🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

At Infinity Market Research, we dont just deliver data — we deliver clarity, confidence, and competitive edge.

In a world driven by insights, we help businesses unlock the infinite potential of informed decisions.

Here why global brands, startups, and decision-makers choose us:

Industry-Centric Expertise

With deep domain knowledge across sectors — from healthcare and technology to manufacturing and consumer goods — our team delivers insights that matter.

Custom Research, Not Cookie-Cutter Reports

Every business is unique, and so are its challenges. Thats why we tailor our research to your specific goals, offering solutions that are actionable, relevant, and reliable.

Data You Can Trust

Our research methodology is rigorous, transparent, and validated at every step. We believe in delivering not just numbers, but numbers that drive real impact.

Client-Centric Approach

Your success is our priority. From first contact to final delivery, our team is responsive, collaborative, and committed to your goals — because you re more than a client; you re a partner.

Recent Reports

Obesity Management Market

GLP-1 Receptor Agonist Market

3D Printing Filament Market

3D Printing Filament Market (By Type (Plastics, Metals, Ceramics, and Other Types), By Plastic Type (Polylactic Acid (PLA), Acrylonitrile Butadiene Styrene (ABS), Polyethylene Terephthalate Glycol (PETG), Acrylonitrile Styrene Acrylate (ASA), and Other Plastic Types), By Application (Industrial, Aerospace & Defense, Automotive, Healthcare, and Other Applications), By Region and Companies)

Jun 2024

Chemicals and Materials

Pages: 131

ID: IMR1068

3D Printing Filament Market Overview

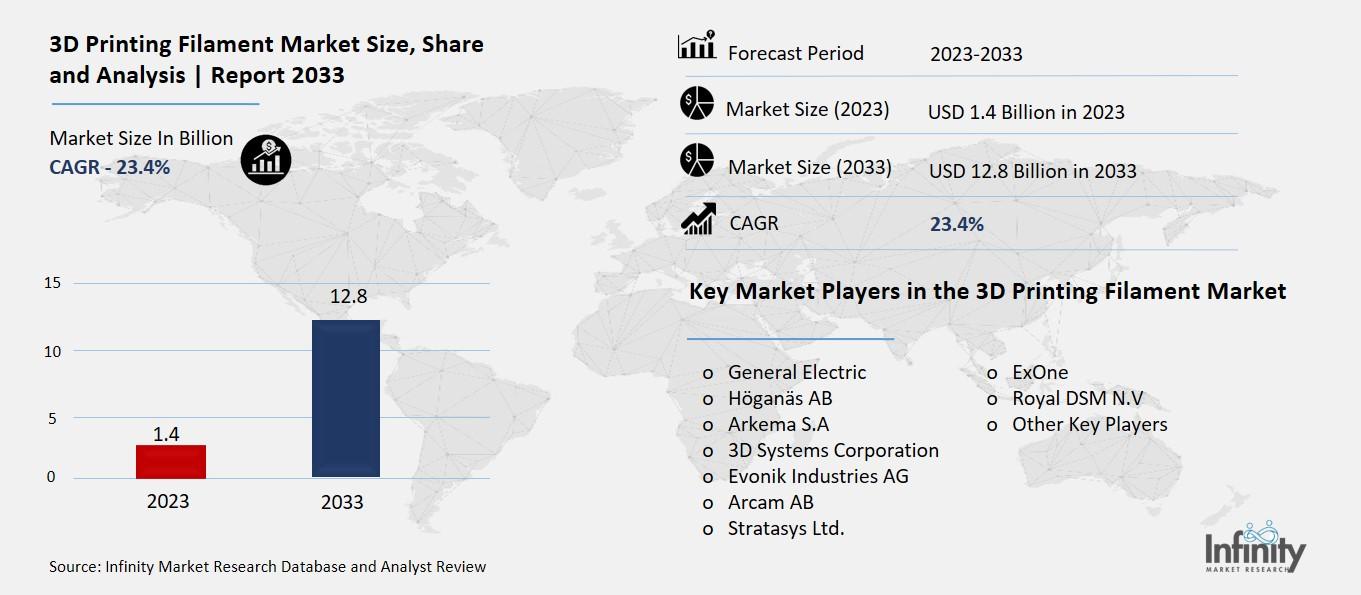

Global 3D Printing Filament Market size is expected to be worth around USD 12.8 Billion by 2033 from USD 1.4 Billion in 2023, growing at a CAGR of 23.4% during the forecast period from 2023 to 2033.

The 3D Printing Filament Market refers to the sector that encompasses the production, distribution, and sale of materials used as filaments in 3D printing processes. These filaments are the raw materials fed into 3D printers, which are then melted and deposited layer by layer to create three-dimensional objects. The market includes a variety of filament types, such as thermoplastics (like PLA and ABS), metals (such as aluminum and titanium), ceramics, and composite materials. Each type of filament offers different properties, including strength, flexibility, heat resistance, and aesthetic qualities, catering to diverse industrial and consumer applications.

In recent years, the 3D Printing Filament Market has experienced significant growth, driven by the expanding applications of 3D printing technology across various sectors. Industries such as aerospace, automotive, healthcare, and consumer goods utilize 3D printing filaments to manufacture prototypes, customized products, and end-use parts. The market is characterized by ongoing innovation in filament materials and technology, aiming to enhance print quality, durability, and efficiency. As the adoption of 3D printing continues to increase globally, the demand for high-quality filaments and advanced printing materials is expected to grow, further fueling the expansion of the 3D Printing Filament Market.

Drivers for the 3D Printing Filament Market

Advancements in 3D Printing Technology:

Advancements in 3D printing technology have significantly contributed to the growth of the 3D Printing Filament Market. Improved printer capabilities, such as higher printing speeds, increased precision, and larger build volumes, have expanded the scope of applications for 3D printing. These technological advancements have made 3D printing more accessible and cost-effective, driving adoption across various industries. Additionally, developments in additive manufacturing processes, such as selective laser sintering (SLS) and fused deposition modeling (FDM), have increased the demand for high-quality filaments that can meet the requirements of complex and functional end-use parts.

Expanding Applications Across Industries:

The versatility of 3D printing filaments has led to their widespread adoption across a diverse range of industries. In the aerospace and automotive sectors, 3D printing filaments are used to create lightweight and durable parts, reducing weight and improving fuel efficiency. In the healthcare industry, biocompatible filaments are utilized to produce patient-specific implants and prosthetics. The consumer goods sector utilizes 3D printing for customized products and rapid prototyping. Moreover, the architecture and construction industries employ large-scale 3D printing to create architectural models and building components. The broad applicability of 3D printing across industries is a significant driver of market growth, as it continues to revolutionize manufacturing processes and product development.

Innovations in Filament Materials:

Innovations in filament materials are another key driver of the 3D Printing Filament Market. Manufacturers are continuously developing new materials with enhanced properties to meet specific industry requirements. For instance, advanced engineering plastics such as nylon, polycarbonate, and PEEK are used for applications requiring high strength and heat resistance. Biodegradable filaments, such as PLA (polylactic acid), are popular in environmentally conscious industries due to their sustainable properties. Metal and ceramic filaments are utilized in aerospace and medical applications for their durability and biocompatibility. The development of composite filaments, combining materials like carbon fiber and glass fiber with polymers, enhances the mechanical properties of printed parts. These innovations in filament materials are expanding the capabilities of 3D printing and driving market growth by enabling the production of increasingly complex and functional components.

Cost Efficiency and Time Savings:

3D printing filaments offer cost efficiency and time savings compared to traditional manufacturing methods. Rapid prototyping and on-demand production reduce the need for tooling and assembly, lowering overall production costs and lead times. Industries can benefit from reduced material waste and inventory costs by printing parts only as needed. Moreover, the ability to iterate designs quickly and produce customized parts without additional setup costs provides a competitive advantage in fast-paced markets. These cost-saving benefits make 3D printing an attractive option for both large corporations and small businesses looking to streamline their manufacturing processes.

Growing Adoption of Industry 4.0 and Smart Manufacturing:

The adoption of Industry 4.0 principles and smart manufacturing practices is driving the demand for 3D printing filaments. Integrated digital systems, IoT (Internet of Things) connectivity, and AI (Artificial Intelligence) optimization are enhancing the efficiency and flexibility of 3D printing operations. Automated workflows and real-time monitoring systems ensure consistent print quality and reduce production errors. This digital transformation is reshaping manufacturing processes, encouraging industries to invest in advanced 3D printing technologies and materials. As Industry 4.0 continues to evolve, the demand for high-performance 3D printing filaments is expected to grow, supporting the expansion of the market.

Restraints for the 3D Printing Filament Market

Material Limitations:

One significant restraint for the 3D Printing Filament Market is the limitations of available materials. While there has been significant innovation in filament materials, certain applications still require materials with specific properties that are challenging to achieve with current 3D printing technologies. For instance, while materials like PLA and ABS are widely used due to their ease of use and affordability, they may not possess the necessary strength or heat resistance for more demanding applications in industries such as aerospace and automotive. Additionally, the development of new materials with desired properties, such as biocompatibility for medical applications or conductivity for electronics, requires extensive research and testing, which can be time-consuming and costly. These material limitations hinder the adoption of 3D printing in certain industries and applications, thereby restraining market growth.

Regulatory Challenges:

Another significant restraint for the 3D Printing Filament Market is regulatory challenges related to material safety and product certifications. Filament materials used in industries such as healthcare and aerospace must meet stringent regulatory requirements to ensure patient safety and product reliability. Regulatory bodies may require extensive testing and certification processes to verify the mechanical, thermal, and chemical properties of 3D-printed parts. For example, medical devices produced using 3D printing must adhere to FDA (Food and Drug Administration) regulations in the United States or similar regulatory frameworks in other countries. Ensuring compliance with these regulations adds complexity and cost to the development and commercialization of 3D printing filaments, slowing down market adoption and growth.

High Cost of 3D Printing Technology:

The high cost of 3D printing technology is another significant restraint for the market. While the cost of 3D printers has decreased over the years, high-performance industrial 3D printers and advanced materials remain expensive. Initial investment costs for 3D printers capable of printing with high-performance materials such as metals or composites can be prohibitive for small and medium-sized enterprises (SMEs) and startups. Moreover, the cost of raw materials, maintenance, and post-processing equipment further adds to the total cost of ownership. This high cost of entry limits the adoption of 3D printing technology to larger corporations with significant capital resources, thereby restricting the overall market size.

Challenges in Scalability and Production Speed:

Scalability and production speed are critical challenges for the 3D Printing Filament Market, particularly in industries requiring mass production or large-scale manufacturing. While 3D printing offers advantages in rapid prototyping and customization, it currently struggles to match the speed and volume capabilities of traditional manufacturing methods like injection molding or CNC machining. Print times for large parts can be lengthy, and the build volume of most 3D printers is limited compared to industrial-scale production needs. Improving print speed and scalability without compromising part quality remains a technical challenge for the industry, hindering widespread adoption in high-volume manufacturing applications.

Lack of Standardization and Quality Control:

The lack of standardization and quality control is another restraint for the 3D Printing Filament Market. Unlike traditional manufacturing processes that have established standards and quality assurance protocols, 3D printing lacks universally accepted standards for material properties, printing parameters, and post-processing techniques. Variability in filament quality, print settings, and equipment calibration can result in inconsistencies in part performance and reliability. Establishing standardized testing methods and quality control procedures is crucial to gaining trust and acceptance from industries such as aerospace, automotive, and healthcare, where product quality and reliability are paramount.

Limited Awareness and Skills Gap:

Limited awareness and a skills gap pose challenges to the adoption of 3D printing technology, particularly in small and medium-sized enterprises (SMEs) and traditional manufacturing sectors. Many businesses are unaware of the capabilities and potential benefits of 3D printing, leading to slower adoption rates. Moreover, there is a shortage of skilled professionals with expertise in 3D printing design, operation, and maintenance. Addressing these challenges requires industry-wide education and training initiatives to increase awareness, build technical skills, and facilitate the integration of 3D printing into existing manufacturing workflows.

Trends for the 3D Printing Filament Market

Advancements in Material Science:

Advancements in material science are driving innovation in the 3D Printing Filament Market. Researchers and manufacturers are developing new filament materials with enhanced mechanical, thermal, and chemical properties to meet the demands of various industries. For instance, the development of high-performance engineering plastics like nylon, polycarbonate, and PEEK enables the production of functional prototypes and end-use parts with superior strength and heat resistance. Similarly, the introduction of metal filaments, such as aluminum, titanium, and stainless steel, allows for the creation of metal parts through additive manufacturing processes. These advancements expand the capabilities of 3D printing technology and cater to a broader range of industrial applications, from aerospace components to medical implants.

Increasing Adoption of Composite Filaments:

Composite filaments are gaining traction in the 3D Printing Filament Market due to their unique properties and versatility. Composite materials combine polymer matrices with reinforcing fibers such as carbon fiber, fiberglass, or Kevlar, enhancing the strength, stiffness, and durability of printed parts. These filaments are used in industries requiring high-performance materials, such as automotive, aerospace, and defense. The automotive sector, for example, utilizes carbon fiber-reinforced filaments to produce lightweight and impact-resistant components. As technology improves, the adoption of composite filaments is expected to grow, driving market expansion and encouraging further innovation in material development.

Rising Demand for Sustainable Materials:

There is a growing demand for sustainable 3D printing filaments made from biodegradable or recycled materials. Filaments such as PLA (polylactic acid) and PETG (polyethylene terephthalate glycol) are bio-based and can be composted at the end of their lifecycle, reducing environmental impact. Recycled filaments, derived from post-consumer or industrial waste, promote circular economy practices by minimizing resource consumption and waste generation. The adoption of sustainable materials aligns with corporate sustainability goals and consumer preferences for eco-friendly products. As environmental awareness increases, manufacturers are investing in the development of sustainable 3D printing filaments, driving market growth and innovation in green technologies.

Growth in Medical Applications:

The medical and healthcare sectors are increasingly adopting 3D printing filaments for applications such as surgical guides, prosthetics, and patient-specific implants. Biocompatible filaments, including medical-grade polymers and ceramics, enable the production of personalized medical devices that improve patient outcomes. 3D printing technology allows for the customization of implants to match patient anatomy, reducing surgery time and enhancing recovery. Furthermore, the development of pharmaceutical-grade filaments for drug delivery systems is expanding the application of 3D printing in healthcare. As medical 3D printing continues to evolve, the demand for specialized filaments that meet stringent regulatory requirements is expected to grow, contributing to market expansion.

Expansion of 3D Printing in Aerospace and Automotive Sectors:

The aerospace and automotive industries are significant adopters of 3D printing technology and filaments due to the benefits of lightweight, design flexibility, and rapid prototyping. Aerospace manufacturers use 3D printing filaments to produce complex components with reduced weight and improved fuel efficiency. In the automotive sector, filaments are employed for prototyping, tooling, and production of customized parts. The adoption of metal and composite filaments in these industries supports the development of advanced applications, such as engine components and structural parts. As 3D printing technology matures, the aerospace and automotive sectors will continue to drive the demand for high-performance filaments, fostering innovation and market growth.

Technological Advancements and Industry 4.0 Integration:

Technological advancements and the integration of Industry 4.0 principles are transforming the 3D Printing Filament Market. Innovations in printer hardware, software, and materials are enhancing print quality, speed, and reliability. IoT (Internet of Things) connectivity enables real-time monitoring and control of 3D printing processes, ensuring consistent part quality and production efficiency. Artificial intelligence and machine learning algorithms optimize printing parameters and material usage, reducing waste and improving overall productivity. The convergence of these technologies supports the scalability of 3D printing operations and drives adoption across industries. As Industry 4.0 continues to evolve, the 3D Printing Filament Market will benefit from enhanced automation, digitalization, and smart manufacturing practices.

Segments Covered in the Report

By Type

o Plastics

o Metals

o Ceramics

o Other Types

By Plastic Type

o Polylactic Acid (PLA)

o Acrylonitrile Butadiene Styrene (ABS)

o Polyethylene Terephthalate Glycol (PETG)

o Acrylonitrile Styrene Acrylate (ASA)

o Other Plastic Types

By Application

o Industrial

o Aerospace & Defense

o Automotive

o Healthcare

o Other Applications

Segment Analysis

By Type Analysis

With a 61.2% revenue share in 2023, the plastics category led the market and is expected to grow at a compound annual growth rate of 18.9% throughout the forecast period. The ease of manufacturing and the capacity to fuse at any surface are the main factors driving the demand for 3D filament printing of plastic types. Additionally, the product's flexible nature allows it to be used in the creation of several components for a variety of applications, including motor vehicles, spacecraft, machining equipment, instructional models, and many others, which is driving additional market expansion.

Extremely fine metal powders, including copper, brass, bronze, stainless steel, and others, are used to create metal-filled 3D printing filament. These metals don't require a high-temperature extruder and offer an aesthetically pleasing metal finish. Furthermore, metal printing filaments are heavier and stay on the surface longer than plastic printing filaments. However, compared to plastics and ceramics, the energy required to produce metal filaments for printing is three to four times higher, which hampers the market for metal-based 3D printing filaments.

Ceramics is a substitute material for metal- and plastic-based 3D printing filament. The creation of artistic figurines, models, statues, and art & design projects is credited to the use of ceramics for printing. Furthermore, it's commonly utilized in biomedical to create customized implants, including three-dimensional bone substitutes. However, using ceramic filament to create intricate parts and components is expensive and requires a long manufacturing process. Consequently, the major industry participants are funding the same to research and develop novel printing techniques.

Alumide (polyamide and aluminum powder), nylon, composites, hybrid materials, soluble materials, and other materials are also utilized in 3D printing filaments. For ease of manufacture and flexibility, these previously stated materials are frequently combined with plastics. The market has expanded as a consequence of this.

By Plastic Type Analysis

Owing to its ease of printing it does not require a heating platform when printing on a structure—the Polylactic Acid (PLA) segment led the market and had the highest revenue share of more than 38.8% in 2023. Furthermore, biodegradable materials are favored in Europe because of strict environmental regulations.

The most widely used 3D printing filament is Acrylonitrile Butadiene Styrene (ABS), because of its great flexibility and shock resistance. It is extensively utilized in the production of mobile phone cases, electronic gadgets, and car exterior pieces (bumpers). Leading electronics manufacturers, including the United States, China, South Korea, and Hong Kong, employ 3D filament printing on electronic products, contributing significantly to the market.

There is expected to be an increase in the usage of PLA-type materials for 3D printing owing to growing consumer awareness of sustainable product design. Other materials, on the other hand, have stiff and strong chemical resistance, which is predicted to boost their employment in the aerospace and defense as well as the automotive sectors. Examples of these materials are Acrylonitrile Styrene Acrylate (ASA), Polyethylene Terephthalate Glycol (PETG), and Polyethylene Terephthalate (PET).

The globe's top space agencies are investing an increasing amount of money annually in space exploration missions, which is driving up demand for 3D filament printing as a way to reduce storage costs, free up warehouse space, and manufacture aerospace components like engine and aircraft frames. Furthermore, several major industry players have expressed interest in sustainable 3D filaments, such as PLA made from corn starch and plant-based 3D printing material, which has contributed to the market's positive expansion.

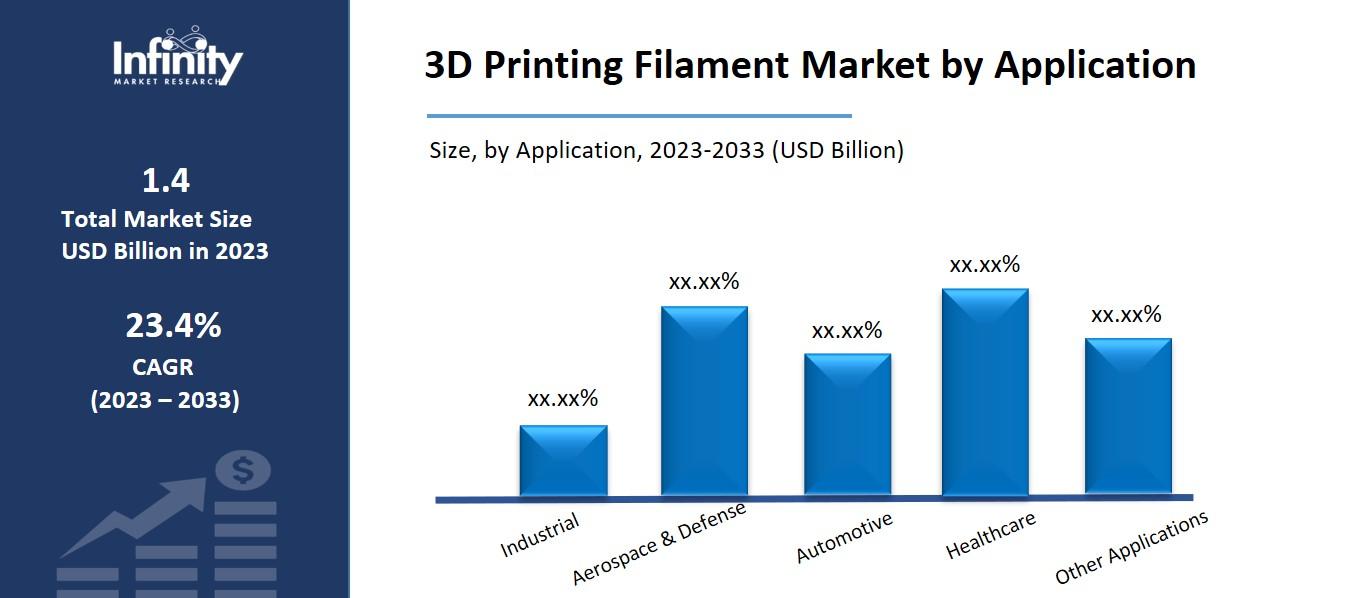

By Application Analysis

Owing to extensive use in the creation of design prototypes, the aerospace and defense application area had the highest revenue share of 27.1% in 2023. Demand for 3D printing filament is anticipated to increase throughout the anticipated period as additive manufacturing is used more often in aircraft components across the world in search of more affordable alternatives.

The typical aerospace item and component made using 3D printing technology is lighter and reduces air drag, which lowers fuel costs. Furthermore, factors like rising environmental consciousness and falling fuel and emission prices are probably going to lessen the environmental impact, which means that during the anticipated period, there will be a greater need for 3D printing filament.

The market for 3D printing filament is anticipated to be significantly dominated by the automotive application segment due to an increase in demand for designs that are more durable, lightweight, strong, and safe. For example, in June 2020, the massive electric vehicle maker Tesla Inc. manufactured the rear underbody components of its newest model, the Model-Y, using 3D printing technology.

The growth in the production of components such as wall panels, automotive spares and replacement parts, injector heads, and others has led to a significant portion of the market being accounted for by industrial and other manufacturing applications. Parts and components like fixtures and jigs, robotic grippers and sensor mounts, and other applications in the education sector such as model designs and artwork are probably going to contribute a lot to the market's growth.

Regional Analysis

With a revenue share of over 36.9% in 2023, North America led the market and is expected to expand at a compound annual growth rate (CAGR) of over 19.1% over the forecast period. In the anticipated time frame, growing investment from the U.S. aerospace and defense industry is anticipated to assist the expansion of the regional market by enabling the production of high-end designs and models for vital components like circuit boards, spacer panels, spare parts, and others.

North America's largest consumer of 3D printing filament in 2023 was the United States. The demand for complex parts and components, such as exterior and interior vehicle body components that require 3D printers, is expected to be supported by developments in defense industrial operations and an increase in motor vehicle production in the automotive sector within the region. This is anticipated to have a positive impact on the market.

The market held the second-largest revenue share in Asia Pacific in 2023 owing to rising costs in the manufacturing sector, which produces toys, fixtures, electronics, tools, and other items. When compared to traditional CNC machines, 3D printers provide a considerable reduction in manufacturing time for the previously stated products.

The market in Europe is anticipated to expand at a noteworthy rate of 18.2% during the projected period owing to the escalation in the production of automotive and aircraft components. Strict regulations about the usage of non-biodegradable materials, such as ABS and other high-performance polymers derived from petrochemical feedstock, are probably going to impede the market's expansion.

Competitive Analysis

The major firms use a variety of market tactics, including investment, innovation, and acquisition. In addition, the major corporations are growing their capabilities to support the corresponding markets. Due to the presence of key rivals using 3D filament printing technology to produce better products faster, the industry is competitive. Numerous application industries that are concerned with longer lead times at lower operating costs owing to printing technology are what define the market.

Key Market Players in the 3D Printing Filament Market

o General Electric

o Höganäs AB

o 3D Systems Corporation

o Arcam AB

o ExOne

o Royal DSM N.V

o Other Key Players

|

Report Features |

Description |

|

Market Size 2023 |

USD 1.4 Billion |

|

Market Size 2033 |

USD 12.8 Billion |

|

Compound Annual Growth Rate (CAGR) |

23.4% (2023-2033) |

|

Base Year |

2023 |

|

Market Forecast Period |

2024-2033 |

|

Historical Data |

- |

|

Market Forecast Units |

Value (USD Billion) |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

Type, Plastic Type, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Countries Covered |

The U.S., Canada, Germany, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

|

Key Companies Profiled |

General Electric, Höganäs AB, Arkema S.A, 3D Systems Corporation, Evonik Industries AG, Arcam AB, Stratasys Ltd., ExOne, Royal DSM N.V, Other Key Players |

|

Key Market Opportunities |

Advancements in 3D Printing Technology |

|

Key Market Dynamics |

Expanding Applications Across Industries |

📘 Frequently Asked Questions

1. What would be the forecast period in the 3D Printing Filament Market report?

Answer: The forecast period in the 3D Printing Filament Market report is 2024-2033.

2. How much is the 3D Printing Filament Market in 2023?

Answer: The 3D Printing Filament Market size was valued at USD 1.4 Billion in 2023.

3. Who are the key players in the 3D Printing Filament Market?

Answer: General Electric, Höganäs AB, Arkema S.A, 3D Systems Corporation, Evonik Industries AG, Arcam AB, Stratasys Ltd., ExOne, Royal DSM N.V, Other Key Players

4. What is the growth rate of the 3D Printing Filament Market?

Answer: 3D Printing Filament Market is growing at a CAGR of 23.4% during the forecast period, from 2023 to 2033.

🔐 Secure Payment Guaranteed

Safe checkout with trusted global payment methods.

🌟 Why Choose Infinity Market Research?

- Accurate & Verified Data:Our insights are trusted by global brands and Fortune 500 companies.

- Complete Transparency:No hidden fees, locked content, or misleading claims — ever.

- 24/7 Analyst Support:Our expert team is always available to help you make smarter decisions.

- Instant Savings:Enjoy a flat $1000 OFF on every report.

- Fast & Reliable Delivery:Get your report delivered within 5 working days, guaranteed.

- Tailored Insights:Customized research that fits your industry and specific goals.