🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

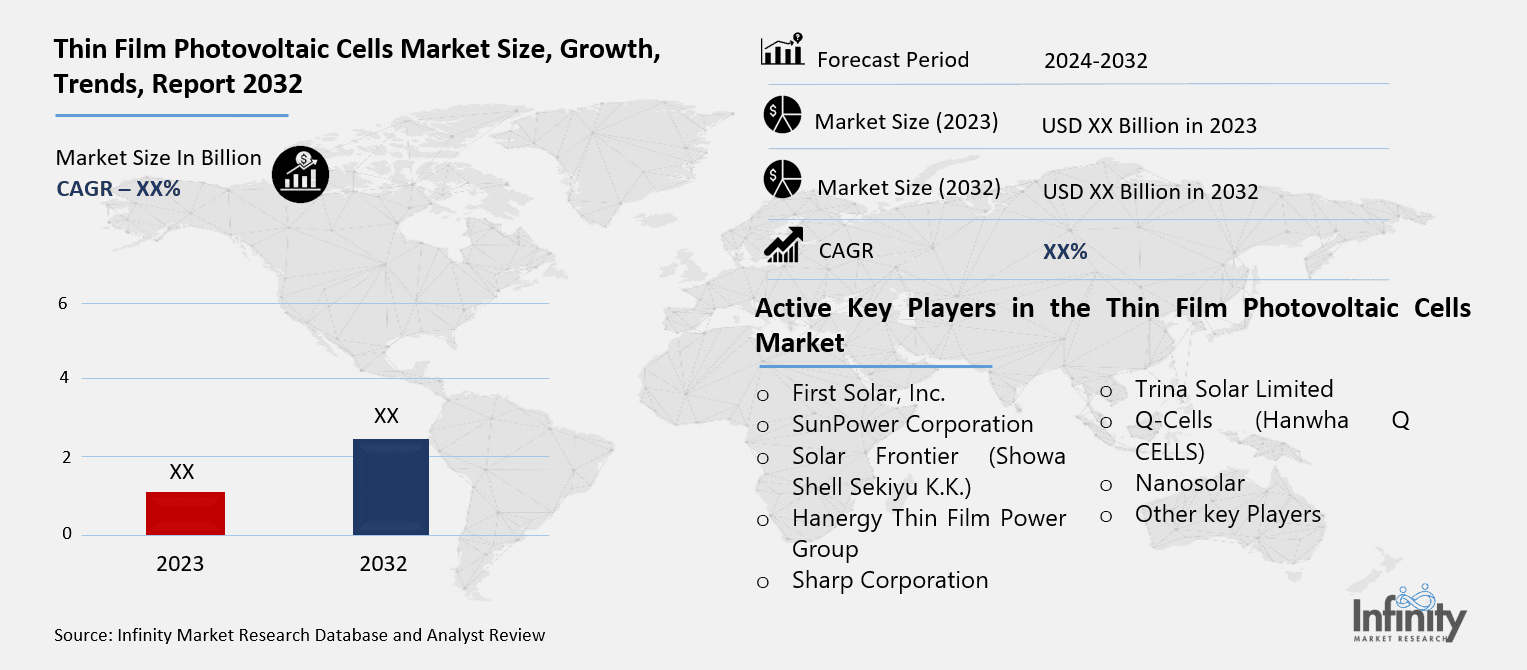

Thin Film Photovoltaic Cells Market

Thin Film Photovoltaic Cells Market Global Industry Analysis and Forecast (2024-2032) By Material Type (Amorphous Silicon (a-Si), Cadmium Telluride (CdTe), Copper Indium Gallium Selenide (CIGS), Other Materials) By Technology (Single-Junction Thin Film, Multi-Junction Thin Film, Flexible Thin Film) By Application (Residential, Commercial, Industrial, Agriculture, Others) By End-Use (Off-Grid Systems, Grid-Tied Systems) and Region

Mar 2025

Energy and Power

Pages: 138

ID: IMR1887

Thin Film Photovoltaic Cells Market Synopsis

Thin Film Photovoltaic Cells Market research report acquired the significant revenue of XX Billion in 2023 and expected to be worth around USD XX Billion by 2032 with the CAGR of XX% during the forecast period of 2024 to 2032.

The market for thin-film photovoltaic cells made by depositing one or more layers of photovoltaic material onto a substrate is the segment of the solar energy sector concentrated on their manufacturing and adoption. Attractive for a range of uses, particularly in space-constrained locations and on surfaces unable of supporting rigid panels, these cells are lighter, flexible, and often less expensive to build than conventional silicon-based solar panels. Materials recognized for their effectiveness in turning sunlight into electricity are cadmium telluride, amorphous silicon, and copper indium gallium selenide used in thin-film technology Growing demand for photovoltaic technology, developments in photovoltaic technologies, and the necessity of more flexible and reasonably priced solar solutions drive this market.

The growing need for renewable energy solutions globally has driven notable expansion in the Thin Film Photovoltaic (PV) Cells Market. Among the benefits over conventional silicon-based solar panels, these cells which use tiny layers of semiconductor material to convert sunlight into electricity offer are cheaper production costs, flexibility, and lightweight construction. Thin-film PV cells are becoming a desirable substitute in the solar energy industry as governments, businesses, and consumers are progressively investing in clean energy technologies in view of increased knowledge of climate change and the drive toward sustainable energy sources.

The thin film PV cells industry is mostly driven by lowering production costs, which have made them more accessible and reasonably priced for a wider clientele. Improved efficiency and performance resulting from technological developments in thin-film materials including cadmium telluride (CdTe), copper indium gallium selenide (CIGS), and amorphous silicon (a-Si) have driven industry expansion even more. From home rooftops to massive commercial solar farms, these highly flexible solar cells are demanded in many different fields.

Where conventional energy infrastructure is scarce, the market is also benefiting from growing acceptance of solar energy among developing nations in Asia Pacific, Latin America, and Africa. The demand for thin film PV cells is being greatly raised by governments in these areas providing incentives and subsidies to support the acceptance of renewable energy solutions. Furthermore helping the thin film PV cell market to develop is the growing inclination toward distributed energy solutions including solar-powered microgrids.

Nevertheless, despite its expansion, the thin-film photovoltaic cells market confronts various difficulties including rivalry from conventional silicon-based solar panels that still dominate the worldwide solar market due of their better efficiency and longer lifespan. Future market development may also be hampered by the volatility in raw material prices and questions about the thin-film solar panel recycling. Still, thin-film PV cells are likely to be very important in the change towards a more sustainable and renewable energy future as the sector keeps innovating and tackling these issues.

Thin Film Photovoltaic Cells Trend Analysis

Trend

Rising Adoption of Thin-Film PV Cells in Urban and Industrial Settings

Particularly in urban and industrial environments, the lightweight and flexible architecture of thin-film photovoltaic (PV) cells is driving increasing acceptance. These qualities make them perfect for uses on uneven surfaces, rooftops, and places where conventional solar panels could be difficult to install. Thin-film PV cells including cadmium telluride (CdTe), copper indium gallium selenide (CIGS), and amorphous silicon (a-Si) are becoming more and more sought for their capacity to provide effective performance even under less than ideal conditions including low light and high temperatures. Their performance benefits and versatility help them to be a main answer in the worldwide drive toward renewable energy.

Major government and commercial entity expenditures in green energy projects support this trend even further. Adoption of thin-film PV cells is being pushed in great part by supportive policies and incentives include subsidies for solar installations and renewable energy objectives. Along with helping to fulfill environmental targets, these initiatives are fostering innovation and thin-film PV sector expansion. The demand for flexible and effective thin-film PV technology is poised to explode as urbanization proceeds and the emphasis on renewable energy sharpens.

Opportunity

Advancements in Thin Film Technology

Increasing the cost-effectiveness and efficiency of perovskite solar cells. High-performance materials as perovskites and cadmium telluride (CdTe) have improved the conversion efficiency of thin film solar cells, hence increasing their competitiveness with conventional silicon-based panels. These developments have also helped to lower manufacturing costs, thereby enabling thinner, lighter, and more affordable solar solutions. Particularly in markets where energy efficiency is a top concern, these materials show great possibility for greater efficiency rates and improved energy yields as they develop.

Furthermore widening the possible uses of thin film photovoltaic technology is research on flexible and light-weight solar panels. From handheld devices and wearables to major urban uses like building-integrated photovoltaics (BIPV), these next-generation solar panels can be incorporated into a range of situations. Key to satisfying the rising worldwide need for sustainable energy solutions is thin film technology's flexibility to many surfaces and its capacity to be deployed in unusual environments. Particularly in locations significantly investing in renewable energy infrastructure, the adaptability of thin film panels offers a perfect answer to satisfy renewable energy targets as urban areas concentrate more on including solar energy into building designs and infrastructure.

Thin Film Photovoltaic Cells Market Segment Analysis:

Thin Film Photovoltaic Cells Market Segmented on the basis of By Material Type, By Technology, By Application, By End-Use.

By Material Type

o Amorphous Silicon (a-Si)

o Cadmium Telluride (CdTe)

o Copper Indium Gallium Selenide (CIGS)

o Other Materials

By Technology

o Single-Junction Thin Film

o Multi-Junction Thin Film

o Flexible Thin Film

By Application

o Residential

o Commercial

o Industrial

o Agriculture

o Others

By End Use

o Off-Grid Systems

o Grid-Tied Systems

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

By Material Type, Amorphous Silicon (a-Si) segment is expected to dominate the market during the forecast period

Amorphous Silicon (a-Si) is a widely utilized material in the thin-film solar panel market, primarily due to its lightweight and flexible nature, as well as its lower manufacturing costs. The process of producing a-Si panels involves depositing a thin layer of silicon onto substrates such as glass or plastic. This enables the creation of flexible and lightweight solar panels, making them suitable for a wide range of applications where traditional rigid panels may not be ideal. The cost-effectiveness of a-Si panels further enhances their appeal, especially in applications that prioritize affordability over high efficiency, such as consumer electronics and portable solar devices. Additionally, these panels are commonly used in building-integrated photovoltaics (BIPV), where aesthetic considerations and space efficiency are important.

While a-Si panels are advantageous in terms of cost, they generally exhibit lower efficiency when compared to other materials like crystalline silicon. This limitation makes them less suitable for applications where high energy output is required within a limited space. However, in scenarios where large areas are available and the primary goal is reducing initial costs, a-Si panels are a viable choice. Their versatility and ease of integration into various products, including consumer electronics like calculators and watches, contribute to their widespread use. As technological advancements continue to improve the performance of amorphous silicon, the material's adoption in a broader range of applications is expected to grow, offering both flexibility and affordability for various solar energy needs.

By End-Use, Off-Grid Systems segment expected to held the largest share

Off-grid solar systems are commonly deployed in remote areas where traditional electricity infrastructure is either unavailable or difficult to access. These systems provide a reliable and sustainable energy source for rural homes, cabins, and temporary installations such as construction sites. Thin-film solar panels are particularly well-suited for off-grid applications due to their lightweight construction and cost-effectiveness, making them easier and more affordable to transport and install in areas that lack grid connectivity. While the efficiency of thin-film solar panels may be lower compared to other types, their affordability compensates for this drawback, especially when the primary goal is to provide energy in off-grid environments where budget constraints are often a concern.

In off-grid systems, battery storage is an essential component, as it allows for the storage of energy generated during the day to be used at night or during cloudy periods. The combination of thin-film panels and battery storage creates a complete off-grid solution that can reliably provide electricity in remote locations. The ability to install and maintain these systems with minimal technical expertise further enhances their appeal. Despite the lower efficiency of thin-film panels, their ability to generate sufficient power for off-grid applications combined with their easy scalability and lower initial investment has made them a preferred choice for users seeking cost-effective, off-grid energy solutions.

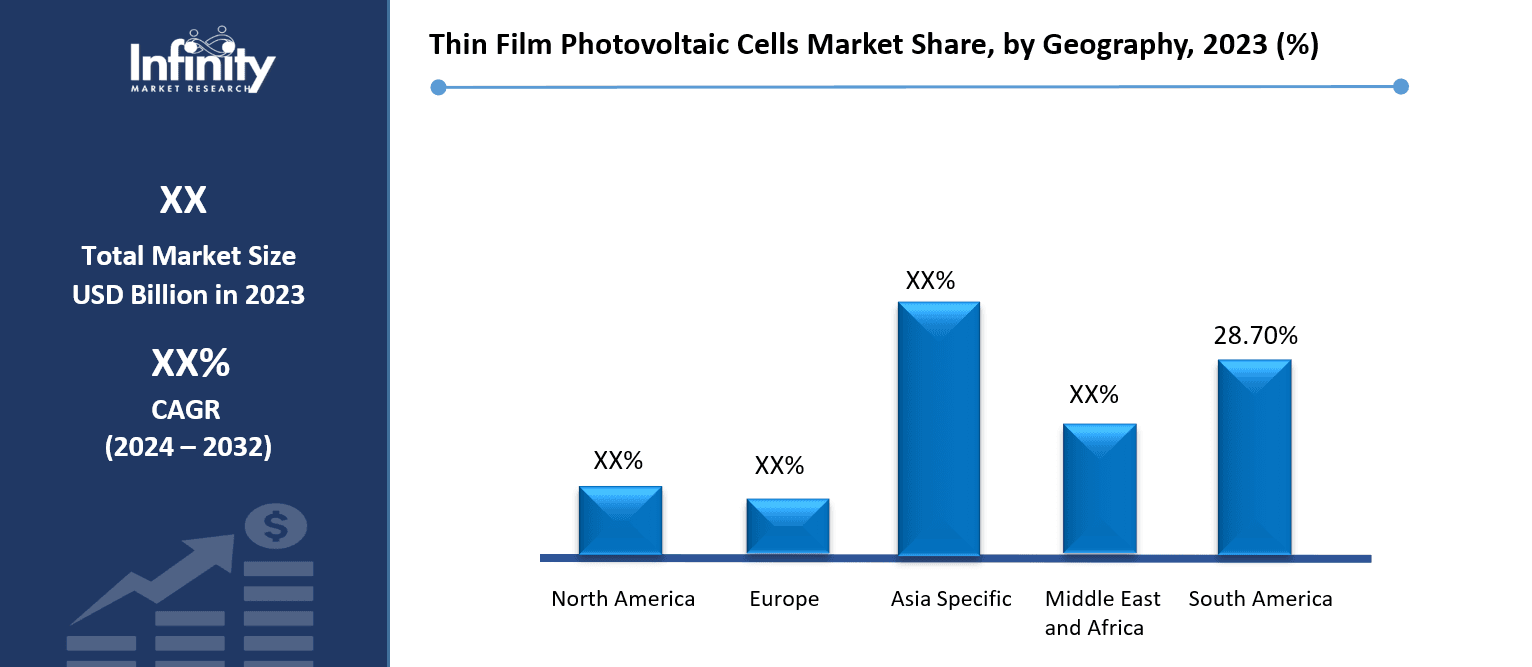

Thin Film Photovoltaic Cells Market Regional Insights

North America is Expected to Dominate the Market Over the Forecast period

Driven mostly by North America's dedication to the acceptance of renewable energy, the Thin Film Photovoltaic (PV) Cell Market is expanding significantly in this continent. With federal and state governments providing a broad spectrum of subsidies and incentives to increase the usage of clean energy, the United States has set numerous bold renewable energy targets. This significant regulatory backing is motivating investments in solar energy technology, including flexible installation choices thin film PV cells are recognized for. As consumers and companies both search for reasonably priced, energy-efficient substitutes, the U.S. residential and commercial sectors are major drivers of the expanding demand for thin film solar systems. To reach renewable energy targets, many utility-scale projects also include thin film technology, therefore energizing the industry.

Thanks to continuous federal and provincial projects aiming at lowering greenhouse gas emissions and advancing sustainable energy, the thin film PV cells market is becoming very popular in Canada. Together with increased awareness of environmental problems and Canada's clean energy policies, which help to create a positive market environment for renewable technologies including thin film solar panels Particularly in areas with great solar potential, the support of the Canadian government by means of incentives and subsidies for solar energy projects has promoted development Since thin film PV cells provide installation flexibility and less total cost than conventional silicon-based technologies, both the residential and commercial sectors are also likely to stimulate demand for these systems. The increasing trend in the use of sustainable energy sources in Canada is predicted to quicken the market for thin film solar solutions in next years.

Thin Film Photovoltaic Cells Market Share, by Geography, 2023 (%)

Active Key Players in the Thin Film Photovoltaic Cells Market

o First Solar, Inc.

o SunPower Corporation

o Solar Frontier (Showa Shell Sekiyu K.K.)

o Hanergy Thin Film Power Group

o Sharp Corporation

o Trina Solar Limited

o Q-Cells (Hanwha Q CELLS)

o Nanosolar

o Other key Players

Global Thin Film Photovoltaic Cells Market Scope

|

Global Thin Film Photovoltaic Cells Market | |||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD XX Billion |

|

Forecast Period 2024-32 CAGR: |

XX% |

Market Size in 2032: |

USD XX Billion |

|

|

By Material Type |

· Amorphous Silicon (a-Si) · Cadmium Telluride (CdTe) · Copper Indium Gallium Selenide (CIGS) · Other Materials | |

|

By Technology |

· Single-Junction Thin Film · Multi-Junction Thin Film · Flexible Thin Film | ||

|

By Application |

· Residential · Commercial · Industrial · Agriculture · Others | ||

|

By End-Use |

· Off-Grid Systems · Grid-Tied Systems | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Rising Focus on Carbon Emission Reduction | ||

|

Key Market Restraints: |

· Lower Efficiency Compared to Conventional Solar Cells | ||

|

Key Opportunities: |

· Advancements in Thin Film Technology | ||

|

Companies Covered in the report: |

· First Solar, Inc., SunPower Corporation, Solar Frontier (Showa Shell Sekiyu K.K.), Hanergy Thin Film Power Group, Sharp Corporation, Trina Solar Limited, Q-Cells (Hanwha Q CELLS), Nanosolar and Other Major Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Thin Film Photovoltaic Cells Market research report?

Answer: The forecast period in the Market research report is 2024-2032.

2. Who are the key players in the Thin Film Photovoltaic Cells Market?

Answer: First Solar, Inc., SunPower Corporation, Solar Frontier (Showa Shell Sekiyu K.K.), Hanergy Thin Film Power Group, Sharp Corporation, Trina Solar Limited, Q-Cells (Hanwha Q CELLS), Nanosolar and Other Major Players.

3. What are the segments of the Thin Film Photovoltaic Cells Market?

Answer: The Thin Film Photovoltaic Cells Market is segmented into By Material Type, By Technology, By Application, By End-Use and region. By Material Type, the market is categorized into Amorphous Silicon (a-Si), Cadmium Telluride (CdTe), Copper Indium Gallium Selenide (CIGS), Other Materials. By Technology, the market is categorized into Single-Junction Thin Film, Multi-Junction Thin Film, Flexible Thin Film. By Application, the market is categorized into Residential, Commercial, Industrial, Agriculture, Others. By End-Use, the market is categorized into Off-Grid Systems, Grid-Tied Systems. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Thin Film Photovoltaic Cells Market?

Answer: The market for thin-film photovoltaic cells—made by depositing one or more layers of photovoltaic material onto a substrate—is the segment of the solar energy sector concentrated on their manufacturing and adoption. Attractive for a range of uses, particularly in space-constrained locations and on surfaces unable of supporting rigid panels, these cells are lighter, flexible, and often less expensive to build than conventional silicon-based solar panels. Materials recognized for their effectiveness in turning sunlight into electricity are cadmium telluride, amorphous silicon, and copper indium gallium selenide used in thin-film technology Growing demand for photovoltaic technology, developments in photovoltaic technologies, and the necessity of more flexible and reasonably priced solar solutions drive this market.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.