🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Ayurveda Market

Ayurveda Market (By Form (Herbal, Mineral, Herbomineral), By Indications (GI Tract, Infectious Diseases, Skin/Hair, Respiratory System, Nervous System, Cardiovascular System, Other Indications), By Application (Medical/Therapy and Personal), By End-Use (Hospitals, Clinics, Academia & Research), By Distribution Channel (Direct Sales, E-sales, Distance Correspondence), By Region and Companies)

May 2024

Healthcare

Pages: 110

ID: IMR1045

Ayurveda Market Overview

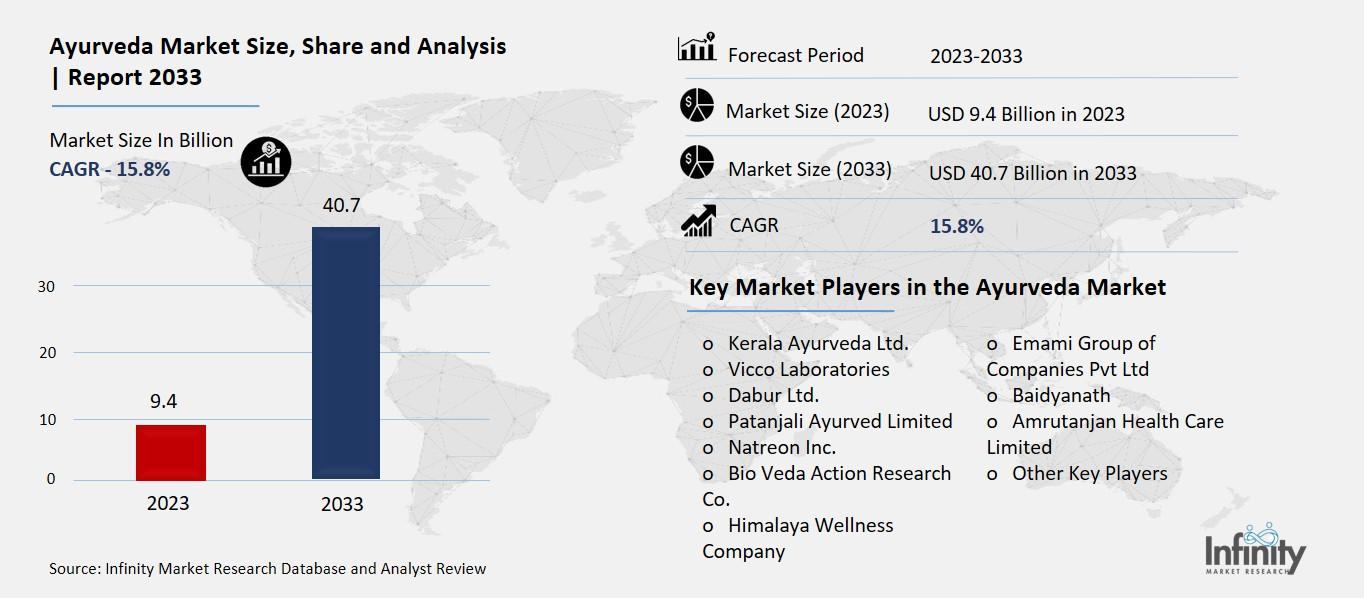

Global Ayurveda Market size is expected to be worth around USD 40.7 Billion by 2033 from USD 9.4 Billion in 2023, growing at a CAGR of 15.8% during the forecast period from 2033 to 2033.

The term "Ayurveda Market" generally refers to the global marketplace for products and services based on Ayurveda, a traditional system of medicine that originated in India over 3,000 years ago. The Ayurveda Market includes a wide range of products such as herbal supplements, skincare products, dietary supplements, Ayurvedic medicines, and wellness services including yoga, meditation, and Ayurvedic treatments.

Key components of the Ayurveda Market include:

1. Herbal Products: These include various herbs, powders, and extracts used for their medicinal properties.

2. Personal Care Products: Items such as shampoos, soaps, and lotions that are made using Ayurvedic principles and ingredients.

3. Dietary Supplements: Capsules, tablets, and powders designed to support health and wellness.

4. Medicines: Traditional Ayurvedic formulations used for treating various ailments.

5. Wellness Services: Ayurvedic treatments, massages, panchakarma (detoxification), yoga, and meditation sessions are offered at wellness centers and retreats.

The growth of the Ayurveda Market is driven by increasing consumer interest in natural and holistic health solutions, rising awareness of traditional medicine, and the expanding wellness industry globally. The market is particularly strong in countries with a rich tradition of Ayurveda, like India, but it is also gaining popularity in regions such as North America, Europe, and Asia-Pacific due to the rising trend towards alternative and complementary medicine.

Drivers for the Ayurveda Market

Growing Health Consciousness

One of the primary drivers for the Ayurveda market is the increasing health consciousness among consumers worldwide. People are becoming more aware of the benefits of natural and holistic healthcare solutions as they seek to improve their overall well-being. Ayurveda, with its ancient roots and emphasis on natural remedies, is being embraced for its preventive and curative capabilities. The demand for Ayurvedic products is growing as consumers prefer herbal and organic products over synthetic ones, which are perceived to have fewer side effects and provide long-term health benefits.

Rising Incidences of Chronic Diseases

The rise in chronic diseases is another significant driver for the Ayurveda market. With the increase in lifestyle-related health issues such as diabetes, hypertension, and obesity, there is a growing interest in Ayurvedic treatments that focus on holistic health and long-term wellness. Ayurvedic medicine offers natural and sustainable solutions for managing these chronic conditions, which attracts patients looking for alternative therapies to complement or replace conventional treatments. This trend is further supported by the increasing research and evidence supporting the efficacy of Ayurvedic practices in managing chronic illnesses.

Government Support and Initiatives

Government support and initiatives play a crucial role in the expansion of the Ayurveda market. Many countries are recognizing the potential of traditional medicine systems and are incorporating Ayurveda into their healthcare frameworks. For example, the Indian government has launched various initiatives to promote Ayurveda globally, including the establishment of the Ministry of AYUSH and the signing of international agreements for cooperation in traditional medicine. These efforts help increase awareness, enhance research, and improve the availability of Ayurvedic products and services, thereby boosting market growth.

Increasing Investment in Research and Development

The investment in research and development is another key driver propelling the Ayurveda market. Leading market players and institutions are investing heavily in the development of new and effective Ayurvedic products. This includes modernizing production processes, conducting clinical trials, and integrating modern technology with traditional practices. Such investments not only enhance the quality and efficacy of Ayurvedic products but also expand their applications in various health conditions, thereby attracting a broader consumer base.

Expanding Global Reach

The global reach of Ayurveda is expanding due to the growing interest in natural and alternative medicine across different regions. Markets such as North America and Europe are witnessing increased acceptance of Ayurvedic products, driven by rising healthcare costs and growing concerns over the side effects of conventional medicines. Additionally, the Asia-Pacific region, with its rich history of herbal medicine, continues to be a significant market for Ayurveda, supported by strong governmental initiatives and established manufacturing facilities. This global expansion is facilitated by strategic partnerships, collaborations, and the entry of new players into the market, making Ayurvedic products more accessible to consumers worldwide

Restraints for the Ayurveda Market

Challenges Hindering the Growth of the Ayurveda Market

One of the primary restraints for the Ayurveda market is the lack of standardization and quality control in the production of Ayurvedic products. Unlike pharmaceutical drugs, which are subject to rigorous regulatory standards and quality checks, many Ayurvedic products are manufactured with varying levels of consistency and purity. This inconsistency can lead to variations in efficacy and safety, eroding consumer trust. The absence of standardized procedures and certification can also hinder the global acceptance of Ayurvedic products, limiting their market potential.

Limited Scientific Validation and Research

Another significant challenge is the limited scientific validation and research supporting Ayurvedic treatments. While Ayurveda has been practiced for thousands of years and has a rich historical background, modern scientific evidence supporting its efficacy is relatively sparse. This lack of robust clinical trials and peer-reviewed studies makes it difficult to gain acceptance in the mainstream medical community and among skeptical consumers. Without substantial scientific backing, the credibility of Ayurvedic treatments remains questionable, which can hamper market growth.

Regulatory Hurdles and Fragmented Market

Regulatory hurdles also pose a considerable restraint on the Ayurveda market. Different countries have varying regulations regarding the approval, marketing, and sale of Ayurvedic products. These regulations can be stringent and challenging to navigate, especially for small and medium-sized enterprises. Additionally, the market is highly fragmented, with numerous small players operating without uniform regulatory oversight. This fragmentation leads to a lack of coordination and consistency in product quality, further complicating regulatory compliance and market expansion.

Competition from Modern Medicine

The Ayurveda market faces stiff competition from modern pharmaceutical and healthcare products. Modern medicine, backed by extensive research, standardized protocols, and widespread availability, often overshadows traditional medicine systems like Ayurveda. Consumers may prefer conventional treatments due to their immediate effects and the perceived reliability of scientifically validated drugs. This competition can limit the adoption of Ayurvedic treatments, particularly in regions with advanced healthcare systems and access to modern medicine.

Misconceptions and Lack of Awareness

Misconceptions and a lack of awareness about Ayurveda among the general population also restrain market growth. Many people perceive Ayurveda as pseudoscience or confuse it with other forms of alternative medicine, which can lead to skepticism and reluctance to try Ayurvedic products. Furthermore, there is often a lack of clear information about the benefits and proper usage of Ayurvedic treatments. Without adequate education and awareness campaigns, it remains challenging to dispel myths and promote the adoption of Ayurveda as a credible healthcare option.

Trends for the Ayurveda Market

Increasing Popularity of Ayurvedic Dietary Supplements

Another significant trend in the Ayurveda market is the rising popularity of Ayurvedic dietary supplements. With growing awareness about the benefits of natural health supplements, more consumers are turning to Ayurvedic products for their preventive and therapeutic properties. These supplements, made from natural herbs and ingredients, are perceived as safe and effective for maintaining overall health and well-being. The trend is particularly strong in regions with high health consciousness, such as North America and Europe, where consumers are increasingly looking for alternatives to conventional pharmaceuticals. The availability of these products through online platforms has further fueled their popularity, making them accessible to a global audience.

Digital Transformation and E-commerce Expansion

The digital transformation and expansion of e-commerce are also shaping the Ayurveda market. The advent of digital platforms has made it easier for consumers to access information about Ayurveda and purchase products online. E-commerce has opened new avenues for Ayurvedic brands to reach a broader audience, overcoming geographical barriers. Digital Advertising strategies, including social media campaigns and influencer partnerships, are being utilized to educate consumers and build brand loyalty. The convenience of online shopping, coupled with targeted digital marketing, has significantly boosted the sales of Ayurvedic products. This trend is expected to continue as more consumers embrace online shopping for their health and wellness needs.

Innovation in Product Offerings

Innovation in product offerings is another trend driving the Ayurveda market. Companies are continually developing new and innovative Ayurvedic products to cater to the evolving preferences of consumers. This includes the introduction of Ayurvedic skincare and beauty products, which are gaining popularity due to their natural and organic ingredients. The development of functional foods and beverages infused with Ayurvedic herbs is also on the rise, offering consumers convenient and enjoyable ways to incorporate Ayurveda into their daily lives. These innovative products are appealing to a wider demographic, including younger consumers who are interested in natural and sustainable health solutions.

Increased Government Support and Regulation

Increased government support and regulation are playing a crucial role in the growth of the Ayurveda market. Governments in countries like India are actively promoting Ayurveda through various initiatives, including funding for research and development, establishing regulatory frameworks, and promoting Ayurvedic education. This support is helping to legitimize Ayurveda and build consumer trust in its efficacy and safety. Internationally, there is growing interested in integrating Ayurveda into mainstream healthcare systems, supported by collaborative efforts between countries. Such regulatory support is essential for the market's growth, ensuring that Ayurvedic products meet quality and safety standards.

Segments Covered in the Report

By Form

o Herbal

o Mineral

o Herbomineral

By Indications

o GI Tract

o Infectious Diseases

o Skin/Hair

o Respiratory System

o Nervous System

o Cardiovascular System

o Other Indications

By Application

o Medical/Therapy

o Personal

By End-Use

o Hospitals

o Clinics

o Academia & Research

By Distribution Channel

o Direct Sales

o E-sales

o Distance Correspondence

Segment Analysis

By Form Analysis

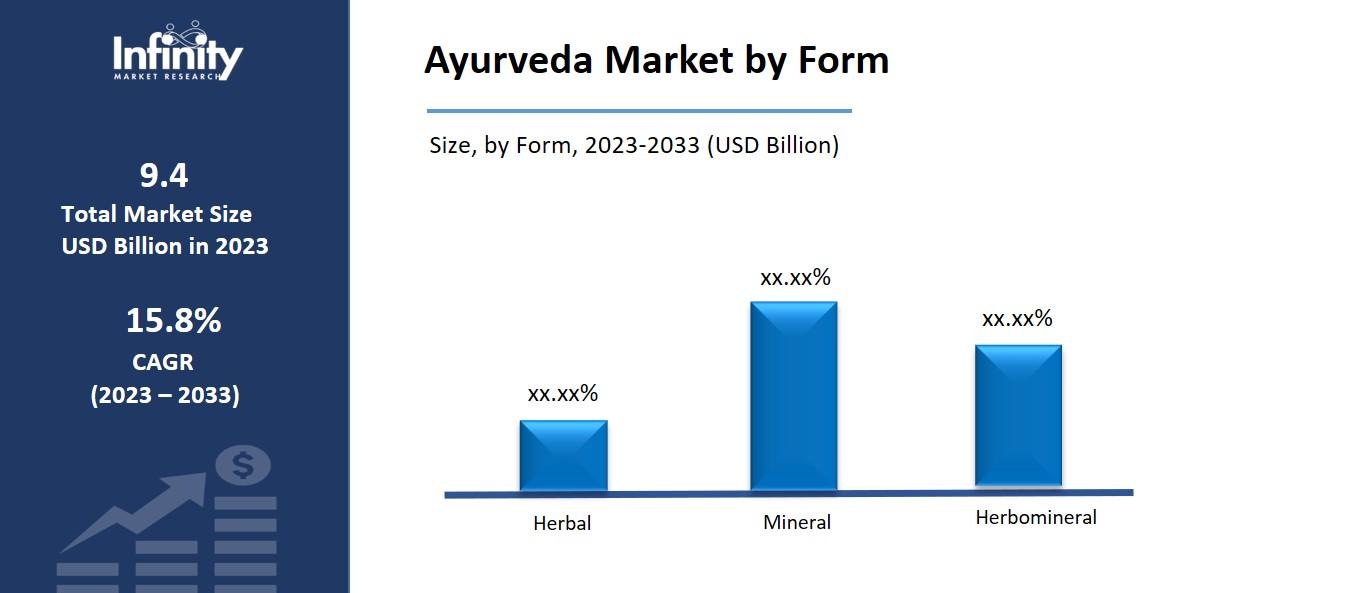

In 2023, the herbal category held a dominant market share of almost 39.7% of revenue. This development is ascribed to expanding consumer interest in natural and organic products, greater consumer knowledge of the advantages of herbal supplements, and the tendency toward preventative healthcare. Herbal supplements, which include botanicals, herbs, or plant-based components, help treat a variety of health conditions, such as stress, sleep disturbances, and digestive issues. This increases consumer demand for Ayurvedic goods. Over 80% of individuals worldwide, spanning 170 nations, practice traditional medicine, which includes Ayurveda, herbal therapy, acupressure, acupuncture, yoga, and indigenous therapies, according to the World Health Organization (WHO).

The herbomineral segment is anticipated to grow at the fastest rate- 28.2%, throughout the projection period. They are a desirable choice for customers who are concerned about their health because they provide the ideal balance of natural herbs and necessary minerals. Growing public awareness of the value of upholding a healthy lifestyle has led to a rise in the use of natural and herbal supplements to improve general well-being. The market is expanding as a result of rising consumer knowledge of the advantages of Ayurvedic goods as well as growing acceptance and adoption of Ayurveda.

By Indication Analysis

With the most revenue share in 2023, the skin and hair category led the market. The demand for Ayurvedic skincare and haircare products has been driven by the preference for herbal therapies and traditional therapeutic methods. Natural and Ayurvedic formulas are growing more popular as consumers become more aware of the contents of the skincare and haircare products they use. The growing recognition and legitimacy of Ayurvedic products due to celebrity and influencer endorsements has also played a part in the segment's expansion. The infectious illness segment is anticipated to rise at the fastest CAGR throughout the forecast period.

The development of new Ayurvedic medicines and therapies for infectious diseases, such as HIV, H1N1, and tuberculosis, has increased the incidence of infectious diseases. This is projected to propel the expansion of the category. For example, the Chinese Herbal Medicine Drug Development (CDD) made great strides in July 2023 in creating a novel Chinese botanical medication to treat persistent constipation. Permission to undertake a clinical trial on the new medicine has been granted to CDD by the U.S. Food and Medicine Administration, after the approval of the Investigational New Drug Application. Nonetheless, there is now a greater market for Ayurvedic products as people become more conscious of the advantages of Ayurvedic therapy.

By Application Analysis

With the highest revenue share and the fastest anticipated compound annual growth rate (CAGR) during the projection period, the personal segment led the market in 2023. In the personal care sector, personalization has become a major trend as customers seek items that are customized to meet their unique requirements and tastes. Ayurvedic personal care products are a popular choice among consumers because they provide personalization possibilities based on specific doshas or body kinds.

For instance, the Indian Ayurvedic company TotalAyurvedaCare.com unveiled a novel telemedicine platform in April 2020 that combines contemporary technology with age-old Ayurvedic methods. Patients can consult with Ayurvedic practitioners virtually in person thanks to this platform. The platform offers comprehensive medical care and therapy that is customized to each patient's unique needs by highly skilled and knowledgeable physicians.

By End-Use Analysis

In 2023, the clinics segment held the highest revenue share and dominated the market. There is a growing need for the Ayurvedic medications and therapies that Ayurvedic clinics provide due to the increased prevalence of chronic diseases like diabetes, arthritis, and cancer and the use of Ayurveda in their treatment. Ayurvedic practitioners with training are easily accessible, which has further fueled the growth of the market. Ayurvedic training and education are provided by numerous organizations and universities, which has increased the number of trained practitioners and clinics. For instance, the All India Institute of Ayurveda (AIIA) extended its partnership with the Rosenberg European Academy of Ayurveda (REAA) in Germany for additional years in December 2022 and signed a Memorandum of Understanding (MoU) with the University of Medical Sciences in Cuba.

To support cooperative activities, the AIIA has partnered with 35 national and 15 international organizations. Promoting evidence-based research, cutting-edge scientific investigations, exchange initiatives, clinical trials, and improved patient care are the main goals of these collaborations. Throughout the projection period, the academia and research category is anticipated to develop at the quickest CAGR. Due to its growing popularity, there has been a noticeable increase in research and development in the field of Ayurveda. To learn more about the potential advantages and therapeutic uses of Ayurveda, many academic institutions are currently funding research into the practice.

It is anticipated that the increasing interest in Ayurveda will propel the growth of the academic sector. For example, the World Health Organization (WHO) and the Government of India struck a deal in March 2022 to establish the WHO Global Centre for Traditional Medicine. The goal of this institute is to enhance people's health by utilizing contemporary science and technology to harness the power of traditional medicine from around the globe. The global center of traditional medicine knowledge has been established with the support of USD 250 million from the Indian government.

By Distribution Channel Analysis

With the most revenue share in 2023, the direct sales segment led the market. Ayurvedic product demand has surged due to greater awareness of its benefits, which enterprises using direct sales methods have successfully met. Businesses can provide tailored product recommendations and experiences based on the unique demands of each customer by using direct sales channels. Through direct channels, this degree of personalization improves the whole customer experience and increases revenue. The e-sales segment is anticipated to increase at the fastest CAGR.

The e-sales segment of the global market has grown due to the ease with which customers can now access information, products, and services in the Ayurvedic sector owing to the integration of technology. E-commerce sites have been crucial in helping Ayurvedic items become more widely available throughout the world. For instance, Amazon India stated in February 2022 that it would open a special storefront on its marketplace that would sell only Ayurvedic products. The purpose of this storefront is to draw attention to Ayurvedic products, which include a variety of immune-boosting supplements, juices, oils, and skin-care products, as well as other products from D2C brands and small businesses.

Regional Analysis

One of the major regions contributing to the global Ayurvedic market is North America. There is a growing trend in North America towards natural and organic items as customers grow more skeptical of synthetic medications and chemicals. This choice for safer and more holistic alternatives is ideally aligned with the power of herbs, minerals, and natural substances found in Ayurvedic treatments, which is what drives their appeal and adoption in the market. Significant changes occurred in organic agriculture between 2011 and 2021, according to data from the U.S. Department of Agriculture (USDA) survey: certified organic cropland increased by 79% to 3.6 million acres, while pastureland and rangeland designated for organic use decreased by 22% to 1.3 million acres. Additionally, organic retail sales in the United States showed a steady 8% annual growth rate, topping USD 52 billion in 2021-roughly 5.5% of all retail food sales. Furthermore, sales of organic products brought in close to USD 11 billion for American farms and ranches in the same year, demonstrating the considerable economic impact and increasing need for organic agriculture in the nation.

With a market share of more than 29.8% in 2023, the European Ayurvedic market led the global industry. This high percentage is explained by the growing acceptance of holistic and natural medicine in European nations, as well as the popularity of yoga and meditation. The laws governing the manufacture and distribution of Ayurvedic products are favorable in many European nations. In Germany, for instance, Ayurvedic medications are regarded as traditional herbal therapeutic remedies, which facilitates their registration and commercialization. Several significant and emerging competitors in the market, including Dabur, Himalaya Herbal Healthcare, and Maharishi Ayurveda, are based in Europe. These businesses are well-established in the European market and aid in its expansion. For instance, "The Ayurveda Experience," a global internet platform for Ayurvedic products with headquarters in India, said in September 2022 that it will be entering the European market with a line of health supplements, personal care items for hair, skin, and body care, food and drink, and even educational courses.

Owing to the growing popularity of Ayurvedic practices in daily routines, expanding demand for natural and organic products, and growing knowledge of the advantages of Ayurveda, the Asia Pacific Ayurveda market is expected to experience considerable expansion. Ayurveda is ingrained in traditional culture and customs in nations like China, Thailand, and India. For ages, the healthcare systems of these nations have included the traditional healing method as a fundamental component. Ayurveda's renaissance in popularity can be attributed to an increasing number of individuals choosing natural and holistic healing methods. To support and acknowledge AYUSH in the global practice of medicine, the Ministry of AYUSH (Ayurveda, Yoga & Naturopathy, Siddha, Unani, and Homeopathy) India signed 25 Memorandums of Understanding in February 2021. Countries including Bangladesh, Iran, Germany, Colombia, China, Brazil, Japan, and Zimbabwe are parties to these Memorandums of Understanding.

Competitive Analysis

Prominent industry participants are making significant R&D investments to broaden their product offerings, hence contributing to the Ayurvedic market's continued expansion. To increase their market share, market players are also engaging in a range of calculated strategic actions. Notable developments in this regard include the introduction of new products, contracts, mergers and acquisitions, increased investment, and cooperation with other businesses. To grow and thrive in an increasingly competitive and developing market, the Ayurvedic sector needs to provide affordable products.

Key Market Players in the Ayurveda Market

o Vicco Laboratories

o Dabur Ltd.

o Patanjali Ayurved Limited

o Natreon Inc.

o Bio Veda Action Research Co.

o Himalaya Wellness Company

o Emami Group of Companies Pvt Ltd

o Amrutanjan Health Care Limited

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 9.4 Billion |

|

Market Size 2033 |

USD 40.7 Billion |

|

Compound Annual Growth Rate (CAGR) |

15.8% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2032 |

|

Historical Data |

2019-2022 |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

Form, Indications, Application, End-Use, Distribution Channel and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Kerala Ayurveda Ltd., Vicco Laboratories, Dabur Ltd., Patanjali Ayurved Limited, Natreon Inc., Bio Veda Action Research Co., Himalaya Wellness Company, Emami Group of Companies Pvt Ltd., Baidyanath, Amrutanjan Health Care Limited, and Other Key Players |

|

Key Market Opportunities |

Expansion Through E-commerce and Digital Platforms |

|

Key Market Dynamics |

Increasing Investment in Research and Development |

📘 Frequently Asked Questions

1. How much is the Ayurveda Market in 2023?

Answer: The Ayurveda Market size was valued at USD 9.4 Billion in 2023.

2. What would be the forecast period in the Ayurveda Market?

Answer: The forecast period in the Ayurveda Market report is 2023-2033.

3. Who are the key players in the Ayurveda Market?

Answer: Kerala Ayurveda Ltd., Vicco Laboratories, Dabur Ltd., Patanjali Ayurved Limited, Natreon Inc., Bio Veda Action Research Co., Himalaya Wellness Company, Emami Group of Companies Pvt Ltd., Baidyanath, Amrutanjan Health Care Limited, and Other Key Players

4. What is the growth rate of the Ayurveda Market?

Answer: Ayurveda Market is growing at a CAGR of 15.8% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.