🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Steel Market

Steel Market (By Product (Hot Rolled Steel, Direct Rolled Steel, Cold Rolled Steel, Tubes, Other Profiles), By End-Use (Pre-engineered Metal Buildings, Bridges, Industrial Structures), By Region and Companies)

Jun 2024

Chemicals and Materials

Pages: 190

ID: IMR1050

Steel Market Overview

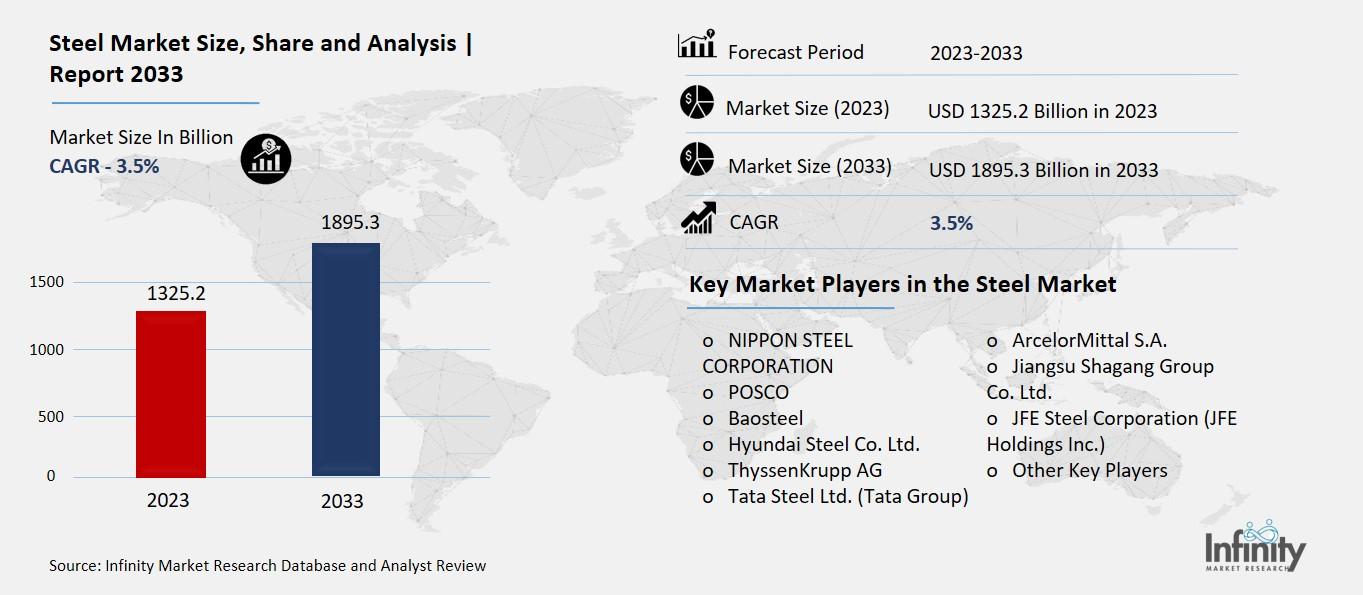

Global Steel Market size is expected to be worth around USD 1,895.3 Billion by 2033 from USD 1,325.2 Billion in 2023, growing at a CAGR of 3.5% during the forecast period from 2033 to 2033.

The steel market refers to the global or regional marketplace where steel, a crucial industrial material, is bought, sold, and traded. Steel is a versatile alloy of iron and carbon that is used extensively in construction, manufacturing, transportation, and various other industries. The steel market encompasses various types of steel products, including flat steel, long steel, and specialty steel products.

Factors influencing the steel market include demand from key industries such as automotive, construction, and infrastructure development. Economic growth, industrialization, urbanization, and government infrastructure investments also play significant roles in shaping the steel market. The market is influenced by global supply and demand dynamics, raw material prices (such as iron ore and scrap metal), energy costs, technological advancements, and environmental regulations impacting production processes. Overall, the steel market is critical to the global economy and serves as a barometer for industrial activity and economic health.

Drivers for the Steel Market

Economic Growth and Industrial Production:

Economic growth is a major driver of the steel market. As economies grow, there is an increased demand for steel in the construction, manufacturing, and transportation industries. For example, as countries urbanize and build new infrastructure, the demand for steel for buildings, roads, bridges, and other structures increases. Developing countries, such as India and China, are experiencing rapid industrialization and urbanization, which drives significant demand for steel. In developed countries, infrastructure renewal and maintenance projects also contribute to steel demand.

Industrial production is closely linked to economic growth and directly affects the steel market. Steel is a fundamental material used in manufacturing processes across various industries, including automotive, machinery, and appliances. As industrial production expands, so does the demand for steel to produce goods and equipment.

Technological Advancements in Manufacturing Processes:

Technological advancements play a crucial role in shaping the steel market. Innovations in steel manufacturing processes, such as electric arc furnaces (EAFs) and continuous casting, have improved efficiency and reduced production costs. These advancements enable steel producers to meet the growing demand for high-quality steel products at competitive prices.

Environmental Regulations and Sustainability Initiatives:

Environmental regulations and sustainability initiatives are becoming increasingly important drivers in the steel market. Governments worldwide are implementing stricter environmental regulations to reduce carbon emissions and improve air quality. This has led to a shift toward cleaner steel production methods, such as using electric arc furnaces powered by renewable energy sources. Sustainability initiatives, including the use of recycled steel and the development of low-carbon steel products, are also driving innovation in the steel industry.

Raw Material Prices and Supply Chain Dynamics:

Raw material prices, particularly for iron ore and scrap metal, significantly influence the cost of steel production and, consequently, steel prices in the market. Supply chain dynamics, including the availability of raw materials and transportation costs, impact the overall supply of steel products. Changes in raw material prices and supply chain disruptions can affect the profitability and competitiveness of steel producers.

Global Trade and Geopolitical Factors:

Global trade policies and geopolitical factors, such as tariffs, trade agreements, and geopolitical tensions, can affect the steel market. Trade policies and agreements impact the flow of steel products between countries, influencing pricing and supply-demand dynamics. Geopolitical tensions, such as trade disputes or sanctions, can disrupt global supply chains and affect steel market stability.

Restraints for the Steel Market

Cyclical Demand Patterns:

One of the primary restraints for the steel market is its cyclical demand patterns. The steel demand is closely tied to economic cycles, particularly in sectors like construction, automotive, and manufacturing. During economic downturns, demand for steel products decreases as construction projects are delayed, automotive production slows down, and industrial activity declines. For example, during the global financial crisis in 2008-2009, the steel industry experienced a significant downturn due to reduced demand across major markets. These cyclical demand patterns can lead to periods of oversupply and pricing pressures in the steel market.

Overcapacity Issues:

Overcapacity is another significant restraint in the steel market. Overcapacity occurs when steel production exceeds market demand, leading to excess inventory and downward pressure on prices. Overcapacity can be caused by factors such as rapid capacity expansions, technological advancements that increase production efficiency, and government subsidies that encourage overproduction. China, for example, has been criticized for its excess steel production capacity, which has contributed to global oversupply and pricing volatility in the steel market.

Environmental Challenges:

Environmental challenges pose a growing restraint on the steel market. Steel production is energy-intensive and contributes to greenhouse gas emissions, particularly from traditional blast furnace operations. Environmental regulations aimed at reducing carbon emissions and improving air quality are becoming stricter, increasing compliance costs for steel producers. This includes regulations on emissions, water use, and waste management. Compliance with these regulations can add to production costs and impact the competitiveness of steel manufacturers, especially in regions with stringent environmental standards.

Fluctuating Raw Material Prices:

Fluctuating raw material prices, particularly for iron ore and scrap metal, pose a challenge for the steel market. The prices of raw materials used in steel production are influenced by global supply-demand dynamics, geopolitical factors, and market speculation. Sharp fluctuations in raw material prices can impact the profitability of steel producers, as these costs typically cannot be passed on to consumers immediately. For example, increases in iron ore prices can squeeze profit margins for steelmakers, especially during periods of weak steel demand.

Trade Protectionism and Trade Disputes:

Trade protectionism and trade disputes can restrain the steel market by disrupting global trade flows and imposing tariffs or quotas on steel imports. Trade policies, such as Section 232 tariffs imposed by the United States on steel imports, can distort market dynamics and create uncertainty for steel producers and consumers. Trade disputes between major steel-producing countries, such as the United States, China, and the European Union, can lead to retaliatory tariffs and trade barriers that restrict market access and increase costs for steel stakeholders.

Trends for the Steel Market

Digitalization and Automation:

Digitalization and automation are transforming the steel industry, driving efficiency improvements and cost reductions. Advanced digital technologies, such as artificial intelligence (AI), machine learning, and Internet of Things (IoT) sensors, are being integrated into steel production processes. These technologies enable real-time monitoring of equipment performance, predictive maintenance, and optimization of production schedules. Automation in steel mills enhances safety, reduces labor costs, and improves overall operational efficiency. Digital twins and simulation technologies are also being used to optimize steel manufacturing processes, reduce energy consumption, and minimize environmental impacts. As digitalization continues to evolve, steel producers are expected to become more agile and responsive to market demands.

Sustainability and Environmental Regulations:

Sustainability is a growing trend in the steel market, driven by increasing environmental awareness and stringent regulations. Steel producers are adopting sustainable practices to reduce carbon emissions and minimize environmental impacts. This includes investing in cleaner production technologies, such as electric arc furnaces (EAFs) powered by renewable energy sources and hydrogen-based steelmaking processes. Recycling scrap metal to produce new steel reduces energy consumption and greenhouse gas emissions compared to primary steel production. The development of low-carbon and green steel products is gaining momentum as customers and governments prioritize sustainable materials. Environmental regulations, such as carbon pricing and emissions trading schemes, are also influencing steel producers to improve their environmental performance and reduce compliance costs.

Shifts in Global Trade Dynamics:

Global trade dynamics are impacting the steel market, driven by geopolitical tensions, trade disputes, and evolving trade policies. Trade protectionism measures, such as tariffs and quotas, are affecting the flow of steel products between countries and regions. For example, Section 232 tariffs imposed by the United States on steel imports have disrupted global trade flows and created uncertainty for steel producers and consumers worldwide. Trade disputes between major steel-producing countries, such as the United States, China, and the European Union, have led to retaliatory tariffs and trade barriers that restrict market access and increase costs for steel stakeholders. The global steel market is also influenced by trade agreements and partnerships, such as regional free trade agreements, which facilitate the movement of steel products and support market growth.

Technological Advancements and Innovation:

Technological advancements and innovation are driving new product developments and market opportunities in the steel industry. Steelmakers are investing in research and development to develop advanced steel grades with improved strength, durability, and corrosion resistance. High-strength and lightweight steels are in demand for applications in the automotive, aerospace, and construction sectors. Additive manufacturing (3D printing metal) is also emerging as a potential growth area for steel, allowing for complex designs and customized products. Innovations in coating technologies are enhancing the performance and lifespan of steel products in challenging environments. The adoption of digital manufacturing technologies is streamlining supply chains and enhancing product traceability, quality control, and customer satisfaction.

Market Consolidation and Mergers & Acquisitions:

Market consolidation and mergers & acquisitions (M&A) activities are reshaping the competitive landscape of the steel industry. Steel producers are seeking economies of scale, geographic diversification, and technological capabilities through strategic partnerships and acquisitions. M&A activities enable companies to enhance their market position, expand their product portfolios, and achieve cost synergies. Consolidation in the steel market also leads to capacity rationalization and operational efficiencies, which can improve profitability and competitiveness in a global market.

Segments Covered in the Report

By Product

o Hot Rolled Steel

o Direct Rolled Steel

o Cold Rolled Steel

o Tubes

o Other Profiles

By End-Use

Pre-engineered Metal Buildings

o Primary Members

o Secondary Members

o Roofs & Walls

o Panels

Bridges

Industrial Structures

Segment Analysis

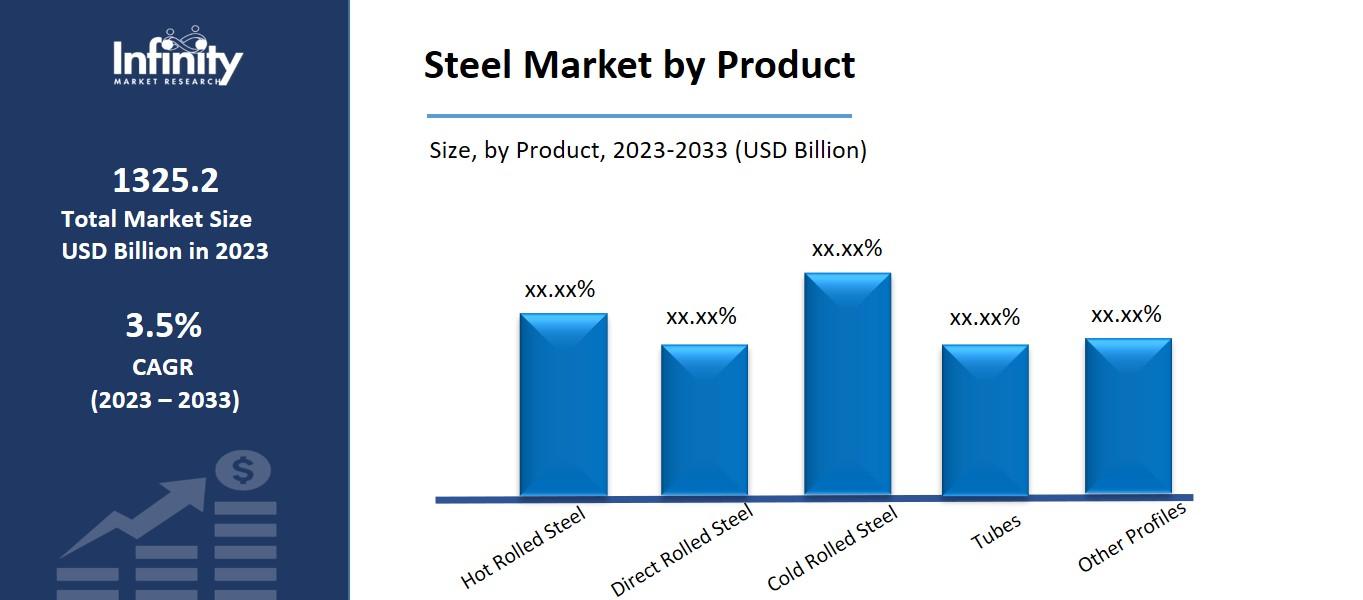

By Product Analysis

The hot-rolled steel segment had the highest revenue share of 75.2% in 2023. The product is becoming increasingly popular due to its low manufacturing costs and remarkable properties such as great weldability, formidability, high residual strain during baking, and good adhesive ability. Cold-rolled steel, on the other hand, is typically produced below recrystallization temperatures and is essentially a hot-rolled product that has undergone additional processing to achieve a superior surface finish and high tolerance. The finished product is used in applications where look and texture are critical, such as rail wheels, axles, and fish plates.

Direct rolling procedures are fast gaining popularity in the industry since they increase ultimate yield by nearly 4-5% while reducing costs. The method also mitigates the hazards associated with poorer output caused by several manual rolls, such as ingot polishing, loading, and mold setting. Steel tubes, sheets, and other profiles are also becoming popular, though at a slower rate than traditional product forms. Sheets are used not just in construction, but also in a variety of other industries, including automotive, transformers, beverage cans, and housing materials, due to their durability, aesthetic appeal, and corrosion resistance.

The steel tubes category is expected to grow at the quickest CAGR of 4.1% over the forecast period. Tubes are commonly utilized for subsurface gas and water transit across cities, as well as overhead electrical wire and cable protection. Rapid urbanization and rising construction investment are anticipated to continue to be important macroeconomic drivers of tube demand growth in the years to come, particularly in emerging markets.

By End-Use Analysis

The pre-engineered metal buildings category had the highest revenue share of 38.7% in 2023. The growing demand for ready-made, hassle-free buildings for industrial purposes is a primary driving force in this segment. Rapid industrialization in emerging economies, combined with rising awareness of the lower costs associated with pre-engineered metal buildings (PMB), is likely to drive steel consumption in this area in the coming years.

PMB is most typically found in industrial buildings and warehouses since it can be readily disassembled or reassembled depending on the length of use. These buildings also reduce construction costs, provide design flexibility, and increase energy efficiency by consuming less electricity for HVAC management.

The PMB component has been further classified as primary and secondary members, roofs and walls, and panels. Primary members accounted for approximately 31.2% of total revenue in 2023. These are the primary structural supports of a building, such as columns, beams, and braces. Cold-rolled sections are increasingly being used in their manufacture because of their lightweight, simplified design procedures, ease of erection, and design flexibility.

The industrial structures segment is predicted to grow at the quickest CAGR of 2.8% throughout the forecast period. Structural steel is widely utilized in industrial buildings owing to its great strength, which benefits not only structural integrity but also reduces the possible impact of repairs. It is especially appropriate for big bridge construction due to its great durability and outstanding strength-to-weight ratio, which ensures high tolerance to vehicle and pedestrian weight.

The steel panels segment is predicted to grow at a CAGR of 2.5% over the forecast period. These panels are used in both residential and non-residential infrastructures due to their lightweight design, ease of installation, and great resistance to unfavorable climatic conditions such as snow, storms, and heavy rains.

Regional Analysis

Asia Pacific dominated the market, accounting for 68.9% of total revenue in 2023, and is predicted to grow at the quickest CAGR of 3.9% throughout the forecast period. The steel sector in the Asia Pacific area is likely to be driven by an increasing desire among end users for prefabricated engineered buildings (PEBs), which offer benefits such as energy efficiency, design flexibility, and faster project completion rates.

The Indian steel market is predicted to expand significantly throughout the forecast period due to increased industrial construction activity and population growth. Furthermore, rising per capita disposable income combined with increased urbanization is likely to drive residential buildings during the projection period.

Steel production is an important contributor to Europe's goal of increasing the construction sector's proportion of GDP to 20% by 2020. The European Commission is mobilizing various EU funds and policy instruments, including Horizon 2020, Structural Funds, and the Research Fund for Coal and Steel, to reduce societal costs and secure the retention of competitive steel-producing skills. The European steel sector has greater energy costs than its overseas competitors, a tendency that has been exacerbated by price increases in recent years.

Competitive Analysis

The global industry is distinguished by the presence of significant players who are increasingly under pressure due to the introduction of advanced technologies and emerging market players. The creation of diverse product portfolios, as well as intensive R&D initiatives to improve product offerings, has increased market rivalry. Furthermore, manufacturers are focusing increasingly on digitization to meet a variety of difficulties.

Key Market Players in the Steel Market

o POSCO

o Baosteel

o Hyundai Steel Co. Ltd.

o ThyssenKrupp AG

o Tata Steel Ltd. (Tata Group)

o ArcelorMittal S.A.

o Jiangsu Shagang Group Co. Ltd.

o JFE Steel Corporation (JFE Holdings Inc.)

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 1,325.2 Billion |

|

Market Size 2033 |

USD 1,895.3 Billion |

|

Compound Annual Growth Rate (CAGR) |

3.5% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

- |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

Product, End-Use, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

NIPPON STEEL CORPORATION, POSCO, Baosteel, Hyundai Steel Co. Ltd., ThyssenKrupp AG, Tata Steel Ltd. (Tata Group), ArcelorMittal S.A., Jiangsu Shagang Group Co. Ltd., JFE Steel Corporation (JFE Holdings Inc.), Other Key Players |

|

Key Market Opportunities |

Expanding Applications in New Industries |

|

Key Market Dynamics |

Economic Growth and Industrial Production |

📘 Frequently Asked Questions

1. Who are the key players in the Steel Market?

Answer: NIPPON STEEL CORPORATION, POSCO, Baosteel, Hyundai Steel Co. Ltd., ThyssenKrupp AG, Tata Steel Ltd. (Tata Group), ArcelorMittal S.A., Jiangsu Shagang Group Co. Ltd., JFE Steel Corporation (JFE Holdings Inc.), Other Key Players

2. How much is the Steel Market in 2023?

Answer: The Steel Market size was valued at USD 1,325.2 Billion in 2023.

3. What would be the forecast period in the Steel Market?

Answer: The forecast period in the Steel Market report is 2023-2033.

4. What is the growth rate of the Steel Market?

Answer: Steel Market is growing at a CAGR of 3.5% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.