🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Recovered Carbon Black Market

Recovered Carbon Black Market (By Application (Tires, Rubber, High-Performance Coatings, Plastics, Other Applications), By End-Use (Automotive, Aerospace, Marine, Electronics, Packaging, Other End-Uses), By Region and Companies)

Jun 2024

Chemicals and Materials

Pages: 141

ID: IMR1059

Recovered Carbon Black Market Overview

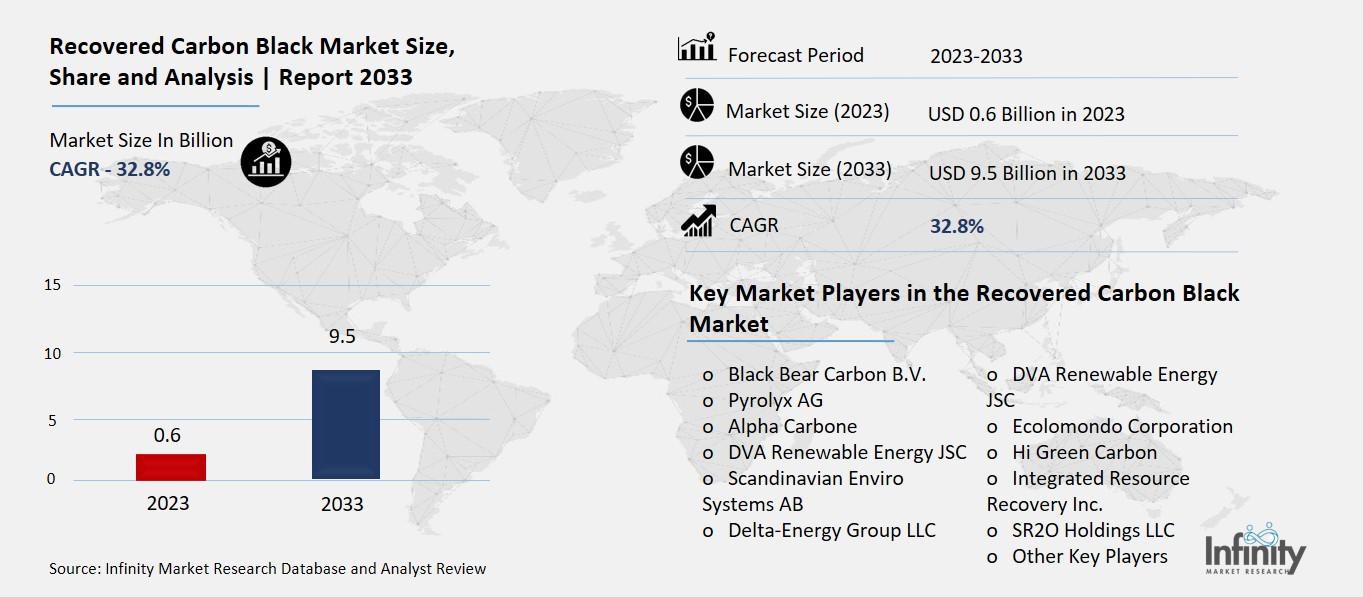

Global Recovered Carbon Black Market size is expected to be worth around USD 9.5 Billion by 2033 from USD 0.6 Billion in 2023, growing at a CAGR of 32.8% during the forecast period from 2023 to 2033.

Recovered Carbon Black is an eco-friendly material obtained from the recycling of used tires. This process, called pyrolysis, transforms scrap tires into a form of carbon black free of fabric and other impurities. Recovered carbon black is highly valued in various industries, particularly for its environmental benefits and cost-effectiveness compared to virgin carbon black. It significantly reduces CO2 and greenhouse gas emissions, making it a sustainable alternative in tire and non-tire rubber products, plastics, inks, and coatings.

The market for recovered carbon black is driven by the expanding rubber industry and the increasing demand for eco-friendly products. Its lower price and the rising availability of recyclable tires contribute to its popularity. Major applications of Recovered Carbon Black include the production of tires, rubber roofing, gaskets, seals, hoses, rubber sheets, geo-membranes, and conveyor belts. Additionally, its use in high-performance coatings, particularly in the automotive and aerospace sectors, is growing due to its protective capabilities and visual appeal. The automotive industry's growth, especially in regions like Asia-Pacific, further propels the demand for Recovered Carbon Black.

Drivers for the Recovered Carbon Black Market

Growing Demand for Sustainable Products

The increasing need for eco-friendly products is a major driver for the recovered carbon black market. Companies across various industries are seeking sustainable alternatives to reduce their environmental impact. This demand is particularly strong in the automotive and tire industries, where Recovered Carbon Black is used extensively due to its cost-effectiveness and ability to lower carbon emissions compared to virgin carbon black. As regulations around the world become stricter regarding carbon emissions, the appeal of Recovered Carbon Black continues to rise, pushing market growth significantly.

Government Regulations and Initiatives

Government policies and initiatives aimed at reducing carbon footprints are fueling the growth of the Recovered Carbon Black market. Many countries have set ambitious targets for reducing greenhouse gas emissions, and Recovered Carbon Black plays a crucial role in meeting these goals. For example, the European Union has stringent regulations that encourage the use of sustainable materials like Recovered Carbon Black to achieve its environmental objectives. This regulatory support is a significant growth driver, as it promotes the adoption of Recovered Carbon Black across various applications.

Cost-Effectiveness of Recovered Carbon Black

One of the primary advantages of Recovered Carbon Black is its cost-effectiveness compared to virgin carbon black. The production of Recovered Carbon Black is less expensive because it utilizes scrap tires, which are abundantly available and cheap. This cost advantage makes Recovered Carbon Black an attractive option for manufacturers looking to reduce costs without compromising on quality. Additionally, the use of Recovered Carbon Black helps companies reduce their raw material costs, which can be a significant portion of their overall expenses.

Increasing Use in Various Applications

The versatility of Recovered Carbon Black is another key driver of its market growth. Recovered Carbon Black is used in a wide range of applications, including tires, non-tire rubber products, plastics, coatings, and inks. Its properties make it suitable for various industrial applications, enhancing its market demand. The tire industry, in particular, is a major consumer of Recovered Carbon Black due to its performance benefits and environmental advantages. As industries continue to seek sustainable and cost-effective materials, the demand for Recovered Carbon Black is expected to grow further.

Expansion of the Rubber Industry

The rubber industry’s growth is directly linked to the Recovered Carbon Black market expansion. With the increasing production of rubber products such as tires, hoses, gaskets, and seals, the demand for Recovered Carbon Black is on the rise. The rubber industry values Recovered Carbon Black for its reinforcing properties and sustainability benefits. As the global rubber industry continues to grow, driven by increasing automotive and industrial applications, the Recovered Carbon Black market is expected to expand in tandem.

Innovation and Technological Advancements

Innovations and advancements in Recovered Carbon Black production technologies are also driving market growth. Companies are investing in research and development to improve the quality and performance of Recovered Carbon Black, making it a more viable alternative to virgin carbon black. These technological improvements are enhancing the appeal of Recovered Carbon Black across various industries, contributing to its market growth. Additionally, new methods of Recovered Carbon Black production are making it possible to recycle a higher percentage of scrap tires, further boosting the market.

Restraints for the Recovered Carbon Black Market

High Costs and Investment Requirements

One of the major restraints in the recovered carbon black market is the high cost associated with its production. The development of sustainable production processes requires significant capital investment. Establishing facilities for the pyrolysis of scrap tires, the primary method for producing recovered carbon black involves substantial financial outlays. Furthermore, ongoing research and development to enhance the quality and efficiency of the recovered product add to the overall costs. These financial burdens can be particularly challenging for smaller companies trying to enter the market.

Technological Complexity

The process of recovering carbon black from scrap tires is technically complex. It requires specialized equipment and expertise to ensure the product meets the quality standards necessary for its intended applications. The reinforcing properties of recovered carbon black, which determine its suitability for use in various products, depend on post-treatment methods. Achieving consistent quality in the recovered product is a significant challenge, limiting its widespread adoption in industries accustomed to the uniform quality of virgin carbon black.

Regulatory and Environmental Challenges

While recovered carbon black is considered an eco-friendly alternative, the industry still faces regulatory hurdles. Compliance with environmental regulations can be costly and time-consuming. Moreover, the industry must navigate varying regulations across different regions, which can complicate production and distribution strategies. In some areas, stringent environmental standards can increase the cost of compliance, impacting the overall profitability of recovered carbon black manufacturers.

Market Awareness and Acceptance

There is still a lack of widespread awareness and acceptance of recovered carbon black as a viable alternative to virgin carbon black. Many industries remain hesitant to switch to recovered carbon black due to concerns about its consistency and performance. This hesitation is compounded by the need for manufacturers to educate potential customers about the benefits and reliability of the recovered product. Overcoming this barrier requires significant marketing and outreach efforts, which can be resource-intensive.

Supply Chain Issues

Supply chain issues also pose a significant challenge for the recovered carbon black market. The availability of scrap tires, the primary raw material, can be inconsistent, leading to supply disruptions. Additionally, the logistics of collecting, transporting, and processing scrap tires can be complex and costly. These supply chain challenges can affect the steady production and distribution of recovered carbon black, hindering market growth.

Economic Factors

Global economic conditions can influence the growth of the recovered carbon black market. Economic downturns, inflation, and sluggish demand can result in reduced capital expenditures by companies, affecting investments in new technologies and sustainable practices. The economic impact of the COVID-19 pandemic, for instance, has created uncertainties in many markets, including the recovered carbon black market. Companies may be more cautious in their spending, delaying investments in innovative but costly processes like carbon black recovery.

Trends for the Recovered Carbon Black Market

Growing Adoption in the Tire Industry

The tire industry is a major consumer of recovered carbon black (Recovered Carbon Black). Manufacturers are increasingly using Recovered Carbon Black as a substitute for virgin carbon black to reduce costs and improve sustainability. The rise of electric vehicles has also boosted the demand for high-performance, sustainable tires, which drives the use of Recovered Carbon Black. Companies like Bridgestone and Continental are setting goals to incorporate more recovered materials in their tire production processes, further pushing the adoption of Recovered Carbon Black in this sector.

Increased Focus on Sustainability

As the world shifts towards more sustainable practices, the demand for Recovered Carbon Black has surged. Recovered carbon black helps reduce the environmental footprint by utilizing waste tires and decreasing reliance on fossil fuels. This aligns with global efforts to reduce carbon emissions and promotes a circular economy. Government regulations and initiatives aimed at reducing greenhouse gas emissions are also encouraging industries to adopt Recovered Carbon Black, contributing to its market growth.

Expansion in Non-Tire Rubber Applications

Beyond the tire industry, Recovered Carbon Black is finding increasing applications in non-tire rubber products such as hoses, gaskets, and seals. These applications benefit from the cost savings and performance improvements that Recovered Carbon Black offers. The construction industry, for instance, uses Recovered Carbon Black in various rubber-based products, enhancing the market’s growth potential in this segment.

Rising Demand in the Plastics Industry

The plastics industry is another significant consumer of Recovered Carbon Black. The material is used to enhance the properties of plastic products, such as durability and resistance. As industries strive for more sustainable solutions, the integration of Recovered Carbon Black in plastic manufacturing is becoming more prevalent. This trend is expected to continue as more companies seek to improve their environmental impact.

Technological Advancements

Technological innovations in the production of Recovered Carbon Black are improving its quality and broadening its applications. Companies are investing in research and development to enhance the efficiency of the recovery process and the performance characteristics of Recovered Carbon Black. These advancements are making Recovered Carbon Black a more attractive option for a wider range of industries, supporting its market growth.

Geographical Expansion

The Recovered Carbon Black market is expanding geographically, with significant growth observed in regions like North America, Europe, and Asia-Pacific. In North America, the U.S. and Canada are major markets due to their large automotive and construction industries. Europe’s stringent environmental regulations and strong automotive sector drive its demand for Recovered Carbon Black. Meanwhile, the Asia-Pacific region, particularly China and India, is witnessing rapid growth due to increasing industrialization and urbanization.

Strategic Partnerships and Investments

Companies in the Recovered Carbon Black market are forming strategic partnerships and making significant investments to expand their market presence. Collaborations between tire manufacturers and Recovered Carbon Black producers are common, aiming to integrate sustainable practices across the supply chain. Investments in new facilities and technologies are also driving market growth, with examples like Life for Tyres Group building new processing plants to meet the rising demand for Recovered Carbon Black.

Comprehensive Insight into Recovered Carbon Black Market Trends

The recovered carbon black market is on an upward trajectory, driven by the tire industry's shift towards sustainability, increasing applications in non-tire rubber and plastics, technological advancements, and geographical expansion. With growing environmental awareness and regulatory support, the market is poised for continued growth. Strategic partnerships and investments further enhance the market's potential, positioning Recovered Carbon Black as a crucial component in the global push toward a sustainable future.

Segments Covered in the Report

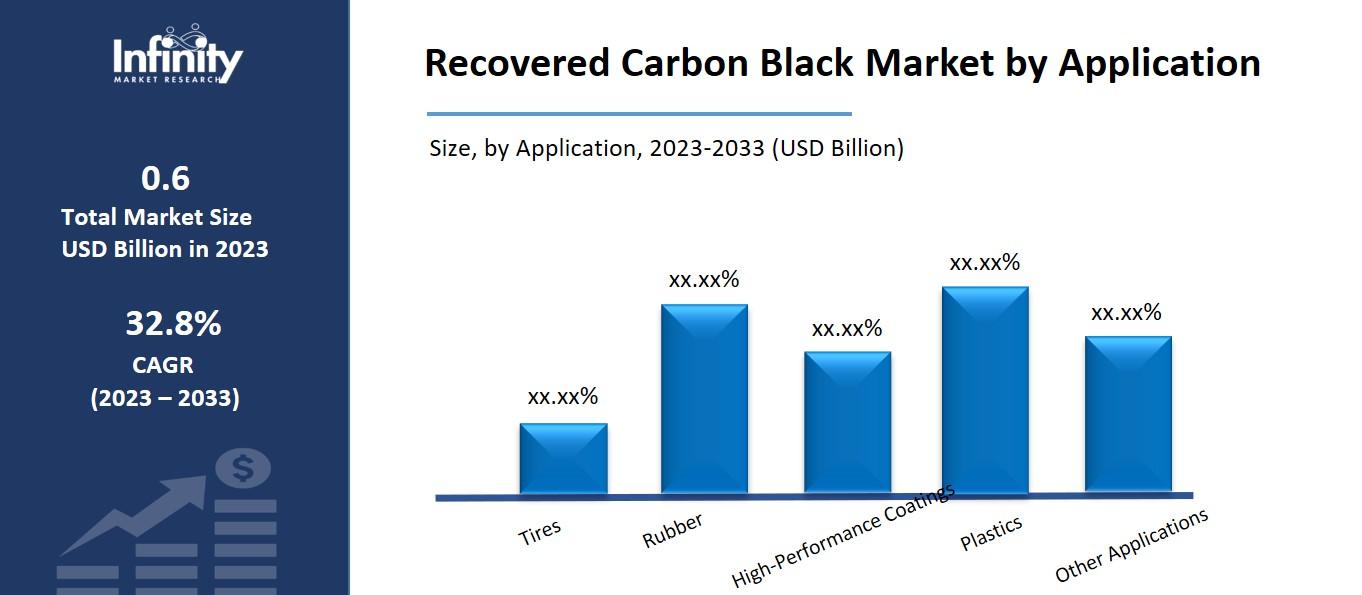

By Application

o Tires

o Rubber

o High-Performance Coatings

o Plastics

o Other Applications

By End-Use

o Automotive

o Aerospace

o Marine

o Electronics

o Packaging

o Other End-Uses

Segment Analysis

By Application

In 2023, tire manufacturing was the most prevalent application for recovered carbon black, accounting for 72.2%. The rise of the overall transportation industry, together with the urbanization of developing countries in Asia Pacific, and Central and South America, is expected to drive recovered carbon black (rCB) market growth over the forecast period.

Tire manufacture surged dramatically in Asia Pacific's emerging countries, particularly China and India, as car production expanded. This output growth is owing to the expanding transportation industry in these economies. Factors such as low-cost land for industrial facilities, an increase in disposable income, and the ease of access to skilled personnel have all contributed to the region's industry growth.

Rubber manufacture was the second most common application for recovered carbon black, and it is expected to increase rapidly at a CAGR of 31.9% between 2023 and 2033. General rubber goods are largely employed in the automotive business, but they also find employment in the construction, mechanical, and pharmaceutical industries due to features such as durability and abrasion resistance. The rise of these end-use sectors, together with the increasing need for sustainable solutions and products, is expected to boost the rubber manufacturing market over the forecast period.

By End-Use

The automotive sector led the recovered carbon black market in 2023 and is expected to increase at a CAGR of 14.1% over the forecast period. Recovered carbon black contains fewer polycyclic aromatic hydrocarbons and contributes to reaching sustainability goals, allowing for widespread utilization in the automotive sector. The remaining material is utilized in huge numbers to produce car tires, hoses, belts, and other components. The automotive sector is seeing enormous growth internationally, which is projected to boost market growth throughout the forecast period. For example, according to Maruti Suzuki's October 2021 statistics, the micro and compact market in India sold 400,568 units from April to September in 2021-22, compared to 307,322 units at the same time in 2020-21. Similarly, diesel truck registrations in Europe grew to 361,135 units in 2019 compared to the previous year, with the United Kingdom seeing the biggest demand (+10.2%). Such an enormous increase in the automotive sector is likely to boost demand for recovered carbon black, resulting in market growth over the forecast period.

Regional Analysis

North America had the highest market share (39.3%) in 2023. The market is being driven by the region's local government agencies' intense inspection of the manufacturing sector. Furthermore, the region's manufacturers are increasingly implementing waste management systems for recycling and reusing waste goods, which is driving industry growth.

Asia Pacific was the third largest market for recovered carbon black in 2023, accounting for 26.7% after Europe and North America. The region's penetration is poor in comparison to industrialized regions due to a lack of technological improvements in the manufacturing of recovered carbon black. The industry growth is expected to be driven by a strong monetary framework that stimulates private investment in the manufacturing sector through favorable government policies.

However, the Asian economy and manufacturing sector are expected to experience instability in the latter half of 2020 as a result of the COVID-19 pandemic, particularly in China and India. The epidemic is expected to slow down the entire industrial industry, including the automobile sector, reducing demand for recovered carbon black.

Competitive Analysis

Major industry players are investing heavily in R&D to expand their product offerings, which will help the Recovered Carbon Black market grow even more. Market participants are also pursuing a variety of strategic measures to expand their global footprint, including new product releases, contractual agreements, mergers and acquisitions, increased investment, and collaboration with other companies. Competitors in the Recovered Carbon Black industry must provide cost-effective products to grow and thrive in an increasingly competitive and expanding market.

Key Market Players in the Recovered Carbon Black Market

o Black Bear Carbon B.V.

o Pyrolyx AG

o Alpha Carbone

o DVA Renewable Energy JSC

o Scandinavian Enviro Systems AB

o Delta-Energy Group LLC

o DVA Renewable Energy JSC

o Integrated Resource Recovery Inc.

o SR2O Holdings LLC

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 0.6 Billion |

|

Market Size 2033 |

USD 9.5 Billion |

|

Compound Annual Growth Rate (CAGR) |

32.8% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

- |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

Application, End-Use, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Black Bear Carbon B.V., Pyrolyx AG, Alpha Carbone, DVA Renewable Energy JSC, Scandinavian Enviro Systems AB, Delta-Energy Group, LLC, DVA Renewable Energy JSC, Ecolomondo Corporation, Hi Green Carbon, Integrated Resource Recovery Inc, SR2O Holdings, LLC, And Others |

|

Key Market Opportunities |

Expansion in the Automotive Industry |

|

Key Market Dynamics |

Growing Demand for Sustainable Products |

📘 Frequently Asked Questions

1. How much is the Recovered Carbon Black Market in 2023?

Answer: The Recovered Carbon Black Market size was valued at USD 0.6 Billion in 2023.

2. What would be the forecast period in the Recovered Carbon Black Market report?

Answer: The forecast period in the Recovered Carbon Black Market report is 2023-2033.

3. Who are the key players in the Recovered Carbon Black Market?

Answer: Black Bear Carbon B.V., Pyrolyx AG, Alpha Carbone, DVA Renewable Energy JSC, Scandinavian Enviro Systems AB, Delta-Energy Group, LLC, DVA Renewable Energy JSC, Ecolomondo Corporation, Hi Green Carbon, Integrated Resource Recovery Inc, SR2O Holdings, LLC, And Others

4. What is the growth rate of the Recovered Carbon Black Market?

Answer: Global Recovered Carbon Black Market size is expected to be worth around USD 9.5 Billion by 2033 from USD 0.6 Billion in 2023, growing at a CAGR of 32.8% during the forecast period from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.