🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Airline Retailing Market

Airline Retailing Market Global Industry Analysis and Forecast (2024-2033) by Retail Type (Pre-Boarding and Post-Boarding), Shopping Type (Merchandise, Alcohol, Accessories, and Beauty Product), Carrier Type (Full Service Carrier and Low Cost Carrier) and Region

Jul 2025

Consumer and Retails

Pages: 138

ID: IMR2097

Airline Retailing Market Synopsis

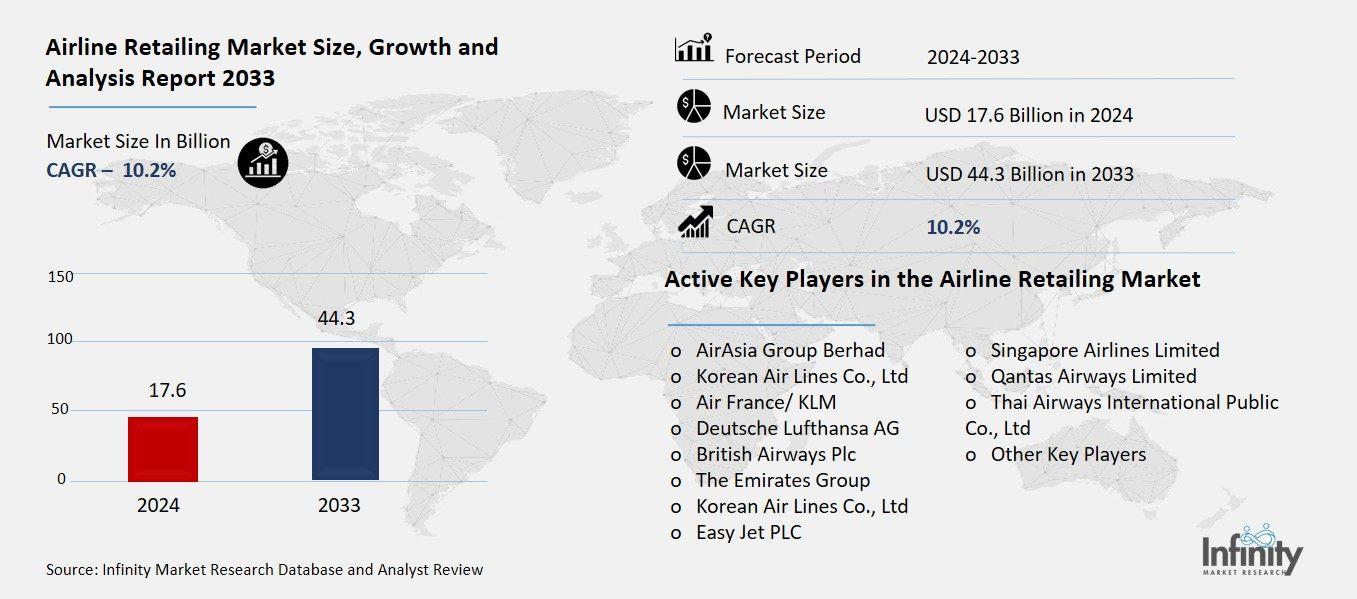

The Global Airline Retailing Market was valued at USD 16.0 billion in 2023 and is expected to grow from USD 17.6 billion in 2024 to USD 44.3 billion by 2033, reflecting a CAGR of 10.2% over the forecast period.

Airline retailing is a market that is undergoing a major shift due to the digitalization of the sphere, a shift in consumer interests, and focusing on ancillary revenue growth. Airline retailing has long existed on ticket selling and simple on board offerings, but has now diversified in a wide range of goods and services, e.g. seat upgrade, baggage, entertainment on board, Wi-Fi, food and drink as well as hotel and rental car franchises. Airlines are also transforming to embrace New Distribution Capability (NDC) standards and contemporary retailing models that will introduce individualization of offers, liquid pricing, and omnichannel smooth shopping both on direct and indirect distribution channel.

Airline Retailing Market Driver Analysis

Adoption of New Distribution Capability (NDC) Standards

New Distribution Capability (NDC) is the data transmission standard created by the International Air Transport Association (IATA) which revolutionizes the distribution of airline products to travel agent, online and consumers. In contrast to the traditional distribution systems, where the product differentiation is mostly deficient and the prices are unchangeable, the NDC system allows the airlines to provide the content of richer and dynamic value that is much more similar to the present-day e-commerce process. With NDC, airlines are able to release finer information regarding ancillary services (bag, meals, seat choices) permission to release more personalized bundles where a customer may adjust the bundle to his or her liking, and utilize dynamic prices on-the-fly.

Airline Retailing Market Restraint Analysis

Resistance from Traditional Distribution Channels

Travel agents and Global Distribution Systems (GDS) are likely to put up a fight against the inevitable direct and NDC-based retailing based on fears of loss of control, revenue and relevance in the airline distribution world value chain. Historically, GDS platforms have been intermediaries between airlines and travel agencies, providing fairly uniform content, and being rewarded by commissions or booking fees. NDC however bypasses the usual GDS infrastructure as airlines make it possible to make richer contents and dynamic offers to customers or preferred partners.

Airline Retailing Market Opportunity Analysis

AI and Data Analytics for Predictive Retailing

Artificial Intelligence (AI) use in airline retailing is changing the way in which airlines use and interact with their customers. Using massive data sets i.e. booking history, browsing history, travel preferences, and loyalty program behavior AI is able to know the needs of the travelers and predict future purchases with a high level of precision. This allows airlines to provide more focus marketing campaigns and personified offers that are more specific and in time including recommending upgrades, seat preferences, or service packages based on previous travel or trip conditions. Real-time pricing and promotion optimization in real-time by AI-powered recommendation engines also can boost the conversion rates and customer satisfaction.

Airline Retailing Market Trend Analysis

Shift Toward Offer and Order Management Systems (OOMS)

The industry as a whole is shifting towards integrated platforms, dubbed Offer and Order Management Systems (OOMS) to simplify the retailing process, including offers creation, management of orders, pay, and post-sale delivery services. Conventionally, they were dealt with via separate systems which were not connected in any way, causing inefficiencies, data silos, and inflexibility. On a single platform, airlines can handle every part of this customer journey on a single platform through which we can get real-time updating, dynamic pricing, bundling that can be tailored to individuals and also servicing that works in hand or with one another. This transition is in line with the new way of retailing since it facilitates homogeneous nature of sales channels as well as responsive nature across both the direct and indirect sales channels.

Airline Retailing Market Segment Analysis

The Airline Retailing Market is segmented on the basis of Retail Type, Shopping Type, and Carrier Type.

By Retail Type

o Pre-Boarding

o Post-Boarding

By Shopping Type

o Merchandise

o Alcohol

o Accessories

o Beauty Products

By Carrier Type

o Full Service Carrier

o Low Cost Carrier

By Region

o North America (U.S., Canada, Mexico)

o Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

o Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

o Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

o Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

o South America (Brazil, Argentina, Rest of SA)

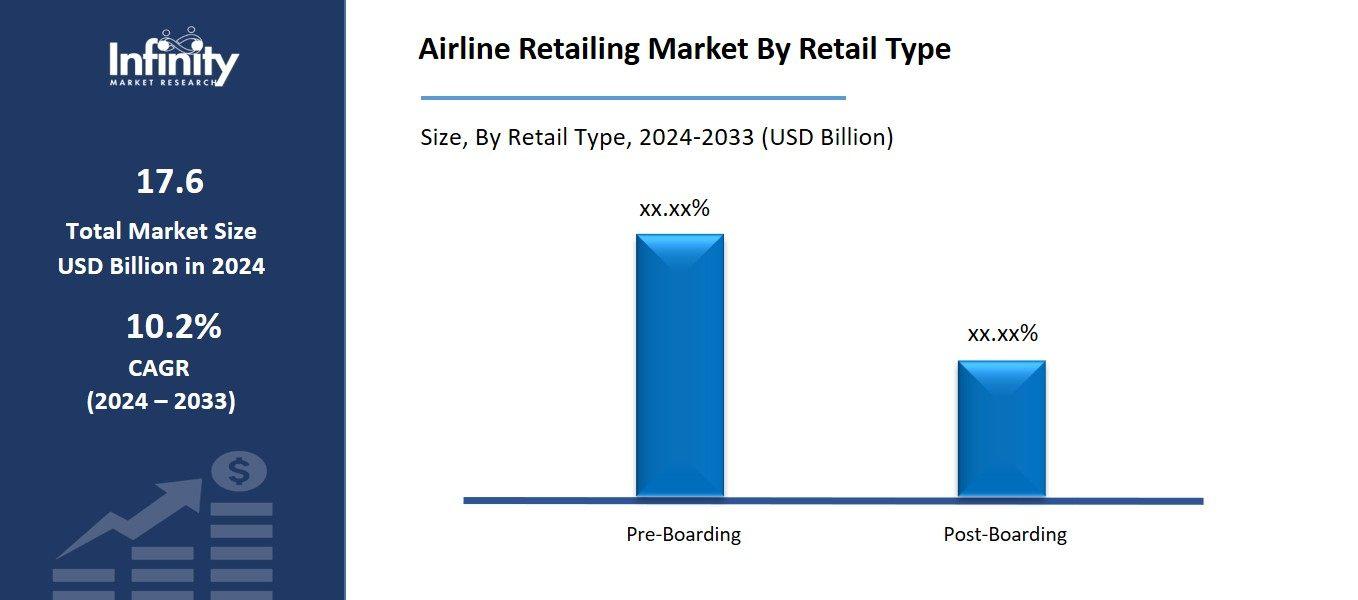

By Retail Type, Pre-Boarding Segment is Expected to Dominate the Market During the Forecast Period

The retail types discussed in this research study, the pre-boarding segment is expected to account for the largest market share of airline retailing market in the forecast period. It comprises services and goods served during the reservation, check-in, and when waiting at the airport- seat upgrade, prior boarding, lounges, luggage, and ordered meals. Digital mechanisms and cutthroat mobile apps are also being used by airlines to encourage and market these extras even ahead of time so passengers can personalize their excursion, and address the complexity of transactions that happen in the air. Being convenient, personal, and allows to plan ahead, pre-boarding retailing services are incredibly appealing to customers, and their popularity leads to their extensive usage, making them one of the most important segments with regard to airline retailing revenue gains.

By Shopping Type, the Merchandise Segment is Expected to Held the Largest Share

The merchandise segment is likely to dominate the market. Airline retail is being diversified to offer a variety of goods and products sold on air or over the digital advertising channel through internet and mobile applications as cosmetics, electronics, travel accessories and souvenirs. The element is boosted by the increased popularity of on-trip shopping and the gamble of in-transit buying. It is also expanding sales through strategic associations with the leading brands globally and use of personalized marketing that uses the passenger data.

By Carrier Type, the Full Service Carrier Segment is Expected to Held the Largest Share

By carrier type, the full service carrier segment is expected to hold the largest share in the airline retailing market, owing to their broad service offerings, established global networks, and strong focus on enhancing the passenger experience. Full service carriers (FSCs) usually have mixed cabin classes and offer a broad range of ancillary services such as lounge access, additional baggage, luxurious meals and in-flight entertainment and it opens a variety of retailing opportunities. Such airlines also happen to be the first to use and implement complex retailing technologies to operate, like New Distribution Capability (NDC) and its management systems, to be able to offer dynamic pricing and individualized offers.

Airline Retailing Market Regional Insights

Asia Pacific is Expected to Dominate the Market Over the Forecast period

Asia Pacific is expected to dominate the market over the forecast period due to the region's rapidly expanding air travel industry, rising middle-class population, and increasing disposable incomes. Domestic and international air passenger traffic is increasing rapidly in countries like China, India, Japan and South east Asian countries and there is high demand in order to improve airline services and personalised retailing. The increased use of digital technologies, mobile trade, as well as the development of contactless payment systems in the region, also contributes to the development of airline shopping. Moreover, ancillary selling area as dynamic pricing, low-cost carriers as well as full-service carriers are catching up with innovative retailing strategies through an analysis of regionally-based carriers. Competitive scenario along with changes in consumer attitude, government investments in airport infrastructure makes Asia Pacific a major engine of global airline retailing industry.

Recent Development

In September 2024, Virgin Australia, one of the leading airlines in Australia, partnered with Sabre Corporation, a prominent software and technology provider, to enhance its retailing capabilities. The collaboration involves a phased implementation of Sabre’s AI-powered platform, SabreMosaic™, designed to modernize and streamline Virgin Australia’s retail operations.

In November 2023, Qatar Airways introduced a range of new onboard food items made with ingredients sourced from local organic farms. Passengers departing from Doha were able to enjoy these fresh and flavorful additions to the airline’s menu through March 2024.

Active Key Players in the Airline Retailing Market

o AirAsia Group Berhad

o Korean Air Lines Co., Ltd

o Deutsche Lufthansa AG

o British Airways Plc

o Korean Air Lines Co., Ltd

o Easy Jet PLC

o Singapore Airlines Limited

o Qantas Airways Limited

o Thai Airways International Public Co., Ltd

o Other Key Players

Global Airline Retailing Market Scope

|

Global Airline Retailing Market | |||

|

Base Year: |

2024 |

Forecast Period: |

2024-2033 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 16.0 Billion |

|

Market Size in 2024: |

USD 17.6 Billion | ||

|

Forecast Period 2024-33 CAGR: |

10.2% |

Market Size in 2033: |

USD 44.3 Billion |

|

Segments Covered: |

By Retail Type |

· Pre-Boarding · Post-Boarding | |

|

By Shopping Type |

· Merchandise · Alcohol · Accessories · Beauty Products | ||

|

By Carrier Type |

· Full Service Carrier · Low Cost Carrier | ||

|

By Region |

· North America (U.S., Canada, Mexico) · Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe) · Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe) · Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC) · Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa) · South America (Brazil, Argentina, Rest of SA) | ||

|

Key Market Drivers: |

· Adoption of New Distribution Capability (NDC) Standards | ||

|

Key Market Restraints: |

· Resistance from Traditional Distribution Channels | ||

|

Key Opportunities: |

· AI and Data Analytics for Predictive Retailing | ||

|

Companies Covered in the report: |

· AirAsia Group Berhad, Korean Air Lines Co., Ltd, Air France/ KLM, Deutsche Lufthansa AG and Other Key Players. | ||

📘 Frequently Asked Questions

1. What would be the forecast period in the Airline Retailing Market Research report?

Answer: The forecast period in the Airline Retailing Market Research report is 2024-2033.

2. Who are the key players in the Airline Retailing Market?

Answer: AirAsia Group Berhad, Korean Air Lines Co., Ltd, Air France/ KLM, Deutsche Lufthansa AG and Other Key Players.

3. What are the segments of the Airline Retailing Market?

Answer: The Airline Retailing Market is segmented into Retail Type, Shopping Type, Carrier Type, and Regions. By Retail Type, the market is categorized into Pre-Boarding and Post-Boarding. By Shopping Type, the market is categorized into Merchandise, Alcohol, Accessories, and Beauty Product. By Carrier Type, the market is categorized into Full Service Carrier and Low Cost Carrier. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

4. What is the Airline Retailing Market?

Answer: Airline retailing market is defined as the network of technologies, platforms, approaches, and services that allow airlines to not only to sell one type of product, i.e., flight tickets, to customers but also a variety of other products and services. This covers ancillary services which consists of additional baggage, preferential seat selection, in-flight food and beverages, Internet access and even non-travel services such as insurance extensions, hotel and car hire.

5. How big is the Airline Retailing Market?

Answer: The Global Airline Retailing Market was valued at USD 16.0 billion in 2023 and is expected to grow from USD 17.6 billion in 2024 to USD 44.3 billion by 2033, reflecting a CAGR of 10.2% over the forecast period.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.