🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Online Banking Market

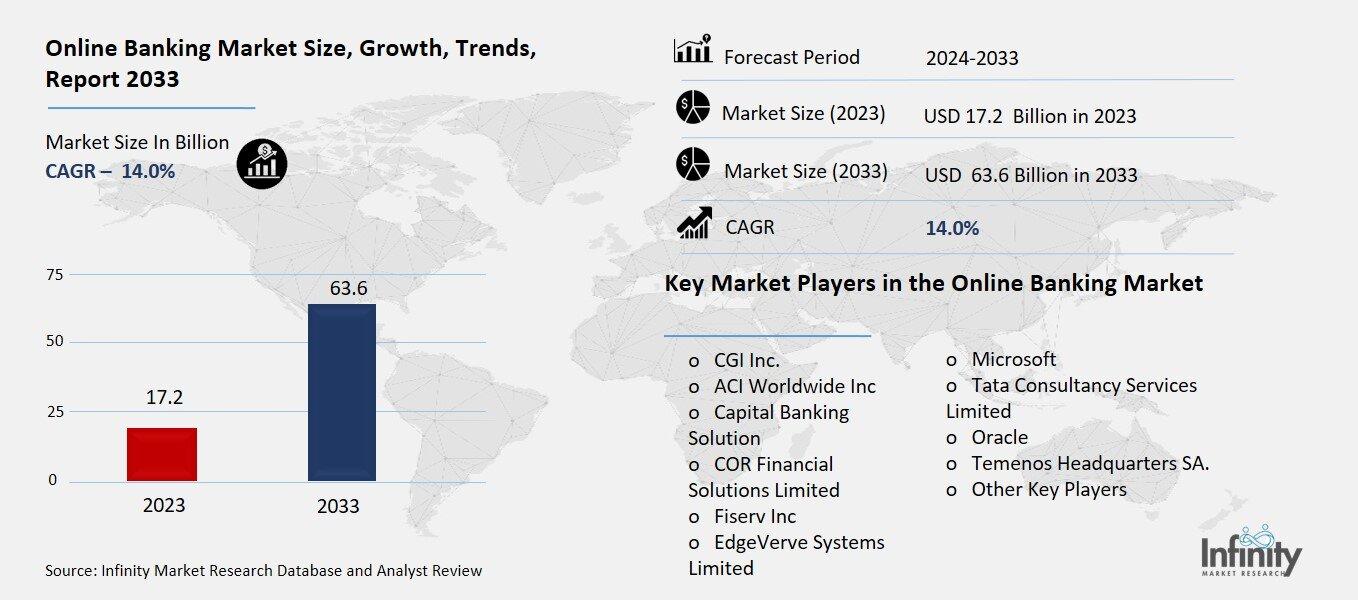

Global Online Banking Market (By Service Type, Payments, Wealth Management, Customer & Channel Management, Processing Services, and Other Service Types; By Banking Type, Retail Banking, Investment Banking, and Corporate Banking; By Region and Companies), 2024-2033

Oct 2024

Financial Services & Insurance

Pages: 138

ID: IMR1275

Online Banking Market Overview

Global Online Banking Market acquired the significant revenue of 17.2 Billion in 2023 and expected to be worth around USD 63.6 Billion by 2033 with the CAGR of 14.0% during the forecast period of 2024 to 2033. The online banking market has expanded over the years due to improvements in technology, shifts in consumer behavior, and improved access to the internet. Tapping into this demand, financial organizations are continually spending their resources on developing mobile banking applications that allow multiple functions, such as account access and management, transfer of funds, and multiple forms of mobile payments.

Fintech companies have upped the ante further and have forced traditional banks to improve on their online services and the general experience. Security is still a paramount issue, forcing banks to employ the latest measures in encryption and authentication in order to prevent customer information leakage. Thus, future trends will be based on such developments as artificial intelligence, individually tailored financial services, and the blockchain technology, as the need for efficient banking services grows.

Drivers for the Online Banking Market

Increased Internet Penetration

The increase in internet connectivity has further improved the prospects of online banking as a large number of clients can transact business on the go. This expansion is so evident in the urban and rural areas where reliability of internet increases and gives the user the flexibility of attending to his/her banking needs regardless of the physical location of the branches. It therefore enables consumers to complete everyday activities like moving money, checking balances, and paying bills at their own will thus helping spread financial access.

However, the use of mobile internet access has also continued to drive this trend by enabling customers to conduct banking activities using their smart phones and tablets, and this has changed the manner in which people share information with the banking institutions.

Restraints for the Online Banking Market

Risk of Cyberattacks and Data Breaches

The risk of cyberattacks and data breaches poses a significant challenge to the online banking market, often deterring consumers from fully embracing digital financial services. High-profile incidents of data theft and identity fraud can erode trust in banking platforms, making customers hesitant to share personal and financial information online. This apprehension is compounded by the increasing sophistication of cyber threats, which can target both large financial institutions and smaller banks alike. As a result, consumers may prefer traditional banking methods that they perceive as safer, limiting the growth potential of online banking services. To counteract these concerns, financial institutions are investing heavily in robust security measures, including advanced encryption, multi-factor authentication, and continuous monitoring of transactions for suspicious activities.

Opportunity in the Online Banking Market

Integration of Advanced Technologies

The adoption of technologies such as blockchain, artificial intelligence (AI), and machine learning is revolutionizing the online banking sector by enhancing security, improving customer experience, and streamlining operations. Blockchain technology offers a decentralized ledger system that enhances transaction security and transparency, significantly reducing the risk of fraud and unauthorized access. By enabling real-time transaction verification, blockchain can also expedite processes like cross-border payments, which traditionally involve lengthy waiting periods.

AI and machine learning play crucial roles in personalizing customer experiences and improving operational efficiency. These technologies analyze vast amounts of data to identify user behavior patterns, allowing banks to offer tailored services, such as customized financial advice and targeted product recommendations.

Trends for the Online Banking Market

Shift to Digital-Only Banks

The rise of neobanks and digital-only financial institutions is significantly reshaping the competitive landscape of the banking industry, compelling traditional banks to innovate and adapt to new consumer expectations. Neobanks, which operate entirely online without physical branches, offer streamlined services, lower fees, and enhanced user experiences tailored to tech-savvy consumers. Their agility in deploying new technologies and features allows them to rapidly respond to market demands, attracting a growing customer base that prioritizes convenience and accessibility.

As neobanks gain popularity, traditional banks face increasing pressure to modernize their offerings to remain relevant. This competition has prompted established institutions to invest in digital transformation initiatives, such as developing user-friendly mobile apps, enhancing online banking functionalities, and incorporating advanced technologies like artificial intelligence and machine learning for personalized services.

Segments Covered in the Report

By Service Type

o Payments

o Wealth Management

o Customer & Channel Management

o Processing Services

o Other Service Types

By Banking Type

o Retail Banking

o Investment Banking

o Corporate Banking

Segment Analysis

By Service Type Analysis

On the basis of service type, the market is divided into payments, wealth management, customer & channel management, processing services, and other service types. Among these, payments segment acquired the significant share around 37.4% in the market owing to the increasing consumer preference for digital payment solutions and the growing adoption of contactless transactions. The convenience and speed offered by online payment systems have transformed the way individuals conduct financial transactions, enabling them to make payments seamlessly through mobile apps and online platforms.

By Banking Type Analysis

On the basis of banking type, the market is divided into retail banking, investment banking, and corporate banking. Among these, retail banking held the prominent share of the market due to the increasing demand for accessible and convenient financial services among individual consumers. Retail banking primarily focuses on providing services to the general public, including savings and checking accounts, personal loans, mortgages, and credit cards. The rise of digital technology has transformed retail banking, enabling customers to manage their finances online through user-friendly mobile apps and websites.

Regional Analysis

North America Dominated the Market with the Highest Revenue Share

North America held the most of the share of 32.1% the market. The region is home to several leading financial institutions and fintech companies that have significantly advanced digital banking services. High levels of internet penetration and smartphone usage have facilitated widespread access to online banking, enabling consumers to conduct financial transactions seamlessly from their devices.

Additionally, North American consumers exhibit a strong preference for digital payment solutions, further bolstered by the rapid adoption of technologies such as mobile wallets, contactless payments, and peer-to-peer payment systems. The region's regulatory environment also supports innovation in the banking sector, allowing for the emergence of new players and services that enhance the overall consumer experience.

Competitive Analysis

The competitive landscape of the online banking market is characterized by a mix of traditional financial institutions, emerging fintech companies, and neobanks, each vying for market share through innovative offerings and enhanced customer experiences. Established banks are leveraging their brand reputation, extensive customer bases, and comprehensive service portfolios to maintain their dominance, often investing heavily in digital transformation to enhance their online platforms. In contrast, fintech firms and neobanks are disrupting the market with agile, technology-driven solutions that prioritize user experience and convenience, appealing particularly to younger, tech-savvy consumers.

Recent Developments

In August 2022, ACI Worldwide, a global leader in mission-critical, real-time payments software, announced that Eximbay, South Korea's premier overseas payment services provider (PSP), has integrated ACI Fraud Management for Merchants into its payment services offerings. This addition enhances Eximbay's capabilities by providing a robust real-time fraud prevention solution.

In August 2022, ACI Worldwide, a global leader in mission-critical, real-time payments software, announced today an agreement with Japan's premier domestic payment network, Japan Card Network, Inc. (CARNET), to enhance its digital payments infrastructure. This partnership will enable ACI to collaborate with CARNET in delivering cutting-edge digital payments technology and next-generation solutions to CARDNET's customers.

Key Market Players in the Online Banking Market

o CGI Inc.

o ACI Worldwide Inc

o Capital Banking Solution

o COR Financial Solutions Limited

o Fiserv Inc

o EdgeVerve Systems Limited

o Microsoft

o Tata Consultancy Services Limited

o Oracle

o Temenos Headquarters SA.

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 17.2 Billion |

|

Market Size 2033 |

USD 63.6 Billion |

|

Compound Annual Growth Rate (CAGR) |

14.0% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Service Type, Banking Type, Distribution Channel, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

CGI Inc., ACI Worldwide Inc, Capital Banking Solution, COR Financial Solutions Limited, Fiserv Inc, EdgeVerve Systems Limited, Microsoft, Tata Consultancy Services Limited, Oracle, Temenos Headquarters SA., and Other Key Players. |

|

Key Market Opportunities |

Integration of Advanced Technologies |

|

Key Market Dynamics |

Increased Internet Penetration |

📘 Frequently Asked Questions

1. Who are the key players in the Automotive IoT Market?

Answer: CGI Inc., ACI Worldwide Inc, Capital Banking Solution, COR Financial Solutions Limited, Fiserv Inc, EdgeVerve Systems Limited, Microsoft, Tata Consultancy Services Limited, Oracle, Temenos Headquarters SA., and Other Key Players.

2. How much is the Online Banking Market in 2023?

Answer: The Online Banking Market size was valued at USD 17.2 Billion in 2023.

3. What would be the forecast period in the Online Banking Market?

Answer: : The forecast period in the Online Banking Market report is 2024-2033.

4. What is the growth rate of the Online Banking Market?

Answer: Online Banking Market is growing at a CAGR of 14.0% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.