🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Sustainable Aviation Fuel Market

Sustainable Aviation Fuel Market Global Industry Analysis and Forecast (2024-2032) by Fuel Type (Biofuel, Gas-to-Liquid, Power-to-Liquid), Technology (HFS-SIP, HEFA-SPK, ATJ-SPK, and FT-SPK), Aircraft Type (Commercial, Business & General Aviation, Military Aviation, Unmanned Aerial Vehicles, and Regional Transport Aircraft) and Region

Mar 2025

Energy and Power

Pages: 138

ID: IMR1894

Sustainable Aviation Fuel Market Synopsis

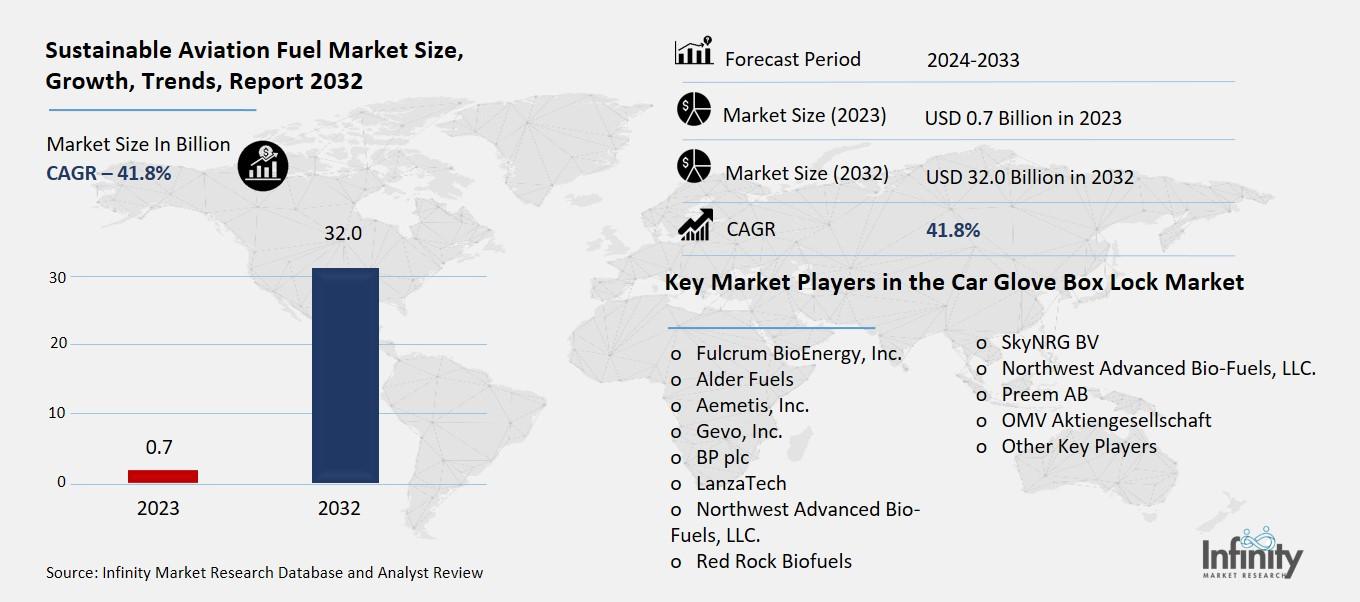

Sustainable Aviation Fuel Market Size Was Valued at USD 0.7 Billion in 2023, and is Projected to Reach USD 32.0 Billion by 2032, Growing at a CAGR of 41.8% From 2024-2032.

The aviation sector is rapidly adopting SAF as a cleaner alternative to traditional jet fuel which is anticipated to bolster the market growth. The SAF, sourced from Used Cooking Oils, biomass, synthetic processes etc, brings down GHG emissions substantially and fits within the overall global sustainability agenda. The stringent environmental laws, airline carbon neutrality pledges, and growing government incentives are driving the market in North America and Europe. Although it is expensive, between 2-5 times that of normal jet fuel, technology improvements in Hydroprocessed Esters and Fatty Acids (HEFA), Fischer-Tropsch (FT) and Power-to-Liquid (PtL) will lead to upscaling and cost reductions.

SAF is made from renewable feedstocks like used cooking oil, agricultural residues, municipal waste, algae and synthetic processes such as Power-to-Liquid (PtL). It can offer up to 80% lower carbon emissions than conventional jet fuel. More and more fuel regulators worldwide have set rules for jet fuel emissions. These requirements will spur the market's expansion. Policies including EU fit for 55 and US' Inflation Reduction Act the Inflation Reduction Act (IRA), the U.S.

Sustainable Aviation Fuel Market Trend Analysis

Increasing Airline Partnerships & SAF Offtake Agreements

Airlines are entering into long-term deals with Sustainable Aviation Fuel (SAF) producers to ensure fuel supply and carbon reductions while helping bring SAF to scale. Airlines can integrate SAF into their operation under long periods of agreement, which provides cost certainty/supply security/compliance with changing carbon mandates which demand emission reductions. For instance, Boeing and Neste have teamed up to speed up the use of SAF, with Boeing giving its assurance to deliver aircraft capable of 100% SAF by 2030. Similarly, Airbus and TotalEnergies are working together to increase SAF production and distribution, making more SAF available for Airbus’ aircraft testing and commercial operations. An additional long-term offtake agreement exists between Delta Air Lines and Gevo for the yearly purchase of 75 million gallons of SAF over a 7-year period. This agreement supports Delta’s 2050 net zero goal. Collectively, these arrangements not only help ramp up SAF output but also spur investment in new refinery infrastructure and technology improvement and cost reductions to help make SAF mainstream aviation fuel.

Rise of Synthetic SAF & Power-to-Liquid (PtL) Technology

E-fuels, which are also known as synthetic fuels or electrofuels (e-SAF), are coming up as sustainable aviation’s long-term solution. A technology called P2L is being used to manufacture E-fuels. It creates green hydrogen (H₂) from renewable energy through electrolysis. Carbon dioxide (CO₂) is obtained either from industry emissions or direct air capture (DAC). The process of combining H₂ and CO₂ involves synthesizing liquid hydrocarbons, which can then be refined into sustainable aviation fuel.

Companies like LanzaTech and Sunfire are making e-fuels for aircrafts. LanzaTech is a carbon recycling tech firm, they use emissions captured from industry to make ethanol based SAF that can be converted into a jet fuel via the alcohol to jet process.

Sustainable Aviation Fuel Market Segment Analysis

The Sustainable Aviation Fuel Market is segmented on the basis of component, Technology, and end user.

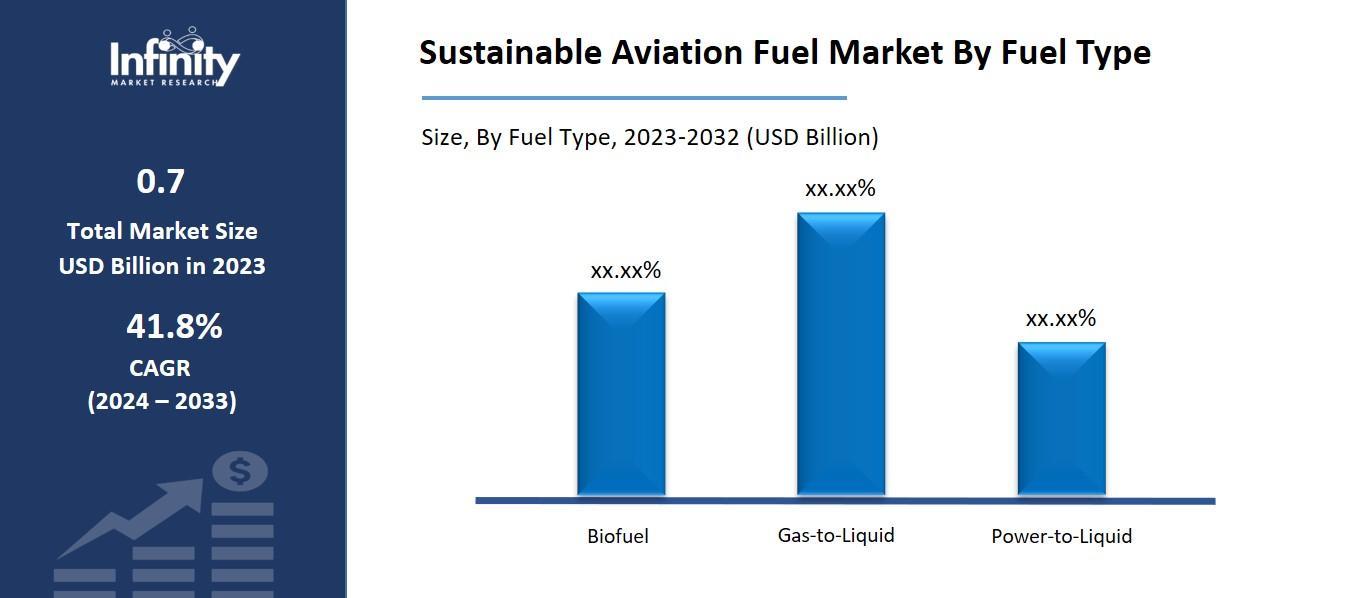

By Fuel Type

o Biofuel

o Gas-to-Liquid

o Power-to-Liquid

By Technology

o HFS-SIP

o HEFA-SPK

o ATJ-SPK

o FT-SPK

By Aircraft Type

o Commercial

o Business & General Aviation

o Military Aviation

o Unmanned Aerial Vehicles

o Regional Transport Aircraft

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Fuel Type, Biofuel segment is expected to dominate the market during the forecast period

Of the applications discussed in this research study, the biofuel segment is expected to account for the largest market share of Sustainable Aviation Fuel Market in the forecast period. The technological readiness regulatory backing, and growing business use have an impact on Bio-SAF. People make Bio-SAF from renewable organic raw materials. These include used cooking oil, animal fats, farm leftovers, and city trash. This makes it a good low-carbon option to replace regular jet fuel. Among the different ways to produce SAF, Hydroprocessed Esters and Fatty Acids (HEFA) remains the top choice. This is because it's cheap to make, easy to scale up, and works well with current aviation fuel systems. The biofuel sector's lead gets stronger thanks to solid policy plans. These include the EU's ReFuelEU program, the U.S. SAF Grand Challenge, and CORSIA (Carbon Offsetting and Reduction Scheme for International Aviation). These rules call for higher SAF mixing goals and offer money perks to make biofuel.

By Technology, the HEFA-SPK segment is expected to held the largest share

The UTM segment is likely to dominate the market on account of the proven technology regulatory approval, and large-scale production capabilities. Manufacturers create HEFA-SPK by processing renewable oils and fats, including used cooking oil, animal fats, and vegetable oils. The result is a clean-burning aviation fuel that blends with standard jet fuel. HEFA-SPK's leading position in the SAF market comes from widespread use by airlines strong government incentives, and well-established supply networks.

By Aircraft Type, the Commercial segment is expected to held the largest share

Sustainable Aviation Fuel (SAF) consumption reaches its peak within the commercial aviation sector due to airplanes' high fuel demands combined with legal mandates for cleaner alternatives and airlines' eco-friendly commitments. The majority of aviation emissions originate from airlines that operate both passenger and cargo services. The deployment of SAF stands as the essential method to cut these emissions and achieve the 2050 zero carbon target.

Delta, Lufthansa, British Airways, and United have entered lengthy contracts with Neste, Gevo, and World Energy for SAF provision. Through these collaborations airlines manage to reduce their environmental emissions. The implementation of government policies actively promotes the utilization of SAF. The EU's ReFuelEU Aviation program, the U. S. The SAF Grand Challenge and ICAO’s CORSIA framework compel airlines to integrate SAF into their fuel supplies through mandatory blending requirements while providing financial incentives.

Sustainable Aviation Fuel Market Regional Insights

North America is Expected to Dominate the Market Over the Forecast period

In the upcoming years, North America is expected to emerge as the dominant region for Sustainable Aviation Fuel (SAF). Strong government support, significant investments in SAF production, and airline efforts to become more ecologically friendly are the main drivers of this growth. This initiative is being spearheaded by the US and Canada. The SAF Grand Challenge is a U.S. plan that aims to reduce aviation emissions to net-zero by 2050 and produce 3 billion gallons of SAF annually by 2030. Furthermore, tax incentives for SAF production are provided by the Inflation Reduction Act (IRA) of 2022, which accelerates market growth in this area.

Leading producers of SAF, including Neste, World Energy, Gevo, and LanzaJet, are based in North America and are increasing their production capabilities to keep up with the growing demand. United Airlines, Delta Air Lines, and American Airlines are among the major U.S. airlines that have committed to long-term SAF purchase agreements and are actively incorporating SAF into their operations. Large-scale adoption is also made easier by the fact that major international airports like Los Angeles International Airport (LAX), San Francisco International Airport (SFO), and Chicago O'Hare have already set up SAF supply infrastructure.

Active Key Players in the Sustainable Aviation Fuel Market

o Fulcrum BioEnergy, Inc.

o Aemetis, Inc.

o Gevo, Inc.

o BP plc

o LanzaTech

o Northwest Advanced Bio-Fuels, LLC.

o Red Rock Biofuels

o SkyNRG BV

o Northwest Advanced Bio-Fuels, LLC.

o Preem AB

o OMV Aktiengesellschaft

o Other Key Players

Global Sustainable Aviation Fuel Market Scope

|

Global Sustainable Aviation Fuel Market | |||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 0.7 Billion |

|

Forecast Period 2024-32 CAGR: |

41.8% |

Market Size in 2032: |

USD 32.0 Billion |

|

Segments Covered: |

By Fuel Type |

· Biofuel · Gas-to-Liquid · Power-to-Liquid | |

|

By Technology |

· HFS-SIP · HEFA-SPK · ATJ-SPK · FT-SPK | ||

|

By Aircraft Type |

· Commercial · Business & General Aviation · Military Aviation · Unmanned Aerial Vehicles · Regional Transport Aircraft | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Airline Sustainability Commitments | ||

|

Key Market Restraints: |

· Feedstock Supply Limitations | ||

|

Key Opportunities: |

· Cost Reduction Through Scaling & Innovation | ||

|

Companies Covered in the report: |

· Fulcrum BioEnergy, Inc., Alder Fuels, Aemetis, Inc., Gevo, Inc., and Other Major Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Sustainable Aviation Fuel Market Research report?

Answer: The forecast period in the Sustainable Aviation Fuel Market Research report is 2024-2032.

2. Who are the key players in the Sustainable Aviation Fuel Market?

Answer: Fulcrum BioEnergy, Inc., Alder Fuels, Aemetis, Inc., Gevo, Inc., and Other Major Players.

3. What are the segments of the Sustainable Aviation Fuel Market?

Answer: The Sustainable Aviation Fuel Market is segmented into Fuel Type, Technology, Aircraft Type, and Regions. By Component, the market is categorized into Biofuel, Gas-to-Liquid, Power-to-Liquid t. By Technology, the market is categorized into HFS-SIP, HEFA-SPK, ATJ-SPK, and FT-SPK. By End User, the market is categorized into Commercial, Business & General Aviation, Military Aviation, Unmanned Aerial Vehicles, and Regional Transport Aircraft. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Sustainable Aviation Fuel Market?

Answer: Sustainable Aviation Fuel (SAF) can be defined as biofuels and synthetic fuels for aviation that have less carbon emissions than conventional jet fuel. Basically put, SAF comes from a renewable resource such as biomass, waste oils, or a synthetic process, and is a cleaner alternative to fossil-based aviation fuels, making it a very important part of the aviation industry for reducing greenhouse gas (GHG) emissions and achieving sustainability objectives.

5. How big is the Sustainable Aviation Fuel Market?

Answer: Sustainable Aviation Fuel Market Size Was Valued at USD 0.7 Billion in 2023, and is Projected to Reach USD 32.0 Billion by 2032, Growing at a CAGR of 41.8% From 2024-2032.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.