🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Metal Forging Market

Metal Forging Market Global Industry Analysis and Forecast (2024-2033) by Raw Material (Carbon Steel, Alloy Steel, Stainless Steel, Aluminum, Magnesium, Titanium, and Other Raw Materials), Technology (Closed Die, Open Die, and Other Technologies), End-User (Automotive, Mechanical Equipment, Aerospace & Railways, and Other End-Users) and Region

Apr 2025

Chemicals and Materials

Pages: 138

ID: IMR1922

Metal Forging Market Synopsis

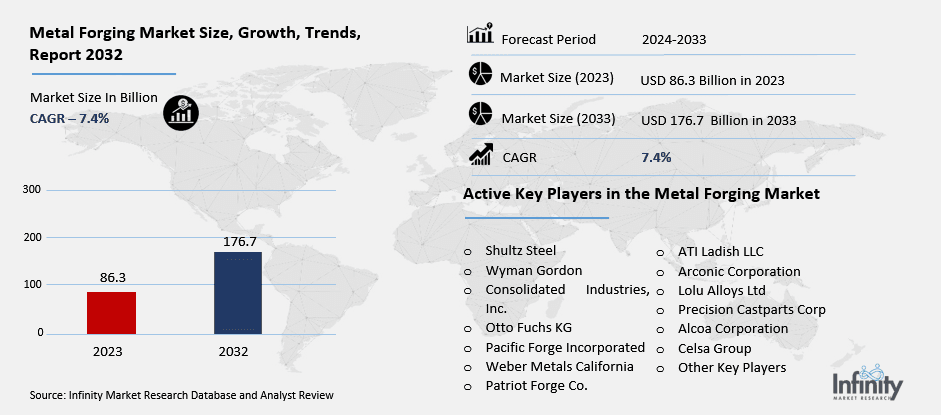

The global metal forging market was valued at USD 86.3 billion in 2023 and is expected to grow from USD 92.7 billion in 2024 to USD 176.7 billion by 2033, reflecting a CAGR of 7.4% over the forecast period.

The metal forging market represents a fundamental piece of the worldwide manufacturing and industrial structure because it supplies tough reliable elements needed by automotive aerospace oil & gas construction and heavy machinery industries. Made through compressive forces metal forging generates components that offer better mechanical advantages than casting or machining methods. During modern manufacturing the market profits from expanding end-use operations because automotive producers need lightweight engine parts that meet fuel efficiency and emission rules. Defensive aerospace operations require forged components because they require exceptional structural integrity and reliability in their designs. Real-time computer control systems with precision forging capabilities bring higher technical outcomes while improving productivity and quality standards in manufacturing.

Metal Forging Market Driver Analysis

Superior Mechanical Properties of Forged Products

The forging manufacturing technique produces stronger metal components which succeed in critical and demanding applications. Metal undergoing forging must endure high pressure while forming which leads to an organized and improved grain arrangement inside the material. The material develops superior strength and durability because of grain flow which gives forged parts better performance compared to casting or finishing operations. Manufactured components demonstrate superior resistance to stress and extreme temperature fluctuations while handling repeated cycles because of their forging process which benefits applications in aerospace and automotive and oil & gas industries together with heavy machinery. The exceptional capabilities of forging qualify it as the best solution for extended service life components and critical safety-focused applications such as engine parts and gears as well as crankshafts and structural framework elements.

Metal Forging Market Restraint Analysis

Environmental Regulations and Energy Consumption

The production methods of forging need both elevated thermal conditions and strong mechanical pressures thus making them energy-intensive by nature. The energy requirements of forging operations generate high costs and substantial greenhouse gas emissions when fossil fuels provide most of the power. Manufacturers using forging operations must handle the responsible management of both their operational by-products and their production emissions and noise as well as waste materials. Manufacturers operate under strict environmental guidelines as well as compliance standards to reduce their environmental footprint. Environmental requirements demand manufacturing companies to buy clean technologies together with emission control systems and efficient waste management practices which increase process complexity.

Metal Forging Market Opportunity Analysis

Adoption of Advanced Forging Technologies

Precision forging and isothermal forging together with automation technology create industry transformations which together improve both the product quality and reduction of costs in metal forging operations. Precision forging produces nearly finished components that require minimal subsequent machining thus minimizing production waste as well as reducing manufacturing time. Using isothermal forging at a steady work piece-die temperature improves metal flow while optimizing dimension precision mainly benefits the fabrication of challenging metals including titanium. Through the combination of robotics and real-time monitoring systems within forging operations the technology achieves production streamlining and cost reduction and creates improved consistency. The innovative methods and techniques decrease operational expenses while reducing manufacturing timelines and improving business productivity thus making forging more competitive in high-demand production conditions.

Metal Forging Market Trend Analysis

Integration of IoT and Automation in Forging Plants

The forging industry experiences industrial transformation through the integration of Internet of Things systems together with Artificial Intelligence and data analytical solutions in its manufacturing operations. Modern technology systems allow real-time monitoring and control of essential parameters including temperature pressure and material flow and thus produce more precise and better consistent forged products. Quality monitoring systems that use sensors and machine learning detect manufacturing defects at early stages to minimize product failures which increases both reliability levels and decreases waste. The implementation of smart systems enables dynamic process adjustments according to both demand rates and efficiency measurements that results in both lower energy consumption and operational costs. Smart manufacturing brings improved product quality together with reliability increases and maintains sustainability along with competitive advantages for forging operations.

Metal Forging Market Segment Analysis:

The Metal Forging Market is segmented on the basis of Raw Material, Technology, and End-User.

By Raw Material

o Carbon Steel

o Alloy Steel

o Stainless Steel

o Aluminum

o Magnesium

o Titanium

o Other Raw Materials

By Technology

o Closed Die

o Open Die

o Other Technologies

By End-User

o Automotive

o Mechanical Equipment

o Aerospace & Railways

o Other End-Users

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Raw Material, Carbon Steel Segment is Expected to Dominate the Market During the Forecast Period

Of the raw materials discussed in this research study, the carbon steel segment is expected to account for the largest market share of metal forging market in the forecast period. Carbon steel combines its mechanical properties of strength with hardness and ductility to suit many different forged components utilized by automotive industries and by construction companies and by oil & gas sectors along with heavy equipment manufacturers. Due to its strong resistance against stress and impact forces carbon steel is widely used for producing structural parts such as gears shafts axles and other parts. Increasing industrialization activities in emerging economies combined with continuous infrastructure development generate elevated demand for forged components based on carbon steel. The market segment will uphold its position as leader during the entire forecast duration.

By Technology, the Open Die Segment is Expected to Held the Largest Share

By technology, the open die forging segment is expected to hold the largest share of the metal forging market during the forecast period. The method controls a dominant market presence because it enables adaptable manufacturing of significant simple components which deliver superior mechanical properties. Open die forging enables metal work piece deformation through the use of flat or contoured dies which expose the metal to external adjustments of grain flow during the process. Open die forging allows the production of massive components such as aerospace shafts and oil & gas rollers and power generation cylinders’ best fits heavy industries including these sectors. The method works well for manufacturing limited to medium-sized production volumes while handling various metallic materials from steel to aluminum and titanium.

By End-User, the Automotive Segment is Expected to Held the Largest Share

By end-user, the automotive segment is expected to hold the largest share of the metal forging market during the forecast period, driven by the high demand for forged components in vehicle manufacturing. Automobile components including crankshafts and connecting rods as well as gears and axles and wheel hubs undergo forging to guarantee proper structure and performance and safety requirements in automotive vehicles. Manufacturers produce an increasing number of passenger and commercial vehicles at the same time they focus on lightweight fuel-efficient designs leading to higher demand for high-strength forged components. The electric vehicle market creates fresh prospects for forged parts which provide unique solutions for electric powertrains and chassis systems. As the automotive industry strives to fulfil multiple standards of safety and efficiency while meeting regulations the primary market position of forging stays secure because it functions as a crucial manufacturing process.

Metal Forging Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

North America is expected to dominate the metal forging market over the forecast period due to several key factors. The region possesses a well-developed manufacturing industry which includes automotive aerospace defense and energy sectors because these industries need forged components to fulfil their high-performance demands. Advanced high-strength parts demand in automotive and aerospace sectors prompts industry-wide necessity for high-quality forging technologies because producers require lightweight durable materials. The American forging technology providers along with key market stakeholders in North America work together to drive innovation by utilizing precision forging and automation and smart manufacturing methods for manufacturing enhancements. The U.S. and Canada achieve market expansion because of their well-developed infrastructure alongside proficient workforce members and solid regulatory systems.

Recent Development

· In May 2024, Balu Forge Industries Ltd. announced the strategic acquisition of 72,000-tonne forging lines in Karnataka, India, a move that significantly boosts its manufacturing capabilities and strengthens its market presence in the metal forging industry. This acquisition plays a crucial role in the company’s efforts to expand its production capacity and cater to the increasing demand for high-quality forged components across key sectors such as automotive, aerospace, and defense.

· In October 2024, Bharat Forge Ltd. announced an agreement to acquire AAMIMCPL, a strategic move designed to strengthen its position in the global metal forging market. This acquisition will allow Bharat Forge to leverage AAMIMCPL's advanced manufacturing technologies and extensive expertise in producing high-quality forged components, further enhancing its capabilities and competitiveness in the industry.

Active Key Players in the Metal Forging Market

o Shultz Steel

o Wyman Gordon

o Consolidated Industries, Inc.

o Otto Fuchs KG

o Pacific Forge Incorporated

o Weber Metals California

o Patriot Forge Co.

o ATI Ladish LLC

o Arconic Corporation

o Lolu Alloys Ltd

o Precision Castparts Corp

o Alcoa Corporation

o Celsa Group

o Other Key Players

Global Metal Forging Market Scope:

|

Global Metal Forging Market | |||

|

Base Year: |

2024 |

Forecast Period: |

2024-2033 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 86.3 Billion |

|

Market Size in 2024: |

USD 92.7 Billion | ||

|

Forecast Period 2024-33 CAGR: |

7.4% |

Market Size in 2033: |

USD 176.7 Billion |

|

Segments Covered: |

By Raw Material |

· Carbon Steel · Alloy Steel · Stainless Steel · Aluminum · Magnesium · Titanium · Other Raw Materials | |

|

By Technology |

· Closed Die · Open Die · Other Technologies | ||

|

By End-User |

· Automotive · Mechanical Equipment · Aerospace & Railways · Other End-Users | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Superior Mechanical Properties of Forged Products | ||

|

Key Market Restraints: |

· Environmental Regulations and Energy Consumption | ||

|

Key Opportunities: |

· Adoption of Advanced Forging Technologies | ||

|

Companies Covered in the report: |

· Shultz Steel, Wyman Gordon, Consolidated Industries, Inc., Otto Fuchs KG and Other Key Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Metal Forging Market Research report?

Answer: The forecast period in the Metal Forging Market Research report is 2024-2033.

2. Who are the key players in the Metal Forging Market?

Answer: Shultz Steel, Wyman Gordon, Consolidated Industries, Inc., Otto Fuchs KG and Other Key Players.

3. What are the segments of the Metal Forging Market?

Answer: The Metal Forging Market is segmented into Raw Material, Technology, End-User, and Regions. By Raw Material, the market is categorized into Carbon Steel, Alloy Steel, Stainless Steel, Aluminum, Magnesium, Titanium, and Other Raw Materials. By Technology, the market is categorized into Closed Die, Open Die, and Other Technologies. By End-User, the market is categorized into Automotive, Mechanical Equipment, Aerospace & Railways, and Other End-Users. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Metal Forging Market?

Answer: The metal forging market represents the international market that produces and delivers forged metal components which serve different fields including automotive, aerospace, construction, oil and gas and industrial machinery sectors. Through compressive forces including hammering and pressing or rolling the metal forging process creates metal components which offer outstanding strength and durability together with lower susceptibility to wear out and fatigue. High-performance components that face tough operating conditions and heavy loads drive the market because manufacturers need resistant parts for critical safety applications.

5. How big is the Metal Forging Market?

Answer: The global Metal Forging Market was valued at USD 86.3 billion in 2023 and is expected to grow from USD 92.7 billion in 2024 to USD 176.7 billion by 2033, reflecting a CAGR of 7.4% over the forecast period.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.