🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Pigment Dispersion Market

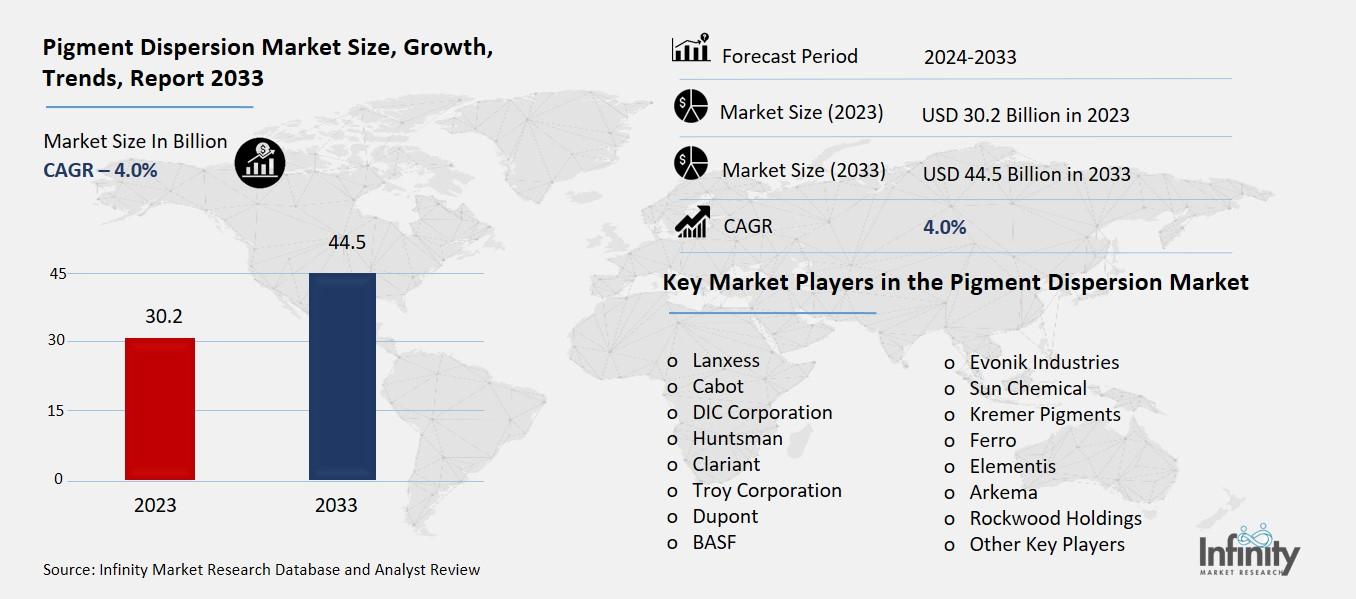

Global Pigment Dispersion Market (By Type, Specialty Pigments, Organic Pigments, and Inorganic Pigments; By Form, Liquid, Paste, and Powder; By Application, Plastics, Paints and Coatings, Textiles, Cosmetics, Inks, and Other Applications; By End-Use Industry, Automotive, Consumer Goods, Construction, Furniture, Packaging, and Other End-Use Industries; By Region and Companies), 2024-2033

Jan 2025

Chemicals and Materials

Pages: 138

ID: IMR1401

Pigment Dispersion Market Overview

Global Pigment Dispersion Market acquired the significant revenue of 30.2 Billion in 2023 and expected to be worth around USD 44.5 Billion by 2033 with the CAGR of 4.0% during the forecast period of 2024 to 2033. The pigment dispersion market is another vast segment in the overall market of coatings, inks, and plastics since more people give preference to bright and durable colors. Pigment dispersants play a big role of enhancing the outlook and effectiveness of products in industries such as automotive, construction, textiles, and packaging among others. This has been accelerated by improvements in the technology that enhances dispersion hence allowing the market develop. Some trends including customer awareness towards superior quality, abrasion resistance, and biodegradable products, and the increasing tendency of pigments used in digital print, and high-end applications, would consolidate the growth of the market.

Drivers for the Pigment Dispersion Market

Rising Demand for Eco-Friendly Products

Increasing ecofriendly, non-hazardous and bio-derived pigments tendencies are observed due to the consumer and regulatory requirements. Yearning for more natural pigments increases due to potential dangers of dangerous impacts of traditional pigments on human health and environment. Natural pigments are obtained from renewable biological sources, and their usage cuts the dependence on petroleum-based materials.

Also, non-hazardous colors, which don’t contain hazardous substances such as heavy metals, are becoming common in markets including the food processing sector and the textile and the cosmetic industries where the quality of the products is of high importance. The promotion of environmentally friendly dispersion solutions is additionally intensified by reinforced legislation on limiting the impact on the environment, for example, low VOC in coatings and paints.

Restraints for the Pigment Dispersion Market

Complex Manufacturing Process

The production of high-quality, consistent pigment dispersions involves complex technical processes that require advanced equipment, precise formulations, and significant expertise. One of the primary challenges is achieving uniform dispersion of pigments in the base material, as inadequate dispersion can lead to issues such as poor color consistency, settling, or reduced performance of the final product. Additionally, producing stable dispersions that maintain their quality over time, without agglomeration or degradation, requires sophisticated technologies and careful control of variables such as temperature, shear forces, and solvent types. The high cost of these advanced manufacturing techniques can be a significant barrier, especially for smaller manufacturers with limited resources.

Opportunity in the Pigment Dispersion Market

Rising Demand for Sustainable Solutions

With the increasing consumer awareness of environmental issues, there is a significant opportunity for manufacturers to innovate and develop bio-based, non-toxic, and sustainable pigment dispersions. As consumers demand eco-friendly products, businesses across various industries such as packaging, textiles, automotive, and cosmetics are seeking to align with this shift toward sustainability. Bio-based pigments, sourced from renewable materials like plants or algae, offer an alternative to traditional synthetic pigments, reducing reliance on fossil fuels and minimizing environmental impact.

Non-toxic pigment dispersions, free from harmful chemicals such as heavy metals, contribute to safer products, addressing growing health concerns and regulatory pressures. Moreover, manufacturers who adopt sustainable production processes, such as reducing water usage or eliminating hazardous chemicals, are in a prime position to meet stringent environmental regulations and cater to eco-conscious consumers.

Trends for the Pigment Dispersion Market

Shift Toward Water-Based Pigment Dispersions

As environmental concerns and regulations around air quality continue to tighten, there is a growing focus on reducing volatile organic compound (VOC) emissions in various industries, particularly in coatings and paints. VOCs are harmful chemicals that evaporate into the air, contributing to air pollution, smog formation, and adverse health effects. In response, water-based pigment dispersions are gaining popularity as an eco-friendly alternative to solvent-based dispersions, which tend to release higher levels of VOCs. Water-based formulations use water as the primary solvent, significantly reducing the emission of VOCs during production, application, and drying. This shift not only helps companies comply with stringent environmental regulations but also meets the growing consumer demand for safer, more sustainable products.

Segments Covered in the Report

By Type

o Specialty Pigments

o Organic Pigments

o Inorganic Pigments

By Form

o Liquid

o Paste

o Powder

By Application

o Plastics

o Textiles

o Cosmetics

o Inks

o Other Applications

By End-Use Industry

o Automotive

o Consumer Goods

o Construction

o Furniture

o Packaging

o Other End-Use Industries

Segment Analysis

By Type Analysis

On the basis of type, the market is divided into specialty pigments, organic pigments, and inorganic pigments. Among these, organic pigments segment acquired the significant share in the market owing to their widespread application, vibrant color range, and superior performance in various industries. Organic pigments are derived from carbon-based compounds, offering excellent color strength, stability, and versatility across a wide spectrum of hues. Their ability to provide high-performance and vivid colorants in coatings, paints, plastics, textiles, and inks makes them highly sought after. Furthermore, organic pigments are increasingly favored due to their lighter environmental footprint compared to some inorganic alternatives, especially with the growing demand for eco-friendly and sustainable products.

By Form Analysis

On the basis of form, the market is divided into liquid, paste, and powder. Among these, liquid held the prominent share of the market. Liquid dispersions are preferred because they can be easily mixed, applied, and processed, allowing for uniform distribution of color and improved performance. The liquid form is particularly beneficial in applications where precise and smooth dispersion is critical, such as in automotive paints, packaging coatings, and printing inks. Additionally, liquid pigment dispersions often offer better compatibility with different solvent systems, including water-based formulations, which are gaining popularity due to environmental regulations and consumer demand for eco-friendly products.

By Application Analysis

On the basis of application, the market is divided into plastics, paints and coatings, textiles, cosmetics, inks, and other applications. Among these, paints and coatings segment held the significant share of the market due to its extensive use across numerous industries, including automotive, construction, and industrial manufacturing. Paints and coatings require high-quality, durable, and vibrant pigments to achieve the desired aesthetic and protective qualities. The demand for these products is driven by the need for decorative finishes, corrosion resistance, and weather protection in various applications. In particular, the automotive and construction industries rely heavily on paints and coatings to deliver long-lasting, visually appealing results, which require advanced pigment dispersion solutions.

By End-Use Industry Analysis

On the basis of end-use industry, the market is divided into automotive, consumer goods, construction, furniture, packaging, and other end-use industries. Among these, packaging segment held the most of the share of the market due to the growing demand for high-quality, visually appealing, and functional packaging solutions across a wide range of industries, including food and beverages, pharmaceuticals, and consumer goods. Packaging is essential not only for protecting products but also for enhancing their aesthetic appeal and brand identity. Pigment dispersions are used extensively in flexible packaging, rigid containers, and labels to provide vibrant colors, durability, and the ability to withstand various environmental conditions.

Regional Analysis

Asia Pacific Dominated the Market with the Highest Revenue Share

Asia Pacific held the most of the share of 32.4% of the market. Asia Pacific is home to some of the world’s largest manufacturing hubs, particularly in countries like China, India, Japan, and South Korea, where industrial production and consumption of pigment dispersions are on the rise. The region’s strong economic growth, coupled with an expanding middle class and increasing disposable incomes, has significantly contributed to the demand for high-quality consumer goods and advanced manufacturing products, which require vibrant, durable pigments.

In particular, the demand for paints and coatings in the construction and automotive sectors is growing rapidly, driven by infrastructure development, urbanization, and increased vehicle production. The packaging industry is also flourishing in the region, driven by both domestic consumption and export activities.

Competitive Analysis

The competitive landscape of the pigment dispersion market is characterized by the presence of several key global players and a mix of regional and smaller manufacturers. Leading companies in this market include major chemical and pigment producers such as BASF, Clariant, DIC Corporation, and Lanxess, which dominate the industry through their extensive product portfolios, strong brand presence, and global distribution networks. These companies are focusing on innovation, offering a wide range of high-performance pigment dispersions, including sustainable, eco-friendly, and bio-based solutions, to meet the increasing demand for environmentally responsible products.

Recent Developments

In January, a consortium comprising Heubach Group and SK Capital Partners acquired Clariant’s pigment business, with Clariant retaining a 20% stake in the newly established entity.

In August 2021, LANXESS finalized the acquisition of U.S.-based specialty chemicals manufacturer Emerald Kalama Chemical for US$ 1.04 billion. This acquisition enhances LANXESS' portfolio in the plastics, paints and coatings, and adhesives industries.

Key Market Players in the Pigment Dispersion Market

o Lanxess

o Cabot

o Huntsman

o Clariant

o Troy Corporation

o Dupont

o BASF

o Evonik Industries

o Sun Chemical

o Kremer Pigments

o Ferro

o Elementis

o Arkema

o Rockwood Holdings

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 30.2 Billion |

|

Market Size 2033 |

USD 44.5 Billion |

|

Compound Annual Growth Rate (CAGR) |

4.0% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Type, Form, Application, End-Use Industry, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Lanxess, Cabot, DIC Corporation, Huntsman, Clariant, Troy Corporation, Dupont, BASF, Evonik Industries, Sun Chemical, Kremer Pigments, Ferro, Elementis, Arkema, Rockwood Holdings, and Other Key Players. |

|

Key Market Opportunities |

Rising Demand for Sustainable Solutions |

|

Key Market Dynamics |

Rising Demand for Eco-Friendly Products |

📘 Frequently Asked Questions

1. Who are the key players in the Pigment Dispersion Market?

Answer: Lanxess, Cabot, DIC Corporation, Huntsman, Clariant, Troy Corporation, Dupont, BASF, Evonik Industries, Sun Chemical, Kremer Pigments, Ferro, Elementis, Arkema, Rockwood Holdings, and Other Key Players.

2. How much is the Pigment Dispersion Market in 2023?

Answer: The Pigment Dispersion Market size was valued at USD 30.2 Billion in 2023.

3. What would be the forecast period in the Pigment Dispersion Market?

Answer: The forecast period in the Pigment Dispersion Market report is 2024-2033.

4. What is the growth rate of the Pigment Dispersion Market?

Answer: Pigment Dispersion Market is growing at a CAGR of 4.0% during the forecast period, from 2024 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.