🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Petrochemicals Market

Petrochemicals Market (By Type (Ethylene, Propylene, Methanol, Xylene, Others), By Application (Packaging, Electronics, Construction, Automotive, Other Applications), By End-Use Industry (Chemical Industry, Plastics Industry, Textile and Apparel Industry, Automotive Industry, Agriculture, Other End-Use Industries), By Region and Companies)

Jul 2024

Chemicals and Materials

Pages: 156

ID: IMR1173

Petrochemicals Market Overview

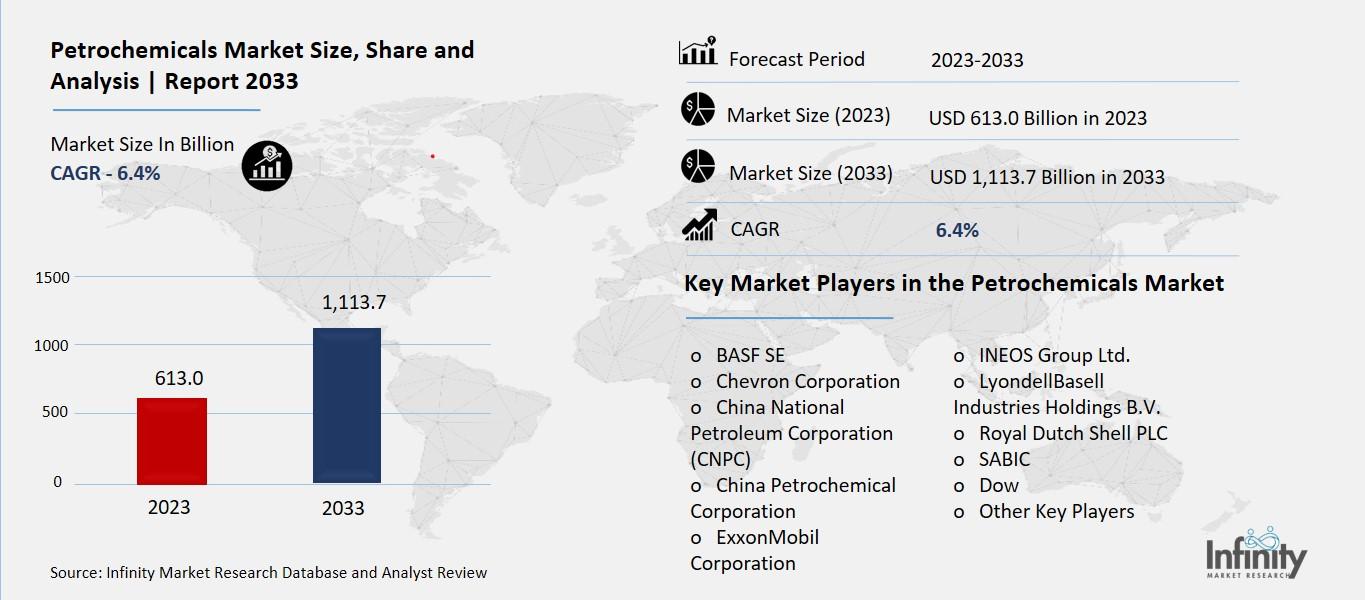

The global Petrochemicals Market size is expected to be worth around USD 1,113.7 Billion by 2033 from USD 613.0 Billion in 2023, growing at a CAGR of 6.4% during the forecast period from 2023 to 2033.

The Petrochemicals Market refers to a sector of the economy focused on chemicals derived from petroleum or natural gas. These chemicals are used to make various products that we use in daily life, such as plastics, fertilizers, pharmaceuticals, and synthetic fibers. Petrochemicals play a crucial role in modern industry because they provide the raw materials needed for manufacturing a wide range of goods, from packaging materials to clothing and medicines.

In simple terms, petrochemicals are chemicals that come from oil or natural gas. They're used to make lots of things we use every day, like plastic, medicine, and fertilizer. So, the petrochemicals market is all about producing and selling these chemicals to make products for different industries around the world.

Drivers for the Petrochemicals Market

Strong Demand from End-Use Industries

One of the primary drivers of the petrochemicals market is the strong demand from diverse end-use industries such as automotive, construction, packaging, electronics, and healthcare. Petrochemicals serve as essential raw materials for manufacturing plastics, polymers, resins, solvents, and various chemical compounds used in these sectors. The growing population, urbanization trends, and rising disposable incomes are fueling the demand for consumer goods and infrastructure development, thereby boosting the consumption of petrochemical products.

Technological Advancements in Petrochemical Processes

Technological advancements play a crucial role in driving innovation and efficiency in petrochemical production processes. Advancements in catalyst technologies, process optimization, and automation have led to higher yields, improved product quality, and reduced operational costs in petrochemical manufacturing. Innovations such as shale gas extraction techniques have also unlocked new sources of feedstock, enhancing the supply chain resilience and cost competitiveness of petrochemical producers globally.

Favorable Regulatory Policies and Government Initiatives

Government policies and regulations that support the growth of the petrochemical industry are significant drivers. Many governments around the world are implementing policies to attract investments in petrochemical infrastructure, promote industrialization, and support economic growth. Incentives such as tax breaks, subsidies for research and development, and favorable trade agreements contribute to creating a conducive environment for petrochemical companies to expand their operations and invest in new technologies.

Increasing Investments in Infrastructure Development

Rapid infrastructure development in emerging economies is driving the demand for petrochemical products, particularly in construction materials, automotive components, and electrical appliances. Investments in infrastructure projects such as roads, bridges, residential buildings, and industrial facilities require significant quantities of petrochemical-derived materials like plastics, adhesives, coatings, and insulation materials, thereby stimulating market growth.

Evolving Consumer Lifestyles and Demands

Changing consumer preferences and lifestyles are influencing the demand for innovative products that rely on petrochemicals. Increased urbanization, rising middle-class populations, and changing consumer behavior towards convenience and sustainability drive the demand for packaged goods, electronic devices, personal care products, and automotive components all of which heavily rely on petrochemical inputs.

Global Economic Growth and Industrialization

The overall economic growth and industrialization in developing regions are pivotal drivers for the petrochemicals market. Countries in Asia-Pacific, Latin America, and the Middle East are experiencing rapid industrialization, urbanization, and infrastructural development, leading to increased consumption of petrochemical products. These regions offer substantial growth opportunities for petrochemical producers due to their expanding manufacturing base and rising per capita incomes.

Restraints for the Petrochemicals Market

Environmental Concerns and Sustainability Pressures

One of the primary restraints for the petrochemicals market is increasing environmental awareness and stringent regulations aimed at reducing carbon emissions and plastic waste. Petrochemical production processes are energy-intensive and contribute to greenhouse gas emissions and environmental pollution. Regulatory pressures to comply with emission standards and adopt sustainable practices pose challenges for petrochemical companies, increasing operational costs and restricting expansion opportunities.

Volatility in Crude Oil Prices

The petrochemicals industry is highly dependent on crude oil and natural gas as feedstocks. Fluctuations in global oil prices due to geopolitical tensions, supply-demand imbalances, and economic uncertainties impact the cost structure and profitability of petrochemical producers. Sudden price spikes or declines in crude oil prices can disrupt production planning, inventory management, and investment decisions, posing financial risks and affecting market stability.

Regulatory Challenges and Trade Barriers

Petrochemical companies face regulatory challenges related to product safety, environmental protection, labor standards, and trade restrictions across different regions. Compliance with complex regulatory frameworks, obtaining permits for new projects, and navigating trade barriers can delay project timelines and increase operational complexities. Moreover, trade disputes and tariffs on petrochemical products between major economies create uncertainties and limit market access, affecting profitability and investment flows.

Geopolitical Tensions and Supply Chain Risks

Geopolitical tensions and regional conflicts in key petrochemical-producing regions can disrupt supply chains, restrict raw material availability, and escalate operational costs. Political instability, trade sanctions, and geopolitical rivalries impact market dynamics, supply chain logistics, and investment decisions in the petrochemical sector. Companies must manage geopolitical risks and diversify supply sources to mitigate disruptions and ensure business continuity.

Technological Limitations and Innovation Barriers

Technological limitations in petrochemical production processes, such as energy efficiency, waste management, and recycling capabilities, pose challenges for industry innovation and sustainability. Traditional petrochemical manufacturing methods may lack the flexibility to adapt to evolving consumer preferences and regulatory requirements for eco-friendly products. Investment in research and development is crucial to overcoming technological barriers and advancing sustainable practices in the petrochemicals market.

Shift towards Sustainable Alternatives and Circular Economy

The growing shift towards sustainable alternatives and circular economy principles presents a restraint for the petrochemicals market. Increasing consumer awareness about plastic pollution, single-use plastics bans, and preferences for bio-based or recyclable materials drive demand for eco-friendly alternatives. Petrochemical companies face pressure to innovate and invest in bioplastics, renewable feedstocks, and recycling technologies to align with market trends and regulatory expectations for environmental stewardship.

Opportunity in the Petrochemicals Market

Rising Demand from End-Use Industries

One of the key opportunities for the petrochemicals market lies in the rising demand from various end-use industries such as automotive, construction, packaging, electronics, and textiles. Petrochemicals serve as essential raw materials for manufacturing plastics, synthetic fibers, coatings, adhesives, and other chemical products that are integral to these sectors. Rapid urbanization and population growth in emerging economies fuel the demand for consumer goods and infrastructure development, driving the consumption of petrochemical-based products.

Technological Advancements and Innovation

Technological advancements in petrochemical production processes, including catalytic cracking, polymerization, and olefins production, present opportunities for efficiency improvements, cost reductions, and product innovation. Innovations in chemical engineering, automation, and digitalization enhance operational capabilities, enable customization of product specifications, and support the development of high-performance materials with enhanced properties. Investments in research and development (R&D) foster continuous innovation, leading to the discovery of new applications and sustainable solutions in the petrochemical market.

Emerging Markets and Infrastructure Development

Emerging markets in Asia-Pacific, Latin America, and Africa offer lucrative opportunities for petrochemical manufacturers due to rapid industrialization, urbanization, and infrastructural developments. Increasing disposable incomes, rising middle-class populations, and urban migration drive demand for consumer goods, automobiles, electronics, and construction materials derived from petrochemicals. Strategic investments in production capacities and distribution networks in emerging economies enable market expansion, capitalize on growth opportunities, and strengthen market presence in dynamic regions.

Shift towards Sustainable Practices and Circular Economy

The transition towards sustainable practices and circular economy principles presents opportunities for petrochemical companies to innovate and diversify product portfolios. Growing environmental awareness, regulatory initiatives promoting recyclability and reduced carbon footprint, and consumer preferences for eco-friendly products drive demand for bio-based plastics, renewable feedstocks, and recyclable materials. Investments in green technologies, such as biodegradable polymers, biofuels, and waste-to-energy solutions, enable companies to meet sustainability goals, enhance brand reputation, and capture market share in eco-conscious markets.

Integration of Petrochemicals in Healthcare and Pharmaceutical Sectors

The healthcare and pharmaceutical sectors represent emerging opportunities for petrochemicals due to the increasing use of plastics, polymers, and specialty chemicals in medical devices, drug packaging, diagnostics, and healthcare infrastructure. Petrochemical-based materials offer superior performance characteristics, including biocompatibility, sterilization resistance, and durability, essential for medical applications. Expansion of healthcare facilities, advancements in medical technology, and global healthcare spending drive demand for petrochemical-derived products, creating new avenues for market growth and diversification.

Strategic Partnerships and Market Collaborations

Collaborations between petrochemical companies, technology providers, research institutions, and end-users foster innovation, accelerate market entry, and facilitate technology transfer in the petrochemical market. Strategic partnerships enable joint ventures, product co-development, and shared resources, leveraging combined expertise to address market challenges, capitalize on emerging opportunities, and expand market presence. Collaborative efforts in sustainable practices, digital transformation, and supply chain optimization enhance competitiveness, resilience, and sustainability in the evolving global petrochemical market landscape.

Trends for the Petrochemicals Market

Shift towards Sustainable Petrochemicals

There is a notable trend towards sustainable petrochemicals, driven by increasing environmental regulations and consumer demand for eco-friendly products. Companies are focusing on reducing carbon footprints, enhancing energy efficiency, and adopting cleaner production technologies. The industry is investing in bio-based feedstocks, renewable energy sources, and recycling technologies to develop sustainable alternatives to traditional petrochemicals. This trend not only addresses environmental concerns but also meets regulatory requirements and enhances brand reputation in environmentally conscious markets.

Technological Innovations in Petrochemical Processes

Technological advancements are revolutionizing petrochemical production processes, leading to improved efficiency, cost-effectiveness, and product quality. Innovations such as advanced catalysts, molecular modeling, and process automation are optimizing manufacturing operations and reducing energy consumption. Digitalization and artificial intelligence (AI) are being integrated into petrochemical plants to enhance operational control, predictive maintenance, and supply chain management. These innovations enable companies to respond swiftly to market demands, customize products, and maintain competitive advantage in a rapidly evolving industry landscape.

Growth of Specialty Petrochemicals

There is a growing demand for specialty petrochemicals, driven by their diverse applications across industries such as pharmaceuticals, electronics, aerospace, and automotive. Specialty chemicals offer unique properties and high-performance characteristics, making them essential in niche markets requiring precision, reliability, and advanced functionalities. The trend towards customization and product differentiation in consumer goods is further fueling the demand for specialty petrochemicals, which include polymers, intermediates, and fine chemicals tailored to specific end-user requirements.

Regional Market Dynamics and Globalization

Regional market dynamics play a crucial role in shaping the petrochemicals industry, with Asia-Pacific emerging as a dominant market due to rapid industrialization, urbanization, and infrastructure development. The Middle East remains a key player in petrochemical production, leveraging abundant feedstock resources and strategic geographical location. North America and Europe focus on technological innovations, sustainability initiatives, and regulatory compliance to maintain competitive advantage in mature markets. Globalization trends are driving investments in cross-border collaborations, joint ventures, and market expansions to capture emerging opportunities and optimize supply chain efficiencies.

Resilience and Adaptability in Supply Chain Management

The petrochemical industry is enhancing resilience and adaptability in supply chain management to mitigate risks, disruptions, and market uncertainties. Companies are diversifying sourcing strategies, optimizing logistics networks, and implementing digital solutions for real-time monitoring and inventory management. The COVID-19 pandemic underscored the importance of agile supply chains capable of responding to global crises, prompting industry stakeholders to prioritize supply chain resilience through scenario planning, capacity optimization, and strategic partnerships.

Rising Demand for Petrochemicals in Emerging Economies

Emerging economies, particularly in Asia-Pacific, Latin America, and Africa, are experiencing robust growth in petrochemical consumption driven by rapid urbanization, industrialization, and rising disposable incomes. These regions offer significant market potential for petrochemical producers seeking to expand their footprint and capitalize on the burgeoning demand for plastics, polymers, and chemical derivatives. Government initiatives, infrastructure investments, and favorable business environments further bolster market opportunities in emerging economies, positioning them as key growth drivers in the global petrochemicals market.

Segments Covered in the Report

By Type

o Ethylene

o Propylene

o Methanol

o Xylene

o Others

By Application

o Packaging

o Electronics

o Construction

o Automotive

o Other Applications

By End Use Industry

o Chemical Industry

o Plastics Industry

o Textile and Apparel Industry

o Automotive Industry

o Agriculture

o Other End-Use Industries

Segment Analysis

By Type Analysis

The market is divided into five segments based on type: xylene, propylene, methanol, ethylene, and others. The market was led by the ethylene and propylene sector in 2023, and during the forecast period, this segment is anticipated to hold the biggest share of petrochemicals. Ethylene and propylene are two of the most important and prominent market sectors for petrochemicals. They serve as essential components for a wide range of goods and have broad uses in numerous industries. In the petrochemical sector, ethylene is essential for the synthesis of plastics and a wide range of other chemicals. Its broad range of applications and adaptability confirm its position as the industry leader. Numerous chemical intermediates are created with the use of propylene.

It is essential to the creation of acrylonitrile, which is used to make acrylic fibers and plastics, cumene, which is used to make phenol and acetone, and propylene oxide, which is used in the production of polyurethane foam and glycol. In terms of relevance, propylene is a crucial subset of the petrochemicals market, right behind ethylene. It is essential to many sectors due to its versatility in the synthesis of synthetic materials, chemicals, and plastics.

By Application Analysis

The market is divided into four segments based on application: packaging, electronics, construction, and automotive. Throughout the forecast period, the automotive segment is anticipated to hold the greatest share of the Petrochemicals Market. In 2023, it held the largest market share. Petrochemical-derived plastics are widely used in the manufacture of dashboards, exterior panels, bumpers, and interior components for automobiles. These polymers are highly valued for their beneficial qualities, including flexibility in design, durability, and lightweight nature. Synthetic rubber, which is derived from petrochemicals, is an essential component of tires.

The automotive sector has a significant need for tires due to the production of new vehicles and the need for tire replacements. As a result, the market for petrochemicals has grown significantly. The automotive sector's efforts to lower emissions and improve fuel economy have led to a rise in the use of lightweight materials made from petrochemicals. These materials include sophisticated polymers and composites, which strengthens the position of petrochemicals in this industry.

By End-Use Analysis

The petrochemical market is significantly impacted by the building and construction sector since petrochemical products are widely used in a variety of construction-related applications. Petrochemicals are necessary raw materials used in the production of commodities, chemicals, and building materials. They come from natural gas or petroleum. Petrochemicals are needed in the production of plastics, which are widely used in construction materials like pipelines, wires, insulation, roofing, and flooring. These polymers are widely used in plumbing and fitting applications in construction. Adhesives and sealants with petrochemical bases are used in the construction industry to unite and seal different materials, increasing the longevity and robustness of buildings.

Regional Analysis

In 2023, the Asia Pacific region held a dominant market share of over 50.8% in the petrochemicals industry. This is explained by the growing need for polymers and the thriving chemicals industry. Businesses in the area are planning cost-effective ways to boost product sales in addition to switching to natural gas liquids and other non-oil feedstock to meet the growing demand for the product.

India Petrochemicals market: Due to significant investments made by major companies in capacity expansions and technological upgrades, as well as the nation's growing industrial and manufacturing sectors, the petrochemicals market in India is experiencing robust growth.

The expansion of the petrochemicals sector in North America is anticipated to be fueled by the rising shale gas development operations in the United States and Canada. These nations' increasing shale gas production offers the chance to use shale gas instead of conventional feedstock to produce a range of petrochemicals. Over the projection period, significant capacity additions are anticipated to drive growth in the United States and Canada.

Competitive Analysis

To extend their product lines and promote more market growth, the key industry players are heavily investing in research and development. In addition to major industry developments such as new product launches, contracts, mergers and acquisitions, higher investments, and partnerships with other companies, market players are also engaging in a range of strategic initiatives to broaden their worldwide reach. To survive and prosper in an increasingly cutthroat market, rivals in the petrochemicals sector need to provide reasonably priced goods.

Recent Developments

In June 2023: In September, Long Son Petrochemicals, a subsidiary of SCG Chemicals, will start commercial production at its petrochemical facility in southern Vietnam, the chairman of Thai conglomerate Siam Cement Group told Reuters on Monday. During a break during an industry conference, Siam Cement Group's Roongrote Rangsiyopash said that the company is testing all of the site's operational units.

In March 2023: China and Saudi Arabia formed a joint venture for an integrated refinery and petrochemical complex for raw materials and fine chemicals as part of the multitrillion-dollar Belt and Road program. The USD 12.2 billion project, dubbed the "green and low-carbon initiative," between China and Saudi Arabia was presented in Panjin City, northeastern Liaoning province, according to the Chinese Daily Global Times.

Key Market Players in the Petrochemicals Market

o BASF SE

o China National Petroleum Corporation (CNPC)

o China Petrochemical Corporation

o ExxonMobil Corporation

o INEOS Group Ltd.

o LyondellBasell Industries Holdings B.V.

o Royal Dutch Shell PLC

o SABIC

o Dow

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 613.0 Billion |

|

Market Size 2033 |

USD 1,113.7 Billion |

|

Compound Annual Growth Rate (CAGR) |

6.4% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Type, Application, End-Use Industry, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

BASF SE, Chevron Corporation, China National Petroleum Corporation (CNPC), China Petrochemical Corporation, ExxonMobil Corporation, INEOS Group Ltd., LyondellBasell Industries Holdings B.V., Royal Dutch Shell PLC, SABIC, Dow, Other Key Players |

|

Key Market Opportunities |

Rising Demand from End-Use Industries |

|

Key Market Dynamics |

Strong Demand from End-Use Industries |

📘 Frequently Asked Questions

1. What would be the forecast period in the Petrochemicals Market report?

Answer: The forecast period in the Petrochemicals Market report is 2024-2033.

2. How much is the Petrochemicals Market in 2023?

Answer: The Petrochemicals Marketsize was valued at USD 613.0 Billion in 2023.

3. Who are the key players in the Petrochemicals Market?

Answer: BASF SE, Chevron Corporation, China National Petroleum Corporation (CNPC), China Petrochemical Corporation, ExxonMobil Corporation, INEOS Group Ltd., LyondellBasell Industries Holdings B.V., Royal Dutch Shell PLC, SABIC, Dow, Other Key Players

4. What is the growth rate of the Petrochemicals Market?

Answer: Petrochemicals Market is growing at a CAGR of 6.4% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.