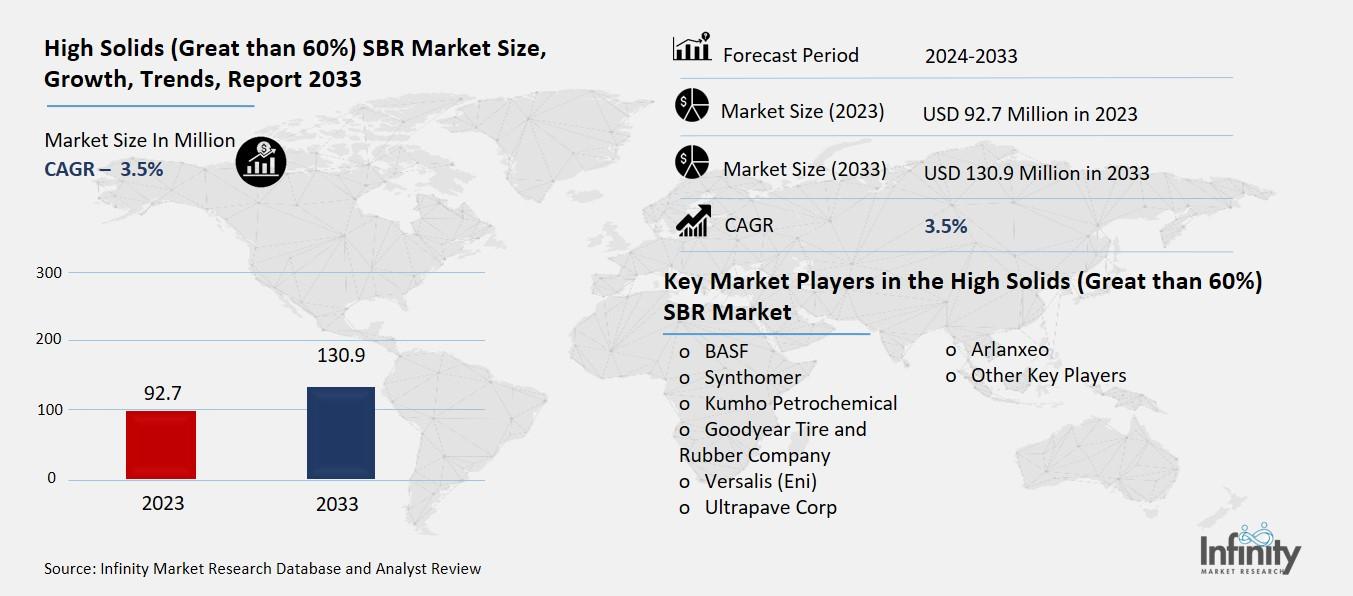

Global High Solids (Great than 60%) SBR Market acquired the significant revenue of 92.7 Million in 2023 and expected to be worth around USD 130.9 Million by 2033 with the CAGR of 3.5% during the forecast period of 2024 to 2033. The high solids (greater than sixty percent) Styrene-Butadiene Rubber market is one that is still within the category of specialty but enjoys great growth in the synthetic rubber industry. The high-solids SBR is appreciated for better strength, comparatively higher adhesive strength and better resistance to water and thus finds wide application in adhesives, sealants and coatings. It is used widely where high-performance elastomers are required, such as in the construction industry, the automotive industry, and packaging industries. Market growth is due to rising requirements for environmental-friendly and performing products, particularly in industries seeking low VOC products.

Drivers for the High Solids (Great than 60%) SBR Market

Rising Demand in Adhesives and Sealants

High solids SBR has gained a reputation for its high bonding strength and water resistance; these properties make it popular with industries such as construction and automobile. Because the construction industry is concerned, it is employed in any application where staking is vital like floors, roofs, and insulating materials that need to resist weather influences.

Similarly, in automobile industry, high solids SBR is equally important since it is used to improve performance of the adhesives that is used for joining and repair of automobiles, and resistance to water absorption. Each of these attributes has gone a long way in explaining the increasing embrace of this cloud deployment model across these competitive industries.

Restraints for the High Solids (Great than 60%) SBR Market

Health and Environmental Concerns

Styrene, a key component in the production of Styrene-Butadiene Rubber (SBR), is a regulated compound due to its classification as a potential carcinogen and its associated health risks when exposed to high concentrations. Regulatory bodies worldwide impose strict guidelines on its usage, handling, and emissions to minimize environmental and occupational hazards. These restrictions may lead to increased production costs and pose challenges for manufacturers, potentially limiting the market growth of high solids SBR. Additionally, growing consumer awareness of health and environmental concerns could drive demand for alternative, less hazardous materials, further impacting the market dynamics.

Opportunity in the High Solids (Great than 60%) SBR Market

Development of Bio-Based SBR

The increasing consumer and regulatory emphasis on sustainability has opened significant opportunities for the development and adoption of bio-derived high solids SBR products. As industries strive to reduce their environmental footprint, the demand for eco-friendly materials that can replace petroleum-based counterparts is rising.

Bio-derived high solids SBR, produced from renewable sources, aligns with these sustainability goals while offering comparable performance in applications like adhesives, coatings, and sealants. Companies investing in the research and production of such materials are well-positioned to capitalize on this trend, as it addresses both regulatory pressures for greener products and growing consumer preference for environmentally responsible solutions.

Trends for the High Solids (Great than 60%) SBR Market

Shift Toward Low-VOC and Eco-Friendly Products

The growing emphasis on sustainability is fueling research and development efforts in low-VOC and bio-based high-solids SBR. As industries prioritize reducing environmental impact, there is a strong push for materials that meet stringent regulations and consumer expectations for eco-friendly products. Low-VOC formulations are particularly attractive in construction and automotive applications, where compliance with emissions standards is critical.

Concurrently, bio-based high-solids SBR, derived from renewable resources, is gaining traction as a sustainable alternative to traditional petroleum-based variants. This dual focus on reducing volatile organic compounds and enhancing the material's environmental profile is shaping innovation and expanding the potential applications for high-solids SBR in the global market.

Segments Covered in the Report

By Type

o Type I

o Type II

o Type III

o Type IV

By Application

o Adhesives and Coatings

o Foam Products

o Asphalt Modification

Segment Analysis

By Type Analysis

On the basis of type, the market is divided into type I, type II, type III, and type IV. Among these, type II segment acquired the significant share in the market owing to its superior balance of flexibility, adhesive strength, and water resistance. These properties make it a preferred choice in high-demand applications such as construction adhesives, industrial coatings, and automotive sealants. Its versatility and cost-effectiveness have further strengthened its adoption across various end-use industries, solidifying its dominant position in the market.

By Application Analysis

On the basis of application, the market is divided into adhesives and coatings, foam products, and asphalt modification. Among these, adhesives and coatings segment held the prominent share of the market due to the growing demand for high-performance materials in construction, automotive, and industrial applications. The excellent bonding strength, durability, and water resistance of high solids SBR make it ideal for adhesives used in flooring, roofing, and vehicle assembly, as well as for protective coatings in industrial environments. The segment's dominance is further driven by increasing regulatory pressure to reduce VOC emissions, which has boosted the adoption of high solids formulations in these applications.

Regional Analysis

Asia Pacific Dominated the Market with the Highest Revenue Share

Asia Pacific held the most of the share of 30.4% of the market due to the region's robust industrial growth and expanding end-use sectors such as construction, automotive, and packaging. Countries like China, India, and Japan are key contributors, driven by rising infrastructure projects, increasing automotive production, and strong demand for adhesives and coatings.

Additionally, the availability of raw materials, cost-effective manufacturing, and a large consumer base have positioned Asia Pacific as a global leader in this market. Favorable government policies promoting industrialization and urbanization further bolster the demand for high solids SBR in the region. The growing shift toward sustainable materials also provides opportunities for innovation, further enhancing the market's growth trajectory in Asia Pacific.

Competitive Analysis

The competitive landscape of the high solids SBR market is characterized by a mix of established players and emerging companies, all vying for market share through product innovation, strategic partnerships, and geographical expansion. Key industry players are focusing on developing advanced formulations of high solids SBR, including bio-based and low-VOC variants, to meet the growing demand for sustainable and eco-friendly materials. Companies are also investing heavily in research and development to improve the performance properties of their products, such as adhesion strength, durability, and resistance to environmental factors. Mergers and acquisitions are a common strategy to strengthen market presence, particularly in high-growth regions like Asia Pacific.

Key Market Players in the High Solids (Great than 60%) SBR Market

o BASF

o Synthomer

o Kumho Petrochemical

o Goodyear Tire and Rubber Company

o Versalis (Eni)

o Ultrapave Corp

o Arlanxeo

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 92.7 Million |

|

Market Size 2033 |

USD 130.9 Million |

|

Compound Annual Growth Rate (CAGR) |

3.5% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Million) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Type, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

BASF, Synthomer, Kumho Petrochemical, Goodyear Tire and Rubber Company, Versalis (Eni), Ultrapave Corp, Arlanxeo, and Other Key Players. |

|

Key Market Opportunities |

Development of Bio-Based SBR |

|

Key Market Dynamics |

Rising Demand in Adhesives and Sealants |

Frequently Asked Questions

1. Who are the key players in the High Solids (Great than 60%) SBR Market?

Answer: BASF, Synthomer, Kumho Petrochemical, Goodyear Tire and Rubber Company, Versalis (Eni), Ultrapave Corp, Arlanxeo, and Other Key Players.

2. How much is the High Solids (Great than 60%) SBR Market in 2023?

Answer: The High Solids (Great than 60%) SBR Market size was valued at USD 92.7 Million in 2023.

3. What would be the forecast period in the High Solids (Great than 60%) SBR Market?

Answer: The forecast period in the High Solids (Great than 60%) SBR Market report is 2024-2033.

4. What is the growth rate of the High Solids (Great than 60%) SBR Market?

Answer: High Solids (Great than 60%) SBR Market is growing at a CAGR of 3.5% during the forecast period, from 2024 to 2033.