🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Global Hydrogen Compressors Market

Global Hydrogen Compressors Market (By Technology Type, Mechanical Compressors and Non-Mechanical Compressors; By Lubrication Type, Oil-free and Oil-based; By End-Use Industry, Oil and Gas, Automotive, Chemical, and Other End-Use Industries, By Region and Companies), 2024-2033

Nov 2024

Energy and Power

Pages: 138

ID: IMR1321

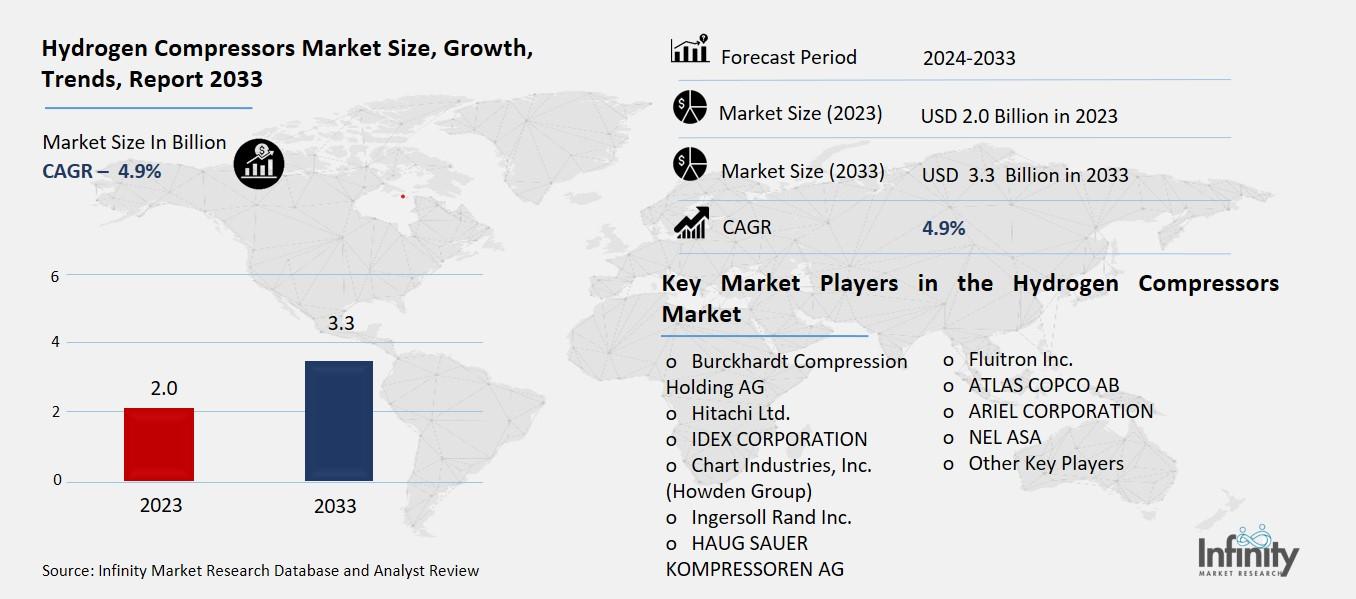

Hydrogen Compressors Market Overview

Global Hydrogen Compressors Market acquired the significant revenue of 2.0 Billion in 2023 and expected to be worth around USD 3.3 Billion by 2033 with the CAGR of 4.9% during the forecast period of 2024 to 2033. The market for hydrogen compressors is growing rapidly due to the expanded usage of hydrogen as a green energy solution in transport, electricity production, and manufacturing sectors. Growing worldwide efforts to control carbon emissions and encourage efficient energy technologies, such as hydrogen, have created demand for associated equipment, including compressors. Pump pressure is also important to hydrogen storage and distribution as well as fuelling, since compressors are essential to raise the pressure of hydrogen for use in fuel cells and storage tanks.

Other factors for discussion are technological trends, including high-efficiency and low-emission compressors, which are taking the market further. Furthermore, government policies, subsidies and investment in hydrogen fuel cell technology are increasing the market potential beyond the present level, as most of the countries are trying to develop a reliable hydrogen chain.

Drivers for the Hydrogen Compressors Market

Growing Demand for Clean Energy

The effort to address effects of climate change on the global climate is the major force behind the need to cut down on carbon emissions and use of fossil energy so there is increased focus on the use of energies such as hydrogen. Hydrogen is appealing because it creates no carbon emissions at the ‘tank’ level, hence it is suitable for industries which require high carbon energy, for instance, independence and power industry.

Reflecting the increasing commitments to low-carbon targets at the country and industrial level, hydrogen is picking up steam especially in sectors that cannot be easily decarbonized, including heavy duty transportation, shipping, and selected industries. In transportation, hydrogen fuel cells are better than batteries due to decreased mass, higher energy capacity, quicker refueling time and longer ranges that are important by commercial vehicles.

Restraints for the Hydrogen Compressors Market

Lack of Hydrogen Infrastructure

The limited availability of hydrogen fueling stations remains a significant barrier to the widespread adoption of hydrogen as an energy source, particularly in the transportation sector. Hydrogen fueling infrastructure is still in the early stages of development, with relatively few stations available globally, primarily concentrated in specific regions like parts of Europe, Japan, and California. This limited network restricts the feasibility of hydrogen fuel cell vehicles for long-distance travel and heavy-duty transport, as drivers cannot rely on easily accessible refueling options. Moreover, building hydrogen stations requires substantial investment and compliance with strict safety standards, adding to the challenge of rapid expansion.

Opportunity in the Hydrogen Compressors Market

Expansion of Hydrogen Fueling Infrastructure

Investments in hydrogen fueling infrastructure are on the rise, driven by growing recognition of hydrogen’s potential to power heavy-duty vehicles with zero emissions. Unlike light passenger vehicles, heavy-duty trucks, buses, and other commercial vehicles often require high energy density and extended driving ranges, which hydrogen fuel cells can provide more efficiently than battery-electric alternatives. As a result, governments and private companies are increasingly investing in dedicated hydrogen fueling stations, particularly along major trucking routes and in areas with high commercial vehicle traffic. These targeted investments are aimed at developing “hydrogen corridors” that will enable long-haul hydrogen-powered trucks to operate across longer distances without fueling constraints, thereby supporting the decarbonization of the freight and logistics sector.

Trends for the Hydrogen Compressors Market

Shift Toward Green Hydrogen Production

As the demand for sustainable energy intensifies, there is a strong shift towards electrolysis-based hydrogen production powered by renewable energy sources. Electrolysis, which splits water into hydrogen and oxygen using electricity, is becoming the preferred method for producing "green hydrogen" when powered by renewables like wind, solar, or hydroelectric energy. This process is entirely carbon-free, making it an ideal choice for sectors looking to reduce their carbon footprint.

Governments and energy companies worldwide are investing in large-scale electrolysis projects to produce hydrogen without relying on fossil fuels, positioning green hydrogen as a cornerstone of future energy systems. This approach aligns with global sustainability targets and helps energy-intensive industries meet stringent environmental regulations.

Segments Covered in the Report

By Technology Type

o Mechanical Compressors

o Non-Mechanical Compressors

By Lubrication Type

o Oil-free

o Oil-based

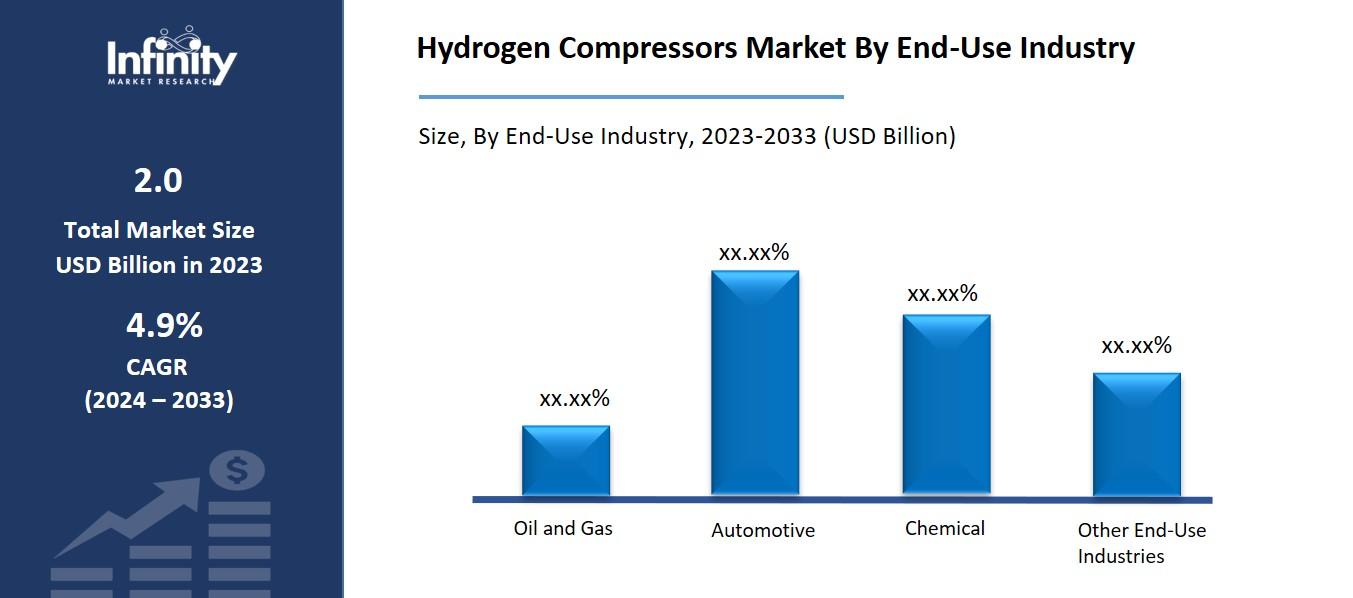

By End-Use Industry

o Oil and Gas

o Automotive

o Chemical

o Other End-Use Industries

Segment Analysis

By Technology Type Analysis

On the basis of technology type, the market is divided into mechanical compressors and non-mechanical compressors. Among these, mechanical compressors segment acquired the significant share in the market owing to their well-established reliability, efficiency, and capacity to achieve high pressure levels required for hydrogen storage and transport.

Mechanical compressors, such as piston and diaphragm compressors, are widely used across industries because they are proven, mature technologies capable of delivering consistent performance in large-scale applications. These compressors are especially valuable in hydrogen fueling stations, industrial hydrogen applications, and large-scale storage facilities, where high-pressure hydrogen is essential.

By Lubrication Type Analysis

On the basis of lubrication type, the market is divided into oil-free and oil-based. Among these, oil-free segment held the prominent share of the market due to its ability to deliver high-purity hydrogen, which is essential for applications like fuel cells and high-precision industrial processes. Oil-free compressors are specifically designed to prevent contamination by eliminating the need for lubricants in the compression chamber, ensuring that hydrogen remains free from impurities. This purity is critical for hydrogen fuel cells used in vehicles and for other applications where even minor contamination can reduce efficiency, damage equipment, or cause safety risks.

By End-Use Industry Analysis

On the basis of end-use industry, the market is divided into oil and gas, automotive, chemical, and other end-use industries. Among these, oil and gas segment held the prominent share of the market due to its high demand for hydrogen in refining processes and industrial applications, such as hydrocracking and desulfurization. In these processes, hydrogen is used to remove sulfur from crude oil, produce cleaner fuels, and improve the quality of final products, making it essential for meeting stringent fuel standards and emissions regulations. The oil and gas industry requires compressors capable of handling high pressures and large volumes of hydrogen, and it has the infrastructure and financial resources to invest in high-performance hydrogen compression technology.

Regional Analysis

Asia Pacific Dominated the Market with the Highest Revenue Share

Asia Pacific held the most of the share of 32% of the market. Countries like China, Japan, and South Korea have made significant investments in hydrogen infrastructure as part of their long-term energy strategies, with ambitious government initiatives aimed at promoting hydrogen as a key energy source. The region’s strong industrial base, including sectors such as oil and gas, chemicals, and automotive, has a high demand for hydrogen solutions, particularly in refining processes, fuel cell applications, and industrial production.

Additionally, Asia Pacific is increasingly integrating renewable energy sources, such as solar and wind, with hydrogen production through electrolysis, enhancing its commitment to a sustainable energy transition. These factors combined make Asia Pacific a critical player in the global hydrogen compressor market, driving growth and technological innovation in the sector.

Competitive Analysis

The competitive landscape of the hydrogen compressor market is characterized by a mix of established industrial players and emerging technology providers, all vying for market share in a rapidly growing industry. Key players such as Atlas Copco, Elliott Group, Burckhardt Compression, and Siemens dominate the market, leveraging their strong global presence and expertise in providing high-quality, reliable compressor solutions across various sectors, including oil and gas, automotive, and chemicals. These companies are investing heavily in research and development to enhance compressor efficiency, integrate new technologies, and cater to the rising demand for green hydrogen production.

Recent Developments

In April 2024, MITSUI E&S Co. Ltd. announced the launch of its high-flow hydrogen compressors, specifically designed for hydrogen station facilities and production equipment. These compressors are capable of compressing hydrogen to pressures of up to 50 MPa, with a flow rate of 95 kg/h.

Key Market Players in the Hydrogen Compressors Market

o Burckhardt Compression Holding AG

o Hitachi Ltd.

o IDEX CORPORATION

o Chart Industries, Inc. (Howden Group)

o HAUG SAUER KOMPRESSOREN AG

o Fluitron Inc.

o ATLAS COPCO AB

o ARIEL CORPORATION

o NEL ASA

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 2.0 Billion |

|

Market Size 2033 |

USD 3.3 Billion |

|

Compound Annual Growth Rate (CAGR) |

4.9% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Technology Type, Lubrication Type, End-Use Industry, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Burckhardt Compression Holding AG, Hitachi Ltd., IDEX CORPORATION, Chart Industries, Inc. (Howden Group), Ingersoll Rand Inc., HAUG SAUER KOMPRESSOREN AG, Fluitron Inc., ATLAS COPCO AB, ARIEL CORPORATION, NEL ASA, and Other Key Players. |

|

Key Market Opportunities |

Expansion of Hydrogen Fueling Infrastructure |

|

Key Market Dynamics |

Growing Demand for Clean Energy |

📘 Frequently Asked Questions

1. Who are the key players in the Hydrogen Compressors Market?

Answer: Burckhardt Compression Holding AG, Hitachi Ltd., IDEX CORPORATION, Chart Industries, Inc. (Howden Group), Ingersoll Rand Inc., HAUG SAUER KOMPRESSOREN AG, Fluitron Inc., ATLAS COPCO AB, ARIEL CORPORATION, NEL ASA, and Other Key Players.

2. How much is the Hydrogen Compressors Market in 2023?

Answer: The Hydrogen Compressors Market size was valued at USD 2.0 Billion in 2023.

3. What would be the forecast period in the Hydrogen Compressors Market?

Answer: The forecast period in the Hydrogen Compressors Market report is 2024-2033.

4. What is the growth rate of the Hydrogen Compressors Market?

Answer: Hydrogen Compressors Market is growing at a CAGR of 4.9% during the forecast period, from 2024 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.