🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

Flexible Plastic Packaging Market

Flexible Plastic Packaging Market (By Material (Polyethylene (PE), Polypropylene (PP), Polyamide (PA), Polyvinyl Chloride (PVC), Polystyrene (PS), Others), By Product (Pouches, Rollstock, Films & Wraps, Bags, Others), By Application (Food, Beverages, Pharmaceutical & Healthcare, Personal Care & Cosmetics, Others), By Region and Companies)

Jul 2024

Packaging and Transports

Pages: 160

ID: IMR1130

Flexible Plastic Packaging Market Overview

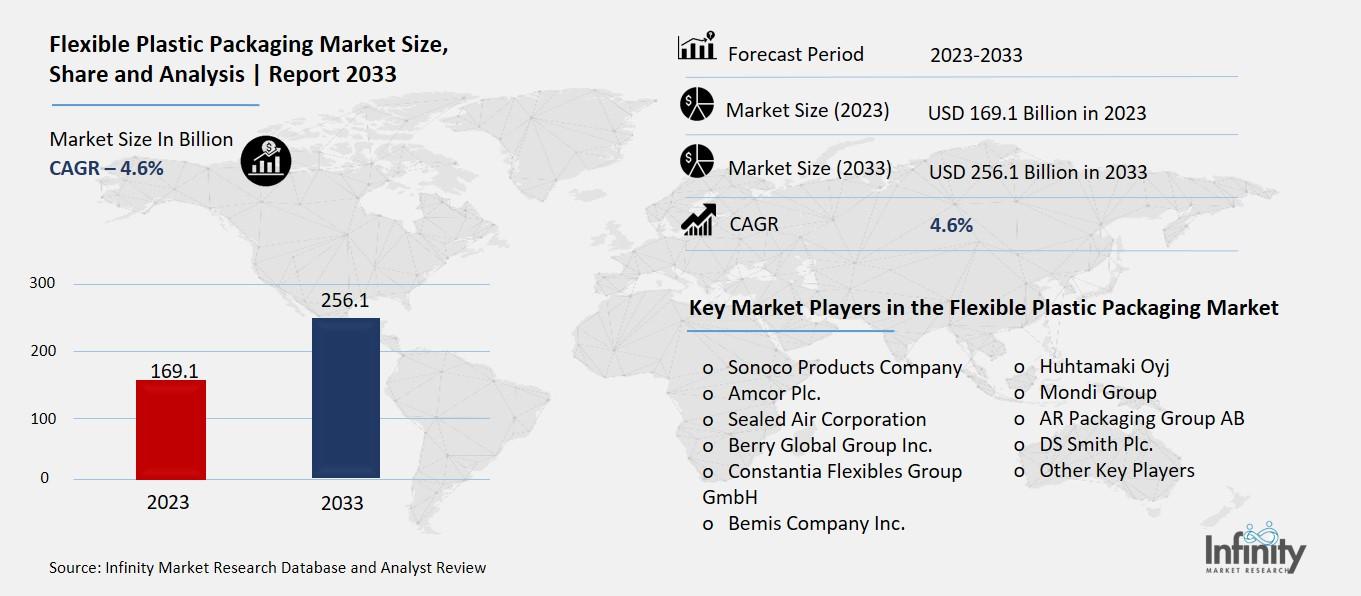

Global Flexible Plastic Packaging Market size is expected to be worth around USD 256.1 Billion by 2033 from USD 169.1 Billion in 2023, growing at a CAGR of 4.6% during the forecast period from 2023 to 2033.

A semiconductor is a special material that can conduct electricity under certain conditions but not always. The flexible plastic packaging market is about all the products used to wrap, cover, and protect items, mainly using bendable plastic materials that can be shaped differently. Think of plastic bags, pouches, and wraps that can hold and keep food, drinks, and other products safe and fresh. This kind of packaging is popular because it's lightweight, can be made in many different sizes and shapes, and often costs less than other types of packaging.

In this market, companies create and sell different types of flexible plastic packaging to businesses that need to package their products. This packaging is used in many industries, such as food and beverages, healthcare, personal care, and more. It's important because it helps keep products safe during shipping, extends the shelf life of food, and makes products look appealing to customers. Plus, with more people and companies caring about the environment, there's a growing interest in making flexible plastic packaging that is easier to recycle and better for the planet.

Drivers for the Flexible Plastic Packaging Market

Increasing Demand for Convenient and Lightweight Packaging

One of the primary drivers for the flexible plastic packaging market is the increasing demand for convenient and lightweight packaging solutions. Consumers today prefer packaging that is easy to carry, store, and dispose of. Flexible plastic packaging, which includes products like pouches, bags, and wraps, offers these benefits and more. This type of packaging is particularly popular in the food and beverage industry, where it helps keep products fresh and extends their shelf life. The ease of handling and the reduced material use compared to rigid packaging make flexible options more attractive for both consumers and manufacturers.

Growth of E-commerce and Online Food Delivery

The rise of e-commerce and online food delivery services has significantly boosted the demand for flexible plastic packaging. As more people order groceries, meals, and other products online, the need for durable and protective packaging has grown. Flexible plastic packaging is ideal for these applications because it is lightweight, reduces shipping costs, and provides excellent protection for the contents during transit. The increasing popularity of online shopping and home delivery services is expected to continue driving market growth in the coming years.

Advancements in Packaging Technology

Innovations in packaging technology are also propelling the flexible plastic packaging market forward. Companies are investing in new materials and production processes to create packaging that is more sustainable and functional. For example, advancements in barrier technologies have improved the ability of flexible packaging to preserve the freshness of food products. Additionally, the development of recyclable and biodegradable plastic materials addresses growing environmental concerns, making flexible packaging more appealing to eco-conscious consumers and businesses.

Increased Focus on Sustainability

Sustainability is a crucial factor driving the market for flexible plastic packaging. Consumers and companies alike are increasingly aware of the environmental impact of packaging waste. As a result, there is a strong push towards using materials that are recyclable or biodegradable. Flexible plastic packaging, when designed with these principles in mind, can help reduce the environmental footprint of packaging. This trend is encouraging manufacturers to adopt greener practices and innovate in the development of sustainable packaging solutions.

Expansion of Food and Beverage Industry

The global food and beverage industry continues to expand, further driving the demand for flexible plastic packaging. This industry relies heavily on packaging to ensure product safety, quality, and convenience. Flexible packaging is particularly suited to meet these needs, offering versatility and efficiency. The growing consumption of processed and packaged foods, along with the rising demand for ready-to-eat meals, is expected to sustain the demand for flexible plastic packaging. This growth is especially notable in emerging markets where the food industry is rapidly evolving.

Regional Market Growth

Regional market dynamics also play a significant role in the growth of the flexible plastic packaging market. In regions like Asia Pacific, increasing disposable incomes, urbanization, and a booming e-commerce sector are major drivers. Countries such as China and India are seeing significant demand for packaged goods, which in turn boosts the need for flexible packaging. Similarly, North America and Europe are experiencing growth due to the high demand for consumer products and the strong presence of key market players. These regional trends underscore the widespread and growing appeal of flexible plastic packaging across the globe

Restraints for the Flexible Plastic Packaging Market

Environmental Concerns

One of the main restraints on the flexible plastic packaging market is the growing environmental concerns. Plastic packaging, despite its convenience and cost-effectiveness, is a major contributor to pollution. Non-biodegradable plastics create significant waste management challenges. Governments and environmental organizations are pushing for stricter regulations on plastic use, which can limit market growth. For instance, many regions are implementing bans on single-use plastics and promoting alternatives, putting pressure on manufacturers to find sustainable solutions.

Raw Material Price Volatility

The prices of raw materials used in producing flexible plastic packaging, such as petroleum-based resins, are highly volatile. Fluctuations in oil prices can directly impact the cost of production, leading to unpredictability for manufacturers. This volatility makes it difficult for companies to maintain stable pricing for their products, which can affect their competitiveness and profitability in the market. Companies must constantly adapt to these price changes, which can be resource-intensive and disruptive.

Regulatory Challenges

Stringent regulations on plastic packaging are another significant restraint. Many countries are adopting strict policies to reduce plastic waste, such as extended producer responsibility (EPR) laws that hold manufacturers accountable for the entire lifecycle of their packaging products. Compliance with these regulations often requires significant investment in new technologies and processes, which can be a financial burden, especially for small and medium-sized enterprises (SMEs). These regulatory challenges can slow down the adoption of flexible plastic packaging solutions.

Competition from Alternative Packaging Materials

Flexible plastic packaging faces stiff competition from alternative materials such as paper, glass, and metal, which are perceived as more environmentally friendly. Consumers and businesses are increasingly opting for these alternatives to align with sustainability goals. This shift in preference can reduce the demand for plastic packaging, forcing manufacturers to innovate and diversify their product offerings to stay relevant. The competition from these alternative materials is a significant hurdle for the growth of the flexible plastic packaging market.

Technological Limitations

While there have been advancements in plastic recycling technologies, significant limitations still exist. Many flexible plastic packaging products are difficult to recycle due to the use of multiple layers and different types of plastics. This limitation not only affects the recyclability of these products but also diminishes their appeal to environmentally conscious consumers. Companies are investing in research and development to create more recyclable and sustainable packaging, but widespread adoption of these technologies is still in progress.

Opportunity in the Flexible Plastic Packaging Market

Rising Demand in the Food and Beverage Sector

The food and beverage industry is a major driver for flexible plastic packaging. With consumers seeking convenience and extended shelf life, the demand for innovative packaging solutions is growing. Flexible packaging not only keeps food fresh for longer but also reduces food waste. Innovations like multi-layer barrier films and nano-coated technology are enhancing the protective qualities of packaging, making it more effective at keeping contaminants out while maintaining product integrity.

Growth in E-commerce and Retail

The boom in e-commerce has significantly increased the demand for flexible plastic packaging. As more people shop online, the need for durable, lightweight, and protective packaging has risen. Flexible packaging meets these needs by being cost-effective and reducing shipping weights. This not only lowers transportation costs but also minimizes environmental impact due to reduced fuel consumption.

Technological Advancements

Advancements in digital printing and automation are providing new opportunities in the flexible plastic packaging market. Companies like Sealed Air and Koenig & Bauer are developing state-of-the-art digital printing technologies that allow for faster and more efficient production of custom packaging. These innovations enable brands to create eye-catching, customized packaging that can help them stand out in a competitive market.

Sustainability Trends

Sustainability is a key trend that offers substantial opportunities. Consumers are increasingly favoring eco-friendly packaging options, and companies are responding by developing recyclable and biodegradable flexible plastic packaging. For example, Mondi's production of eco-friendly paper-based bags and Amcor's use of post-consumer recycled plastics are steps toward meeting the demand for sustainable packaging solutions.

Healthcare and Pharmaceutical Growth

The healthcare and pharmaceutical industries also present significant opportunities for flexible plastic packaging. The need for safe, hygienic, and secure packaging for medicines and medical devices is driving demand. Flexible packaging solutions in this sector offer protection, ease of use, and the ability to meet stringent regulatory requirements, making them an ideal choice for pharmaceutical products.

Expanding Markets in Asia-Pacific

The Asia-Pacific region, particularly countries like China and India, is experiencing rapid growth in the flexible plastic packaging market. Rising disposable incomes and changing consumer lifestyles are increasing the demand for packaged goods. Additionally, manufacturers in this region are investing in improving production processes and expanding their facilities to meet this growing demand.

Trends for the Flexible Plastic Packaging Market

Rising Demand for Sustainable Packaging

One of the major trends in the flexible plastic packaging market is the increasing demand for sustainable packaging solutions. Consumers and regulatory bodies are pushing for eco-friendly packaging options that reduce environmental impact. Companies are responding by developing biodegradable and recyclable flexible plastics. Innovations like compostable films and the use of recycled materials are gaining traction, helping to meet sustainability goals and reduce plastic waste.

Technological Advancements

Technological advancements are driving significant changes in the flexible plastic packaging market. The integration of artificial intelligence (AI) and robotics is streamlining production processes and improving packaging efficiency. AI is being used to optimize packaging designs and reduce material usage, while robotics enhances precision and speed in packaging operations. These technologies are also aiding in the development of smart packaging that can monitor freshness, track products, and enhance consumer engagement through interactive features.

Growth in E-Commerce and Food & Beverage Sectors

The rapid expansion of e-commerce and the food and beverage industry is fueling demand for flexible plastic packaging. Online shopping requires durable and lightweight packaging that protects products during transit. Flexible packaging offers these benefits along with cost-effectiveness and ease of use. In the food and beverage sector, flexible packaging helps extend shelf life and maintain product quality, making it ideal for ready-to-eat meals, snacks, and beverages. This trend is particularly strong in regions like Asia-Pacific, where consumer preferences for convenience foods are growing.

Customization and Personalization

Brands are increasingly turning to customized and personalized packaging to attract and retain customers. Flexible plastic packaging allows for high-quality printing and design flexibility, enabling brands to create visually appealing and unique packaging. This is especially important for targeting younger consumers, such as Gen-Z, who value personalized experiences and aesthetically pleasing packaging. The trend of unboxing videos on social media platforms also emphasizes the need for attractive and distinctive packaging.

Increasing Focus on Health and Safety

Health and safety concerns are influencing packaging trends, particularly in the food and pharmaceutical sectors. Flexible plastic packaging provides excellent barrier properties that protect against contamination and preserve product integrity. The COVID-19 pandemic has heightened awareness of hygiene, leading to increased demand for packaging that ensures product safety. Innovations such as antimicrobial films and tamper-evident packaging are becoming more popular as a result.

Regional Market Trends

Regional differences also play a significant role in shaping the flexible plastic packaging market. In North America and Europe, stringent environmental regulations are pushing manufacturers towards sustainable practices. In contrast, the Asia-Pacific region is experiencing rapid growth due to rising disposable incomes and changing consumer lifestyles. This region is expected to see the highest growth rates, driven by the booming e-commerce market and increased consumption of packaged foods.

Segments Covered in the Report

By Material

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Polyamide (PA)

-

Polyvinyl Chloride (PVC)

-

Polystyrene (PS)

-

Others

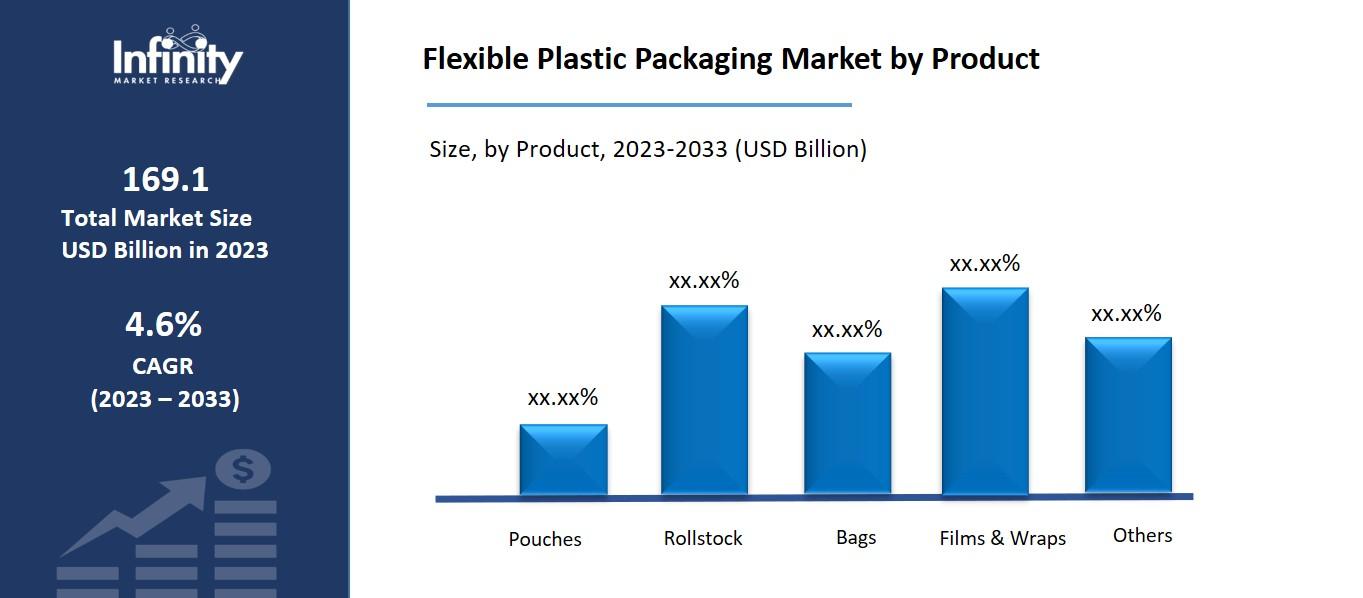

By Product

-

Pouches

-

Rollstock

-

Films & Wraps

-

Bags

-

Others

By Application

-

Food

-

Beverages

-

Pharmaceutical & Healthcare

-

Personal Care & Cosmetics

-

Others

Segment Analysis

By Material Analysis

In 2023, the material segment consisting of polyethylene (PE) held a dominant revenue share of 26.1%. The demand for this material category was stimulated by the abundant availability of raw materials. PE is a perfect material for packaging solutions because of its pliability. It is also reasonably priced and exhibits strong chemical resistance.

Because polyamide (PA) has special qualities like mechanical strength, high flexibility, and great oxygen barrier, it is projected to expand at a fast compound annual growth rate (CAGR) of 4.8% between 2023 and 2033. The food and beverage industry is using polypropylene (PP) more and more, and it is in high demand in nations like China, India, and the United States. The growing ubiquity of plastic recycling in these nations is responsible for the segment's rise.

To comply with the rules set forth by regulatory bodies, the major manufacturers are making investments in recycled materials. For example, Amcor and SK Geo Centric (SK), a well-known petrochemical business with headquarters in South Korea, inked a Memorandum of Understanding (MOU) in October 2023 to obtain sophisticated recycled material mostly in Asia Pacific starting in 2025. The company's MOU with SK will allow it to offer food and healthcare customers in important Asia Pacific markets access to packaging solutions made with recycled content. These collaborations will assist the business in reaching its 2030 goal of having 30% recycled content in all of its products.

By Product Analysis

In 2023, the pouches segment held the greatest market share, with 59.9%. This product's ease of storage has led to its worldwide popularity. It is expected that the manufacturers of packaged beverages, like milk, mineral water, and non-carbonated soft drinks, would continue to favor these goods, which will be good for product demand.

The films and wraps category is expected to rise at the quickest CAGR of 4.9% throughout the projection period. Films and wraps provide manufacturers with a means of expanding their production scale by meeting the packaging needs of samples across multiple industries. Putting their logo on these pouches, plastic films, and wraps in the necessary hues also gives businesses a chance to increase brand awareness.

By Application Analysis

Among the main industries for which flexible packaging materials are used are food and drink, pharmaceuticals and healthcare, and personal hygiene and cosmetics. With about 32.9% sales share, the pharmaceutical and healthcare sector led the industry in 2023. Throughout the projection period, it is anticipated to maintain its significant position. The use of flexible packaging in healthcare satisfies the fundamental need to preserve medications. In healthcare applications, encouraging product differentiation and improving the overall package appeal are other desirable benefits of flexible packaging.

The food and beverage business has also seen notable advances in the packaging industry. Recent advancements in food and beverage product packaging have included the use of nano-coated technologies. This technology helped producers create packaging with transparent, multi-layer barrier films. These advancements in packaging provide improved contamination protection for food and beverage items.

Koenig & Bauer AG and Sealed Air inked a deal in April 2023 to deepen their strategic alliance in the field of digital printing equipment. The alliance will develop cutting-edge digital printing technology, tools, and services to greatly enhance packaging design capabilities. Solutions created by Koenig & Bauer and SEE will enable brand owners to market their products by interacting with customers through a digitally enhanced package, scaling and delivering digitally printed materials substantially faster.

Regional Analysis

The market for flexible plastic packaging was dominated by Asia Pacific, which in 2023 had the most revenue share of about 42.7%. Customers' disposable income has increased significantly throughout Asia Pacific, allowing them to purchase goods from a substantial number of retail outlets. To preserve the integrity of their products, the major manufacturers in Asia have begun to invest in streamlining their production processes. To enhance its packaging product processes, Sealed Air, for example, partnered with Sparck Technologies in September 2023 to develop automated packaging solutions. It offers 3D automated packaging solutions in South Korea, Japan, Australia, and New Zealand.

Because end-user demand is rising, major participants in the North American market are boosting their production capacity. For example, Amcor plans to expand its cutting-edge manufacturing facility in Oshkosh, Wisconsin, U.S., on January 31, 2024, in response to growing demand from clients in the consumer health, pharmaceutical, and medical industries. Additionally, expansion makes it possible to obtain companion die-cut lids and thermoforms from a single source, which simplifies the production and delivery of the product.

The European market for flexible packaging is anticipated to experience a rise in product demand due to the substantial expansion of the food and beverage industry. The food category has seen a significant increase in the sale of prepared foods and fruit compotes, which has helped the industry. The need for packaging is a result of the growing use of metal and glass packaging as alternatives to flexible plastic packaging.

The personal care and home care industries are predicted to have a greater need for flexible plastic packaging items throughout the Middle East and Africa. The significant rise in sales of liquid soaps, detergents, cleansers, shampoos, and other goods supports this.

Competitive Analysis

Owing to the existence of a considerable number of small and medium-sized businesses, the market is extremely fragmented. The pharmaceutical, cosmetic, and food and beverage industries are the primary clients of major players. Over the past few years, the flexible plastic packaging sector has seen a notable increase in mergers and acquisitions as well as the introduction of new products.

Recent Developments

August 2023: Amcor increased its presence in the Indian market by acquiring Phoenix Flexibles. Phoenix Flexibles is based in Gujarat, India, and sells flexible packaging for food, personal care, and home care applications. The company brings in about USD 20 million annually. Additionally, the acquisition provides cutting-edge film technology that permits Amcor to increase its product portfolio in desirable high-value areas and brings skills that enable local manufacturing of a wider range of more environmentally friendly packaging solutions.

February 2023: Liquibox was purchased by Sealed Air for USD 1.15 billion in cash and debt-free terms. For the fresh food, beverage, consumer goods, and industrial end markets, Liquibox is a leading pioneer, innovator, and producer of sustainable fluids and liquids packaging and dispensing solutions in Bag-in-Box form.

Key Market Players in the Flexible Plastic Packaging Market

-

Sonoco Products Company

-

Sealed Air Corporation

-

Berry Global Group Inc.

-

Constantia Flexibles Group GmbH

-

Bemis Company Inc.

-

Huhtamaki Oyj

-

AR Packaging Group AB

-

DS Smith Plc.

-

Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 169.1 Billion |

|

Market Size 2033 |

USD 256.1 Billion |

|

Compound Annual Growth Rate (CAGR) |

4.6% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

- |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Material, Product, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

Sonoco Products Company, Amcor Plc., Sealed Air Corporation, Berry Global Group Inc., Constantia Flexibles Group GmbH, Bemis Company Inc., Huhtamaki Oyj, Mondi Group, AR Packaging Group AB, DS Smith Plc., Other Key Players |

|

Key Market Opportunities |

Rising Demand in the Food and Beverage Sector |

|

Key Market Dynamics |

Increasing Demand for Convenient and Lightweight Packaging |

📘 Frequently Asked Questions

1. How much is the Flexible Plastic Packaging Market in 2023?

Answer: The Flexible Plastic Packaging Market size was valued at USD 169.1 Billion in 2023.

2. What would be the forecast period in the Flexible Plastic Packaging Market report?

Answer: The forecast period in the Flexible Plastic Packaging Market report is 2023-2033.

3. Who are the key players in the Flexible Plastic Packaging Market?

Answer: Sonoco Products Company, Amcor Plc., Sealed Air Corporation, Berry Global Group Inc., Constantia Flexibles Group GmbH, Bemis Company Inc., Huhtamaki Oyj, Mondi Group, AR Packaging Group AB, DS Smith Plc., Other Key Players

4. What is the growth rate of the Flexible Plastic Packaging Market?

Answer: Flexible Plastic Packaging Market is growing at a CAGR of 4.6% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.