🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Sulfuric Acid Market

Sulfuric Acid Market (By Raw Material (Base Metal Smelters, Elemental Sulfur, Pyrite Ores, Other Raw Materials), By Concentration (Below 50%, 50-70%, 70-93%, 93-99%), By Application (Fertilizers, Chemical Manufacturing, Metal Processing, Refining, Textile, Automotive, Other Applications), By Region and Companies)

Jun 2024

Chemicals and Materials

Pages: 133

ID: IMR1058

Sulfuric Acid Market Overview

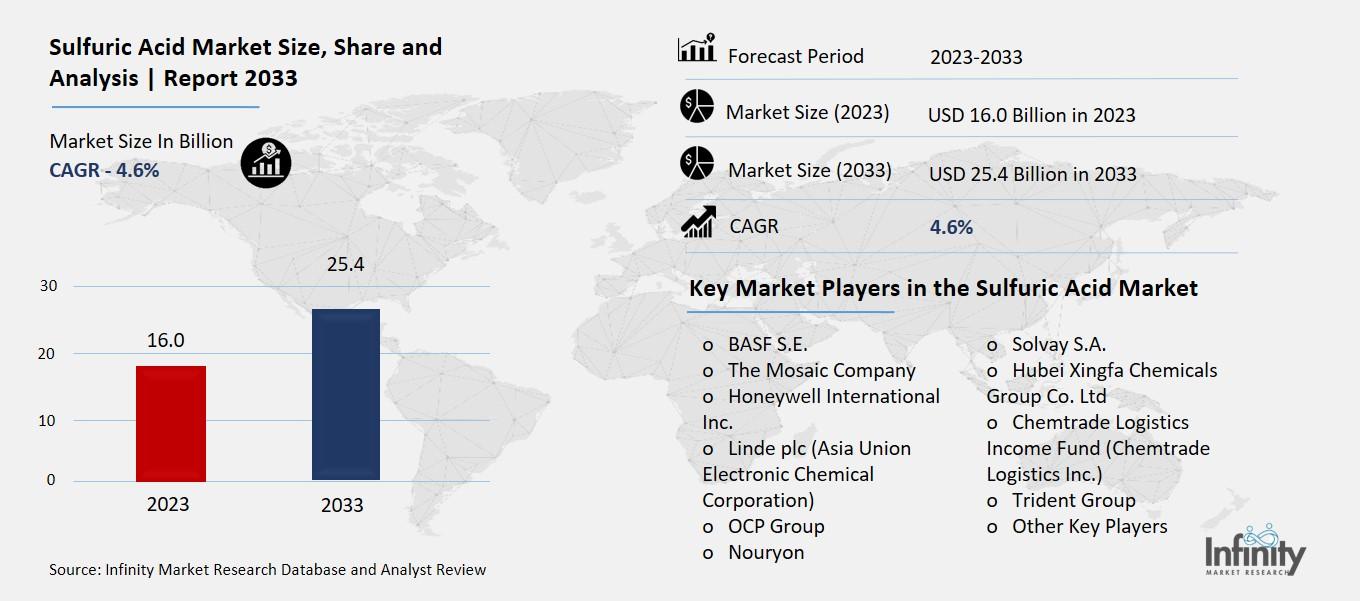

Global Sulfuric Acid Market size is expected to be worth around USD 25.4 Billion by 2033 from USD 16.0 Billion in 2023, growing at a CAGR of 4.6% during the forecast period from 2023 to 2033.

The sulfuric acid market refers to the global marketplace where sulfuric acid is produced, bought, sold, and traded. Sulfuric acid is a strong mineral acid with many industrial applications. It is primarily used in the production of phosphate fertilizers, which are essential for agricultural activities to enhance crop yields. Additionally, sulfuric acid is used in the manufacturing of chemicals, including hydrochloric acid, nitric acid, sulfate salts, synthetic detergents, and dyes. It is also a key ingredient in the production of metals, such as copper and zinc, through the purification process known as leaching. Moreover, sulfuric acid has applications in the petroleum refining industry, where it is used to manufacture catalysts and refine crude oil into gasoline and other petroleum products.

The sulfuric acid market is influenced by several factors, including industrial growth, agricultural activities, and environmental regulations. The market growth is driven by the expanding demand for phosphate fertilizers due to the increasing global population and food security concerns. Furthermore, sulfuric acid's versatility and wide range of applications across various industries contribute to its demand stability. However, the market faces challenges such as fluctuating raw material prices, environmental concerns related to its production, and regulatory constraints. Despite these challenges, technological advancements and innovations in sulfuric acid production processes are expected to create growth opportunities in the market.

Drivers for the Sulfuric Acid Market

Growing Demand for Phosphate Fertilizers:

The sulfuric acid market is significantly driven by the growing demand for phosphate fertilizers, which are crucial for enhancing agricultural productivity and ensuring food security worldwide. Sulfuric acid is a key raw material in the production of phosphoric acid, which is used to manufacture phosphate fertilizers such as diammonium phosphate (DAP) and monoammonium phosphate (MAP). These fertilizers are essential for providing essential nutrients like phosphorus to crops, promoting their growth and increasing yields. As the global population continues to grow, there is a rising need for agricultural intensification, particularly in emerging economies, which is expected to drive the demand for sulfuric acid in the production of phosphate fertilizers.

Critical Role in Industrial Chemical Processes:

Sulfuric acid plays a critical role in various industrial chemical processes, contributing to the manufacturing of a wide range of chemicals and materials. It is widely used in the production of synthetic fibers, detergents, explosives, and other chemicals. Moreover, sulfuric acid is a key component in the production of metal sulfates, which are used in water treatment, as catalysts, and in the pharmaceutical industry. Its strong acidic properties and versatility make it an indispensable part of the chemical industry's manufacturing processes, driving the demand for sulfuric acid globally.

Key Component in Petroleum Refining:

In the petroleum refining industry, sulfuric acid is essential for the production of high-quality fuels. It is used in the alkylation process to produce high-octane gasoline, which improves the performance of automotive engines. Sulfuric acid is also used in the production of aromatic compounds, which are key components in the formulation of gasoline and other petroleum products. As the demand for refined petroleum products continues to grow, particularly in developing economies, the demand for sulfuric acid in petroleum refining processes is expected to increase.

Versatile Applications in the Chemical Industry:

Sulfuric acid has diverse applications in the chemical industry, making it a versatile and indispensable chemical. It is used in the production of various chemicals such as fertilizers, synthetic fibers, detergents, and dyes. Sulfuric acid is also used in the manufacturing of explosives, pharmaceuticals, and pigments. Its strong acidic properties and ability to react with a wide range of materials make it a valuable chemical for various industrial processes. The versatility of sulfuric acid ensures its continuous demand in the chemical industry, supporting its market growth.

Environmental Regulations and Sustainability Initiatives:

Environmental regulations and sustainability initiatives are playing a significant role in boosting the demand for sulfuric acid in environmental protection applications. Sulfuric acid is used in the treatment of wastewater and in flue gas desulfurization processes to reduce air pollution and control emissions of sulfur dioxide (SO2), a major contributor to acid rain. Moreover, sulfuric acid is used in the recycling industry to recover metals from scrap materials, promoting resource efficiency and circular economy practices. As environmental concerns continue to grow globally, the demand for sulfuric acid in environmental protection applications is expected to increase, supporting market growth.

Restraints for the Sulfuric Acid Market

Economic Challenges and Fluctuating Feedstock Costs:

The sulfuric acid market faces several restraints that impact its growth prospects. One of the primary challenges is economic volatility and fluctuating feedstock costs. Sulfuric acid production heavily depends on the availability and cost of sulfur, which is a key raw material derived from sulfur-bearing ores or as a byproduct of natural gas and crude oil refining. The prices of sulfur and natural gas can fluctuate significantly due to various factors such as geopolitical tensions, supply disruptions, and changes in global demand. These fluctuations in feedstock costs directly impact the profitability of sulfuric acid manufacturers, affecting their production volumes and pricing strategies. Moreover, economic downturns and recessions can lead to reduced industrial activities and construction projects, thereby affecting the overall demand for sulfuric acid.

Environmental Concerns and Regulatory Compliance:

Another significant restraint for the sulfuric acid market is the increasing environmental concerns and stringent regulatory compliance requirements. Sulfuric acid production and its industrial applications are associated with environmental challenges, including air and water pollution. The combustion of sulfur-containing fossil fuels and the production of sulfur dioxide (SO2) emissions contribute to acid rain and air quality issues. Regulatory bodies worldwide have implemented stringent emission standards and pollution control measures to mitigate these environmental impacts. Compliance with these regulations requires sulfuric acid producers to invest in expensive pollution control technologies and adopt cleaner production processes, which can increase operational costs and affect profitability. Moreover, the stringent regulatory environment can limit the expansion of sulfuric acid production facilities and hinder market growth.

Impact of Substitute Products and Alternatives:

The sulfuric acid market faces competition from substitute products and alternative technologies that can replace or reduce the need for sulfuric acid in various applications. For instance, in the wastewater treatment industry, alternative chemicals and technologies such as lime, sodium hydroxide, and biological treatment processes are increasingly being used as alternatives to sulfuric acid for pH adjustment and metal precipitation. Similarly, in the mining industry, alternative leaching agents such as hydrochloric acid and nitric acid are sometimes preferred over sulfuric acid. The availability of these substitutes and alternatives can reduce the demand for sulfuric acid, particularly in niche applications where cost-effectiveness and environmental considerations are critical factors.

Safety and Handling Issues:

Safety and handling issues pose significant restraints on the sulfuric acid market. Sulfuric acid is a highly corrosive and hazardous chemical that requires strict safety protocols and specialized equipment for handling, storage, and transportation. Accidental spills or leaks of sulfuric acid can lead to serious environmental contamination and health hazards, requiring emergency response measures and cleanup operations. The high acidity of sulfuric acid also poses risks to workers' health, necessitating the use of personal protective equipment (PPE) and safety training. The safety and handling requirements increase the operational costs for sulfuric acid manufacturers and end-users, making it a challenging chemical to manage and transport safely.

Technological and Infrastructure Challenges:

Technological and infrastructure challenges present additional restraints for the sulfuric acid market. The production of sulfuric acid requires complex manufacturing processes, including sulfur burning, contact process, and wet sulfuric acid processes, which require significant capital investment in plant and equipment. Moreover, the transportation and distribution of sulfuric acid require a well-developed infrastructure of pipelines, tankers, and storage facilities to ensure safe and efficient delivery to end-users. In regions with inadequate infrastructure or logistical challenges, the cost of transporting sulfuric acid can be prohibitive, limiting market access and growth opportunities. Additionally, advancements in technology and process improvements are essential to reduce production costs, improve efficiency, and minimize environmental impacts, which require continuous investment and innovation.

Trends for the Sulfuric Acid Market

Increasing Demand from the Renewable Energy Sector:

A notable trend in the sulfuric acid market is the increasing demand from the renewable energy sector. Sulfuric acid plays a crucial role in the production of lead-acid batteries used for energy storage in renewable energy systems, such as solar and wind power plants. As the world shifts towards renewable energy sources to mitigate climate change and reduce dependence on fossil fuels, the demand for energy storage solutions is growing rapidly. Lead-acid batteries, which require sulfuric acid for their production, are currently the dominant technology for energy storage due to their reliability, cost-effectiveness, and ability to store large amounts of energy. The expansion of renewable energy installations, particularly in emerging markets, is driving the demand for sulfuric acid, creating new growth opportunities for market players.

Shift towards Sustainable Practices:

Another significant trend in the sulfuric acid market is the shift towards sustainable practices. Industries across the globe are increasingly adopting sustainable and environmentally friendly practices to reduce their carbon footprint and comply with stringent regulations. Sulfuric acid, as a critical chemical used in various industrial processes, is being produced and used in ways that minimize environmental impact. Manufacturers are investing in technologies that reduce sulfur dioxide emissions during sulfuric acid production, such as sulfur dioxide capture and conversion to sulfuric acid. Additionally, sulfuric acid is used in environmental applications, such as wastewater treatment and air pollution control, further contributing to sustainable practices. The trend towards sustainability is expected to influence the sulfuric acid market profoundly, with companies focusing on eco-friendly production methods and applications.

Advancements in Recycling Technologies:

Advancements in recycling technologies are emerging as a trend in the sulfuric acid market. Recycling of spent sulfuric acid from various industrial processes, such as metal processing and petroleum refining, is gaining traction as a cost-effective and sustainable practice. Advanced recycling technologies allow for the recovery of sulfuric acid from spent solutions and residues, which can then be regenerated and reused in industrial applications. These technologies not only reduce the environmental impact of sulfuric acid production but also conserve resources and reduce operational costs for manufacturers. The adoption of recycling technologies is expected to grow, driven by regulatory pressures and the desire of industries to achieve greater sustainability in their operations.

Rising Demand from Water Treatment Applications:

The sulfuric acid market is witnessing a rising demand for water treatment applications, which is becoming a significant trend. Sulfuric acid is used in the treatment of water and wastewater to adjust pH levels, remove metals, neutralize alkalinity, and control biological growth. The increasing global population, industrialization, and urbanization are leading to higher demand for clean water, driving investments in water treatment infrastructure. Sulfuric acid's role in water treatment, particularly in municipal and industrial settings, is crucial for ensuring water quality and environmental compliance. As governments worldwide impose stricter regulations on water quality and discharge limits, the demand for sulfuric acid in water treatment applications is expected to continue growing.

Growing Applications in Chemical Manufacturing:

The sulfuric acid market is experiencing growing applications in chemical manufacturing, which is emerging as a prominent trend. Sulfuric acid is a fundamental chemical used in the production of a wide range of chemicals, including fertilizers, detergents, pigments, and pharmaceuticals. The chemical industry's expansion, driven by increasing consumer demand and industrial activities, is boosting the demand for sulfuric acid. In particular, sulfuric acid is used as a catalyst in chemical reactions, such as in the production of synthetic fibers and plastics, where it plays a crucial role in polymerization processes. The growing chemical manufacturing sector, coupled with advancements in process technologies, is expected to drive the demand for sulfuric acid and create new opportunities for market growth.

Adoption of Digitalization and Automation:

The adoption of digitalization and automation in sulfuric acid production processes is becoming a trend in the market. Digital technologies, such as artificial intelligence (AI), the Internet of Things (IoT), and advanced analytics, are being integrated into sulfuric acid plants to optimize production processes, improve efficiency, and reduce operational costs. Automation of plant operations helps in real-time monitoring and control of critical parameters, ensuring consistent product quality and minimizing downtime. These technological advancements enable sulfuric acid manufacturers to enhance their competitiveness, meet customer demands more effectively, and adapt to changing market conditions. The trend toward digitalization and automation is expected to accelerate as companies strive to improve productivity and operational efficiency in sulfuric acid production.

Expansion in Emerging Economies:

The sulfuric acid market is expanding in emerging economies, which is a significant trend. Rapid industrialization, urbanization, and infrastructure development in countries such as China, India, Brazil, and Indonesia are driving the demand for sulfuric acid. These economies are witnessing increased investments in industrial projects, construction activities, and manufacturing sectors, all of which require sulfuric acid for various applications. Moreover, favorable government policies, a growing population, and rising disposable incomes are contributing to the market growth in these regions. The expansion in emerging economies presents opportunities for sulfuric acid producers to expand their market presence and establish strategic partnerships with local industries.

Segments Covered in the Report

By Raw Material

o Base Metal Smelters

o Elemental Sulfur

o Pyrite Ores

o Other Raw Materials

By Concentration

o Below 50%

o 50-70%

o 70-93%

o 93-99%

By Application

o Fertilizers

o Chemical Manufacturing

o Metal Processing

o Refining

o Textile

o Automotive

o Other Applications

Segment Analysis

By Raw Material Analysis

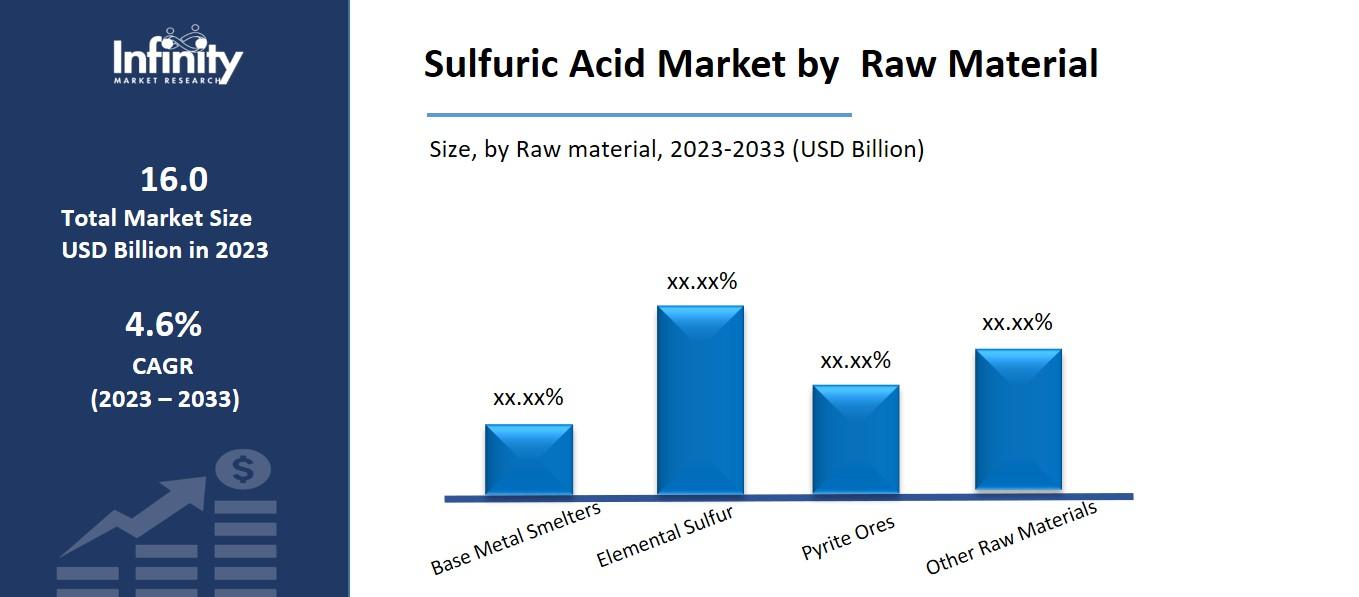

The sulfuric acid market is divided into four raw material categories: base metal smelters, elemental sulfur, pyrite ores, and others. Elemental sulfur accounted for a significant amount of revenue in 2023. Elemental sulfur has a market share of 64.2% among other raw materials. Elemental sulfur is a key ingredient in the synthesis of sulfuric acid. Furthermore, elemental sulfur is readily available as a byproduct of petroleum refining and natural gas processing, where it is extracted from fossil fuels to reduce sulfur dioxide emissions when they are burned. Its widespread availability and low cost make it an appealing raw material for sulfuric acid synthesis.

By Concentration Analysis

According to concentration, this market is divided into four segments: less than 50%, 50-70%, 70-93%, and 93-99%. Among these concentrations, 93-99% sulfuric acid held the majority of the market share (49.1%).Owing to its high purity, 93-99% concentrated sulfuric acid is favored for specialized applications such as petroleum refining, fertilizers (especially phosphates), metal processing, chemical synthesis, and wastewater treatment. Sulfuric acid at this concentration provides the best blend of reactivity and safety.

Higher concentrations (over 98%) are more reactive and perhaps more efficient in certain applications, but they are also more corrosive and dangerous to work with. The 93-99% range combines great efficiency with a moderate safety profile. As a result, the 93-99% concentration range of sulfuric acid is preferred in the global market due to its efficacy, adaptability, and cost-efficiency.

By Application Analysis

The market is further split into applications such as fertilizers, metal processing, petroleum refining, textiles, and others. Fertilizers held the biggest market share among these applications in 2023, accounting for 66.2%. With a growing global population and a greater need for food production, there has been a major increase in demand for fertilizers to boost agricultural productivity.

This increase in demand closely correlates with increased usage of sulfuric acid for fertilizer manufacturing. Sulfur is a critical ingredient for plant growth, helping to synthesize amino acids, proteins, enzymes, and vitamins. The depletion of sulfur in the soil due to intensive farming practices has increased the demand for sulfur-containing fertilizers. In numerous countries, government programs and subsidies aimed at increasing agricultural production and sustainability have resulted in increased fertilizer use, driving up demand for sulfuric acid.

Regional Analysis

In 2023, Asia-Pacific had the greatest market share of sulfuric acid, accounting for 41.8%. APAC has some of the world's fastest-rising economies. Countries such as China, India, and Southeast Asia have experienced considerable industrial growth. This industrial expansion increases the demand for sulfuric acid in a variety of industries, including manufacturing, metal processing, and chemical synthesis.

The region has a substantial agricultural basis, with India and China being among the world's leading agricultural producers. Sulfuric acid is a key component in the manufacturing of phosphate fertilizers. The expanding population in these countries necessitates increased agricultural output, which raises the demand for fertilizers and, as a result, sulfuric acid.

APAC countries, notably China, are abundant in raw materials needed for sulfuric acid manufacturing, such as sulfur and base metals. This abundance encourages local manufacturing, lowering dependency on imported goods and boosting market growth. The APAC region's rapid industrial and agricultural growth, ample raw material supply, supporting government regulations, technical advancements, and strategic geographical location make it a highly profitable market for sulfuric acid.

Competitive Analysis

Mergers and acquisitions are popular tactics for rapid growth in this business. Businesses that acquire or merge with other companies can fast increase their market share, enter new markets, or integrate vertically or horizontally.

For example, purchasing a company with a strong presence in a specific region or a complementary product line might greatly improve a company's market position. Expanding into new geographic markets is an important growth strategy. This could include exporting to new countries or establishing manufacturing operations in areas with high demand or strategic benefits.

Key Market Players in the Sulfuric Acid Market

o The Mosaic Company

o Honeywell International Inc.

o Linde plc (Asia Union Electronic Chemical Corporation)

o OCP Group

o Nouryon

o Solvay S.A.

o Hubei Xingfa Chemicals Group Co. Ltd

o Chemtrade Logistics Income Fund (Chemtrade Logistics Inc.)

o Other Key Players

Report Scope

|

Report Features |

Description |

|

Market Size 2023 |

USD 16.0 Billion |

|

Market Size 2033 |

USD 25.4 Billion |

|

Compound Annual Growth Rate (CAGR) |

4.6% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

- |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

Raw Material, Concentration, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

BASF S.E., The Mosaic Company, Honeywell International Inc., Linde plc (Asia Union Electronic Chemical Corporation), OCP Group, Nouryon, Solvay S.A., Hubei Xingfa Chemicals Group Co. Ltd, Chemtrade Logistics Income Fund (Chemtrade Logistics Inc.), Trident Group, Other Key Players |

|

Key Market Opportunities |

Growing Demand from the Fertilizer Industry |

|

Key Market Dynamics |

Critical Role in Industrial Chemical Processes |

📘 Frequently Asked Questions

1. How much is the Sulfuric Acid Market in 2023?

Answer: The Sulfuric Acid Market size was valued at USD 16.0 Billion in 2023.

2. What would be the forecast period in the Sulfuric Acid Market report?

Answer: The forecast period in the Sulfuric Acid Market report is 2023-2033.

3. Who are the key players in the Sulfuric Acid Market?

Answer: BASF S.E., The Mosaic Company, Honeywell International Inc., Linde plc (Asia Union Electronic Chemical Corporation), OCP Group, Nouryon, Solvay S.A., Hubei Xingfa Chemicals Group Co. Ltd, Chemtrade Logistics Income Fund (Chemtrade Logistics Inc.), Trident Group, Other Key Players

4. What is the growth rate of the Sulfuric Acid Market?

Answer: Water and Sulfuric Acid Market is growing at a CAGR of 4.6% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.